Ballard Power Systems (NASDAQ:BLDP) stands out as a notable player within the proton exchange membrane (PEM) fuel cell technology sector, reflective of a broader shift towards green energy and sustainability on a global scale. The company’s comprehensive product range, especially within the heavy transport vehicle segment, positions it favorably in this burgeoning market. The recent shift in Ballard’s strategic focus from the Chinese market to the more receptive landscapes of the U.S. and Europe, highlighted by a significant $18 million investment in bipolar plate manufacturing, illustrates a proactive adaptation to the evolving market dynamics. In my view, this geographical pivot not only augments the company’s operational prospects but also aligns well with the global clean energy agenda, potentially bolstering its long-term prospects. However, on the flip side, BLDP’s juxtaposition of current unprofitability against a trajectory of promising revenue growth results in a “hold” recommendation with an implied 16.0% downside potential. But, it’s essential to contextualize this within a backdrop of broader industry growth and favorable market positioning.

Business Overview

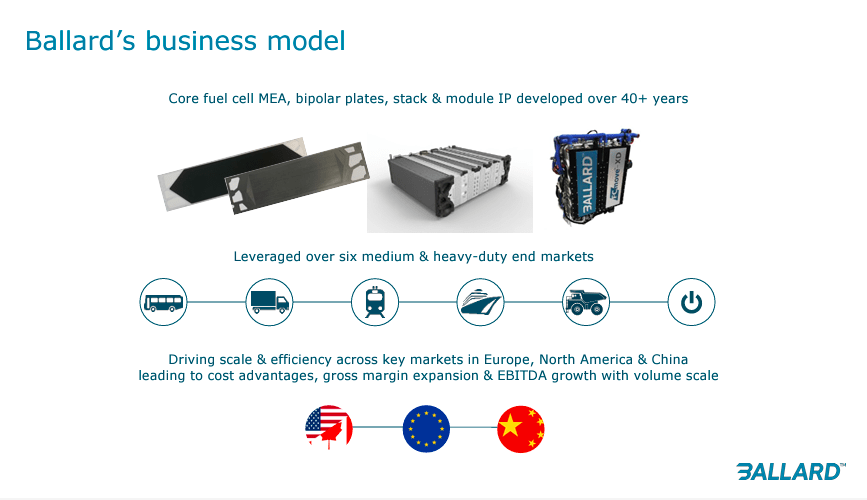

Ballard Power Systems is based in Burnaby, British Columbia, Canada. It is a notable company in the proton exchange membrane (PEM) fuel cell technology sector, a key area in the emerging clean energy field. The crux of its business lies in the designing, developing, manufacturing, and servicing PEM fuel cells catering to a broad spectrum of vehicles and stationary applications. The primary revenue streams are drawn from the sales of power products for buses, trucks, rail, and marine sectors, alongside emerging markets like material handling and off-road equipment. The firm’s strategic foothold in Europe through its subsidiary, Ballard Power Systems Europe A/S, amplifies its market reach and scale.

Ballard Capital Markets Day 2023

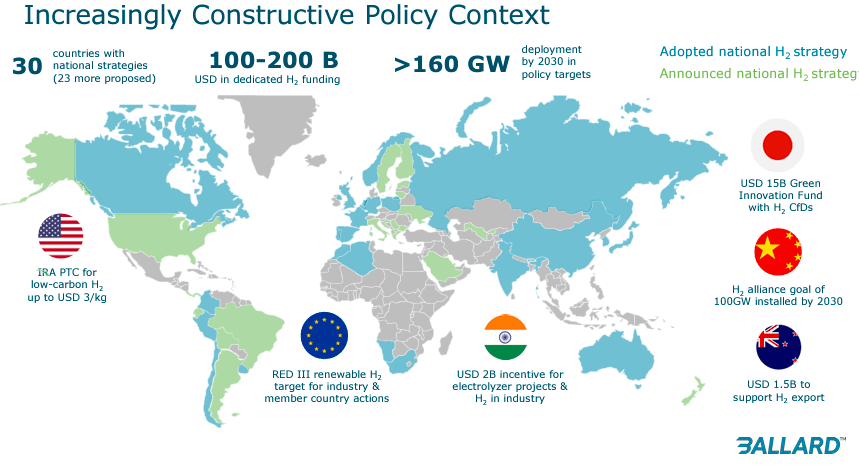

Furthermore, BLDP’s management acknowledges they’re at a crucial point in its growth, navigating market challenges in China due to the high policy uncertainty while ramping up global manufacturing efforts, particularly in the U.S. and Europe, where hydrogen policies are more supportive. Concretely, BLDP plans to invest $18 million in bipolar plate manufacturing until 2025, a significant amount given that BLDP’s CAPEX tends to be between $15 million and $50 million annually. Thus, BLDP seems to be reevaluating its expansion in China due to regulatory concerns, and instead, it’s pivoting towards the U.S. and European markets. This pivot is evidenced by a surge in new orders in Europe and a significant backlog increase.

The partnership with Ford Trucks underscores the credibility of Ballard’s technology, suggesting potential for expanded deployment in the commercial vehicle sector. Coupled with growing demand for fuel-cell buses in Europe, this indicates a market maturing towards wider fuel-cell adoption, potentially boosting BLDP’s long-term revenues. The Australian order through Wisdom Motors reflects Ballard’s global scope and adaptability in uncertain markets. Additionally, the success of the MF Hydra ferry vessel and orders for varied applications like EV charging and data center solutions highlight the diverse usability of Ballard’s fuel cell technology.

Ballard Capital Markets Day 2023

In fact, BLDP’s latest earnings call emphasizes a targeted effort to obtain substantial purchase orders in the bus and marine sectors in the second half of 2023, aiming to close the year with a solid order backlog to bolster 2024 revenue. The debate between hydrogen internal combustion engines and fuel cells highlights the market’s inclination towards fuel cells, validating Ballard’s strategic direction.

Harnessing Hydrogen: Ballard Power’s Green Energy Pursuit

One of BLDP’s most interesting aspects is advancing green energy solutions, mainly through Proton Exchange Membrane (PEM) fuel cells, which provide continuous power as long as fuel is available. This makes BLDP’s offerings ideal for constant power needs. Initially, a lithium power research firm, Ballard Power has pivoted over decades to hydrogen fuel cell technology, now developing proton exchange membrane (PEM) fuel cells for heavy transport vehicles like buses and trucks, where lithium-ion batteries are less effective. In the green energy market, while Tesla and others are backing lithium-ion batteries, Ballard is steadfast in pursuing hydrogen technology, garnering contracts and establishing partnerships.

In exploring energy efficiency and adaptability, Proton Exchange Membrane (PEM) fuel cells emerge as a compelling choice over combustion engines due to their higher energy density. This trait is advantageous in scenarios demanding strict adherence to space and weight constraints, such as heavy-duty transportation. However, lithium-ion batteries, despite sometimes lagging in energy density, are witnessing a steady improvement in energy efficiency courtesy of ongoing technological advancements. A distinct merit of PEM fuel cells is their rapid refueling capability, analogous to conventional gasoline refueling, which, I believe, could catalyze their broader acceptance, especially in sectors where time is a pivotal factor. This belief is premised on the inherent time-saving advantage that PEM fuel cells offer over lithium-ion batteries, which necessitate extended recharging periods. This characteristic could potentially deter their usage in time-critical situations, notably with larger battery configurations.

Moreover, infrastructure presents a significant challenge. Currently, the underdeveloped hydrogen infrastructure catering to PEM fuel cells is overshadowed by the robust electricity infrastructure that ostensibly favors lithium-ion batteries. This infrastructure deficit poses a near-term impediment to PEM fuel cell adoption. From an environmental vantage point, PEM fuel cells, yielding water as a byproduct, embody a cleaner energy alternative, but this is contingent on the sustainable sourcing of hydrogen. Conversely, lithium-ion batteries, although capable of mitigating emissions when charged via renewable energy sources, evoke environmental apprehensions stemming from material mining and battery disposal practices.

Even though BLDP’s prospects are promising, its stock performance has been dismal. (TradingView)

On the financial front, the initial cost of PEM fuel cells is on the higher side, largely due to the incorporation of expensive materials like platinum – a contrast to lithium-ion batteries, which are on a trajectory towards affordability driven by technological progressions and economies of scale. I infer that as the technology underpinning PEM fuel cells reaches maturity and as production escalates, a downward trend in costs is foreseeable, rendering them an attractive option in cost-sensitive markets in the long run. This inference is drawn from the analogous trajectory observed in the lithium-ion battery domain.

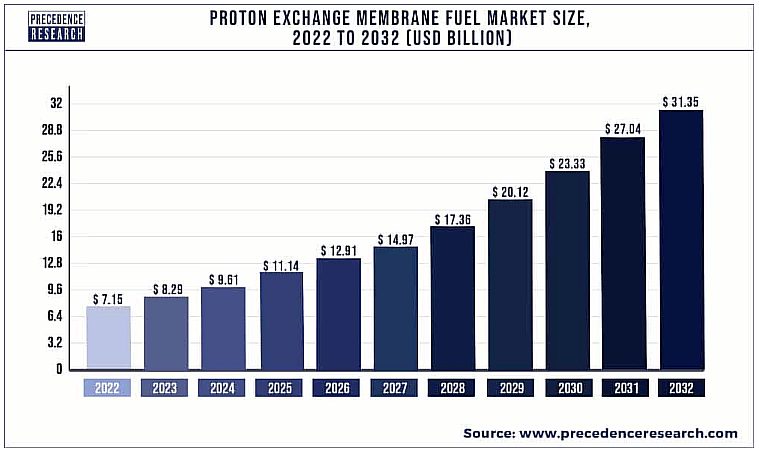

BLDP should enjoy strong secular tailwinds for the foreseeable future. (Precedence Research)

Nevertheless, PEM fuel cells are proficiently matched for scenarios that require long-range capabilities, high energy density, or quick refueling, notably in the case of heavy-duty vehicles. On the other hand, the straightforward recharging process and declining costs related to lithium-ion batteries render them a practical option for portable electronics, electric vehicles, and stationary energy storage systems. In my opinion, the distinct differences in cost, efficiency, and infrastructural prerequisites between PEM fuel cells and lithium-ion batteries highlight a crucial necessity for strategic investments and policy adjustments to nurture a favorable environment for the progression and acceptance of both technologies. The rationale stems from the complementary strengths these technologies bring to diverse applications, thereby signifying the potential for coexistence and shared growth in the energy sector. Consequently, it seems reasonable to infer that there’s a substantial scope for both technologies to thrive. Furthermore, from the information provided, it appears that BLDP is well-placed to capitalize on the ongoing positive trends in the PEM fuel cell domain, which is projected to expand at a 15.93% CAGR through 2032. This prospect is exciting as it not only denotes a promising future for BLDP but also reflects broader industry growth, which could be pivotal in addressing the global energy challenges.

Valuation Analysis

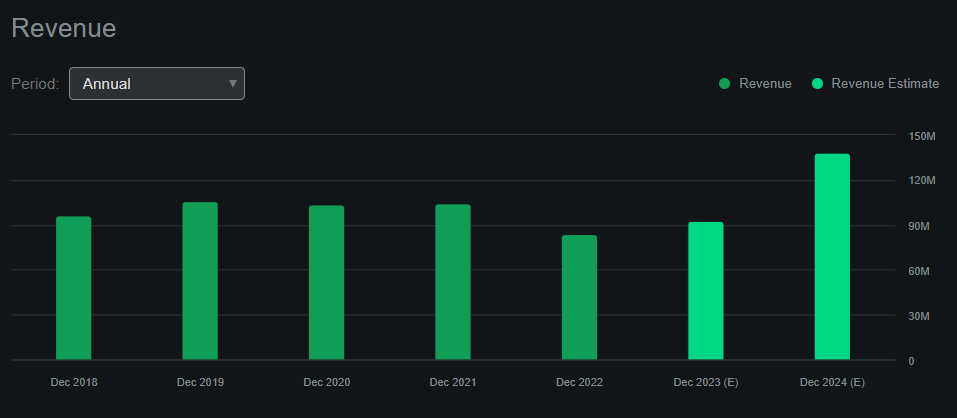

BLDP’s valuation has a certain level of complexity, primarily due to the disparity between its current revenues and market capitalization. At present, the company is not profitable, with ongoing cash burn being a notable concern. Currently, BLDP appears to be burning roughly $140 million per year, which implies it has enough cash to last another 5 to 6 years at the current rate. However, it is projected that BLDP will sustain revenue growth through 2025 with a CAGR of 28.37%. This growth rate outpaces the sector’s anticipated CAGR of 15.93%. In my view, this faster growth rate could reflect a gain in market share within the Proton Exchange Membrane (PEM) market, which might hint at a superior value proposition offered by BLDP.

Moreover, the aforementioned growth rate and potential market share acquisition are promising signs, although the current lack of profitability remains a critical issue. Indeed, the continuous cash burn could potentially undermine the company’s financial stability in the long term despite its projected revenue growth. Yet, analysts’ growth forecast does provide a basis for optimism regarding BLDP’s market position and its value proposition within the sector.

Seeking Alpha.

Additionally, if we look at BLDP’s overall financial context, it’s evident that the company is in a transitional ramp-up phase, poised for revenue expansion in the near future. A notable concern, however, is the lack of profitability thus far, which renders a precise determination of ultimate profitability margins a challenging endeavor. This, in turn, complicates the construction of a reliable DCF model. However, reviewing BLDP’s financial figures from 2021, 2022, and the TTM provides a foundational understanding of the company’s COGS and OpEx. This data, when averaged, can serve as a basis for a long-term estimation of BLDP’s EBIT, leading up to the point of profitability.

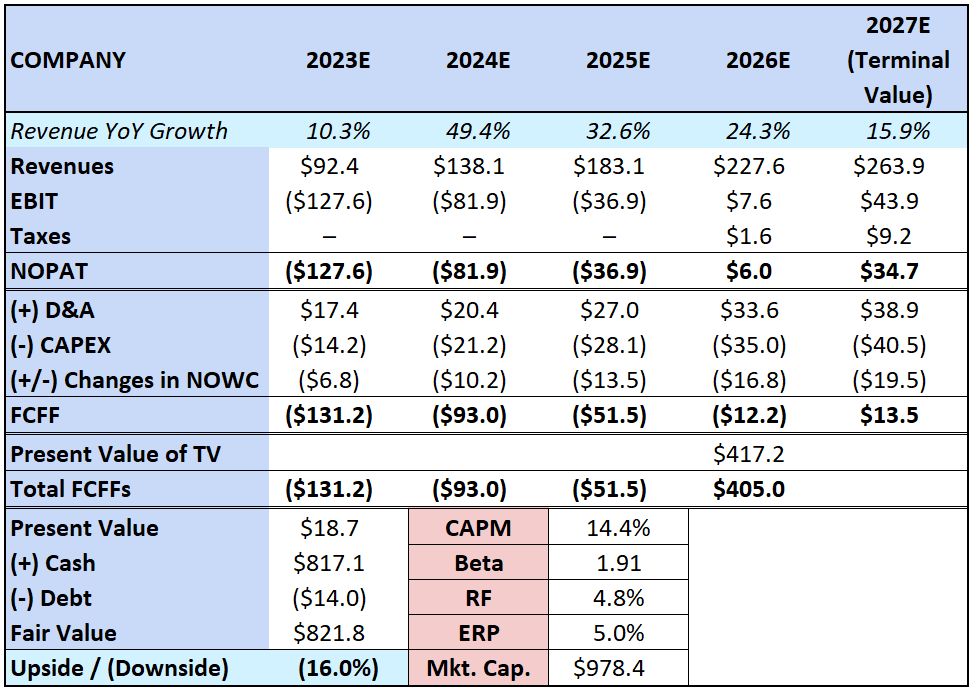

Specifically, using 2021, 2022, and TTM figures, BLDP’s average COGS amounts to $92.4 million, and its OpEx averages at $127.0 million, indicating that a breakeven point would be realized once revenues exceed $219.4 million. In my view, this breakeven analysis is a prudent approach to gauge the financial trajectory of BLDP, grounding expectations in historical financial data that may reflect inherent operational efficiencies or challenges. Drawing from this, along with BLDP’s historical D&A, CAPEX, and NOWC margins, I formulated the following DCF model.

Author’s elaboration

As you can see, my valuation model indicates that BLDP appears to be slightly overvalued, presenting a 16.0% implied downside potential at the current levels. The disparity in valuation is not pronounced enough to elicit concern. Most of the company’s valuation is attributed to its net cash position, a notable strength for BLDP. The company’s favorable technology and solid balance sheet, anticipated rapid growth, and secular tailwinds render the company’s prospects promising. However, the valuation outlook suggests that the stock’s current price already captures this positive sentiment. Furthermore, a substantial portion of the company’s value is currently encapsulated in its book value. Thus, given the present valuation, it seems prudent to rate BLDP as a “hold” at this juncture.

Conclusion

In conclusion, BLDP is an interesting case of strategic pivoting within the burgeoning green energy sector. This tactical realignment, highlighted by a significant $18 million investment in bipolar plate manufacturing to favor American and European markets over China, demonstrates not only a proactive response to evolving market dynamics but also a firm alignment with the global clean energy agenda. While the current unprofitability of BLDP casts a momentary shadow, the trajectory of promising revenue growth juxtaposed against a broader industry growth narrative fosters a favorable long-term outlook. However, my “hold” rating stems from an implied 16.0% downside potential, which implies most of the company’s promising prospects are already priced in. Overall, BLDP’s comprehensive product range, coupled with promising partnerships and contracts, underpins its potential to contribute to a sustainable green energy future significantly.

Read the full article here