Dear readers/followers,

K+S (OTCQX:KPLUY) is a company I’ve now been covering for over a year. Trends have not been superb for the past few articles where I have been adding. My position is in the red, and I don’t foresee any clear catalysts for an upward momentum in the very near term. Starting with that sort of statement, you might ask yourself what the appeal is for this company when the market seems rife with appealing investments with higher yields than is currently being offered by Kali & Salz.

My last article on K+S can be found here, and my key thesis at the time was that the company was buyable based on tightening spreads, good fundamentals, and a good upside despite what could be a more complex near-term development.

While in many ways among the market-leading fertilizer companies out there, and while I remain heavily invested in basic materials, chemicals, and fertilizer here, I would still be careful investing too much or at the wrong price or in the wrong business.

So let me show you why to me, K+S is a superb company among a peer group that while strong, also has potential downside over the short to medium term.

Kali & Salz – why salt and fertilizer are a good combo

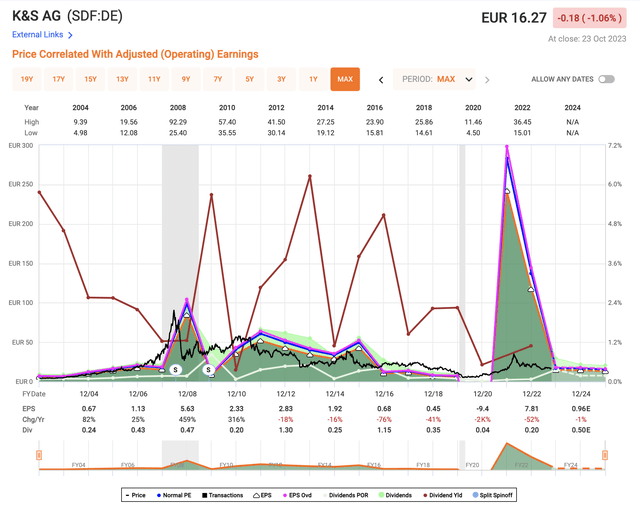

K+S seems to have reached, as I am writing this article, a set of new lows that are worth looking at for the upside. The company, which trades on the native ticker SDF, has a BBB rating, one of the most complex earnings trends I have seen in several years, and has a complex upside and set of forecasts. That is no wonder with a historical trend that looks like this.

K+S Earnings (FAST Graphs)

I said earlier that K+S is pretty much exactly what you want out of any quality fertilizer company – I stand by this. While its products aren’t as high-tech or as “clean” as competitors Yara, because K+S works with Potash, it’s still a very solid and profitable company. With very solid gross margins, not just historically but on a forecast basis, the company also has used the influx of massive cash you see on the trends above to reduce its leverage. It’s going into the next few years not debt-free, but lower in debt than the last decade.

KPLUY works with potassium chloride, so-called MOP, and fertilizer specialties, and like any fertilizer company, the goal is high yields and crop qualities. The company produces, refines, and supplies natural materials for communities, consumers, and numerous industrial solutions. Agri products are about 50%, with industry products at just below 50%, including about 15% of sales being de-icing salt products.

The company issued its half-year report in August, which is the closest set of news and results that we’re going to take a look at here.

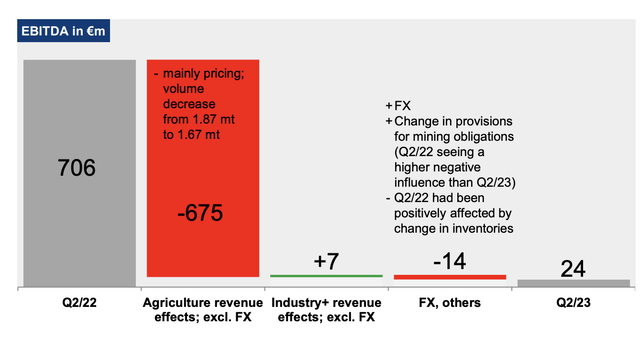

So, first off – the contraction we’ve long expected in fertilizer, not just potash but other fertilizers as well, has “finally” arrived. The company is seeing a massive impact, and I don’t use the word “massive” lightly. Take a look at the YoY comparison for EBITDA.

K+S 2Q23 (K+S 2Q23)

This is obviously a 90%+ drop in company EBITDA. The reason for this is a significant drop in the market price for potash, after the China contract which is finally seeing the turning point in the company and in the industry that we’ve seen expecting for some time.

While farmer/end-user profitability remains high, and while agricultural commodity prices remain high – we know this because we can see it on a daily basis in our shopping and groceries – this does not always translate to positive effects or upswing for the fertilizer companies serving these end users.

If we look at the typical business model for a farmer, Potash only accounts for 5% of the total input costs (Source). Potash is a commodity, and while the war in Ukraine and the exclusion of Belarus and Russia from much of the world has locked the doors on some of the largest suppliers out there, the trends have still turned. This is not the same as there is an overcapacity in terms of the production/availability of Potash, because even prior to Ukraine and the conflict there, the worldwide potash capacity was already being used, with Russia and Belarus each at 16% for the worldwide potash production. (Source).

The company’s annual expected EBITDA is going to be significantly lower than the 2022A period. We’re looking at a range from €600M to €800M on the high end, compared to a €2.4B EBITDA during 2022. Sales volumes are expected to remain stable, showcasing just how extreme the 2022 pricing environment was, given that the company was able to make over €2.3B worth of EBITDA on 7.1MT of sales, with the same amount only netting €800M at most during the year after.

Some housekeeping/fundamentals worth mentioning. CapEx for the year is up – the company is continuing to invest. Given the continued positive environment on the end market and the non-recurring nature of the latest year of results, I don’t foresee any sort of fundamental decline for the company as such in credit rating or other concerns.

Overall, I remain fully in favor of K+S. Why is that? Because there are several very clear megatrends that speak clearly in favor of K+S. This includes the overall shrinkage of Arable land due to among other things, the population as well as climate changes.

This brings about not optional demands, but needs, such as the need for higher efficiencies, which requires better fertilizers, and that’s what the company does. 2/3 of the current world population belongs to the middle class by 2030, and in 2015, that number was only around 14%. That’s a massive change, requiring significant agricultural changes due to the consumption patterns of food during increased patterns of urbanization. Such increased urbanization is likely, as I see it, to drive demands for products derived from industrial large-scale farming, as opposed to the smaller-scale rural farming which may not use potash or fertilizer in the same amount or scale.

A second factor impacting any company in the fertilizer sector is the situation with regard to water. Water scarcity is going to get “real” over the next few years, with 40% estimated to suffer by 2030 – and given that 70% of all water is used for agriculture (Source: UN, OECD World Population Clock of the Deutsche Stiftung Weltbevölkerung), and these are some very up-to-date numbers.

In the very best of situations, it requires incredible optimization on the part of fertilizer companies.

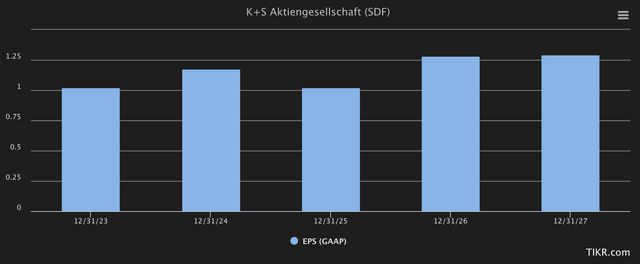

It was no secret that 2023 was going to be facing incredibly difficult comps, with 2022 results. I don’t expect wonders for the company – but if we ignore the non-recurring comp, then forward estimates actually look good.

K+S forecast estimates (TIKR.com)

The problem here is the dividend. The current yield estimate is actually going down despite the EPS trend. I don’t see these yield estimates as actually materializing – if the company’s earnings do go up, I actually expect the yield to be significantly higher.

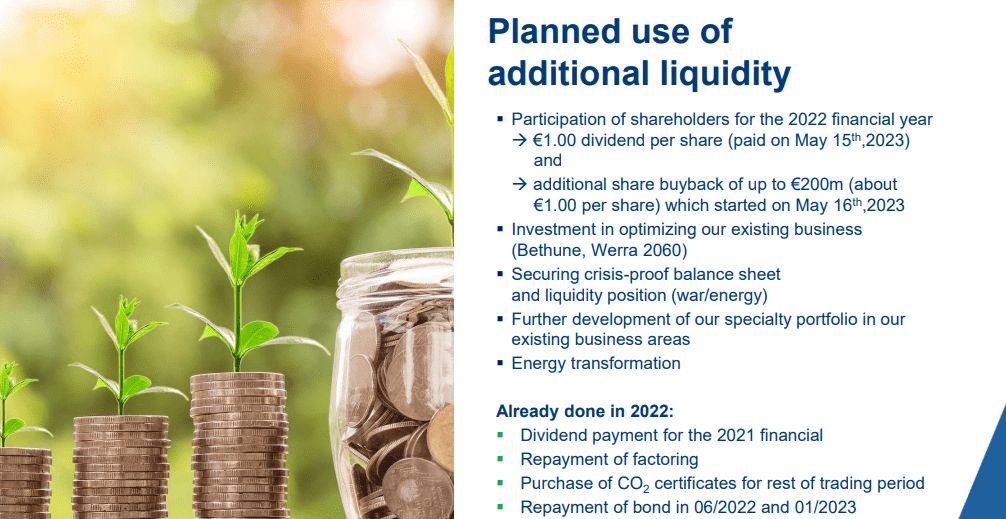

The use of the cash that’s come in has been clear as well.

K+S IR (K+S IR )

I don’t expect Potash to recover until 2026E, and this is a very good potential/future upside for K+S here. I’ve been using options for some time to invest in the company, and so far none of them has gone through.

Here is my current valuation thesis for K+S.

K+S – undervaluation is significant.

I continue to see K+S as significantly undervalued. My thesis and PT for the company is a “BUY”, with a €30.5 PT. I’m not changing this thesis at this time.

Triple-digit RoR over the next few years is not at all unlikely here. The right sort of development and continued demand could see, and likely will see, this stock soar far higher than we’ve seen so far.

You can go for the options here – during down days, the company’s conservative options at a €12-€14/share strike price can go up to a double-digit annualized yield. That’s one way. The other way is common share investment.

Given that many of the cheaper Eastern European players have been knocked out of the game at least temporarily given the current conflict, I believe this player has a significant upside.

My justification for the higher price target is the ongoing tightness of the market, the low likelihood of new capacity on the market in a significant way, as well as a long-term positive fundamental backdrop. I continue to view the larger view or more common view as far too negative. The current analyst estimates for the company are between €16 on the low side – so you see that even the most negative of 16 analysts give the company a “BUY” here – to €29 on the high side, with an average of €20/share. 10 analysts out of 16 are at either “BUY” or a positive thesis here.

K+S might not be the clearest upside or even what you might consider the “best out there” – but it nonetheless presents a very appealing long-term investment thesis, much like Yara, related to feeding the population, and in this case also of the appealing segment of salt.

This combined upside is enough for me to stick to my “BUY” here, and stick with my position.

A risk I would see here is obviously eastern-European capacity returning earlier than expected (2025-2026E as I see it now, but given the current geopolitical discourse I do not consider this likely), or pricing worsening even more. We’re in an unstable market and few things are certain – but at less than 8x P/E normalized, this company is cheap here, and even “okay” in terms of pricing if we use forward rather than historical multiples.

Thesis

- K+S is one of the largest players in Potash remaining after Russia and Belarus are sanctioned off to most of the modern world. This makes this German fertilizer and salt giant an attractive play, and a good time for the company to flex its expansionary muscles. Despite a lack of an IG rating, I view this as an interesting play.

- In the right environment, which we have today, it’s not inconceivable that the company could rise closer to its fair value, which I view as being valid close to €40/share.

- I now remain at my conservative €30.5 PT based on conservative growth rates, mixed NAV/peer valuations, and conservative multiples and forecasts. This is above the average, but I consider it fair.

- I, therefore, view it as a “BUY” here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansions/reversions.

My one change is that I now view K+S as “cheap” here, fulfilling all of my criteria

This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here