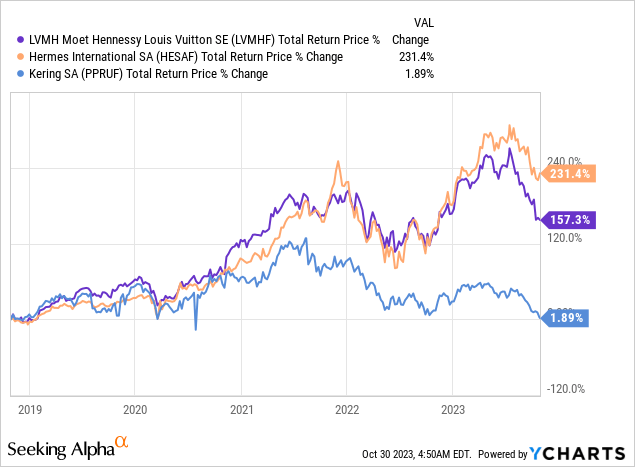

Kering (OTCPK:PPRUF) (OTCPK:PPRUY) announced disappointing Q3-23 sales figures, reporting a 9% organic revenue decline. The luxury group continues to lose share to industry leaders in LVMH (OTCPK:LVMHF) and Hermès (OTCPK:HESAF), with no sign of change approaching.

The luxury sector is experiencing a sharp selloff as investors are suspicious of their near-term prospects, in light of a tough economic environment, post-pandemic normalization, and extremely tough comparisons after a few years of extraordinary growth.

While valuations seem attractive all across the board, it’s important to understand it might get darker before the dawn.

I find Kering as an inferior business in the sector and prefer to exploit the selloff from other angles. Thus, I reiterate a Hold rating.

Introduction

In July, I initiated coverage on Kering claiming its ‘Ugly Duckling Tale Continues’. I urge you to read that article, in which I described my investment thesis in detail, as well as the group’s operating segments, and the main reasons for its underperformance compared to the industry leaders.

I found the company’s management inferior to its rivals like Richemont (OTCPK:CFRHF) and LVMH, as Kering is consistently losing market share and its operations are less profitable and less efficient.

In August, following activist ambitions in the company, it seemed the Pinault family decided to take a step in the right direction with a major management reorganization announcement. However, I viewed the de facto change as questionable, as it was mostly an internal switcharoo, keeping the same leaders that were there for the last decade.

Overall, Kering has already admitted defeat in 2023, calling it a transition soft year. However, I think investors were counting on something a little less softer than that in Q3. Let’s dive in.

Q3-23 Highlights

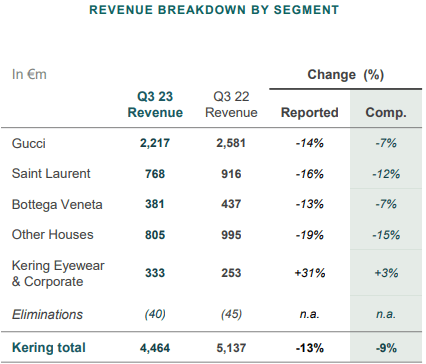

Kering reported revenues of €4,464 million, down 13% on a reported basis and down 9% organically. Revenue from directly operated stores fell 6% on a comparable basis, on lower traffic and contrasted performances across regions. Wholesale and Other revenue fell sharply (down 20% on a comparable basis), due to the Group’s efforts to transition to direct-to-consumer, combined with weakness in the continuing wholesale operations.

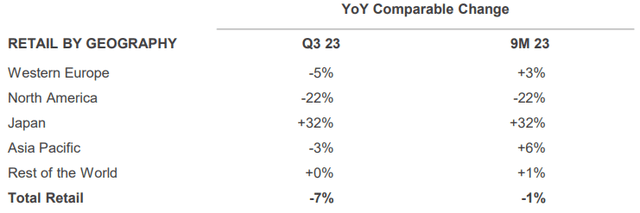

Kering Q3-23 Investor Presentation

As we can see, the only positive geography in the quarter was Japan, which grew organically by 32% Y/Y. That is higher than both Hermes and LVMH, which grew 24% and 30%, respectively. One thing to note is that Kering’s numbers reflect solely their retail operations, so it could affect the comparison, although for both LVMH and Hermes wholesale is a smaller part of their business.

In Europe, Kering declined 5%, compared to growth of 7% and 18% for LVMH and Hermes, reflecting significant share losses. North America saw a similar trend as Kering’s sales declined 22% compared to 20% and 2% increases for Hermes and LVMH. Again, the comparison isn’t perfect because Kering disaggregates North America and the rest of America, whereas Hermes and LVMH include the entire region under the same category. The worst performance was in Asia, as Kering declined 3% compared to 11% and 10% increases, for LVMH Hermes.

On a consolidated basis, Kering declined 7% in the quarter, whereas Hermes grew by nearly 16% and LVMH grew by 9%.

Kering Q3-23 Investor Presentation

Looking at the results of each segment, we can see there are no significant outliers. Almost every category declined in the mid-teens on a reported basis, while Eyewear improved by 31%, due to the acquisition of Maui Jim.

On a comparable basis, the only positive grower was again Kering Eyewear, although it was a mere low-single-digit increase.

The Importance of Superior Management In Luxury

The luxury market, although more resilient than the mid-to-high-end apparel category, is still volatile. There are no subscription-based transactions here and no steady commitments. The fact you achieved record high sales in one year means nothing for the next. Trends change, desirability changes, fashion changes, and more importantly, the customer’s buying power and buying will constantly change.

Clearly, what I’m describing here is an industry that in general, is much tougher for investors, as sales and profits are less predictable. That being said, the luxury sector does comprise a few companies that own portfolios of everlasting high-quality brands. It won’t be a bold take to say that Gucci, Louis Vuitton, or Hermes, will remain the world’s most renowned brands fifty years from now, the same way they’ve been for the last 200 years (or 100 in the case of Gucci).

While the long-term trajectory remains intact, there are periods where the importance of strong management is evident. In my opinion, such a period is happening now.

The luxury sector had an amazing five years. Kering did not participate. It is now experiencing a decline, but Kering is declining even further than the overall sector.

With its inferior management, Kering is late to transition to direct-to-consumer. Its brand desirability is lower, and its operations are not as well run, as reflected by its margins, revenue growth, and cash cycle, all of which we discussed in previous articles.

To conclude my point, I think Kering needs to show us it’s able to turn things around before we put our chips in, and that’s despite the supposably attractive valuation.

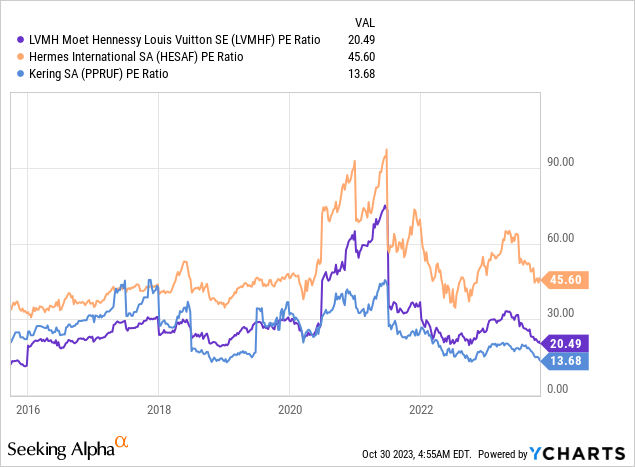

Valuation

As we can see, Kering is trading at an absurd valuation, with a P/E multiple that reflects the average apparel company like Crocs (CROX), Ralph Lauren (RL), or PVH Corp (PVH). Another thing we can see is that Kering was historically trading in line with LVMH’s multiple until Covid-19 hit.

In my view, if and when the luxury sector recovers, we are going to see Kering’s multiple expand, and with the return to growth in profits, it should provide great returns.

However, I estimate that’s true for LVMH as well, which is also trading at a historically low valuation, yet it’s able to sustain positive growth.

Based on everything we discussed so far, I can’t find anything that suggests Kering will be able to take a significant share from its rivals. And strategically, buying an inferior market-share-losing company just because it’s cheaper, is usually a recipe for inferior returns.

Conclusion

Kering owns a portfolio of high-quality, world-renowned, everlasting brands. However, those brands are being managed poorly relative to the industry, as the group loses market share to its rivals consistently, from quarter to quarter.

Despite the obviously attractive valuation, I believe investors should take a ‘buy the news’ approach here, and wait for Kering to show it is able to turn things around. Until then, I rate the stock a Hold, as I find more attractive ways to get exposure to the currently undervalued fashion luxury sector.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here