Introduction

Nabors Industries Ltd. (NYSE:NBR) released its third quarter of 2023 results on October 25, 2023.

Note: As I have done it quarterly for many years, this article is an update of my April 28, 2023, article. I have followed NBR on Seeking Alpha since September 2014.

1: NBR’s 3Q23 results snapshot

Total revenues were $733.974 million (with total revenue and others of $744.143 million) in the third quarter of 2023, up from $694.14 million a year ago.

NBR reported a third-quarter 2023 loss of $48.92 million or $6.26 per share, compared with a loss of $13.78 million last year. The third-quarter 2023 adjusted loss was $2.26 per share.

Anthony G. Petrello, CEO and President of Nabors, stated that despite declining revenue, drilling activity in all of the company’s markets largely met expectations. However, he noted that the U.S. was solely responsible for the eight rig decline in the global average rig count during the third quarter.

The business faced difficulties in Saudi Arabia this quarter with its newly built rigs and their crucial parts, which led to delays in deployment and a large amount of downtime. The company is presently handling the aforementioned issues and anticipates that its third-party supplier will fix the issue in the fourth quarter.

Anthony G. Petrello, Nabors Chairman, CEO, and President, said in the press release (emphasis added):

During the quarter we experienced challenges with our newbuild rigs and some of their critical components in Saudi Arabia, which resulted in deployment delays and significant downtime. We are currently addressing the quality assurance issues on these assets delivered by our third-party supplier. We expect our supplier’s performance to improve rapidly as its local manufacturing experience increases.

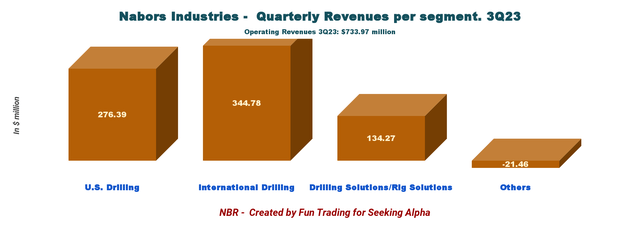

Analysis per segment:

- 1: U.S. Drilling: For the third quarter of 2023 adjusted EBITDA was $117.36 million. Nabors had an average of 74 rigs. In the Lower 48 markets, the average daily adjusted gross margin was $15,855.

- 2: International Drilling: The adjusted EBITDA was$96.2million. Lower rig counts in Kuwait and Saudi Arabia and start-up costs offset improved results across a number of markets. The median number of international rigs was 77, which was the same as the prior quarter. The third quarter’s average daily adjusted gross margin was $15,778, a figure that was about 3% lower than the previous quarter.

- 3: Drilling Solutions: Adjusted EBITDA decreased sequentially by roughly $2.3 million to $30.4 million. decreased activity in the Lower 48 was due to the fewer Nabors rigs which was largely compensated for by an 8% growth in third-party revenue in the USA and internationally.

- 4: Rig Technologies: Adjusted EBITDA was $7.2 million, up from $6.4 million in the second quarter. The sequential rise in adjusted EBITDA was driven by growth from the Energy Transition products and increases in aftermarket margins.

NBR Quarterly Revenue per Segment (Fun Trading)

As we can see, 84.6% of the total output comes from drilling in the USA and internationally.

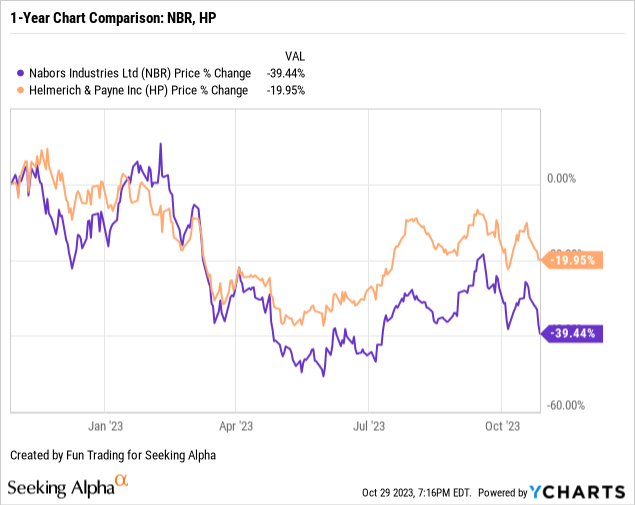

2 – Stock performance

Nabors Industries has experienced a significant decline of 39.5% over the past year. Helmerich & Payne, which is its closest competitor, performed marginally better and is down 20% year over year. The recent decline in this industry followed a robust bullish trend that began in June.

3 – Investment thesis

When comparing Nabors Industries to its direct competitor Helmerich & Payne, Inc. (HP), the investment thesis for NBR remains bit complex.

Due to the industry’s notorious volatility and low profit margins, which fail to indicate the steady cash flow needed for a long-term investment, making an onshore drilling long-term investment in NBR is extremely risky. The recent history of the company makes the issue very apparent.

However, assuming stable oil prices and limited negative effects from the turmoil experienced in the Middle East, the bullish outlook for the fourth quarter may indicate a trading opportunity while the stock still suffers from the technical issue faced in Saudi Arabia.

NBR strongly correlates with the price of gas and oil, as I mentioned in my previous article. Therefore, to lower the risk associated with this industry, I advise trading LIFO over 70% of your long-term position.

Worse, the company doesn’t pay a dividend, so the only investors who would find investing in NBR attractive are those who trade a significant portion of their position in the short term.

Nabors Industries – Balance Sheet History ending 2Q23: The Raw Numbers

| Nabors Industries | 2Q22 | 3Q22 | 4Q22 | 1Q23 | 2Q23 |

| Total Revenues and other income in $ Million | 630.94 | 694.14 | 760.15 | 779.14 | 767.07 |

| Net income in $ Million | -82.92 | -13.78 | -69.07 | 49.22 | 4.61 |

| EBITDA $ Million | 144.33 | 221.59 | 181.09 | 292.25 | 88.84 |

| EPS diluted in $/share | -9.41 | -1.80 | -7.87 | 4.11 | -0.31 |

| Operating cash flow in $ Million | 120.80 | 138.95 | 199.99 | 154.05 | 168.47 |

| CapEx in $ Million | 76.63 | 111.19 | 101.37 | 118.73 | 144.76 |

| Free Cash Flow in $ Million | 44.16 | 27.76 | 98.62 | 35.32 | 23.71 |

| Total cash $ Million | 417.98 | 425.07 | 452.32 | 475.73 | 429.06 |

| Long-term debt in $ Million | 2601.5 | 2,585.5 | 2,537.5 | 2,562.3 | 2.503.3 |

| Shares outstanding (Basic) in Million | 9.08 | 9.10 | 9.10 | 9.87 | 9.20 |

Courtesy: NBR 10-Q.

Balance Sheet Snapshot

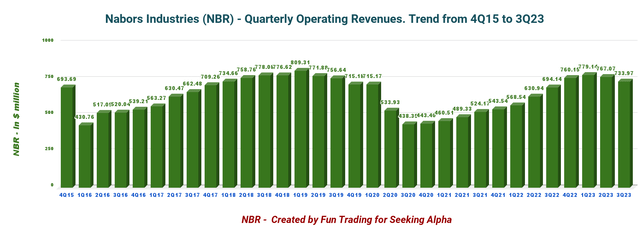

1: Revenues were $733.97 million in 3Q23. Total revenues and others were $744.14 million.

NBR Quarterly Revenue History (Fun Trading)

Note: Operating income plus investment income was $744.143 million.

Nabors Industries reported third-quarter 2023 operating revenues totaling $733.97 million, up from $694.14 million in the same quarter last year (please see the chart above).

Compared to $221.59 million in the third quarter of 2022, the adjusted EBITDA for the third quarter of 2022 was down to $23.31 million.

Anthony G. Petrello, Nabors Chairman, CEO, and President, said in the conference call:

Activity in our major global markets was essentially in line with our expectations. Rig count in the lower 48 declined in the third quarter. It appears to have reached the bottom. Leading-edge pricing seems to have stabilized, lower drilling activity in the U.S. impacted results in our Nabors drilling solutions and rig technologies segments.

The new built rigs in Saudi Arabia were a source of disappointment as reflected in our third quarter results. Specifically, the issues included delivery delays by our local supplier, field performance challenges with certain of the new build rate components, and higher startup costs, as we addressed these challenges.

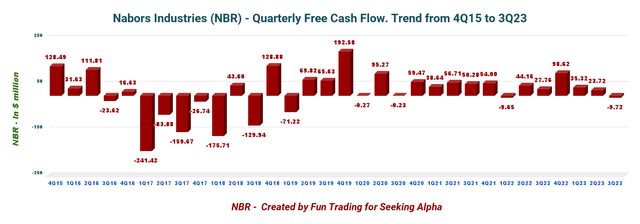

2: Free cash flow was estimated at negative $9.70 million in 3Q23.

NBR Quarterly Free Cash Flow History (Fun Trading)

Note: CapEx subtracted from operating cash flow is the generic free cash flow. The company reported $5 million in adjusted negative free cash flow.

NBR’s trailing 12-month free cash flow was $147.87 million, with a negative $9.72 million in 3Q23.

Due to its lack of dividend payment, the company is substantially worse off than its primary rival, Helmerich & Payne, which offers a dividend yield of 4.92%.

CFO William Restrepo said in the conference call:

Free cash flow for the third quarter at just under breakeven fell below our target, mainly due to higher capital expenditures of $33 million, which reflected the accelerated timing of investments in Saudi Arabia and the US. This should result in lower than previously expected CapEx in the fourth quarter.

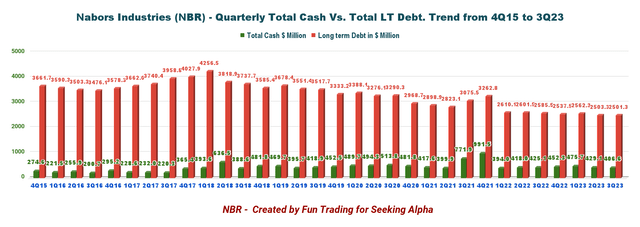

3: Net debt is now down to $2.09 billion at the end of 3Q23

NBR Quarterly Cash versus Debt History (Fun Trading)

The above chart shows that NBR is progressively reducing debt. In the third quarter, there was $2,501.34 million in total debt. There was $406.64 million in cash in total. The company net debt is now $2.1 billion.

4: 4Q23 Outlook

- U.S. Drilling o Lower 48 average rig count of 72 – 74 rigs.

- Lower 48 adjusted gross margin per day of $15,000 – $15,200 which is 4.4% lower than the third quarter.

- Alaska and Gulf of Mexico adjusted EBITDA up by $1.5 million.

- International rig count up by one to two rigs versus the third quarter average

- Adjusted gross margin per day of approximately $16,200 – $16,300 up 2.8% from the third quarter.

- Drilling Solutions adjusted EBITDA up by approximately 10% vs the third quarter

- Rig Technologies adjusted EBITDA up by approximately 20% vs the third quarter.

- Capital expenditures of $95 million, with approximately $35 million for the newbuilds in Saudi Arabia Adjusted Free Cash Flow.

- Adjusted free cash flow for the fourth quarter of $165 to $190 million and for the full year 2023 of $225 to $250 million as compared to the previous expectation to generate between $300 million and $350 million.

CEO Anthony Petrello said in the conference call:

In general, the outlook for international business, including Saudi Arabia, remains quite positive. Coming out of the third quarter, we have 11 deployments expected through the end of 2024. Beyond these, we see improving prospects for additional rigs across the number of markets. These include Kuwait, Algeria, and Oma in the Middle East, and Argentina, and Columbia, and Latin America.

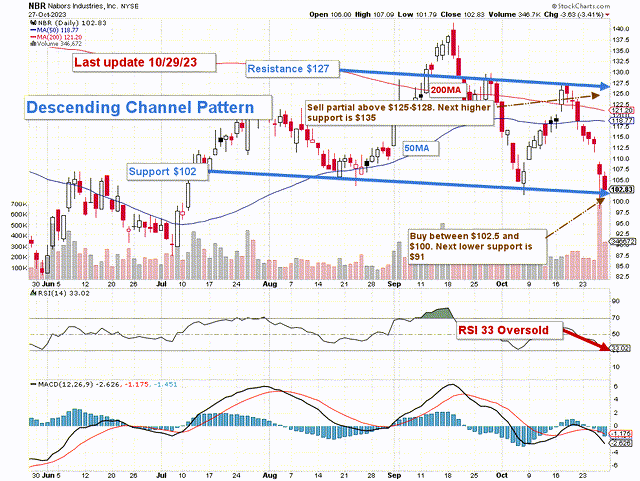

Technical Analysis (Short Term) and Commentary

NBR TA Chart (Fun Trading StockCharts)

NBR establishes a descending channel pattern, with support at $102 and resistance at $127. At 33, the RSI is deemed oversold and may indicate a buying opportunity.

Descending channel patterns are short-term bearish in that a stock moves lower within a descending channel, but they often form within longer-term uptrends as continuation patterns. Higher prices usually follow The descending channel pattern but only after an upside penetration of the upper trend line.

Trading LIFO with roughly 60% of your position is the short-term trading strategy; you should retain a core long-term amount for a much larger payout.

Thus, selling in excess of 60% of your position between $125 and $128 would be a good idea. A higher resistance level could be at $135. Alternatively, you could wait for another retracement between $102.5 and $100 to start building up, with a potential lower support level at $91.

A profitable trading strategy requires hawkish observation of oil prices.

Warning: The TA chart must be updated frequently to be relevant. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Read the full article here