A mixed run for markets last week offered a partial reprieve, but the trend profile still skews negative overall, based on a broad measure of the major asset classes via a set of ETFs.

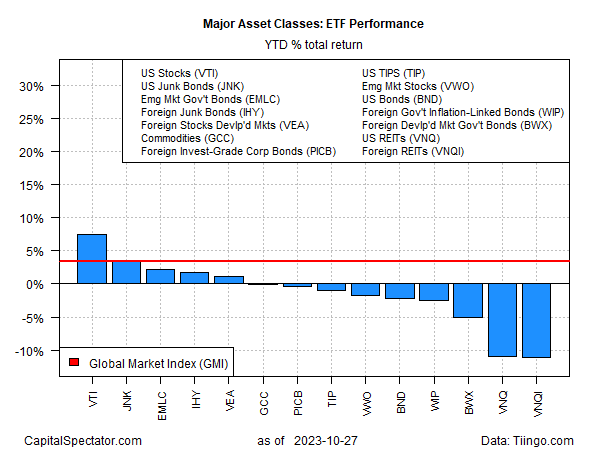

The Global Market Index (GMI) fell again in the trading week through Friday, Oct. 27, marking the fifth weekly decline in the past six. Year to date, GMI is still posting a modest 3.4% gain, but the slide from summer highs appears to be ongoing as 2023 approaches the final two months of the year.

GMI is an unmanaged benchmark that holds all the major asset classes (except cash) in market value weights via ETFs and represents a competitive measure for multi-asset-class-portfolio strategies.

US stocks (VTI) continue to lead the field for 2023 performances, albeit in a diminished degree vs. previous months. American shares are currently up 7.5% through Friday’s close. The second-best performer: US junk bonds (JNK) with a 3.4% gain.

US and foreign commercial real estate (VNQ and VNQI) continue to mark the deepest losses this year for the major asset classes with 2023 declines in excess of -10%.

Two key risk factors continue to weigh on investor sentiment: the potential for a wider Middle East war and passive tightening for Fed policy in recent months via the rise in Treasury yields.

Bloomberg this morning reports that “Mideast Markets Price Low Probability of Wider Regional War,” but the expansion of Israel’s ground offensive in Gaza today could change the calculus.

“There’s a real risk of escalation,” says Sanam Vakil, the director of the Middle East and North Africa program at Chatham House, a London-based think tank, in an interview on Sunday.

Meanwhile, if the Federal Reserve maintains its target rate at the current 5.25-5.50% range, that translates to a positive real rate. The Fed’s preferred measure of pricing pressure, core PCE inflation, ticked lower again last month, easing to a 3.7% year-over-year pace through September.

The 10-year Treasury yield, by contrast, has increased recently and closed on Friday at 4.84%, close to a 16-year high and well above the core inflation rate.

Assuming inflation continues to slip, passive tightening ensues unless the central bank cuts rates, a low-probability, based on Fed funds futures. This week’s Fed announcement (Nov. 1) is projected to leave rates unchanged.

“That the bond market is delivering the tightening the Fed wants means the Fed can be a bit more cautious,” says Shamik Dhar, chief economist at BNY Mellon Investment Management.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here