Introduction

Subaru (OTCPK:FUJHY) car sales are growing rapidly in the US. In September, US car sales were up 23.4% from a year ago. Growth continues to look good, as this is the 14th consecutive month of increased car sales. The Subaru Forester is especially popular, of which 15,237 were sold in September (49% YoY increase).

Japanese automakers are known for their efficient operations through the LEAN method. LEAN is a way to optimize an organization’s people, resources, efforts, and energy to increase customer value. Subaru is in the top 3 best operating margins among Japanese automakers. And with the high profit margins, we also see a neat balance sheet with a strong cash-to-debt ratio of 4.7.

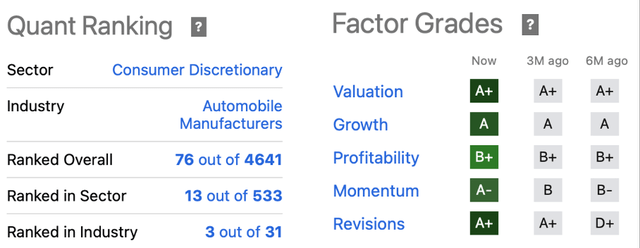

The strong score in Seeking Alpha’s Quant rating is also a plus. Subaru scores well and ranks 76 out of 4641 overall. All factor ratings are strong. The one that lacks is Subaru’s profitability which scores a B+. The industry average gross profit margin is 36%, while Subaru’s gross profit margin is “only” 20%.

Quant Ranking and Factor Grades (Seeking Alpha)

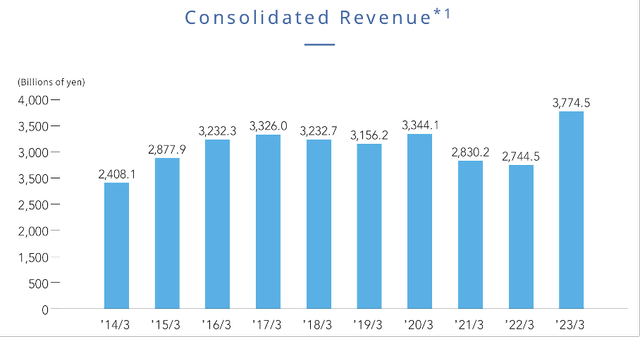

However, the moderate gross margin can be an advantage because it makes Subaru’s price to value better than competitors. And we see that reflected in sales. Sales have risen sharply this year. Consolidated sales (in yen) were up a whopping 38%. All in all, great numbers, which is why I maintain Subaru as a “strong buy.”

Subaru’s Consolidated Revenue (Subaru’s Investor Relations)

Strong Financials and Profit Margin

The car market is looking good. Subaru expects strong growth in the U.S. for its well-known models. The Forest model is the best-selling one and achieved sales growth of 46% in the US. The Outback and WRX also sold also well with 33% and 72% sales growth.

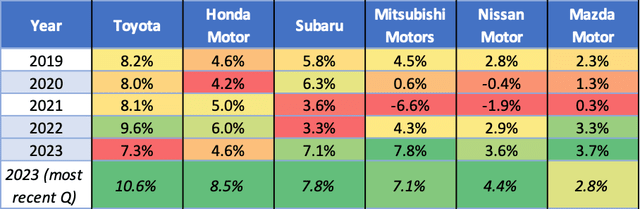

Strong growth rates are often accompanied by meager profit margins. But we don’t see that at Subaru. The operating margin is fine at 7.8%.

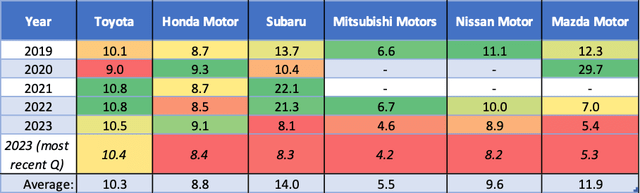

Subaru, like Honda and Toyota, manage to maintain their profit margins just fine. We see that many Japanese automakers struggled to maintain profitable in 2021. But Subaru, like Honda Motors and Toyota, remained profitable. Subaru knows well how to manage their costs through LEAN methodology.

This year, the profit margin of many car manufacturers have increased quite a bit. Perhaps they have increased selling prices in anticipation of purchasing price inflation. This has a positive effect on the profit margin for now, and if inflation falls, there will be no margin contraction in the short term.

Operating Margins of Common Japanese Car Manufacturers (Annual reports)

The Subaru Difference, Strong Outlook

“The Subaru Difference” stands for its creation, fun and peace of mind, and environmental technologies. Subaru is an automaker committed to “people-centered car making.” Safety is its guiding principle.

The Forester is a crossover with both on-road and rough-road capabilities. It is a modern SUV that stems from the Legacy Touring Wagon. The Forester is currently Subaru’s best-selling model.

The U.S. is Subaru’s largest market and it is therefore also a geographic risk. It is now likely that the US will fall into recession due to the sharp rise in interest rates. And since car sales are cyclical, that could be quite detrimental to Subaru.

Subaru does not expect stagnation yet. In fact, the outlook for fiscal 2024 is strong. Subaru expects to increase car production by more than 16% next year. And operating income is expected to increase 12%. These are strong growth prospects, despite the risk of the yen depreciating.

Still, there are some challenges in the short term. The value of the yen has fluctuated significantly in recent years. Also, Subaru continues to suffer from its semiconductor supply chain and logistical constraints. Despite these uncertainties, Subaru maintains its strong growth forecast.

Strong Earnings Offer Shareholders A Good Shareholder Return

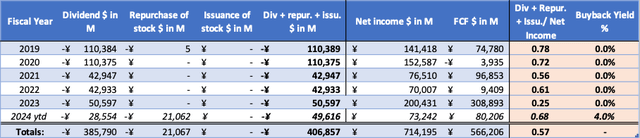

Subaru’s strong profit growth benefits shareholders. In the current fiscal year, Subaru repurchased more than 21 billion yen worth of shares, bringing the return on repurchases to about 4%. This is decent because Subaru also pays a dividend. The current share price tells us that the dividend yield is 1.5%.

Financial highlights (Subaru’s annual reports)

Subaru has an excellent stock return policy, as over the past 5 years it has returned an average of about 57% to its shareholders. So for the long term, they can sustain this easily.

Quant Valuation Rating: A+

In general, Japanese automakers have a solid balance sheet with an abundance of cash. The same is true for Subaru. Subaru has 1.5 billion yen in cash and marketable securities on its balance sheet, and only 239 million yen in long-term debt and 71 million yen in short-term debt. Interest expenses are nicely covered by strong profits (interest coverage is 8.2). In previous years, this ratio was even better. Subaru shows that it has a good leverage policy. And that’s beneficial, because auto manufacturers generally have low profit margins and a lot of overhead costs. This makes Subaru much more resilient to the cyclical auto market.

Rising car sales, high profit margins, acceptable leverage and a cash-rich balance sheet. Subaru’s stock valuation should be trading at a premium to its competitors. In fact, the stock is undervalued, as its share price has fallen slightly since September.

Japanese automaker Mitsubishi Motors appears to have the cheapest stock valuation. Although, Mitsubishi’s profits have fluctuated more frequently in recent years than Subaru’s profits. In my opinion, Subaru can be better compared to Toyota and Honda Motors. These companies have strong operating margins and have had many profitable years. Subaru stands out with a P/E ratio of only 8.3. And it is also undervalued compared to its historical average of 14.

P/E ratio of well-known Japanese automakers. (Analyst’ calculations)

Another way to look at stock valuation is to include cash and debt. I think this is important for capital-intensive companies like car manufacturers. Car manufacturers with abundant cash have more financial security and can grow faster. Moreover, they can distribute the cash to shareholders. Subaru’s EV/EBIT ratio is only 2.6, while its 5-year average is 6.2. This shows that the company is quite undervalued compared to its 5-year average.

The industry average EV/EBIT ratio is 13.0, so Subaru is also undervalued compared to the market. Seeking Alpha Quant therefore gave the stock a decent rating of A+.

Currency Risk

Subaru is a Japanese company listed in Tokyo. And due to increased interest rates in the U.S., the value of the Japanese yen has fallen over the past 2 years. This boosts Japanese exports because American consumers pay less for the same exports. However, American investors in Japanese stocks therefore experience currency risk.

The Bank of Japan has kept its interest rates at around -0.1% since 2016, hoping this will stimulate the economy. Core inflation in Japan was below the 2% target for many years. But recently, core inflation has now risen to 3%. Analysts expect a 10-basis point rate hike in the first half of 2024. But I don’t think this will boost the value of the yen much. US interest rates currently have a stronger influence on the value of the yen compared to the dollar.

There is a silver lining for American investors in Japanese stocks because the Fed is expected to cut interest rates next year. The median federal funds rate is expected to reach 5.6% this year and fall to 5.1% next year. By 2025, FOMC members expect the federal funds rate to fall to 3.9%. The weaker dollar is good for investors who are now buying Japanese stocks. When the yen rises against the dollar, it will provide additional returns for US investors. However, it could affect Japanese exports.

USD:YEN (Seeking Alpha)

Conclusion

Subaru has strong investment criteria. Strong growth rates, strong prospects, high profit margins, a solid balance sheet and an attractive equity valuation. As a result, Subaru comes out favorably in Seeking Alpha’s Quant rating. Subaru is doing well and that is partly because of the strong dollar. Revenue increased by as much as 38% this year. The profit margin is also strong and ranks No. 3 of best profit margins among Japanese automakers.

The high profit margin is due to Subaru’s ability to increase operational efficiency. Subaru has little to worry about rising interest rates because of its abundance of cash. Subaru can use the cash to grow its business or to reward shareholders. It pays an excellent dividend and repurchased more than 4% of its outstanding shares last quarter. Share repurchases increases the dividend per share because there are fewer shares outstanding.

Subaru’s growth prospects are good, but risks lurk. The US is Subaru’s largest sales market. And that entails a geographical risk. There is a good chance that the US will end up in a recession due to the sharp rise in interest rates. The car market is also cyclical in nature. Still, the stock’s attractive valuation provides enough safety to absorb setbacks. The stock is valuable and I hereby give Subaru stock a “strong buy.”

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here