Avnet (NASDAQ:AVT) manufactures and sells electronic components. The company has guided for revenue decreases in Q1 of FY2024 as demand for semiconductors seems to be slowing down. With thin margins and a modest organic revenue growth history, Avnet’s financials seem mostly good, but not exceptionally great. The stock is currently priced at a low forward P/E of 7.9, but as Avnet is currently operating at a record EBIT margin and has a significant amount of debt, I don’t believe the ratio doesn’t contextualize the valuation enough. To take a further look at the valuation, I constructed a discounted cash flow model.

The Company & Stock

Avnet operates through two segments – Electronic Components and Farnell. The Electronic Components segment focuses on manufacturing and selling components such as electronic connectors, sensors, SDRAM, and thermistors – Avnet has a wide range of different semiconductors that the company manufactures. Farnell on the other hand is a distributor of electronic components and other similar products, for mostly industrial use cases. Of the two segments, the Electric Components is a very dominant part of Avnet, as in Q4 the segment represented around 90% of the company’s adjusted operating income.

Avnet’s stock hasn’t made a great return to investors in the past ten years. The stock has appreciated at a CAGR of 1.4%, along with a modest dividend yield that currently stands at 2.71% after a raise of 6.9% made in August.

Ten-Year Stock Chart (Seeking Alpha)

Financials

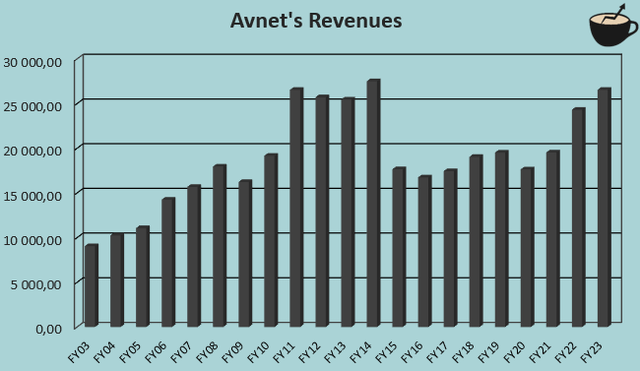

Avnet’s revenues have grown at a historical long-term CAGR of 5.5% from FY2003 to FY2023:

Author’s Calculation Using TIKR Data

The achieved growth has been a result of slight organic growth and a large amount of acquisitions, especially in the period from FY2006 to FY2014. From FY2015 forward, Avnet has only had cash acquisitions in three years. From FY2015 to FY2023, Avnet’s revenue CAGR has been very slightly lower at 5.2% – it seems that the company has been able to achieve organic growth as well.

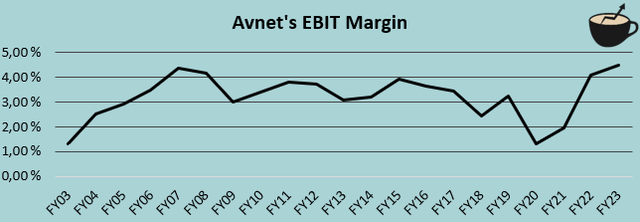

Avnet’s margins are quite thin as the company’s gross margin is low at a trailing figure of 12.0%. From FY2003 to FY2023, the company’s average EBIT margin has been 3.2%. In FY2023, the company achieved a new record margin of 4.5%:

Author’s Calculation Using TIKR Data

I believe that the margin is mostly at a sustainable level – Avnet’s gross margin in FY2023 was even below the company’s 12.3%. The company’s achieved margin seems to be due to operating leverage, as Avnet grew its revenues into a record high figure from FY2015 forward.

Avnet has a good amount of debt on the company’s balance sheet. Avnet’s long-term debt currently stands at almost $3 billion dollars, on top of which the company has $71 million in short-term borrowings. Compared to Avnet’s market capitalization of $4.2 billion, the amount of debt seems quite high. Yet, I believe that the debt is quite non-threatening as in FY2023 interest expenses were only around 21% of Avnet’s operating income.

Valuation

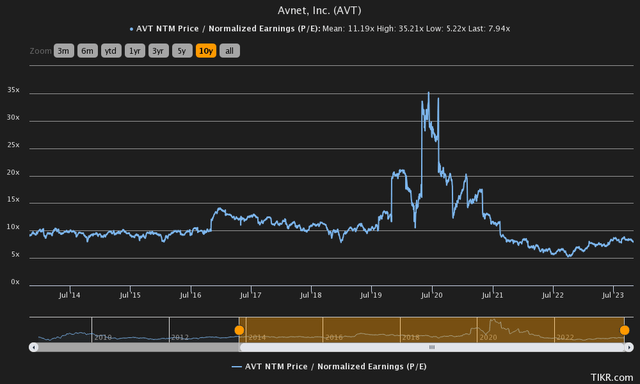

Currently, Avnet trades at a forward P/E of 7.9, around 29% below the company’s ten-year average of 11.2:

Historical Forward P/E (TIKR)

With the P/E ratio alone, Avnet seems very cheap – for example, the S&P 500 currently trades at a P/E of 23.5. The ratio alone doesn’t tell enough of a context for the valuation though, as the fair value is a result of a large amount of factors such as cash flow conversion, risk level, and growth. To estimate a rough fair value for the stock, I constructed a discounted cash flow model in my usual manner.

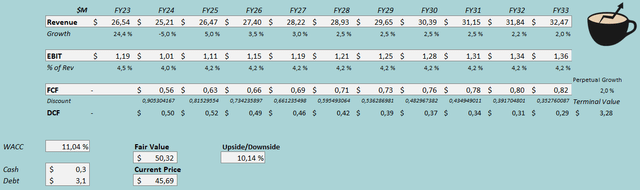

In the model, I estimate Avnet’s revenues to decrease by 5% in FY2024. The decrease seems likely as Avnet currently guides for around a 7% decrease in Q1/FY2024 with the middle point of the $6.15 billion to $6.45 billion revenue guidance. After the year, I estimate Avnet to get back on track into slight growth. I still estimate a growth that’s below Avnet’s twenty-year average of 5.5%, as the long-term growth includes acquisitions and I estimate organic performance. For FY2025, I estimate a growth of 5% after a softer FY2024. After the year, I estimate Avnet’s growth to be 3.5%, but to come down in steps into a perpetual growth rate of 2%. The estimated growth corresponds to a CAGR of 2.0% from FY2023 to FY2033.

For Avnet’s EBIT margin, I estimate the current figure to be quite near the company’s sustainable level. In FY2023, the company achieved a new record margin of 4.5%, and I estimate the margin to come down slightly. For FY2024, I estimate a margin that’s half a percentage point lower at 4.0%. After FY2024, I estimate a stable EBIT margin of 4.2%, still below the achieved FY2023 figure but above Avnet’s twenty-year average.

The mentioned estimates along with a WACC of 11.04% craft the following DCF model with a fair value estimate of $50.32, around 10% above the stock price at the time of writing. The estimated fair value would correspond to a forward P/E of 8.75 with analysts’ estimates – it seems that Avnet’s low P/E is mostly justified with my DCF model inputs.

DCF Model (Author’s Calculation)

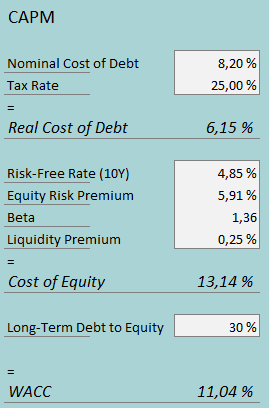

The used weighed average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In the past twelve months, Avnet had around $251 million in interest expenses. With the company’s current amount of interest-bearing debt, Avnet’s interest rate comes up to 8.20%. The company uses a good amount of debt in its operations; I estimate Avnet’s long-term debt-to-equity ratio to be 30%.

On the cost of equity side, I use the United States’ 10-year bond yield of 4.85% as the risk-free rate. The equity risk premium of 5.91% is Professor Aswath Damodaran’s latest estimate for the United States, made in July. Yahoo Finance estimates Avnet’s beta at a figure of 1.36, used in the CAPM. Finally, I add a small liquidity premium of 0.25% into the cost of equity, crafting the figure at 13.14% and the WACC at 11.04%.

Takeaway

Avnet’s low P/E ratio doesn’t seem to correlate into a too good opportunity to buy. The DCF model approximates the stock to be slightly undervalued with my estimated inputs, but seems to be quite near correctly priced. As Avnet is going to face tougher quarters with revenue decreases guided for the next quarterly result, I am on the sidelines for the time being with a hold rating.

Read the full article here