Last July, I initiated coverage of IonQ, Inc. (NYSE:IONQ) with a hold rating and raised three concerns regarding the lack of earnings growth clarity for the company. Although I fell in love with IonQ’s story, I felt as if Mr. Market had already been very fair to the company this year. Since then, IonQ has lost more than 35% of its market value, and almost all these losses have been accumulated over the last 30 trading days. The departure of Co-Founder and Chief Scientist Dr. Chris Monroe has dampened the investor sentiment toward the company, and the general market weakness has not helped IonQ stock either.

With the current market pullback appearing to be an exaggeration and Q3 earnings coming up on post-market on November 8th, I thought it best to revisit IonQ, Inc. today to determine whether there is a market anomaly.

Keeping An Eye On IonQ’s Upcoming Earnings Report

IonQ is a leading player in the field of quantum computing and has been on a remarkable journey this year. The company’s stock is up 174% YTD, valuing the business at a market cap of almost $2 billion driven by the hype surrounding the potential of quantum computing. Dr. Monroe’s departure, while he returns to his academic, research, and policy pursuits, cannot be understated in its significance. He was a key contributor to IonQ’s quantum computing endeavors, and under his leadership, the company has achieved noteworthy milestones including securing exclusive ion trap intellectual property licenses from two esteemed research institutions, the University of Maryland and Duke University. These licenses, bestowed under Dr. Monroe’s leadership, were instrumental in advancing IonQ’s quantum computing capabilities.

As the quantum computing landscape evolves, IonQ faces a pivotal juncture. The company is expected to announce its third-quarter financial results on November 8, and this forthcoming announcement holds the potential to offer insights into the company’s resilience in the face of recent challenges and its continued pursuit of quantum computing excellence.

Cautiously Optimistic Based On Expected Industry Growth

IonQ’s financial landscape presents a notable contrast to its high valuation. While investors like Bill Gates, Marc Benioff, and Michael Dell once backed the company, they no longer hold significant shares in the company. Amazon.com, Inc. (AMZN) has a stake in IonQ, reflecting the symbiotic relationship between the two, primarily driven by IonQ’s partnership with Amazon Web Services (“AWS”) for cloud infrastructure support. IonQ’s quantum computing capabilities are also accessible through cloud services Azure and Google Cloud.

The prospect for mainstream commercial adoption of quantum computing is on the horizon, with many industry leaders foreseeing its realization by 2030. A report from P&S Intelligence forecasts a total addressable market of approximately $65 billion for quantum computing by 2030. This forward-looking perspective suggests that IonQ’s pioneering work in the quantum world may well be rewarded handsomely in the future, but for now, investors will need to be cautious and patient as we are still investing in a business that is yet to prove its ability to convert growth into profits.

IonQ is still a young company that is barely scratching the surface. In the second quarter, IonQ reported revenue of just $5.5 million – more than double YoY but still a relatively small number in the context of the addressable market opportunity. In the third quarter, the company is expected to generate revenue between $4.8 and $5.2 million. The full-year 2023 revenue projection, at an estimated $19.3 million, appears modest in the context of the quantum computing field.

Positive Momentum In IonQ’s Quantum Computing Journey

IonQ has made notable progress that signals its commitment to advancing the field of quantum computing. The company has already secured over $32 million in customer bookings for future services. This achievement serves as a promising indicator, with IonQ’s full-year bookings expected to range from $49 million to $56 million. The surging demand for quantum computing solutions provides a glimpse into the trajectory of IonQ’s future revenue streams.

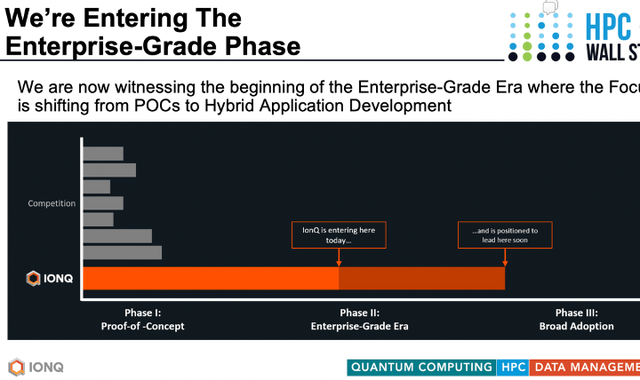

September witnessed significant growth for IonQ with the introduction of two novel systems, Forte Enterprise and Tempo. These systems are designed to be rack-mountable and seamlessly integrated into traditional data center environments. IonQ’s focus on delivering quantum capabilities directly to businesses and government entities within their existing infrastructure is noteworthy. This move represents a departure from the conventional approach in the NISQ era, where quantum computers were primarily accessible through web portals.

Exhibit 1: IonQ’s quantum computing approach

Company presentation

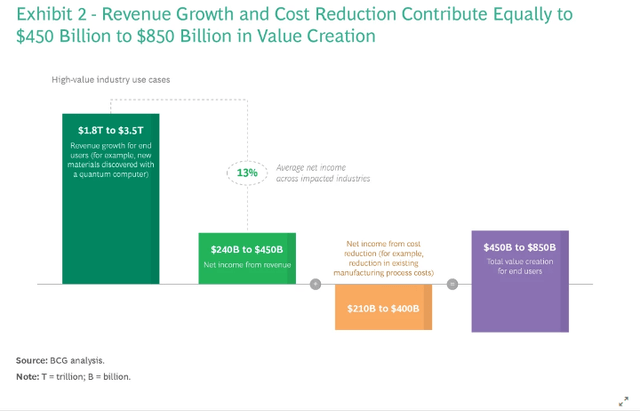

BCG’s assessment of quantum computing underscores its significant business potential, particularly through the utilization of sparse matrix math. This mathematical function, offering a quantum advantage, addresses complex problems in simulation, optimization, machine learning, and cryptography. This advancement has unveiled over 100 use cases across various industries, with the potential to generate $450 billion to $850 billion in net income for end users by 2035, driven by revenue growth and cost reduction.

Exhibit 2: Value creation in the quantum computing field

BCG

IonQ Forte Enterprise, with a target performance of #AQ 35, is poised to solidify IonQ’s standing as a provider of one of the most powerful commercially available quantum computers globally. Forte Enterprise is tailored to tackle complex computational problems, spanning process optimization, quantum machine learning, correlation analysis, and pattern recognition. This offering is designed to bring the power of quantum computing directly into data center infrastructures, enhancing accessibility and ease of integration.

A key revelation is the anticipation of IonQ Tempo, an #AQ 64-based enterprise-grade system that promises to deliver substantial business value for contemporary use cases. Tempo is poised to outstrip classical computers and GPUs, offering a computational space 536 million times larger than IonQ Forte Enterprise, showcasing an astounding leap in computational power.

While IonQ has set its sights on the future, the tangible introduction of these systems is planned for 2024 for Forte Enterprise and 2025 for Tempo. The quantum computing landscape is in a state of transition, with many acknowledging that the technology is not yet ready for production environments. The road to fault-tolerant quantum machines, with the capacity for practical applications, is a journey that could span a decade. IonQ characterizes the number of qubits in its devices using the algorithmic qubits metric, a comprehensive measure that factors in performance, circuit depth, and width. The forthcoming systems are projected to have 35 and 64 algorithmic qubits, respectively.

This leap forward in quantum computing is not merely theoretical; it involves practical considerations. IonQ’s shift from its previous 5-foot-wide machines to 19-inch-wide server cabinets necessitated significant redesign efforts. This transformation has affected the optical components at the core of IonQ’s devices, which have been substantially downsized. Unlike superconducting-circuit-based quantum computers by Alphabet Inc. (GOOG) and International Business Machines Corporation (IBM), IonQ utilizes a special chip to manipulate individual ytterbium ions through electromagnetic fields. The programming of qubits involves the precise firing of lasers, requiring a substantial optical infrastructure.

IonQ’s transition to a rack-mounted form factor also reflects a shift in its business model. The move suggests a pivot from offering remote access via the cloud to hardware sales. While this transition brings its benefits, such as dedicated quantum computers for on-site use, it can present revenue-scaling challenges as it entails creating new devices for each customer. Currently, IonQ facilitates access to its devices through major cloud providers as mentioned earlier. However, the absence of service-level agreements for quantum hardware remains a hurdle. IonQ envisions a future where a significant number of its machines are sold to cloud partners to provide more reliable quantum cloud services.

IonQ’s Strategic Alliances And Technological Advancements

IonQ is making significant strides in its goal through strategic partnerships and technological innovations. Notably, the company has inked an agreement to supply both Forte Enterprise and Tempo systems to QuantumBasel, a leading Swiss quantum-technology hub. Additionally, IonQ has secured a substantial $25.5 million deal with the U.S. Air Force Research Lab, paving the way for the deployment of two quantum systems at the lab’s facility in Rome, New York.

Furthermore, IonQ achieved a notable milestone by attaining 29 algorithmic qubits on a barium platform. This achievement signifies a step forward in IonQ’s journey to develop quantum systems capable of delivering commercial quantum advantages. The company’s exploration of barium-based qubits represents a forward-looking approach to trapped ion quantum computing. While current-generation ytterbium systems have been instrumental in tackling complex algorithms, the introduction of barium-based systems is expected to unlock new technical applications. The inherent characteristics of barium qubits promise scalability and reliability, laying the foundation for future quantum systems.

IonQ is also responding to customer demands by offering 24/7 access and support for its cloud-accessible quantum systems, namely IonQ Harmony and IonQ Aria. This expanded availability is poised to benefit users worldwide, facilitating their engagement in complex commercial and research use cases. This development highlights the company’s commitment to fostering quantum networking research and application development, underscoring its role in shaping the future of quantum computing.

Takeaway

IonQ’s recent advancements in the quantum computing field have been met with optimism. However, it’s essential to recognize that IonQ remains virtually a startup with ongoing financial losses, a situation that may endure for the foreseeable future. I am not discouraged by the key executive departure to the point that I would make a case for avoiding IONQ stock today, but I also believe Mr. Market will take much longer to digest this and embrace IonQ’s growth potential.

From a valuation perspective, IonQ is still trading at an eye-popping forward price-to-sales multiple of around 100, and in any case, using traditional valuation metrics to estimate the intrinsic value of IonQ at this stage of its business seems naive. This is why I am more interested in how IonQ is making progress toward commercializing quantum computing technology to gauge a measure of competitive advantages the company may enjoy in the future.

So far, from the data that we have, I feel IonQ, Inc. is headed in the right direction, but I do not believe there is sufficient data to suggest the company will enjoy durable competitive advantages. For this reason, investing in IonQ today seems like a wild bet, and as an investor, I prefer taking calculated bets.

Read the full article here