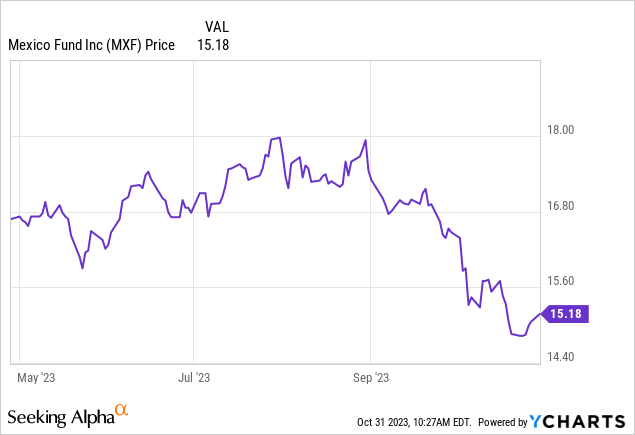

Since I last called for caution on the closed-end Mexico Fund (NYSE:MXF), Mexican equities have pulled back significantly, retracing a large portion of this year’s “nearshoring” gains. On the one hand, higher US Treasury rates have been a key driver of the correction; on the other hand, investors are also likely repricing the fact that few Mexican large-caps are actual direct beneficiaries of the nearshoring trend.

Also weighing on investors’ minds is the recently proposed 2024 budget, which was (unsurprisingly) expansionary ahead of next year’s election cycle. While the budget should boost earnings growth, it also adds an inflationary impulse and constrains Banxico (i.e., the Mexican central bank) from pushing through rate cuts – the latter being arguably the most important driver of equity performance. Plus, the willingness to run a wider deficit is a notable departure from previous budgets and could lead to a wider risk premium to account for fiscal risks.

The low beta MXF has priced in some of these risks, having de-rated to a low-teens earnings multiple (per the MSCI Mexico benchmark). Given the fund’s elevated fee structure and slower low-single-digit % earnings growth outlook next year, though, the risk/reward isn’t compelling here – even at the current ~20% NAV discount.

Fund Overview – Still Too Pricey a Mexican Investment Vehicle

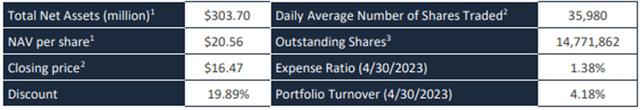

The actively managed, closed-end Mexico Fund, benchmarked against the MSCI Mexico Index (net of dividends), has seen its total assets under management decline over the last quarter, reaching $281m (vs. $337m prior) amid the broader selloff in Mexican equities. The expense ratio is quoted at an elevated 1.38%, though this figure likely skews higher due to the smaller asset base (note the monthly factsheet quotes fees on a lagged basis). By comparison, more liquid, passively managed options like the iShares MSCI Mexico ETF (EWW) and the Franklin FTSE Mexico ETF (FLMX) charge 0.5% and 0.2%, respectively.

Mexico Fund

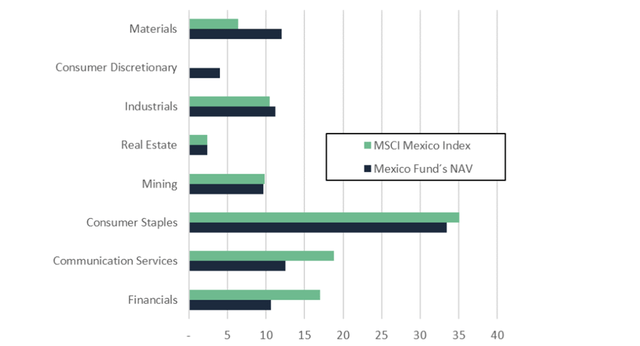

The fund doesn’t disclose updated sector weights, but given the low portfolio turnover (per the September factsheet), MXF’s sector breakdown likely hasn’t changed too much over the last quarter. Recall that the portfolio has generally retained overweights in the consumer discretionary (retail and beverages), materials (mining and chemical products), and industrial sectors. Relative to the MSCI Mexico, the fund is generally underweight consumer staples (although the sector is MXF’s largest exposure in absolute terms), communication services, and financials.

Mexico Fund

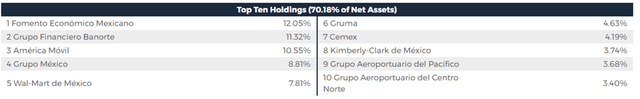

The stock-specific portfolio composition, updated on a monthly basis, now features beverage and retail company Fomento Económico Mexicano (FMX) as its top holding at 12.1%. Telco América Móvil (AMX), formerly the largest MXF exposure and now the third-largest, has ceded further portfolio share in favor of Grupo Financiero Banorte (OTCQX:GBOOF), which has an 11.3% weighting. Conglomerate Grupo México (OTCPK:GMBXF) and Wal-Mart de México (OTCQX:WMMVY) round up the top five at 8.8% and 7.8%, respectively.

With the top ten holdings now contributing an increased 70.2% of net assets (vs 68.8% previously), investors should be mindful of the concentration risk here. Overall, the fund doesn’t deviate too far from comparable ETFs benchmarked to the MSCI Mexico index; MXF’s ‘closet indexer’ status hardly justifies the premium expense ratio, in my view.

Mexico Fund

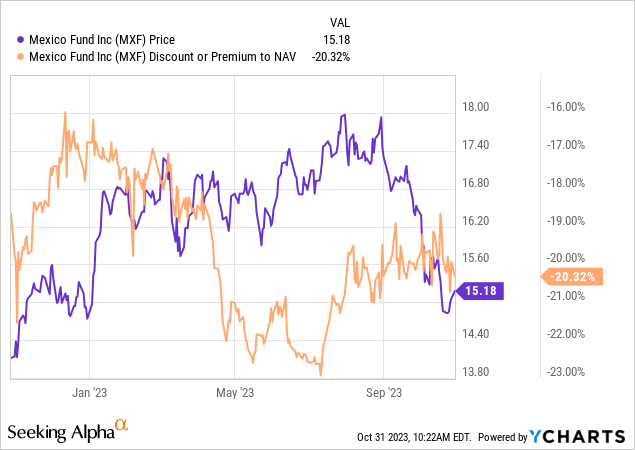

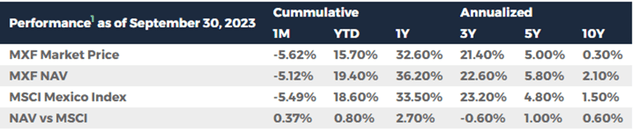

Fund Performance – Relative Performance Subpar Amid Record NAV Discount

As of end-September, the fund has risen by +19.4% in NAV terms, slightly ahead of its benchmark (+18.6%). In market price terms, however, investors have reaped a far lower +15.7% due to the persistently wide NAV discount. Note that Mexican equities have drawn down further in October, so total returns are likely closer to the ~10% range, in line with comparable Mexico ETFs like EWW (+11.0%) and FLMX (+11.8%). Over longer timelines, MXF’s rate of compounding hasn’t been all that impressive either, with the +0.3% gain (+2.1% in NAV terms) paling in comparison to the +1.5% returned by MSCI Mexico.

Mexico Fund

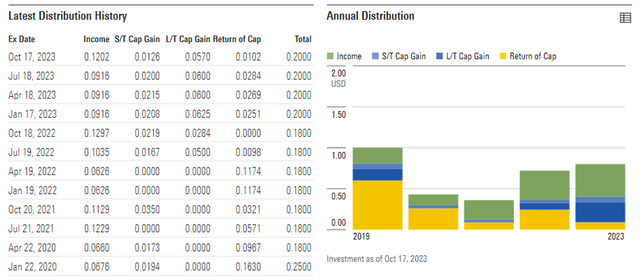

The good news is that MXF continues to deliver steady distributions. The increased $0.2/share quarterly distributions in Q2 and Q3 have notably extended into Q4, keeping the fund on track for a solid ~5% yield (vs. low-single-digits % for EWW and FLMX). The caveat here is that the headline distribution includes capital gains; isolating for the recurring income portion of the yield indicates a low-single-digit % yield for MXF – in line with passive Mexican ETFs.

Morningstar

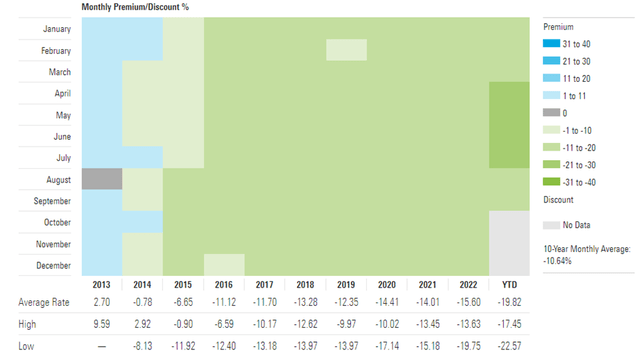

Also concerning is the fund’s NAV discount, which remains at a record ~20% despite the increased pace of distributions. Pending a reduction in the expense ratio or an accelerated pace of capital return, the fund’s NAV discount likely won’t be narrowing anytime soon. The expanded buyback authorization helps, but the limited ~10% limit isn’t enough to fully address the NAV gap. In the meantime, the double whammy of an elevated NAV discount and high expense ratio will eat into investor returns.

Morningstar

Caution Still Warranted Despite the Record NAV Discount

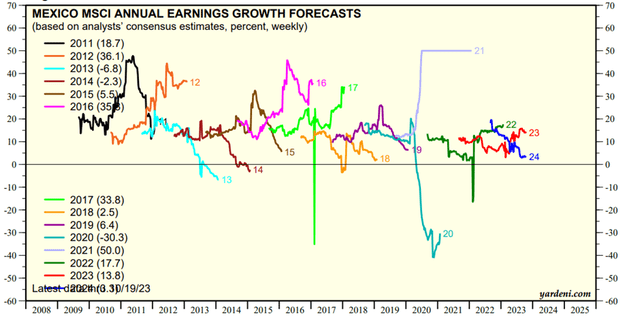

Mexican equities have been the place to be through H1 2023, helped by investor optimism on nearshoring-led growth. The momentum has cooled over the last few months, though, as markets price in a more downbeat view of this economic growth translating into large-cap earnings anytime soon. And relative to consensus earnings growth estimates of +3% next year, the current ~11x P/E multiple for Mexican stocks doesn’t screen that cheaply.

Plus, there are plenty of headwinds on the valuation side, as higher US rates pressure valuations across the board. Further adding to uncertainties are fiscal concerns following a higher budget deficit for 2024, which could delay the Mexican rate cut cycle. As appealing as MXF’s ~20% NAV discount might seem, the fund remains a pricey investment vehicle and is cheap for a reason heading into next year’s elections.

Yardeni

Read the full article here