The management of Medical Properties Trust, Inc. (NYSE:MPW) issued an important update about its state of affairs, as part of its third quarter earnings release last week.

Medical Properties Trust’s 3Q-23 results were quite good, given the restructuring context, and the hospital real estate investment trust has managed expectations well by raising its FFO guidance and preparing the market for a gradual decline in its debt balance, which is still rather excessive.

Though Medical Properties Trust has issues, I think the dividend remained well-covered with FFO in the third quarter and I also think that liquidity events could drive a stock re-rating moving forward.

My Rating History

In my update on Medical Properties Trust following the dividend reduction in August Medical Properties Trust: The Safest Dividend Is Probably The One That’s Just Been Cut (Upgrade) I pointed to improving dividend coverage as well as a low FFO multiple as anchor points for a bull case.

Before that, I have also been quite bullish on the trust, even though I have not much to show for it as of right now.

Moving forward, passive income investors should look forward to joint venture announcements and other liquidity events, accelerating debt repayments as well as debt refinancings.

It’s All About Liquidity And Debt Now

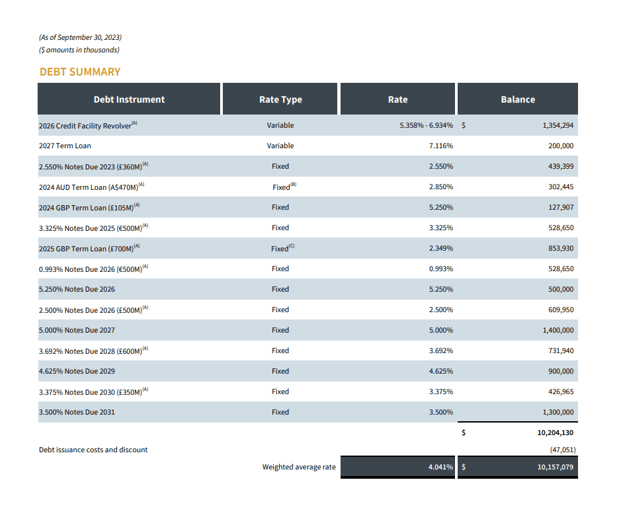

Medical Properties Trust’s balance sheet is leveraged, but not as much as passive income investors might think. True, the trust owed a considerable amount of debt, a total of $10.16 billion to be precise, but overall leverage percentages don’t look that bad.

It seems to be more the case that passive income investors are particularly freaked out about MPW’s high absolute dollar amount of debt as well as the trust’s exposure to variable debt that led to a major re-rating to the downside in 2023.

But, from a leverage perspective, the debt situation seems quite controlled: at the end of 3Q-23, Medical Properties Trust had a financial leverage ratio, which puts its secured and unsecured debt in relation to its gross assets, of a relatively modest 50%.

Medical Properties Trust’s interest coverage ratio, which indicates the trust’s ability to service its debt and make its interest payments on time, was 3.1x, meaning the trust earned 3.1x as much in EBITDA as it booked in interest expenses. EBITDA is reconciled as GAAP income plus interest expenses, taxes, and depreciation and amortization.

The trust’s interest expenses ran at about $106 million a quarter and the interest coverage ratio improved from 2.8x in 2Q-23. The higher the coverage ratio, the better.

Debt Summary (Medical Properties Trust)

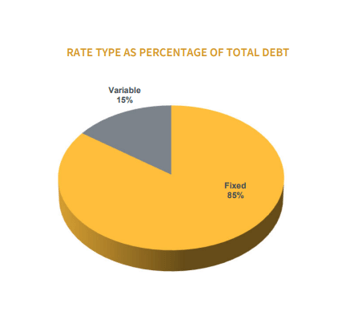

Another cause for concern has been the exposure to high-interest floating-rate debt which represented 15% of the trust’s debt capital structure as of the end of the third quarter.

It goes without saying that owing floating-rate debt in a rising-rate environment is bad, but the relatively small percentage of 15% is something that passive income investors might overreact to a little bit, in my view.

Medical Properties Trust said that it will focus on a quick repayment of its credit facility revolver of $1.35 billion which is the right thing to do in the present interest rate environment.

Floating Rate Debt (Medical Properties Trust)

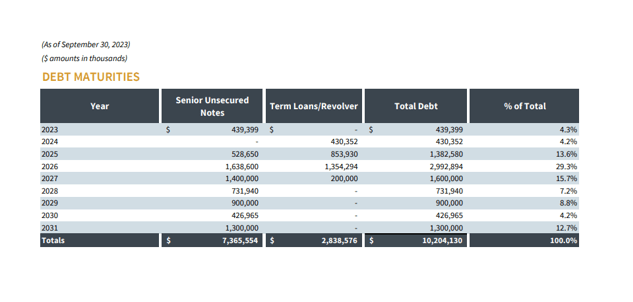

With that being said, though, Medical Properties Trust is not under immediate pressure to sell assets and find new funding sources. The debt maturity ladder looks quite good to me as well, with no particularly threatening near-term debt maturities coming up that are pressuring the trust’s liquidity position.

Medical Properties Trust earned an average of $200 million per quarter in adjusted FFO in the first three quarters of 2023 and the trust had $340 million in cash, which is an amount of liquidity that should be sufficient to deal with the trust’s 2023 debt of maturity of $439 million.

Debt Maturities (Medical Properties Trust)

The Future For MPW: Looking For Liquidity Events

Passive income investors will probably see more liquidity events in the next twelve months than they saw in the last five years combined. Management confirmed that in order to reduce its credit facility and repay its maturities, the trust is evaluating divestitures as well as joint venture opportunities.

The trust already monetized its hospital assets in Australia and is now working towards other cash infusions. This cash will be used to accelerate the repayments of debt maturities, but particularly result in the pay-down of its 2026 credit revolver facility.

Passive income investors should expect to hear about strategic divestments (asset divestitures), new partnerships as well as restructuring efforts to reduce the trust’s leverage in the quarters ahead.

Dividend Coverage Remained Rather Excellent In 3Q-23

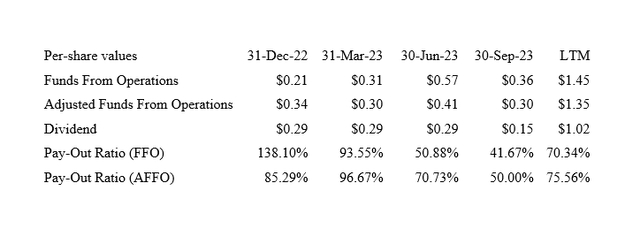

Medical Properties Trust’s dividend coverage in the third quarter was more than sufficient, in my view, to dispense doubts about the hospital REIT’s dividend.

In the table below, you can see that Medical Properties Trust covered its reduced dividend with both FFO and AFFO by a rather large margin in 3Q-23.

The payout ratio, based on AFFO, fell from 71% before the dividend reduction in 2Q-23 to just 50% in 3Q-23. The dividend, thus, should have a high enough margin of safety to ensure that the trust won’t have to slash its dividend again.

Dividend (Author Creation Using Trust Information)

Boosted FFO Guidance, Cheap Multiple Continues To Reflect High Margin Of Safety

Normally, a raised guidance of $0.03 per share at the lower end doesn’t matter much under normal circumstances and is hardly news, but it is in the case of Medical Properties Trust because passive income investors are jittery about the prospect of yet another dividend reduction.

Medical Properties Trust boosted its normalized FFO guidance from $1.53 to $1.57 per share to $1.56 to $1.58 per share. Based on 3Q-23 run-rate AFFO, $1.20 per share, Medical Properties Trust is valued at a very modest 4.1x AFFO multiple, reflecting a high margin of safety.

Investment Risks With Medical Properties Trust

Medical Properties Trust doesn’t look to me as if the trust was headed for another dividend reduction. FFO-coverage-based metrics look solid (with pay-out ratios falling to 50% or less in 3Q-23) and the focus will be much more on liquidity and the trust’s debt situation than anything else moving forward.

The debt maturity and liquidity profiles look solid which buys Medical Properties Trust time to refinance its debt, repay its revolver, look for strategic partners and joint venture possibilities, or sell assets altogether.

My Conclusion

Medical Properties Trust’s dividend reduction in August was a necessity to relieve cash flow and a prudent action at a time when the market has changed its focus away from growth and towards the REIT’s considerable debt burden.

Medical Properties Trust’s liquidity situation, near-term debt maturity ladder as well as the improved cash flow situation (lower pay-out ratio) due to a realignment of the trust’s dividend with its lower expected FFO run-rate look good to me.

Passive income investors that sell now, in my view, would quite likely sell at the worst time. The dividend has been safeguarded by the dividend reduction in August and should prove to be sustainable.

The real lever for improvement now relates to the balance sheet and if Medical Properties Trust plays its cards right in terms of debt repayments, then a re-rating of the stock should follow in due time.

Read the full article here