Geopolitical conflicts sweep the globe, prompting investors to flock to defensive stocks. Hamas’ attack on Israel, the persisting war in Ukraine, depleting resources, supply chain constraints, and the pain of inflation are disrupting economies and increasing global insecurity. Investor fear is rising, but as Citibank affirms, defensive stocks are “still attractive.”

Defensive stocks appeal to investors wanting stability. Military expenditures are increasing, resulting in over $886 billion in U.S. defense spending alone. World military spending grew for the eighth consecutive year in 2022 to an all-time high of $2240 billion. Investors want to know which sectors may offer protection against market downturns if geo-political events continue to deteriorate. More than ever, people want companies and industries they can prioritize as a safe haven and hedge for their portfolios. Defensive stocks were among the top five gainers in October, so now may be the time to consider five top defensive stocks selected using Seeking Alpha’s screening tool. The screening tool helps to identify stocks that are overvalued or lack growth and pinpoint stocks that offer growth at a reasonable price.

What are defensive stocks?

Defensive stocks can be a great addition to a well-rounded, diverse portfolio. Not only are defensive stocks providing peace of mind for investors, but some can offer dividends and stable earnings regardless of investor sentiment. Typically, defensive stocks possess three features:

-

Well-established companies with solid business models

-

Sectors with perennial demand

-

Strong balance sheets with minimal debt

-

Many offer solid dividend payments

With thousands of conflicts sweeping the globe, focusing on aerospace and defense stocks may help fend off the volatility swings in portfolios.

5 Top Defensive Stocks to Invest in

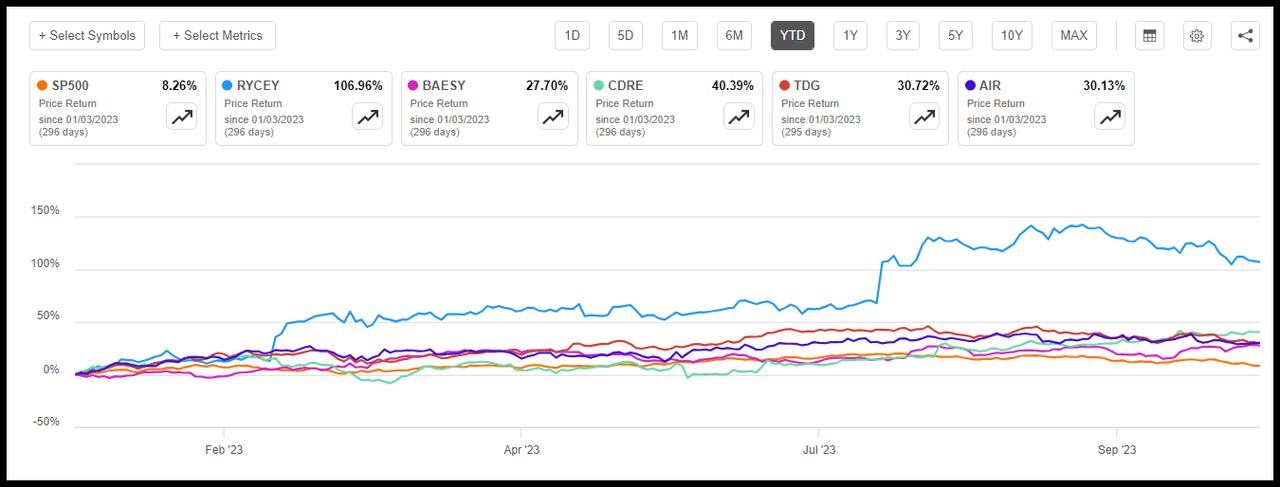

Rising interest rates, war, and geopolitical tensions threaten economies. These catalysts are prompting investors to sell out of consumer discretionary and interest rate-sensitive stocks and turn to defensive stocks that offer better performance, security, and returns. While the performance in defensive sectors may not be as robust as growth stocks, defensive stocks tend to be solid investments and protect returns during periods of volatility. Not only are they portfolio diversifiers, but the five stocks I’ve selected, RYCEY, BAESY, CDRE, TDG, AIR have significantly outperformed the S&P 500 YTD.

S&P 500 YTD Price Performance vs. Top 5 Defensive Stocks (RYCEY, BAESY, CDRE, TDG, AIR)

S&P 500 YTD Price Performance vs. Top 5 Defensive Stocks (RYCEY, BAESY, CDRE, TDG, AIR) (SA Premium, S&P Global)

As an SA News article highlights, investors should consider positioning portfolios toward high-quality defensive assets.

“The global outlook looks troubled as rising rates, oil prices, and the U.S. dollar threaten to exacerbate economic slowdowns. Despite recent economic resiliency, headwinds are building, and investors should be actively positioning their portfolios toward high-quality and defensive assets ahead of the upcoming downturn” -Principal Financial Group.

I pinpointed a selection of top-performing defensive stocks based on quantitative ratings, which have the potential to safeguard returns amid a market downturn. Using the stock screener tool for the Aerospace and defense industry and filtering for strong buy ratings with a minimum $1B market capitalization, I was able to filter out the top five defensive stocks.

5 Best Aerospace and Defense Stocks

One of the first industries people consider when discussing conflicts involving U.S. allies and defensive stocks is aerospace and defense. The U.S. government is not shy about opening its pockets to pay for defense, as highlighted, with military expenditures up more than $886 billion in the U.S. alone. Investors want standout companies that offer defense as geopolitical tensions rise. I’ve selected five top quant-ranked aerospace and defense stocks to buy.

1. BAE Systems plc (OTCPK:BAESY)

-

Market Capitalization: $40.30B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 10/26/23): 28 out of 654

-

Quant Industry Ranking (as of 10/26/23): 2 out of 59

BAE Systems is a United Kingdom-based provider of defense, aerospace, and security solutions that operates through five segments. It offers electronic warfare systems, cyber intelligence, surveillance, and many other solutions. Given the escalation of geopolitical conflicts, BAE’s increased order backlog of +$84B and receiving 44% of its revenue from the U.S., 20% from the UK, 17% from the Middle East, and 13% from the rest of Europe, as analyst James Foord highlighted in a Seeking Alpha article, “BAE Systems is, in my opinion, a great all-around stock, which provides investors with a good “hedge” against war.” Delivering strong financial performance this year, BAE Systems has secured an extensive number of defense contracts to help sustain growth and excellent profitability.

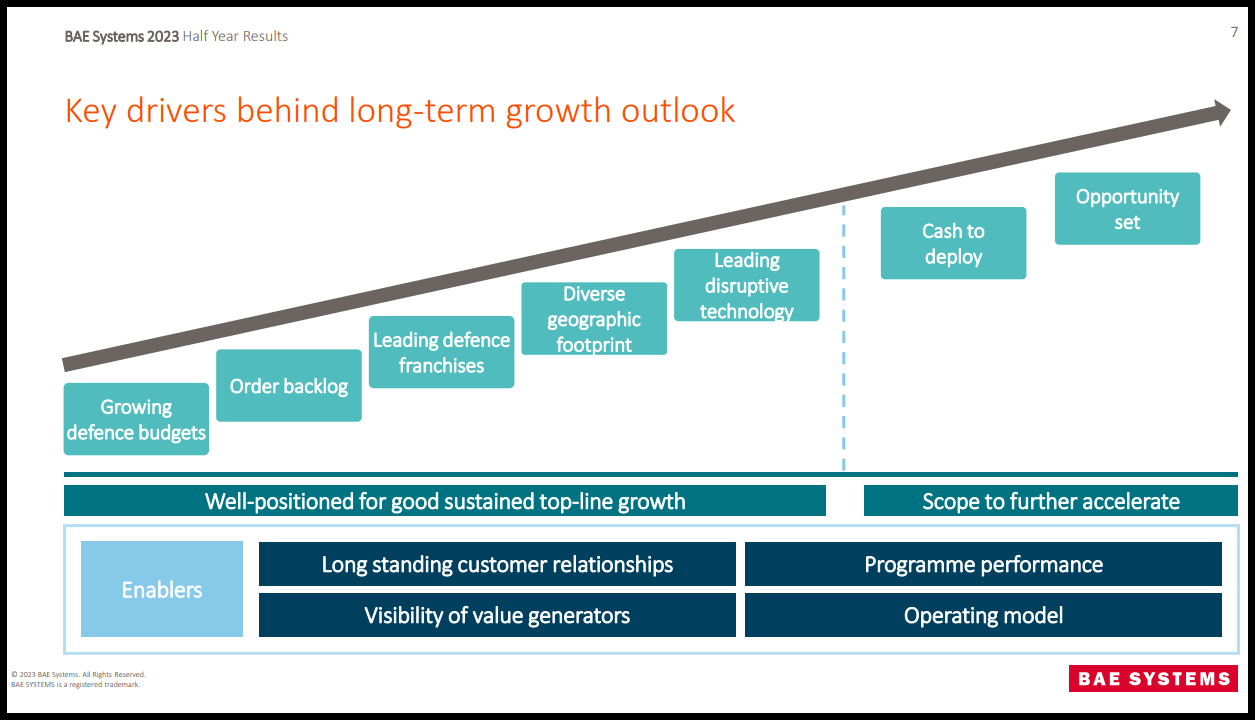

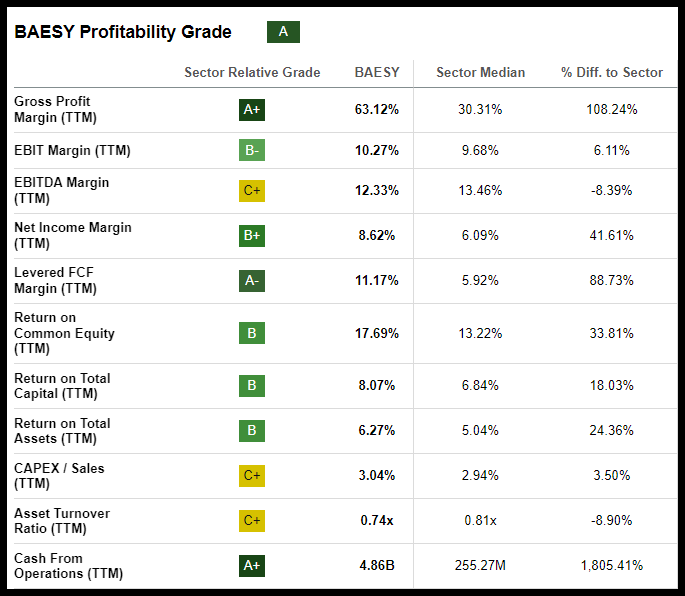

BAESY Stock Growth & Profitability

The latest 2023 Half Year Results showcase strong operational performance, delivering top-line growth, margin expansion, and a focus on capital allocation to add to its $4.86B cash from operations. The key drivers for its success and long-term growth outlook include a strong network and order backlog, being a technology disruptor, and possessing leading defense franchises.

BAE Systems Key Growth Drivers (BAE Systems August 02, 2023, Half Year Results Presentation)

BAE Systems’ geographic diversity has allowed it to gain strength and momentum. As highlighted by BAESY Chief Executive Officer Charles Woodburn,

With a record order backlog and good operational performance, we’re well positioned to continue delivering sustained growth in the coming years, giving us confidence to continue investing in new technologies, facilities, highly-skilled jobs and in our local communities.

BAESY Stock Profitability Grades (SA Premium)

Not only is BAESY capturing million-dollar U.S. Army contracts, gaining as investors weigh whether the wars abroad will expand, but the stock is still trading at a discount.

BAESY Stock Valuation

Trading at a relative discount, BAE Systems has a C- overall valuation grade. Its forward P/E ratio is 17.71x, a 6% difference from the sector, and its forward PEG ratio of 1.19x versus the sector’s 1.56x is more than a 23% difference. Although the stock trades near its 52-week high of $54.26/share, it continues to be on an uptrend, highlighted by a momentum grade of ‘A.’

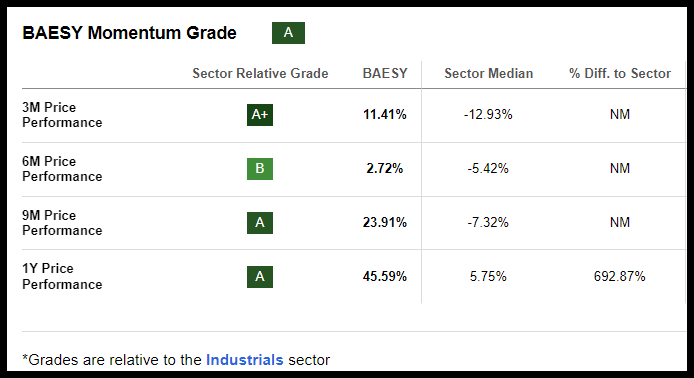

BAESY Momentum Grades (SA Premium)

As shown above, its quarterly price performance has steadily increased, and its astounding one-year price performance is nearly a 700% difference to the sector. Winning a $4.8B nuclear submarine contract from the UK’s largest defense contractor this month, the growth outlook for the company is strong, along with my next aerospace and defense stock, a name you may have heard before.

2. Rolls-Royce Holdings plc (OTCPK:RYCEY)

-

Market Capitalization: $20.32B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 10/26/23): 7 out of 654

-

Quant Industry Ranking (as of 10/26/23): 1 out of 59

Also headquartered in the United Kingdom, Rolls-Royce Holdings plc (RYCEY) is a versatile and innovative operator of industrial technology. The parent company of the luxury car manufacturer Rolls-Royce later established itself as an aero-engine manufacturing business. Operating in four segments: Civil Aerospace, Defense, Power Systems, and New Markets, this industrial powers and propels solutions for safety-critical applications on land, sea, and air. Established in 1884, Rolls-Royce Holdings has strong fundamentals, offering a long legacy of tremendous products and services. The defense business is their second largest segment and is generally stable, with consistent revenue coming from government and defense contracts.

RYCEY Stock Valuation

RYCEY is a large-cap stock trading at a small-cap price. Up 108% YTD and +177% over the last year, although the stock is trading at a mere $2.40 per share, it showcases a solid ‘B’ overall valuation grade, a tremendous discount to the sector. Rolls-Royce’s trailing P/E ratio is 9.93x compared to the sector median’s 18.05x, and its forward PEG ratio is more than a 73% difference to the sector.

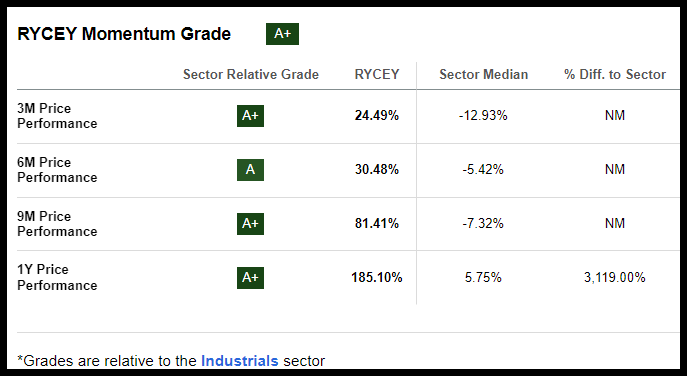

RYCEY Stock Momentum Grades (SA Premium)

In addition to its discounted valuation, the company has strong momentum, as evidenced in its quarterly price performance, with 12 12-month performance a 3119% difference from its sector peers. Complementing its underlying valuation metrics are A+ Growth and Profitability.

RYCEY Stock Growth & Profitability

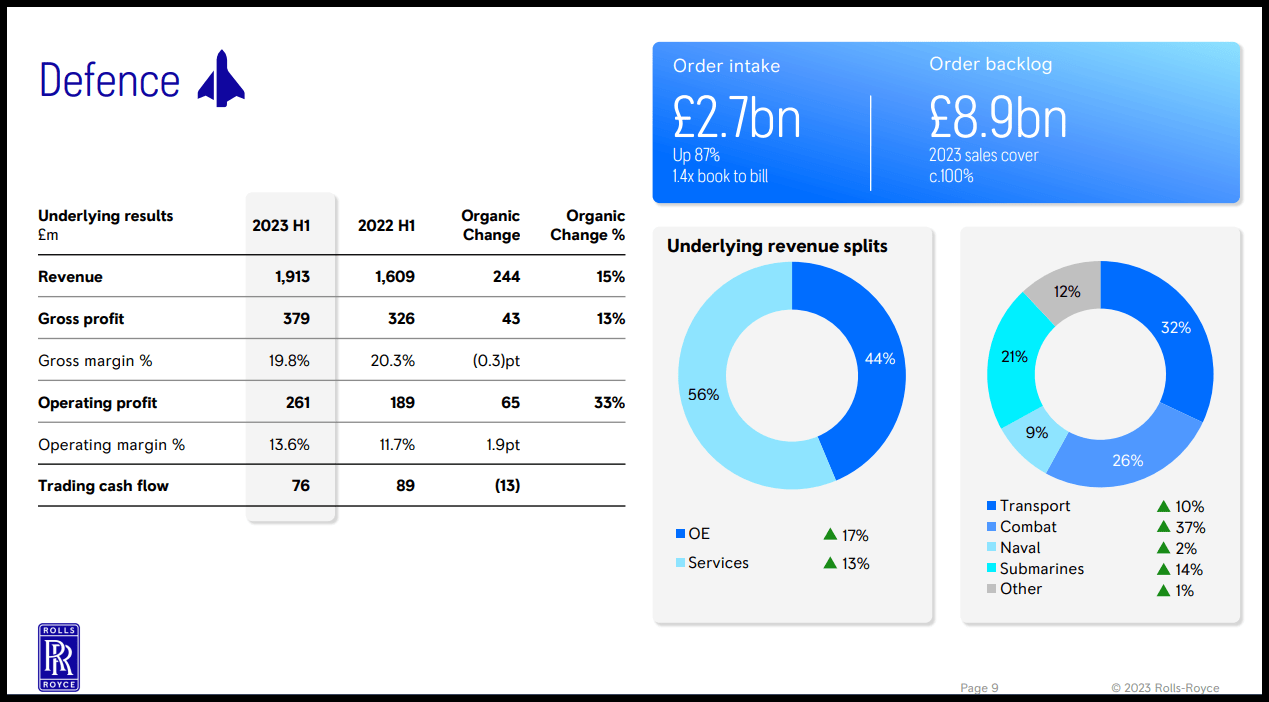

Reporting first half-year results on August 3rd, 2023, Rolls-Royce plc highlights improved operational metrics across all of its segments, increasing orders, margin improvements led by civil and defense, and strong financials. EBIT margins improved by 9.7%, year-over-year operating cash flow is +134% versus the sector 24.12%. Cash from operations (TTM) is at $3.03B, and return on capital (TTM) is +61% versus the sector’s 6.84%. Its Defense division is up 87% for the first half of the year, with 1.4x book to bill and a tremendous order backlog to support the company’s future growth.

RYCEY Stock Defense Division Highlights (RYCEY Stock Investor Presentation)

Focused on cost-savings, including plans for job cuts, the company wishes to improve earnings and efficiency. It wants to position itself to capitalize on the energy transition strategically. As more nations invest in defense amid turbulent times, consider the four quant strong buy stocks and one buy stock to defend your portfolio.

3. Cadre Holdings, Inc. (NYSE:CDRE)

-

Market Capitalization: $1.06B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 10/26/23): 35 out of 654

-

Quant Industry Ranking (as of 10/26/23): 3 out of 59

Providing safety and survivability equipment and protection for users in hazardous or life-threatening circumstances worldwide, Cadre Holdings, Inc. (CDRE) is a Jacksonville, Florida-based company. A trusted global provider of innovative products for first responders, federal agencies, and organizations, CDRE consecutively beat earnings and plans to announce the results of Q3 that ended on September 30, 2023, on Wednesday, November 9th. Second-quarter EPS of $0.30 beat by $0.15, with revenue of $121.09M beating by $8.55M. Producing record adjusted EBITDA margins of 18.8% and record quarterly adjusted EBITDA of $22.8M.

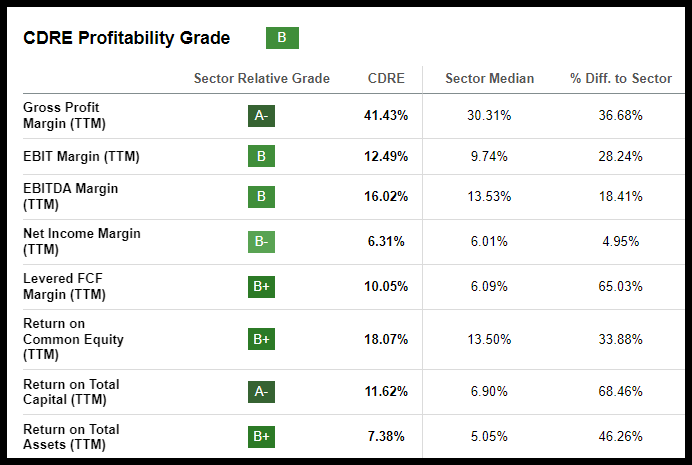

CDRE Stock Profitability Grades (SA Premium)

Focused on strategic acquisitions to drive growth and diversify the company portfolio, Cadre has continued to grow while maintaining strong distribution and manufacturing capabilities, generating cash and a strong backlog.

“We maintained a strong orders backlog, which was $133.2 million as of June 30, a $15.3 million increase since the start of the year. While the backlog total declined from the end of Q1, this was anticipated and is reflected in our significant Q2 revenue. We continue to view our M&A pipeline of opportunities as robust, although the current environment has not been conducive to dealmaking thus far in 2023,” said Cadre Holding President Brad Williams.

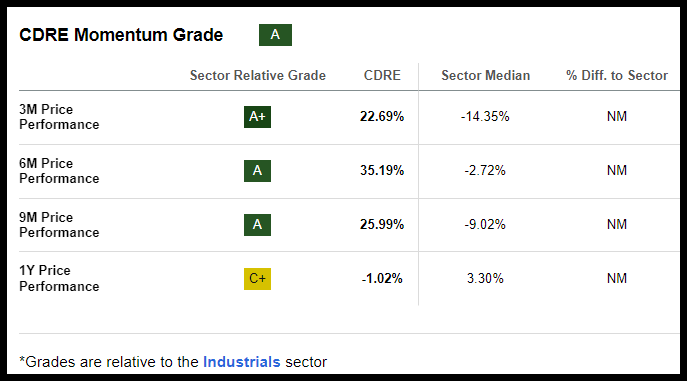

Cadre’s success is evidenced in its modest quarterly dividend of $0.08/share. Up 37% year-to-date with strong growth grades and profitability, CDRE has room for upside despite trading at a premium.

CDRE Stock Valuation Grade

CDRE is on an uptrend, +37% YTD, showcasing strong momentum. Over the last nine months, CDRE’s price performance has outperformed its sector peers quarterly.

CDRE Stock Valuation (SA Premium)

Although the stock’s price-performance is down 3.38% over the last year, and it is trading just above its 52-week price point, consider this strong buy-rated stock a buy-the-dip opportunity. Despite its overall ‘D’ valuation grade, the all-important forward PEG ratio is an ‘A’ grade, 0.44x versus the sector median’s 1.58x, a -71.91% difference to the sector. Investors looking for defense in a stock that distributes safety and survivability look no further than CDRE. If you’re more interested in aircraft components and supplies, check out my next pick.

4. TransDigm Group Inc. (TDG)

-

Market Capitalization: $45.14B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 10/26/23): 53 out of 654

-

Quant Industry Ranking (as of 10/26/23): 4 out of 59

TransDigm Group Inc. (TDG) designs, manufactures and supplies aircraft components globally. With more than 60 manufacturing locations in the U.S. with nearly 7,000 employees, TDG’s goal “is to give our shareholders private equity-like returns with the liquidity of a public market. To do this, we stay focused on both the details of value creation and careful allocation of our capital.”

TDG offers highly engineered and proprietary aerospace components and products, giving it significant pricing power while operating with financial leverage. Sole-source incumbency protects TDG products, of which nearly 90% are proprietary. This is an advantage because as competitors try to enter the space, they must be licensed by the Federal Aviation Administration (FAA), giving TDG immense pricing power. Since its IPO in 2006, TDG’s private equity-like strategy has been to target companies and improve their operations.

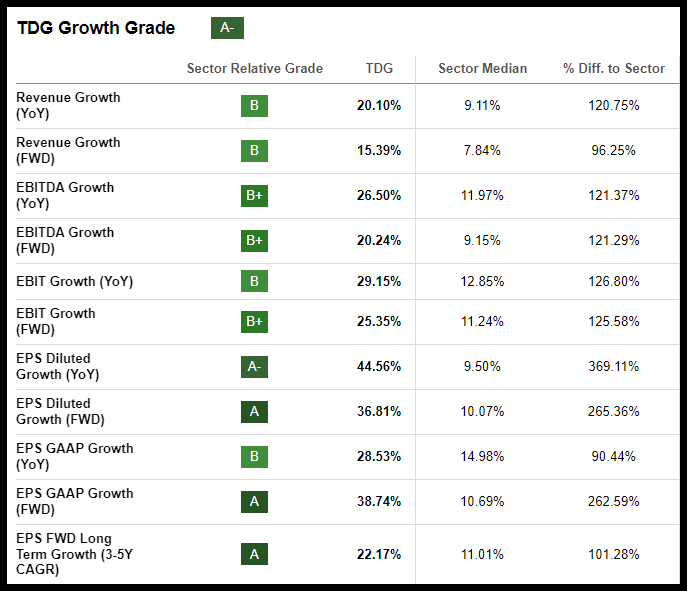

TDG Stock Growth & Profitability

Focused on margin expansion, reducing costs, and strategically acquiring smaller firms, it has transitioned from a five-year average of 38.8% operating margin (TTM) to a mid-cycle operating margin of 44.9%. For Q3, the company generated +$400M in operating cash flow to close with $3.1B.

TDG Growth Grades (SA Premium)

With four consecutive top-and-bottom-line beats, TDG’s latest EPS of $7.25 beat by $0.85, and revenue of $1.74B beat by nearly 25% year-over-year. The tremendous growth and results led to 16 Wall Street analysts revising estimates up over the last 90 days with zero down revisions. And if that’s not enough to make you want to take flight with this aerospace and defense company, despite its premium valuation, TDG raised its midpoint sales guidance, and the stock is +44% over the last year with continued momentum.

TDG Stock Valuation

Similar to CDRE, TransDigm Group is overvalued. Showcasing a ‘D’ valuation grade, TDG comes at a premium. However, its forward PEG ratio is a -6.9% difference to the sector, and its overall growth grades, as showcased above, are tremendous. Bullish momentum and YTD price-performance +30% give investors something to look forward to. Like most defensive sectors and stocks, they do not see significant rallies, but as Gavin Parsons, UBS analyst, writes,

As aerospace continues to normalize post-Covid, we see a return to 5%-plus long-term annual growth in global demand to fly, though we expect what people are flying on to evolve. We see strong demand for new large commercial aircraft coupled with undersupply supporting demand for 2,500 annual deliveries by 2030, benefitting original equipment.

Consider TransDigm Group, a Quant strong-buy rated stock for your portfolio, along with my final pick.

5. AAR Corp. (AIR)

-

Market Capitalization: $45.14B

-

Quant Rating: Buy

-

Quant Sector Ranking (as of 10/26/23): 89 out of 654

-

Quant Industry Ranking (as of 10/26/23): 5 out of 59

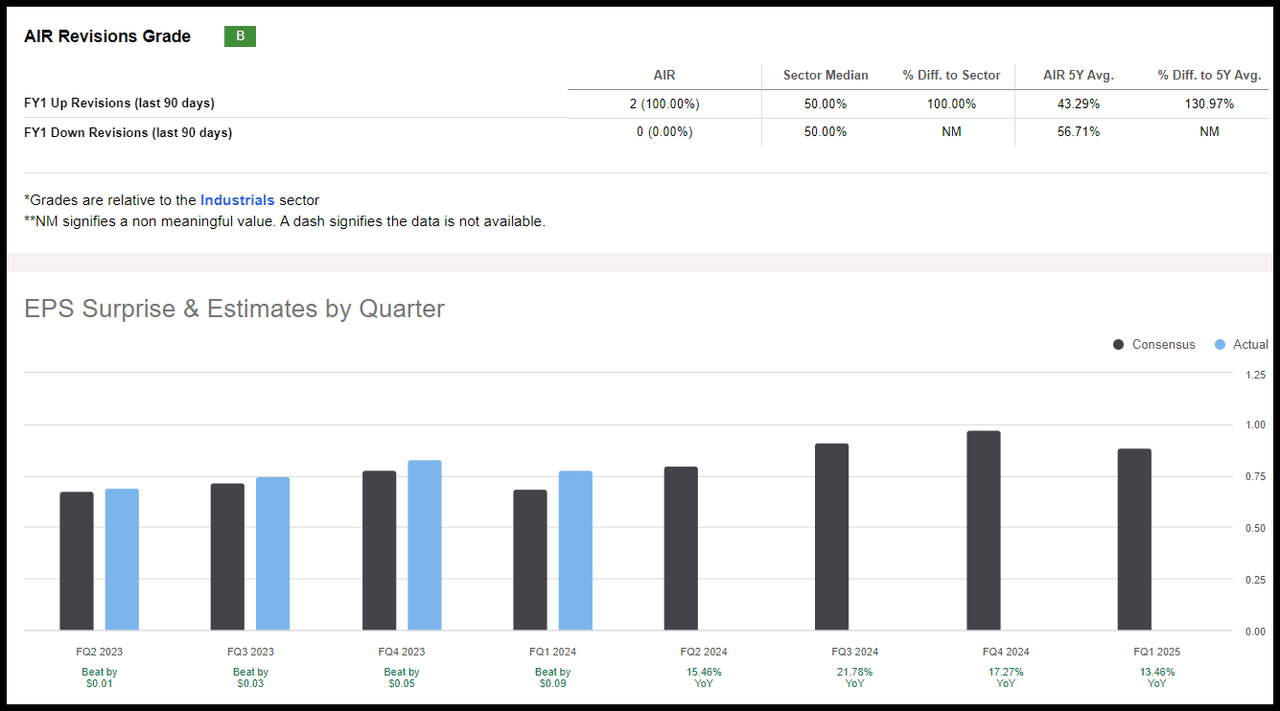

My only Buy-rated stock, AAR Corp. (AIR) is getting a lift following strong quarterly results that beat estimates. An independent provider of aviation products and services, AAR operates through two segments: Aviation Services and Expeditionary Services. Its Aviation Services division leases and sells new, overhauled, and repaired engines, parts, components, and more, while also offering fleet management and operations for the US Department of State and other services for government agencies. Expeditionary Services designs, manufactures, and repairs military and humanitarian tools and systems.

AAR Stock Valuation

Trading at a discount, AAR showcases a forward P/E ratio of 17.10x compared to the sector median of 18.70x and a forward PEG that is a 44% difference to the sector. +27% YTD, and over the last year, AAR has benefited from exclusive foreign military agreements and muti-year deals, aiding its quarterly price performance and tremendous growth.

AAR Stock Growth and Profitability

AAR Corp has showcased strong earnings over the past four quarters, which resulted in two FY1 upward analyst revisions in the last 90 days. First quarter 2024 EPS of $0.78 beat by $0.09, and revenue of $549.70M beat by more than 23% year-over-year, benefitting from increased commercial customer sales of 34% and 3% in government customers.

AIR Stock consecutively beats earnings

AIR Stock consecutively beats earnings (SA Premium)

Repair and engineering sales increased 8%, and integrated solu sales were +22% from the previous quarter. Adjusted operating margins increased to 7.3% from 6.9% for the same quarter last year, and most of its operating margins expanded for its divisions. AAR Corp Chairman, President and CEO stated:

We anticipate mid to high teens year-over-year sales growth with operating margins similar to or better than what we delivered in Q2 of last year…combined with the industry’s continued reliance on current generation aircraft, creates a very favorable operating environment. At our government business, as we win new contracts and the focus shifts to fleet readiness, we expect to accelerate our growth trajectory. Again, we are encouraged by our very strong start to the year and look forward to continuing to invest in our business and our people to drive further growth.

Given the large demand for aerospace and defense at this time, the backlogs of these five picks, and the ability to benefit from the potential risks posed by these turbulent times, my strong buy recommendations are excellent defensive considerations for a portfolio. But I should mention some of the largest names in defense.

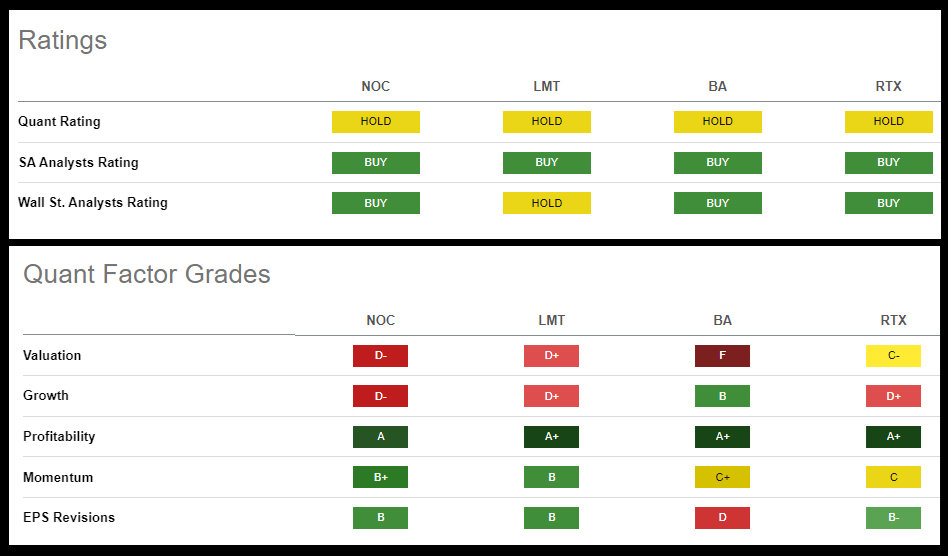

The Biggest Names in Aerospace & Defense

You may have wondered why I did not include some of the biggest names in the industry. Boeing (BA), Lockheed Martin (LMT), RTX Corporation (RTX), and Northrop Grumman Corp. (NOC) have experienced an uptick in trade volumes and are significantly profitable, yet these big-names in defense are rated Hold. Although a Hold does not mean sell, it typically indicates that the stock is trading in line with its sector, and perhaps one of the stock’s core factors ranks lower than if and when it was rated a Strong Buy. For instance, Boeing has a premium valuation, evidenced by an ‘F’ grade and 15 downward Wall Street analyst revisions over the last 90 days. It brings its EPS Revisions grade to a ‘D,’ requiring some prudence if adding to a portfolio.

4 Large Cap Defense Stocks Rated Hold (NOC, LMT, BA, RTX)

4 Large Cap Defense Stocks Rated Hold (NOC, LMT, BA, RTX) (SA Premium)

As showcased in their Quant Ratings and Factor Grades, three big-name defense stocks are likely overvalued, with RTX’s overall valuation a C-. A further dive into RTX’s underlying valuation metric showcases premiums for P/E ratios compared to the sector. Additionally, RTX’s PEG ratio is nearly flat, a metric used to determine the relative trade-off between the price of a stock, the earnings generated per share (EPS), and the company’s expected growth. As you can see from RTX’s quant Growth Grade of D+, the potential upside is questionable. Given the fear moving the markets, geopolitical tension stirring up concerns and having brought down the price of many big-name companies, despite Northrop Grumman, Boeing, Lockheed, and RTX showcasing ‘A’ to A+ Profitability grades, while investors may flock to continue investing in these big-name stocks, given some of their poor quant factor grades, I’d be hard pressed to see them move from Hold to Buy or Strong Buy, which is why I did not select them as my top defensive picks. Consider the fundamentally attractive top five defensive stocks for these turbulent times.

Disadvantages of buying defensive stocks

Where defensive sectors can offer peace of mind as safe haven investments amid market volatility and downturns, they tend to have a lower potential for capital appreciation. Considered more stable investments, they offer greater protection for downturns and typically do not experience the rapid growth other equities offer, especially during bull markets. Although less affected, like any other stocks, they’re still subject to market slides, whether up or down. As we’ve experienced with the surge in inflation, companies – defensive included – that offer dividends may cut or suspend dividend payments as costs eat into gross and net profit returns. Overall, defensive sectors tend to be less affected by economic slowdowns, which is why this article’s top five defensive stocks may serve as the best offense for portfolios.

Defense may be the best offense for portfolios

Amid market and economic uncertainty, stocks in healthcare, consumer staples, and aerospace and defense can insulate portfolios from inflation and volatility due to geopolitical factors. My stock picks RYCEY, BAESY, CDRE, TDG, and AIR offer growth traits, strong elements of sustainable profitability, solid valuation frameworks, and returns amid rising interest rates. Each stock is top-ranked in its industry, with bullish momentum outperforming the S&P 500 year-to-date returns. Each stock comes at a discount and benefits from rising prices. Consider these picks for portfolio diversification and as a hedge against increasingly hostile geopolitical events. We offer a plethora of Top-Rated stocks for you to sift through and select from. Alternatively, if you prefer a list of our top monthly suggestions from among the numerous strong buy quant stocks, you might want to delve into Alpha Picks to discover the crème de la crème of our quant strong buy recommendations.

Read the full article here