Introduction

Investors looking for diversified access to Southeast Asia’s second-largest economy-Thailand maybe interested in considering the iShares MSCI Thailand ETF (NYSEARCA:THD). THD has a 15-year listing history, during which it has managed to accumulate over $250m in AUM.

Currently, THD offers coverage to close to 150 stocks, and it also appears that the portfolio is relatively stable (validated by a rather low annual churn rate of just 9%).

However, despite covering a relatively wide number of stocks, there is an element of top-heaviness about this portfolio, with close to 46% of the portfolio consisting of the top-10 names. If you’re curious about THD, here are a few important macro and technical takeaways.

Macro Considerations

Let’s not beat around the bush, but rather just state that currently, the Thai economy is not a picture of health, and has so far fallen short of what was initially expected.

Earlier in the year, the general consensus was that Thailand would likely deliver 3.6% GDP growth in FY23, which would have represented a healthy 100bps improvement from last year’s growth rate. However, things have not quite gone to plan.

In Q1, GDP growth only came in at 2.6% YoY, and in Q2 it slowed even further to 1.8%. Now a whole host of economic institutions including the IMF and the Ministry of Finance in Thailand believe that growth will likely only come in at 2.7% for the year.

There are quite a few things that are leaving an adverse mark on the economy and THD as well. Firstly, there’s the China linkage. Given the weakness there, countries such as Thailand, which play an important role in the industrial supply chain are paying the price. The Thai manufacturing sector in H1 had witnessed a -3.1% decline after only falling by -0.8% in H2-22.

Also note that Industrials currently account for the highest weighting in THD, and it doesn’t help that the country’s largest industrial conglomerate- Siam Cement (also a part of THD) is currently struggling with its value-unlocking plans.

A cursory glance at the forward-looking manufacturing PMI will help shed some insight into the abating momentum there. The most recent reading for October represented the steepest contraction since February 2021, even as export orders came down for the second straight month.

Trading Economics

This is quite troubling as exports account for a massive chunk of the overall GDP (65%), and has traditionally played a key role in helping the country maintain a current account surplus position. Relative to previous expectations of a -0.5% to -2% decline in exports, the most recent expectation is for a lower range of – 1% to -2%.

Another important cog of the economy is tourism (18% of GDP), and whilst this has shown a marked improvement relative to last year (in 2022, the country only saw 11.5 million foreign visitors, but for the first 7 months of this year it had already hit 15m) it is still not quite at full tilt. Thailand was initially expecting 29.5 million visits for the year, but the Ministry of Finance recently scaled that down to 27.7 million.

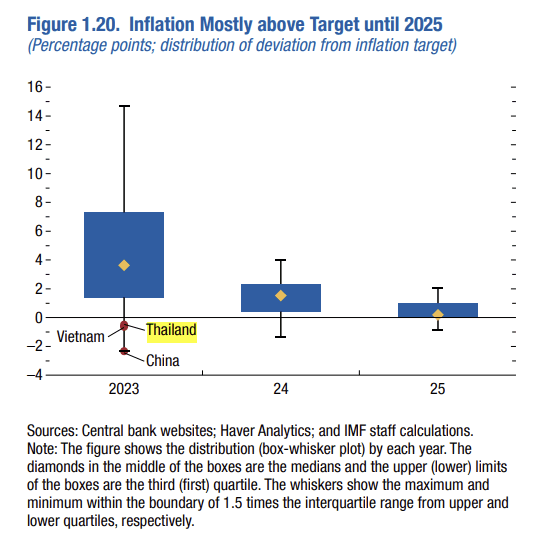

IMF Economic Outlook-Oct 2023

Currently, Thailand comes across as one of those rare economies whose inflation rate (0.3% in September) is below the central bank’s target rate of 1-3% (it has been this way since March 2023), but we would expect this to normalize soon enough on account of two key factors. Firstly, there’s a good chance the minimum wage gets hiked by 20%. Secondly, there’s also a digital wallet scheme in the works, that could see all Thai citizens aged over 16 receive Bt10,000 handouts via digital wallets, which would require them to spend in specific areas.

Closing Thoughts – Technical and Valuation Considerations

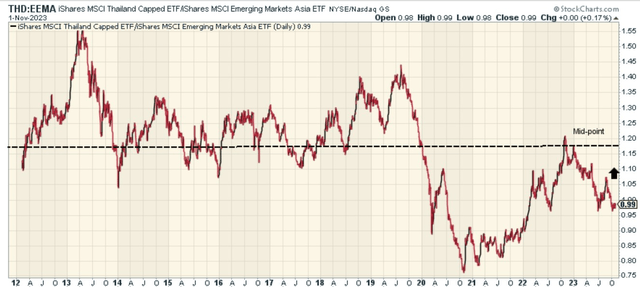

Investors looking for suitable rotational opportunities within emerging markets Asia may likely be open to shifting into Thai equities. Towards the end of last year, we saw Thai equities to EM Asia equities ratio mean-revert to the mid-point of its long-term range, but things have eased off once again, with the current ratio around 16% below the mid-point of the long-term range.

StockCharts

If we focus only on THD’s weekly price movements, there are two key patterns in play. One is the long-term trend that has been going on for two years, that of a descending channel pattern (the range within the two black lines barring a brief period of overextension in early 2023).

Investing

Within this broad channel, one can also currently spot another intermediate descending channel in action (the two red lines), although this is much steeper, reflecting the pronounced bearish sentiment for much of this year.

Clearly descending channels don’t fill one with a great deal of confidence (and the inherent bearishness augmented by a relatively high short-interest ratio of 11% when most ETFs have less than 1%), but what’s key is that at the sub $60 levels, the price has now hit the lower boundaries of both the long-term and the intermediate channel, implying decent reward to risk for Thai bulls with shorter time horizons.

Having said that, some investors may still be reluctant to get on board here, as THD’s valuations are not exactly cheap, despite the weakness in the price. According to Morningstar Thai stocks as well as the broader EM Asia universe are both poised to deliver similar long-term earnings growth of a little less than 10%, however, THD is currently priced at 15x P/E, a 23% premium over the corresponding multiple of EEMA.

Read the full article here