Novo Nordisk A/S (NVO) is a company (and stock) I have covered on a regular basis. Due to its great stock performance in the last few years, it is the biggest position in my portfolio (even after I trimmed my position a little bit in the last few months – I wrote about this in my previous article published in April 2023).

However, in the meantime, the stock has returned almost 20% (including dividends) and maybe it was a mistake to trim the position. In the following article, we look at Novo Nordisk again and update our assessment as to whether it is a good investment or not.

Quarterly Results

As often in the past, we start by looking at the last reported results. When looking at the results for the first nine months of fiscal 2023, Novo Nordisk is continuing to report extremely high growth rates and impressive numbers. But as Novo Nordisk previously announced preliminary third quarter data about three weeks ago, the great results the company reported right now were not a surprise.

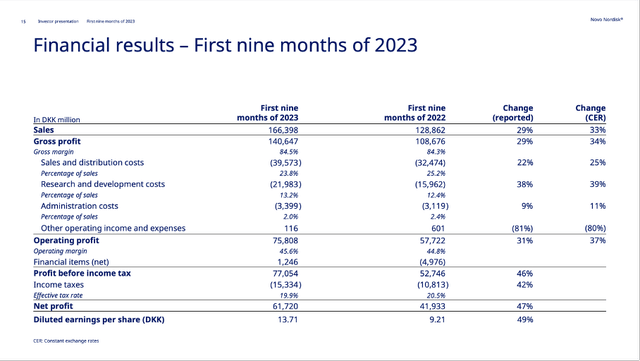

Net sales increased from DKK 128,862 million in the first nine months of 2022 to DKK 166,398 million – resulting in 29.1% year-over-year growth for the top line (in constant exchange rates, sales even increased 33%). Operating profit increased 31.1% year-over-year from DKK 57,722 million in the same timeframe last year to DKK 75,808 million in the first nine months of fiscal 2023. And finally, diluted earnings per share increased from DKK 9.21 in the first nine months of 2022 to DKK 13.71 in the first nine months of fiscal 2023 – resulting in 48.9% year-over-year growth.

Novo Nordisk Q3/23 Presentation

And free cash flow (“FCF”) also increased 20.9% year-over-year, from $62,490 million in the first nine months of fiscal 2022 to $75,576 million in the first nine months of fiscal 2023. When looking at the results for the third quarter of fiscal 2023, sales increased 29% compared to the same quarter last year (in constant exchange rates, net sales increased even 38%). Operating profit in the third quarter increased 33% YoY with growth in constant exchange rates being even 47%.

Novo Nordisk Q3/23 Presentation

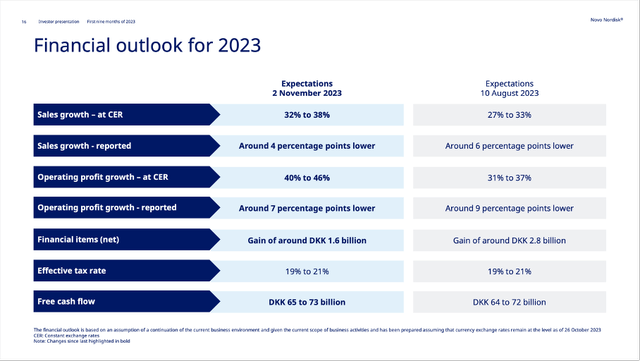

And management is expecting these growth rates to continue and has high expectations for the rest of the year. Novo Nordisk was already expecting high growth rates before, but it raised its guidance once more. Net sales are now expected to grow between 32% and 38% in constant exchange rates for the full year and operating profit is expected to grow between 40% and 46% in constant exchange rates.

GLP-1 and Obesity Driving Growth

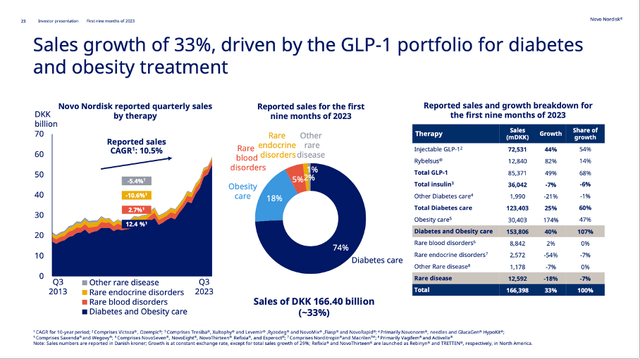

When looking at the different therapeutic areas, the picture for Novo Nordisk is similar to the last few quarters – growth is mostly driven by GLP-1 sales as well as sales of its obesity products. Total insulin sales declined from DKK 40,266 million in 9M/22 to DKK 36,042 million – resulting in a 10% year-over-year decline. And rare disease sales declined even 20% from DKK 15,689 million in 9M/22 to DKK 12,592 million in 9M/23.

Novo Nordisk Q3/23 Presentation

Growth in absolute numbers stemmed mostly from GLP-1 products, which are now not only responsible for more than 50% of total sales but grew 49% year-over-year from DKK 59,019 million in 9M/22 to DKK 85,371 million in 9M/23 and therefore contributing about DKK 26 billion to top line growth. Ozempic sales increased 58% in constant exchange rates to DKK 65,653 million and Rybelsus sales increased 82% to DKK 12,840 million.

The highest growth in relative numbers was reported by obesity care sales. While Saxenda reported 18% growth in constant exchange rates to DKK 8,674 million, Wegovy sales increased 492% in CER to DKK 21,729 million. Total obesity care sales increased 174% in CER to DKK 30,403 million.

Stock Split

On September 13, 2023, Novo Nordisk announced a 2-for-1 stock split. I think it is worth mentioning at this point, as the numbers reported above were before the stock split and, therefore, unadjusted per share numbers were twice as high. Otherwise, the stock split is not news for me. At best, it is another hint that Novo Nordisk performed great in the last few years – but we also knew this before.

Increased Competition from Eli Lilly and Company (LLY)

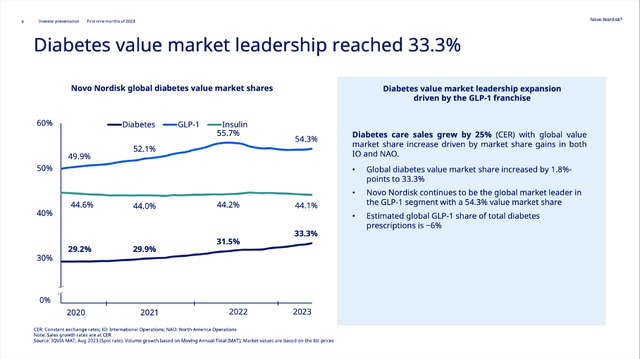

For starters, Novo Nordisk increased its market share in the last few years, which is always a good sign. Novo Nordisk’s market share in the diabetes market is now 33.3% (compared to 29.2% three years ago). Market share in the insulin market is more or less stable around 44% but Novo Nordisk gained market shares in the extremely important (because highly growing) GLP-1 market and increased its market share from 49.9% three years ago to 54.3% right now (it has even been 55.7% last year).

Novo Nordisk Q3/23 Presentation

And when comparing the major GLP-1 drugs of both Novo and Eli Lilly, Novo Nordisk seems to be ahead. When looking at the results for Trulicity in the first nine months, Eli Lilly generated $5,463 million in sales. In the same timeframe, Ozempic reported about $9.4 billion in sales. Additionally, Ozempic reported high growth rates, while Trulicity sales declined about 1% in the first nine months.

When comparing the two major obesity care drugs, Wegovy generated about $3.1 billion in sales in the first nine months of 2023 while Mounjaro generated $2,958 million in sales in the same timeframe. Wegovy was already launched in mid-2021 in the United States, while Mounjaro was launched in June 2022. And it seems like Eli Lilly will outperform Novo Nordisk in obesity care as Mounjaro is growing much faster and might generate higher revenue in the foreseeable future.

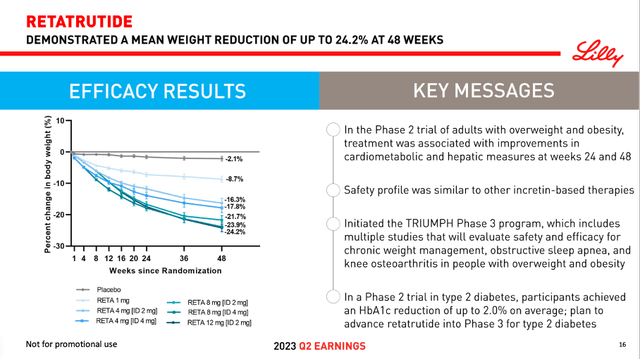

And while it seems like a head-to-head race between Novo Nordisk and Eli Lilly right now (with Novo Nordisk being slightly ahead), Eli Lilly could have the better pipeline for obesity care. Especially retatrutide of Eli Lilly, which entered phase III in August 2023 seems to be very promising. And recently reported results indicate that patients could lose as much as 24% of the previous weight.

Eli Lilly Q2/23 Presentation

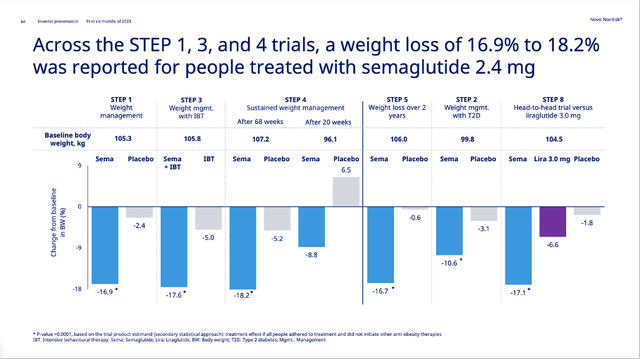

However, it will most likely take several years before retatrutide will enter the market – some are expecting it will take about 5 years before it will contribute to revenue. And it is not like Novo Nordisk is not able to achieve similar results. Novo Nordisk is also reporting weight loss of close to 20% for its patients – however, Eli Lilly seems to be ahead with its obesity care drugs.

Novo Nordisk Q2/23 Presentation

Gigantic Market or Hype

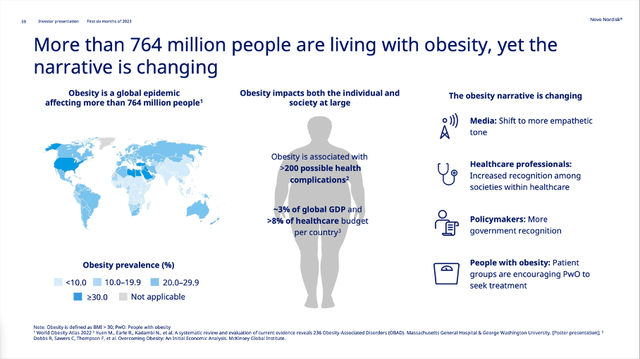

And while the battle between Eli Lilly and Novo Nordisk will be interesting to follow in the years to come, it seems more like both companies will be able to grow at a high pace as the obesity care market will grow with a high pace. For starters, the obesity narrative seems to be changing. While policymakers and healthcare professionals seem to recognize the problem more, the tone in the media also became more empathic towards obesity.

Novo Nordisk Q2/23 Presentation

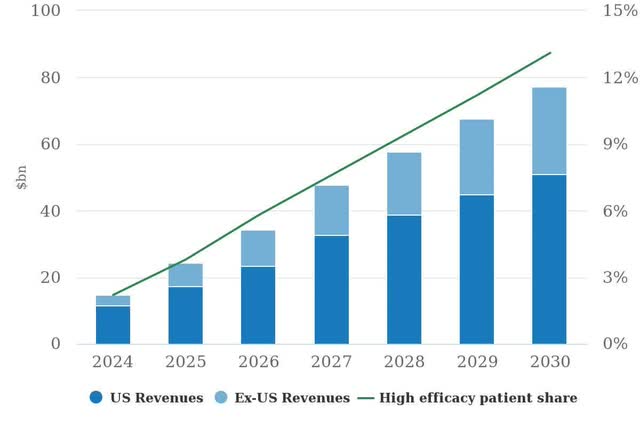

Recently it was reported by Morgan Stanley that 4.4 million U.S. citizens are now on GLP-1 drugs. And Morgan Stanley is expecting the market for obesity drugs to grow with an extremely high pace and reach $77 billion in 2030 (previous assumptions were about $20 billion lower). And, in theory, the market is gigantic, as more than 750 million people are living with obesity and obesity is responsible for 5% of deaths globally (according to the World Health Organization).

Morgan Stanley Research

JPMorgan Chase is even more optimistic, predicting that the weight loss market will hit $100 billion in 2030.

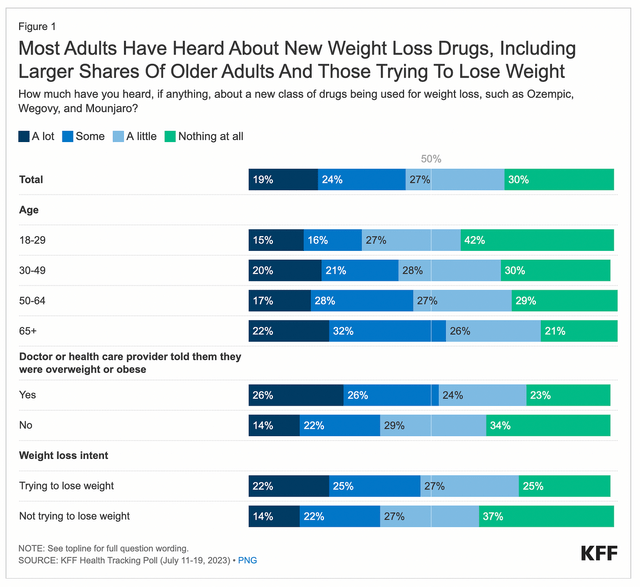

According to KFF polling, 70% of U.S. citizens have already heard about the weight loss drugs. The poll also found that almost half of U.S. adults would generally be interested in taking a safe and effective prescription weight loss drug.

KFF

And we must assume other competitors trying to enter the market as well. But right now, Eli Lilly and Novo Nordisk have a dominant position and both companies will fight to keep it that way. And of course, the products are patent-protected. Right now, Wegovy and Ozempic are patent-protected until 2031 in the European Union and until 2032 in the United States.

Putting Numbers in Perspective

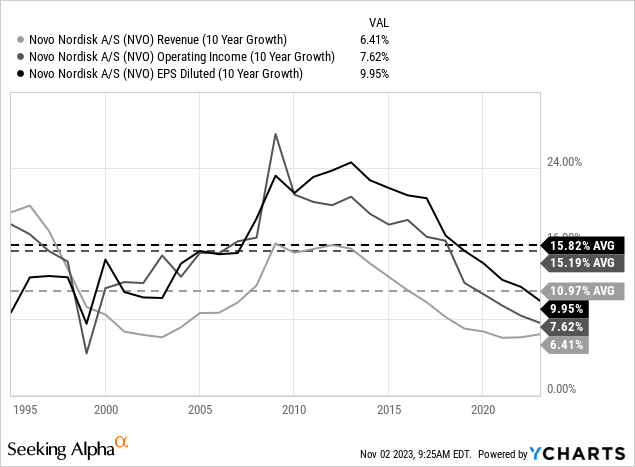

Novo Nordisk is certainly reporting impressive growth numbers right now and not many businesses – especially businesses with a similar market capitalization – are able to report such growth rates. However, when looking at the 10-year growth rates for Novo Nordisk in the years between 2012 and 2022 we see growth rates lower than 10-year CAGRs the company reported in past decades.

In the last ten years, revenue increased with a CAGR of 8.53%, operating income increased with a CAGR of 9.76% and finally, earnings per share increased with a CAGR of 12.14%. The numbers in the chart are a little higher as they already include the last few quarters and are calculated using USD instead of DKK. But the message is the same: On a ten-year basis, Novo Nordisk is actually reporting one of the lowest growth rates in the last 30 years.

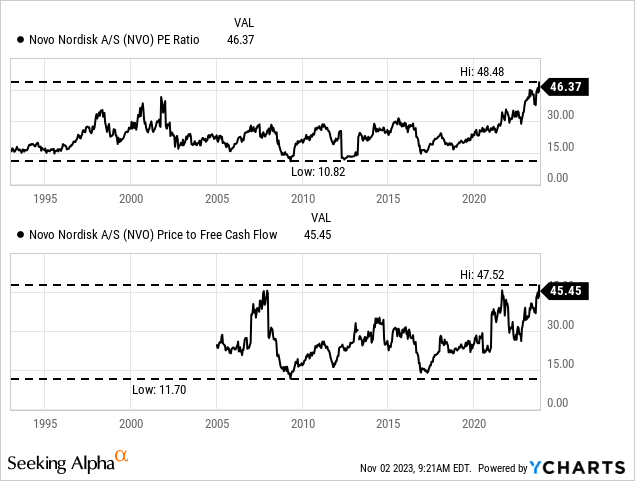

And another way to put the current numbers in perspective is to look at the valuation multiples. And at least for the time we have data – since about 2005 for the price-free-cash-flow ratio and since about the early 1990s for the price-earnings ratio – Novo Nordisk is trading for the highest valuation multiples ever. Without doubt, the growth rates Novo Nordisk is reporting right now are impressive, but the valuation multiples also are – in a bad way. Novo Nordisk is trading for 46 times earnings and for 45 times free cash flow.

Intrinsic Value Calculation

A first impulse would be to call these valuation multiples too high, but high growth rates are justifying high valuation multiples. And with earnings per share growing close to 50% right now, a valuation multiple close to 50 could be justified. However, in such a scenario we should use a discount cash flow calculation to make better (and maybe more reasonable) assumptions.

Following the stock split, we are calculating with 4,489 million diluted outstanding shares and a free cash flow of DKK 69 billion (midpoint of the current guidance). Additionally, we are calculating with a 10% discount rate as the minimum goal we like to achieve for our investment. To be fairly valued right now, Novo Nordisk must grow close to 15% annually for the next 10 years followed by 6% growth till perpetuity.

The question right now is if these growth assumptions are realistic. Of course, we never know what will happen in one, two or three decades from now but Novo Nordisk is one of these companies where I am extremely optimistic that 6% growth till perpetuity is a realistic assumption. If you are familiar with my past articles, you know that I am always cautious not to make too optimistic growth assumptions. And 15% annual growth is certainly an optimistic assumption for any business. While Novo Nordisk reported much higher growth rates in the last few quarters, the results in the past ten years don’t support that kind of optimism (as mentioned above).

However, the past ten years were a rather difficult time for Novo Nordisk as the company lost patent protection for several of its drugs leading to several years with almost no growth. And when looking at longer timeframes, we can back up the thesis as Novo Nordisk grew with a much higher pace long term. We can look at the data for the last 40 years (between 1982 and 2022) but we should not ignore that in 1982 one of the major bull markets of the last century started. Nevertheless, Novo Nordisk increased revenue with a CAGR of 11.04% during that four decades, and earnings per share increased with a CAGR of 15.07% in the last 35 years (I was not able to find EPS data before 1987). And while we saw a major bull run in these past decades, we should also keep in mind that Novo Nordisk was already a mature company. In 1982 Novo Nordisk was already around 60 years old and still reported extremely high growth rates. This should make us confident that Novo Nordisk might also be able to grow by 15% in the next ten years.

Conclusion

I would still rate Novo Nordisk as a “Hold” at this point. And while I don’t want to purchase any shares at this point – as mentioned above I trimmed my position a little bit recently – I also don’t think one would make a major mistake by buying Novo Nordisk. But it should be a long-term investment with the intention to hold the stock at least for 5 to 10 years as we should also be prepared for a theoretical correction. I would assume when Novo Nordisk is disappointing for the first time and is reporting lower growth rates again, the stock will correct.

To sum up, Novo Nordisk A/S is one of the greatest companies on earth. Novo Nordisk only has the problem that its stock is rather expensive right now and it is probably not the best time to buy, but over the long run (next one, two or three decades), one probably won’t regret an investment in Novo Nordisk.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here