The BlackRock Capital Allocation Term Trust (NYSE:BCAT) is a closed-end fund aka CEF that can be utilized by investors who are seeking to earn a high level of income from the assets in their portfolio. The fund certainly manages to deliver on this front quite well, as it boasts a 10.67% current yield. This yield is considerably higher than just about any bond or stock index, although it is not especially high among closed-end funds. After all, we have frequently discussed closed-end funds in this column that have yields of anywhere from 10% to 14%. In the past, anything exceeding 10% was generally considered to be a sign that the market expects that the distribution will soon be cut, but that is no longer the case as it is currently fairly easy to obtain a near-double-digit yield simply by investing in speculative-grade bonds.

As the name of the fund suggests, the BlackRock Capital Allocation Term Trust is a term fund that is scheduled to liquidate on September 27, 2032. This is something that could prove very interesting to potential investors who may only need income for a relatively short period. It may also give the fund the ability to sustain a distribution that is not fully covered by its net investment income and net realized gains because the fund will not need to maintain its asset base permanently. Finally, the fund should see its share price approach its net asset value as the expiration date approaches. That could allow someone who purchases the fund at a discount to earn some capital gains from the share price appreciation, but it is probably too early to be able to really take advantage of this. That is because the fund still has nine years until liquidation and a lot can happen over the next nine years.

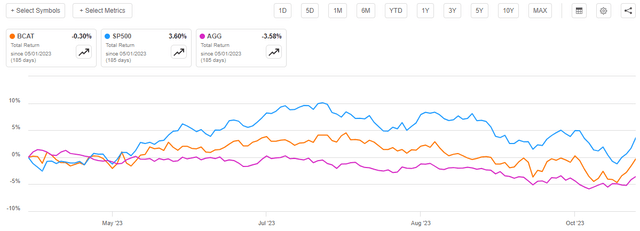

As regular readers may recall, we last discussed this fund in early May of this year. The fund’s performance since that time has actually been pretty solid for an income fund. The fund’s share price is down 5.28% since the date that my prior article was published. That is pretty much in line with the iShares Core U.S. Aggregate Bond ETF (AGG), but considerably worse than the S&P 500 Index (SP500):

Seeking Alpha

However, it is important to note that this fund has a higher yield than either of these two indices and it has continued to pay out its distribution over the entire period in question. That is important because investors in the fund will receive the distribution and that serves to offset some of the share price declines. When we take this into consideration, we see that an investor who purchased shares of the BlackRock Capital Allocation Term Trust has roughly broken even since the date that my last article was published. This beat the performance seen by an investor in the Bloomberg U.S. Aggregate Bond Index but was still not as good as an investor who bought the S&P 500 Index on the same date:

Seeking Alpha

This performance, which puts the fund roughly between the American stock and bond indices, actually makes a lot of sense given the bond’s makeup, as we will see in just a minute.

Let us investigate and see if this fund could be a reasonable addition to your portfolio today.

About The Fund

According to the fund’s webpage, the BlackRock Capital Allocation Term Trust has the primary objective of providing its investors with a high level of both total return and income. This is somewhat confusing as income is a component of total return. Fortunately, the website’s description goes into a bit more detail:

BlackRock Capital Allocation Term Trust’s investment objectives are to provide total return and income through a combination of current income, current gains and long-term capital appreciation. The Trust invests in a combination of equity and debt securities. Generally, the Trust’s portfolio will include both equity and debt securities. At any given time, however, the Trust may emphasize either debt securities or equity securities. The Trust utilizes an option-writing (selling) strategy in an effort to generate current gains from options premiums and to enhance the Trust’s risk-adjusted returns.

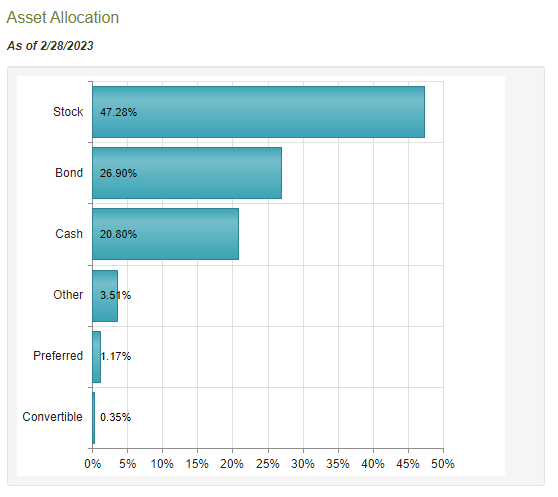

This description directly states that the fund will invest in both equity and debt securities in pursuance of its objectives. It has a portfolio consisting of both types of securities right now, as 47.28% of the fund’s assets are currently invested in common stock alongside fairly large allocations to both bonds and cash:

CEF Connect

This is a rather unusual allocation for a term fund. Usually, these funds attempt to invest in bonds that mature right around their liquidation date. This allows the fund to keep its net asset value right around the initial public offering price over the long term. Basically, the goal is to provide the investors with a substantial amount of income through distributions and then give them their initial investment back on the liquidation date. In effect, the fund would act as a very high-yielding bond due to the fact that it will be using leverage to increase the overall yield of its portfolio.

However, the BlackRock Capital Allocation Term Trust is not doing that. As common stock does not have a maturity date, there is no real way for it to simply assemble a portfolio that matures right around the liquidation date. It could be attempting to use the common stock to generate capital gains and then slowly migrate its assets into bonds maturing around 2032 as that date approaches. This would be similar to the way many financial planners slowly attempt to migrate retirement savers into bonds as they age. The fund’s description explicitly states that its portfolio will always include both debt and equity though, so that largely rules out this possibility. The fund’s management appears to be hoping that the common stock will have appreciated enough that they can give a big payout to investors on the maturity date. There is, of course, no guarantee that this will happen, but stocks usually do go up over a given twelve-year period.

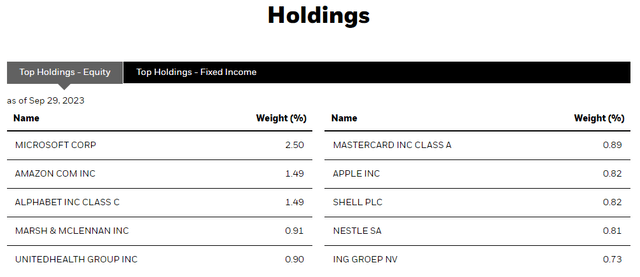

Many of the fund’s largest equity holdings have delivered fairly impressive performance over the past decade. Here they are:

BlackRock

Here are the training ten-year returns for these stocks:

|

Company |

Trailing Ten-Year Total Return |

|

Microsoft Corporation (MSFT) |

1000.28% |

|

Amazon.com, Inc. (AMZN) |

690.13% |

|

Alphabet Inc. (GOOG) (GOOGL) |

373.19% |

|

Marsh & McLennan Companies, Inc. (MMC) |

391.38% |

|

UnitedHealth Group Incorporated (UNH) |

786.42% |

|

Mastercard Incorporated (MA) |

454.12% |

|

Apple Inc. (AAPL) |

981.16% |

|

Shell plc (SHEL) |

28.49% |

|

Nestlé S.A. (OTCPK:NSRGY) |

103.83% |

|

ING Groep N.V. (ING) |

54.23% |

With the possible exceptions of Shell, Nestle, and ING Groep, it seems highly unlikely that any of these stocks will deliver comparable performance over the next decade. Accomplishing that task would require either tremendous economic growth, which does not seem very likely with the Baby Boomer generation entering into retirement and the current horrid fiscal state of governments all across the United States, or massive inflation. The inflation scenario is a possibility, but we do not really want to get asset valuation growth through that method. Thus, the fund’s stock holdings may not perform as well between now and the scheduled liquidation date as they did over the past decade. However, at least some of these stocks could outperform bonds over the same period. Thus, the fund’s willingness to invest more heavily in common stocks than in bonds does make a certain amount of sense despite this being a term fund. This could allow the fund’s liquidation value to be higher than it would be with an all-bond portfolio.

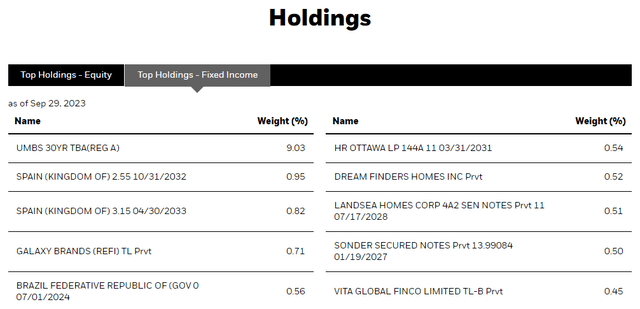

The fund’s bond portfolio consists of a very large position in U.S. agency securities along with small positions in numerous other things:

BlackRock

The first item on the list is a Fannie Mae/Freddie Mac Uniform Mortgage-Backed Security. Fannie Mae explains these securities on its website:

Beginning June 3, 2019, we began issuing Uniform Mortgage-Backed Securities for all to-be-announced-eligible securities backed by 30-, 20-, 15-, and 10-year fixed-rate single-family mortgages. Additionally, all legacy TBA-eligible securities previously issued by Fannie Mae were automatically considered UMBS.

The Single Security initiative aims to ensure both Fannie Mae UMBS and Freddie Mac UMBS are fungible for deliveries into a single TBA market. In a TBA contract, the maturity, coupon, face value, price, and settlement date of an MBS are known, but the issuer, be it Fannie Mae or Freddie Mac, and the actual unique security issuer are “to be announced.”

Thus, this is a thirty-year mortgage-backed security issued by one of the government-sponsored enterprises. As such, it is implicitly, but not explicitly, backed by the U.S. Federal Government. We can therefore assume that it is probably free of default risk or very close to being free of default risk. It is interesting though that the fund opted for a thirty-year security as opposed to a ten-year or fifteen-year security whose maturity date would more closely match the expected liquidation date of the fund. Once again, the closer the bond’s maturity is to the liquidation date, the less interest-rate risk that the fund will have as the liquidation date approaches. A shorter-term bond would thus be much more likely to trade at a price that is close to its face value on that date.

Leverage

As is the case with most closed-end funds, the BlackRock Capital Allocation Term Trust employs leverage as a means of boosting its effective yield and total return beyond that of the underlying assets. I explained how this works in my previous article on the fund:

Basically, the fund borrows money and then uses that borrowed money to purchase income-producing assets like bonds or assets that it expects to appreciate in value such as common stocks. As long as the purchased assets deliver a higher total return than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. This fund is able to borrow money at institutional rates, which are considerably lower than retail rates. As such, this will usually be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund does not employ too much leverage because that would expose us to an excessive amount of risk. I do not generally like a fund’s leverage to exceed a third as a percentage of its assets for that reason.

As of the time of writing, the fund’s leveraged assets comprise 5.18% of the overall portfolio. This is clearly a very low leverage ratio that is well below the one-third maximum that was just mentioned. Overall, we should not have to worry too much about this fund’s leverage as it hardly uses any at all. In fact, the fund might actually benefit from increasing its leverage a bit in order to purchase high-yielding preferred stocks or bonds. As these assets should yield more than the fund’s borrowing costs, it might be able to boost its income via this method.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the BlackRock Capital Allocation Term Trust is to provide its investors with a very high level of current income along with total return. In order to accomplish this objective, the fund invests in a blended portfolio that consists of common stocks, bonds, preferred stock, cash, and other assets. It collects all the dividends and interest payments that it receives from these assets. It adds any capital gains that it manages to realize to this pool of money. The fund even sells call options to collect premiums, which has the effect of acting much like a synthetic dividend from the common stock in the portfolio. The fund then pays out all of the money that it earns from these various activities to its shareholders, net of its own expenses. We might assume that this would result in the fund having a very high distribution yield.

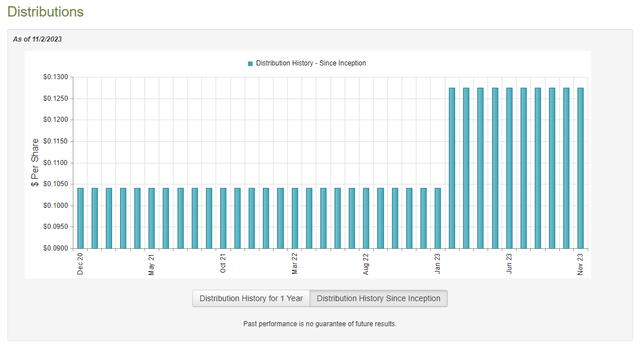

This is certainly the case as the BlackRock Capital Allocation Term Trust pays a monthly distribution of $0.1275 per share ($1.53 per share annually), which gives it a 10.67% yield at the current share price. This is competitive with many other closed-end funds in the market, although it is certainly not the highest yield that we can find. The fund has been remarkably consistent with respect to its distribution since its inception though, and it even increased its payout earlier this year:

CEF Connect

This distribution history seems certain to appeal to any investor who is seeking to earn a safe and consistent income from the assets in their portfolios. However, this is one of the only funds that does not focus on either floating-rate securities or energy stocks that have managed to increase its distribution since the start of 2022. We should therefore have a close look at its finances as it is quite possible that it cannot actually afford the distribution that it is paying out.

Fortunately, we have a relatively recent report that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on June 30, 2023. This is a much newer report than the one that we had available to us the last time that we discussed this fund, which is nice because it will give us a good idea of how well the fund managed to perform during the first half of this year. That was a very interesting time period, as there was a great deal of optimism that the Federal Reserve would reverse course with respect to its interest rate policies and cut rates as the United States fell into a recession. It is very similar to what we have seen over the past week or so. That belief prompted investors to bid up asset prices, including both stocks and bonds. This may have given the fund the opportunity to realize some capital gains, despite the fact that this belief was eventually proven to be incorrect.

During the six-month period, the BlackRock Capital Allocation Term Trust received $12,797,246 in dividends along with $32,402,912 in interest from the investments in its portfolio. When we combine this with a small amount of money received from other sources, the fund reported a total investment income of $44,557,511 during the period. It paid its expenses out of this amount, which left it with $31,667,358 available for the shareholders. That was, unfortunately, nowhere close to enough to cover the distribution. During the period, the fund paid out $80,192,916 to its shareholders in the form of distributions. This may be concerning at first glance as the fund failed to cover its distribution out of net investment income.

With that said, the fund has other methods through which it can obtain the money that it needs to cover its distributions. For example, it might have been able to realize capital gains by selling appreciated assets into the strong market that existed during the first half of the year. The fund might also have been able to make some money by selling call options and pocketing the premiums. These premiums are not considered to be investment income for tax purposes, but they still clearly represent money coming into the fund that can be paid out to the shareholders.

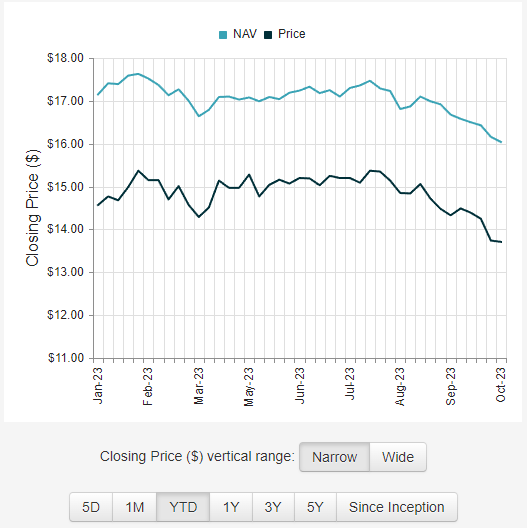

The fund generally had mixed results at generating income through these alternative sources during the period. It reported net realized losses of $25,998,593 but this was offset by $126,957,308 net unrealized gains during the period. Overall, the fund’s net assets went up by $52,433,157 after accounting for all inflows and outflows during the period. Thus, technically the fund did manage to cover the distributions that it paid out. However, it had to rely on net unrealized gains to accomplish this task, which can be risky. After all, unrealized gains can vanish during any market correction. The fund’s net asset value per share is down year-to-date so there is a very real possibility that this is the case:

CEF Connect

Thus, the distribution could be unsustainable at the current level since the fund’s net asset value is declining. While this may not be as big a deal for a term fund as it is for a perpetual fund, it would still be better to see the net asset value remain generally stable over time.

Valuation

As of November 2, 2023 (the most recent date for which data is available as of the time of writing), the BlackRock Capital Allocation Term Trust has a net asset value of $16.25 per share but the shares currently trade for $14.48 each. That gives the fund’s shares a 10.89% discount on net asset value at the current price. This is a reasonable discount on net asset value, but it is nowhere near as attractive as the 12.61% discount that the shares have had on average over the past month. Thus, it may be possible to obtain a better price simply by waiting for a little bit. With that said, a double-digit discount is usually a decent price to pay for any fund so overall investors should be fine buying the fund at the current price.

Conclusion

In conclusion, the BlackRock Capital Allocation Term Trust is a very interesting blended closed-end fund because of its 2032 liquidation date. The fund holds a portfolio that is more heavily weighted towards common stock than fixed-income assets, which is rare for a term fund. There could be some reason to assume that the allocation will work out in the fund’s favor though, since the common stocks in the portfolio could very easily deliver a superior return to a bond portfolio between now and the expiration date. The only real concern here is that the distribution might be more than the fund can really afford as it was dependent on unrealized capital gains that the fund managed to achieve during the first half of the year and it may have since given up much of those gains.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here