Intro

Paramount Global (NASDAQ:PARA) is one of the largest video content producers in the US with a strong presence in broadcast and cable TV, film and streaming distribution channels. Leading scale enables Paramount to invest in high-budget, high-quality content that is appealing to viewers across all distribution channels.

PARA has underperformed as of late due to worries about the future prospects of its traditional TV Media business as well as the apparent lack of scale of its streaming business. We believe that these worries are overblown and the current valuation is overly conservative. Paramount has one of the highest content budgets in the industry and can offer streaming subscribers an appealing content catalogue from its TV and Film divisions.

The content that Paramount generates will increasingly be distributed through Direct-To-Consumer platforms and is likely to compensate for linear distribution decline as it already accounts for c24% of Group revenues. Paramount is currently valued as though it were in a state of permanent decline. We believe this is not the case.

Why does size matter?

Content production is essentially a fixed-cost business. The networks with the largest revenue bases can invest the most in content and thus deliver the best shows for viewers and thus maintain their popularity. In the linear TV world, only one show could be broadcast at a time, thus the scale of an individual network was the key driver of the competitiveness. Streaming platforms enable broadcasting hundreds of different shows at a time and in this setting the overall size of the content portfolio becomes important.

Paramount owns some of the most popular free-view and pay TV networks in the US. The portfolio of individually strong networks includes CBS, Showtime, Paramount Network, Comedy Central, MTV and Nickelodeon. These have the largest reach in their relevant content categories and therefore can afford to spend more on sports rights, scripted or kids shows as compared to smaller players as these expenditures are supported by the largest pools of advertising or affiliate revenues.

In the linear TV world, the scale of individual networks was the main determinant of competitiveness, as the industry moves towards on-demand streaming the size of the group becomes increasingly important. Viewers want to access as much good quality content for the subscription fee that they are paying and the media groups with the largest content budgets can deliver that. Paramount can effectively share content across distribution platforms thus improving the monetisation potential of any individual content project.

Popular shows, such as Yellowstone, can be first aired live on a broadcast or cable network and a few days later be placed on a subscription streaming service, such as Paramount+, for on-demand viewing. Later the content can be licensed to other subscription platforms and at the end of its life get placed on Pluto. Paramount has strong positions along the value chain and therefore can monetise the content effectively.

Declining linear TV viewership also blurs the line between original and second-run content. If a TV series like Yellowstone is first aired on a cable TV network such as Paramount, and only half of US households have access to the network, this would mean that the other half of the households would not have seen it at the first run. When it is placed on a streaming platform it will be essentially original content for the households that did not have cable. Essentially the original content spending of Paramount+ is a lot larger than the headlines indicate.

It is not only the size but also the composition of the overall content portfolio on streaming platforms that matters. Paramount produces a lot of good quality content that is appealing to many segments of audience with back catalogues and production capabilities in key content categories of scripted series (CBS, Showtime, Paramount Network), sports (CBS Sports), movies (Paramount Pictures), comedy (Comedy Central), reality shows (MTV), kids (Nickelodeon), documentaries (Smithsonian), Spanish (Telefe). The well-rounded offering makes it a desirable streaming platform for families.

Overall, Paramount has the scale on individual TV network level which enables them to produce high-budget and high-quality content. This content can easily be distributed through their Direct-To-Consumer streaming platforms. They also have a well-rounded collection of core content that should make their platform desirable.

The scale of Paramount as compared to peers

Paramount is among the industry leaders in terms of revenues and content spending, they generate c30 billion in revenue per annum from CBS, cable networks, movie studios and streaming services and spend $15-17 billion on content. This makes it the 4th largest scripted video content producer.

Paramount is spending even more than Netflix on content, but the composition of spending is different. Netflix (NFLX) as a pure-play competitor, has a significantly larger share of its overall content budget allocated to original streaming content, probably in the 40-50% range. Netflix also produces a lot more content hours as it is able to target smaller viewer niches with lower-budget content. Netflix is a lot stronger than Paramount in the streaming space, but this will not surprise anyone as Netflix is the industry leader with a c10x market value of Paramount.

Disney (DIS) is the largest player in the content market as they have an overall budget in excess of $30 billion, twice as much as Paramount or Netflix. A big chunk of this budget goes to pay for the sports rights of ESPN, but even excluding those Disney spends over $22 billion on scripted content. Across all its streaming platforms Disney has in excess of 170 million subscribers with 105 million in core Disney+, only Netflix has more. Disney is big and strong and integration of Hulu content will only make it stronger. Disney will do just fine in the streaming space.

Warner Bros. Discovery (WBD) have a content spend of c$18 billion, which is only 20% greater than Paramount, but the company managed to build a successful streaming service on the back of the popularity and creative successes of its HBO network and strong back catalogue of movies and IP. The company has c95 million DTC subscribers, they also have large cable networks and studio businesses to generate content. Warner has built a strong position in the industry and will also do well.

Paramount+ has c63 million subscribers and 80 million of add-supported active users on its Pluto platform. The company does not have a leading stand-alone streaming revenue base, though content from its linear networks and studios does allow it to compete in this new distribution channel. Paramount would probably rank as number 4 in terms of their streaming content portfolio. They were late in the game and are still building an original content portfolio on the back of rising revenues.

NBC Universal is the sleeping giant of the industry. They have a leading content budget, but their streaming service Peacock has failed to gain traction. They own part of Hulu, but will most likely sell it to Disney. They will need to make some deals to gain a footing in the streaming space. The company plans to ramp up spending on originals, roughly to the level of Paramount+.

Amazon Prime Video has a lot of subscribers but these are mostly Amazon Prime customers who are given the service for free. Last year the service spent only $7 billion on content and a large share of this budget goes to licensed content and sports. Prime Video does not have the pure play scale of Netflix or the back catalogue of the media groups. The acquisition of MGM Studios will help them somewhat, but Amazon still needs to make more deals to build a solid position.

Apple TV+, Lions Gate (LGF.A) and AMC Networks (AMCX) are other weaker players that will be looking for deals.

|

Content Scale ($ billion) |

2022 |

2023 |

|

Paramount |

||

|

Revenues |

30 |

|

|

Content Spend (P&L) |

15 |

|

|

Originals |

2-3 |

4-5 |

|

Streaming revenues latest quarter (Paramount+, Pluto) |

1.7 |

|

|

Disney Media and Entertainment |

||

|

Revenues |

55 |

|

|

Content Spend (P&L) |

30 |

|

|

Content Spend linear |

12 |

|

|

Content Spend dtc |

14 |

|

|

Content Spend licensing |

4 |

|

|

ESPN Revenues |

16 |

|

|

ESPN Content Spend (guess) |

7-9 |

|

|

Streaming revenues latest quarter (Disney+, ESPN+, Hulu) |

5.5 |

|

|

NBC Universal |

||

|

Media and Studios Revenues |

35 |

|

|

Content Spend (P&L) |

23 |

|

|

Streaming revenues latest quarter (Peacock) |

0.8 |

|

|

Warner Bros. Discovery combined |

||

|

Revenues |

42 |

|

|

Content Spend (P&L) |

18 |

|

|

Streaming revenues latest quarter (MAX) |

2.7 |

|

|

Netflix |

||

|

Revenues |

32 |

|

|

Content Spend (P&L) |

14 |

|

|

Original content |

6 |

|

|

Streaming revenues latest quarter |

8.2 |

|

|

Amazon Prime Video |

||

|

Content Spend |

7 |

7-9 |

|

Apple |

||

|

Content Spend (cash flow) |

6 |

Financial statements and news articles

Overall, it would seem that only Disney, Netflix and Warner have built strong stand-alone streaming businesses. Disney and Warner have done it on the back of the content from their traditional TV networks and movie studios. Paramount is also going down this road. The company have some of the largest content budgets in the industry and a well-rounded content portfolio which makes them a serious contender.

The fate of broadcast networks

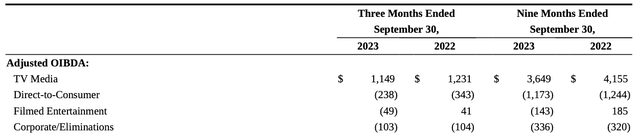

The linear TV Media business, which is made up of Broadcast and Cable networks, still generates most of Paramount’s profits as of now, but the video content is increasingly being accessed through streaming platforms and linear distribution is expected to decline. We believe the bargaining power that the most popular networks have and the popularity of the content that they produce will ensure that this decline will not be rapid.

Paramount Q3 2023 report

Broadcast Networks:

Broadcast TV will stay around for quite some time because of the popularity of live and local content and its leading reach. Live sports as well as local news and political commentary are the two formats where pure play streamers have only made limited inroads. These formats have high fixed costs in the form of rights or newsrooms and can only be provided free of charge by players with the maximum reach. All TV’s at homes will continue having TV signal receivers. As long as broadcasters are able to offer differentiated high-quality content, the viewers will tune in.

Viewers like to watch sports live, therefore the on-demand feature, enabled by technology is not relevant here. Sports rights are becoming more expensive, but advertising rates during sporting events are also soaring. CBS will maintain its reach and will keep broadcasting sports which it has secured for the next 5-6 years. Sports will also be broadcast over streaming platforms.

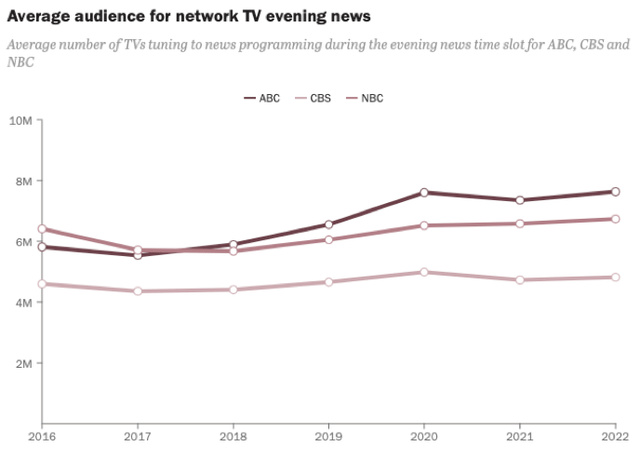

News and political commentary are also a resilient content category. Evening news does not need to be watched live and people can news on their phones. The broadcasters can offer in-depth analysis, live video streams and reputable coverage of local as well as national events. Tech platforms cannot compete in this content category effectively.

pewresearch.org

The TV series and shows of CBS, on the other hand, will experience a gradual decline in linear viewing. There is no reason to watch these live and there is a great supply of good quality alternatives. CBS titles, most loved by their audiences, such as NCIS or Young Sheldon, will move to streaming and will generate an increasing share of revenues from subscriptions. The scripted series of CBS will face additional competition in the streaming space and no doubt will lose some market share to streaming originals. CBS is the most popular broadcast network and its main strength is the lineup of popular scripted series. This content should do okay even on streaming platforms.

Overall, CBS is likely to decline, but it is definitely not about to collapse and it is not a value trap. The content will lose some market share as it transitions to DTC viewing but it is very likely to maintain a rather strong position.

Cable Networks:

Paramount’s major cable networks include Showtime, Paramount Network, Comedy Central, MTV and Nickelodeon. They have leading scales in their respective segments and produce good quality content, on the other hand, this type of content is increasingly being watched on-demand with new market entrants adding to the content supply.

On a positive note, cable as well as broadcast networks have a rather strong bargaining position against pay TV providers. Most cable TV providers sell data and video bundles and two services share much of the same infrastructure. If customers stop subscribing to video services, the operating costs of the cable operator change little. In theory, cable operators should accept gross video margins as low as 5% or 10% on networks which are essential to maintain cable video subscribers. Most cable TV companies still have video gross margin of above 30%.

If a network group has some essential assets and the loss of these could cause the subscriber to switch to a provider that does carry them, the network group will have a lot of bargaining power in negotiations. Cable and broadcast networks have been using their strong bargaining position to raise affiliate and re-trans rates they charge the cable operators. We expect the rates to continue rising and the video gross margins of cable operators to continue declining. The rate rises cannot continue in perpetuity though if the cable subscriber numbers keep declining rapidly.

|

Pay TV Operators or local TV stations |

2022 |

|

Comcast (cable) |

|

|

Video revenues |

21,314 |

|

Programming |

13,884 |

|

Gross margin |

34.9% |

|

Charter (cable) |

|

|

Video revenues |

17,460 |

|

Programming |

11600 |

|

Gross margin |

33.6% |

|

Nextar (local TV) |

|

|

Revenues |

5221 |

|

Operating expenses |

2000 |

|

Gross margin |

61.7% |

Financial statements

Cable networks of Paramount, do make a well-rounded family entertainment package. Some of the content of these networks will make a great addition to portfolios of streaming services. There is a future for the cable networks business but it’s not in linear distribution. Licensing revenues, including inter-group, will be resilient but affiliate fees are likely to start declining. Having said it, rate increases will mitigate the effects of a declining subscriber base for some time.

Overall, the linear viewership of TV Media content will continue declining, especially in the scripted segment. On the other hand, the decline will be gradual and Paramount will maintain a strong revenue base from the linear business and will be able to fund the production of high-budget shows which will also make their way to the streaming platforms of Paramount. Many streaming subscribers will discover shows previously aired on linear networks for the first time as linear viewership declines.

Cost cutting at TV Media

The affiliate and advertising revenues from linear distribution channels will start declining sooner or later as non-primetime viewership in broadcast networks is declining and cable networks cannot continue hyping affiliate fees at rates of subscriber losses in perpetuity.

Effective cost cutting will essentially make or break this company as declining revenues paired with a stubborn cost base could destroy TV Media’s profit margins in a few years and would then bring the Group leverage situation into focus. As we have pointed out there should not be a steep and sudden fall in revenues, but a gradual decline is likely and Paramount is preparing for it.

|

TV Media, cost structure (our estimates) |

FY2022 |

|

Revenues |

21,732 |

|

Programming costs |

9,500 |

|

Distribution and other |

2,185 |

|

Overall operating |

11,685 |

|

SGA |

4,596 |

|

Viacom Media Networks 2018 |

2,400 |

|

CBS 2018 |

2,217 |

|

Total Costs |

16,281 |

|

OIBDA |

5,451 |

|

Margin, % |

25% |

Financial statements and our estimates

CFO of Paramount, Naveen Chopra has provided some comments on the direction of future cost-cutting. Programming and SG&A costs of linear networks will be the main cost-cutting lines.

From q1 2023 earnings announcement call:

But with respect to the cost base, …, there are numerous levers that we continue to exercise. That includes a variety of opportunities on programming, things like continuing to evolve the mix of genres, transitioning some of our programming to lower-cost formats. Moving more production offshore where factor costs are significantly lower.… So lots to do on the programming side.

Beyond programming. We’re taking a highly disciplined approach to headcount and continuing to find efficiencies there and also evolving marketing budgets where it makes sense and where we can do so efficiently.

7 years ago, at the time, on the cable network side, we had probably five fully built-out groups organisationally programming each set of networks. Fast forward to today, through consolidation, call it, economics, we now have one kind of master cable networks group here in the U.S…. and we’re in the middle of effectuating the latest step on that, which is the SHOWTIME consolidation into effectively the U.S. cable group.

Assuming a 5% revenue decline, the business would have to take out $800 million of cost out per annum to maintain the profit margin, this will not be easy in our opinion. We expect the profit margins of the TV Media business to decline over time. Paramount has been proactive with it cost-cutting initiatives and therefore we expect a gradual margin decline.

Increasing value of the good content

The increasing popularity of on-demand streaming is enabling linear TV networks to monetise their content back catalogue. It also increases the share of the industry value that content producers with their own distribution platforms earn as pay-TV operators get cut out. The popular, high quality and differentiated content will now earn more.

The value of back catalogues of TV Networks is increasing as these can now be placed on streaming services and contribute to subscription fees or generate additional advertising fees for FAST services such as Pluto TV. After initial airing, most shows would be discarded even if they have not been watched by millions. DTC enables extracting more value out of this content by making it possible for more people to see the shows at a time convenient for them. If content is now being seen by more people, the value of that content goes up.

Direct distribution also increases the share of the industry value that content producers with their own streaming platforms can take. Previously Paramount would package their content into broadcast and cable networks and sell them to cable companies at wholesale rates. By selling content directly to consumers Paramount would earn retail rates and thus keep 100% of the value. The same content will now earn significantly more.

Not all content will make a successful transition to streaming platforms but the titles that do will increase in value considerably. The rather generously priced, $8.5 billion acquisition of MGM Studios by Amazon Prime Video, probably reflects this expectation. The financial statements of Paramount do not reflect this value increase as of yet as the streaming business is still scaling with associated upfront costs.

To really maximise the value of the content retained for its platform, Paramount does need to scale its platform as much as possible and that is what it has been doing. Until the scale is reached they are likely to continue to license some of the Linear TV content to third parties to maximise the content reach and value. Ideally, they would have a large reach through in-house platforms. Combination with another streaming platform could also be an option.

Overall, digital transformation is eroding linear content distribution but increasing the value of content that can be delivered directly to consumers via streaming platforms. The increased value will only show in financial statements once the streaming industry reaches a point of relative maturity. Content licensing or rights sales to third parties would be a faster and easier way to realise some of the value increase, but they can always do it if all else fails.

Valuation

The revenues of Paramount Group have been on the rise due to the growth of Direct-To-Consumer revenues, but the profit margins have been reduced due to upfront costs to scale the growing business. We expect the group margins to recover once streaming reaches maturity and revenues catch up with content and marketing expenditures. We expect streaming to continue growing domestically and internationally.

Paramount Group as well as its predecessors have been able to generate EBIT margins of about 20% over the last decade, we will assume that going further their profitability will fall to 10%. With a 30 billion revenue base, we would get an adjusted EBIT of 3 billion, after debt service of c1 billion and taxes, earnings would approximate $1.6 billion. Since the business is likely to grow as streaming gains could compensate for TV Media decline, we would apply a conservative 10X earnings multiple on that. Overall, we see the value of the equity of Paramount Group at about 16 billion, conservatively estimated. The current market cap is about $8 billion.

Conclusions

Paramount is one of the largest content producers in the market and is likely to maintain a strong position even as content is increasingly being watched over streaming platforms. Paramount produces high-budget and popular content that will be appealing to viewers across distribution platforms. Streaming growth has both negative and positive effects on the business but the current valuation seems to only consider the negatives. Even if we assume a considerable reduction in profit margins, Paramount still seems attractively priced.

Risks

- TV Media non-content related costs will have to be restructured on an ongoing basis. Cost cutting will have to be quite rapid if affiliate and advertising revenues start declining at an accelerated pace.

- Paramount needs to scale DTC effectively to offset the potential decline in linear revenues and maintain a leading content budget. DTC is already generating a run rate of $7 billion, whereas linear is delivering $22 billion.

- The lack of blockbuster originals on streaming platforms could make it difficult to gain a significant foothold in the direct-to-consumer distribution channel, resulting in content market share losses as linear business declines.

- Large tech groups such as Amazon or Apple could be willing to sustain significant losses on their DTC platforms for an extended period of time. This could disrupt the industry and pressure the balance sheet of Paramount.

- A sudden decline in revenues and profits of the TV Media division could put pressure on debt covenants and force Paramount to dispose of strategic assets which could impair their ability to compete effectively.

Read the full article here