Oregon’s pension and retirement system reduced positions in some of its largest holdings, including makers of chips and autos.

Oregon Public Employees Retirement Fund sold about a fifth of its investment in chip maker

Nvidia

(ticker: NVDA), and chopped about a quarter from stakes in chip maker

Intel

(INTC), and auto makers

Ford Motor

(F) and

General Motors

(GM) in the third quarter. OPERF, as the pension is known, disclosed the stock trades, among others, in a form it filed with the Securities and Exchange Commission.

OPERF declined to comment on the investment changes. Overall, the pension reduced its U.S.-traded investments to $7.3 billion at Sept. 30 from $8.4 billion at June 30. Total assets stood at $95.9 billion at the end of 2022, and it is the 16th-largest public pension in the U.S. by assets.

The pension sold 92,207 Nvidia shares to end the third quarter with 392,422 shares. Nvidia stock tripled in the first nine months of 2023, more than making up for a 50% plunge in 2022. So far in the fourth quarter shares are up 3.4%. For comparison, the

S&P 500 index

rose 12% in the first nine months of 2023, after a 19% drop in 2022. So far in the fourth quarter, the index is up 1.6%.

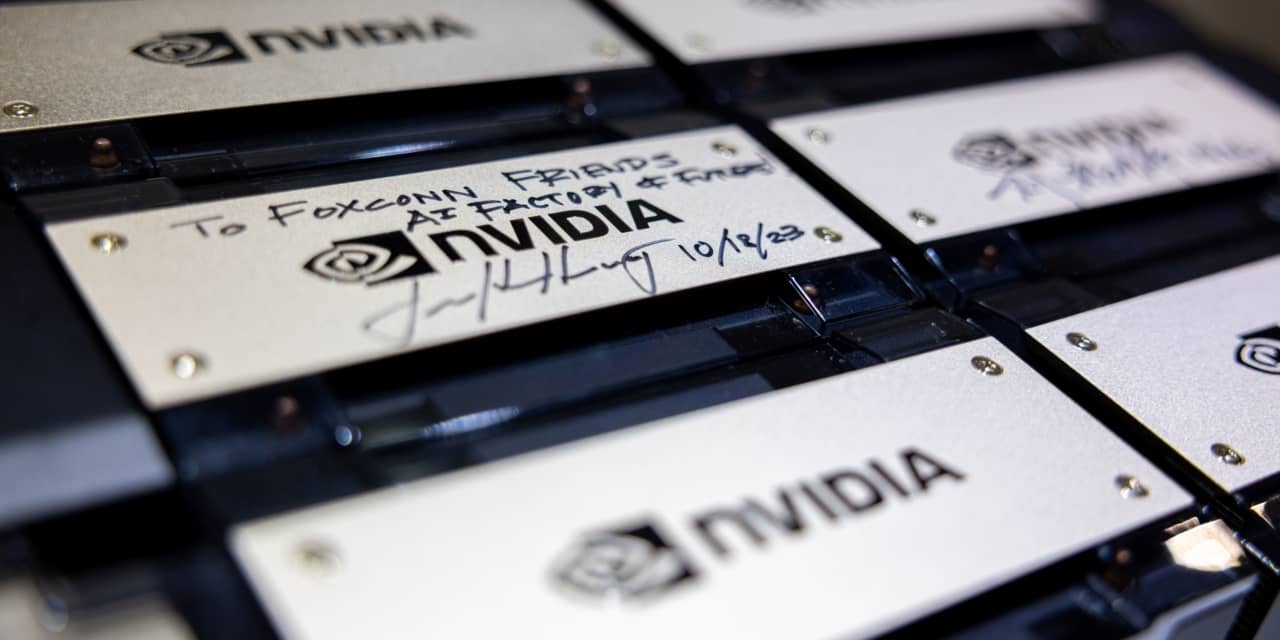

Nvidia earnings have been strong this year, and analysts have been as enthusiastic for the shares as investors. The popularity of generative artificial intelligence has lifted demand for Nvidia chips. The company will report fiscal-third-quarter earnings on Nov. 21, and challenges related to China could be in the spotlight.

Intel CEO Pat Gelsinger told Barron’s in late October that his company must remain engaged with China in the face of tensions between the country and the U.S. Gelsinger himself has been buying up Intel stock this year. Earnings have been strong, even if Intel stock hasn’t gained as much as Nvidia’s this year.

Intel stock rose 35% in the first nine months of 2023, following a 49% drop in 2022. So far in the fourth quarter, shares are up 7.3%. OPERF sold 574,828 Intel shares to end the third quarter with 1.8 million shares.

Ford stock gained 6.8% in the first nine months of 2023, after a 44% drop in 2022. Shares are down 15% so far in the fourth quarter.

Ford shares have been hammered by a United Auto Workers strike, which has come to an end. Third-quarter earnings missed expectations, and the electric-vehicles business continued to lose money, but Ford has been topping GM in deliveries of EVs.

The pension sold 622,672 Ford shares in the third quarter to lower its investment to 1.9 million shares.

OPERF sold 276,674 GM shares to end the third quarter with 792,874 shares. GM stock slipped 2% in the first nine months of 2023, after a 43% drop in 2022. So far in the fourth quarter, shares are down 9.7%.

GM stock hasn’t performed well under the tenure of CEO

Mary Barra,

and we called them a “value trap” in October. GM was the last of the Detroit Three to settle with the UAW, but like its peers, the company’s shares were upgraded in the aftermath.

Inside Scoop is a regular Barron’s feature covering stock transactions by corporate executives and board members—so-called insiders—as well as large shareholders, politicians, and other prominent figures. Due to their insider status, these investors are required to disclose stock trades with the Securities and Exchange Commission or other regulatory groups.

Write to Ed Lin at [email protected] and follow @BarronsEdLin.

Read the full article here