As we were heading to Nu Holdings’ (NYSE:NU) Q2 earnings, I wrote an article expecting it to miss on analysts’ estimates and drop since I believed it was overvalued. While the Brazilian neo-bank beat expectations to my surprise, I still believe its shares are still trading at a high premium based on a number of valuation metrics ahead of its Q3 earnings on November 14. Moreover, I expect the digital bank to miss analysts’ estimates for revenue and EPS in Q3, based on my model.

A factor that could lead to such an outcome is that Nu already has half of Brazil’s adult population as customers which should impact its customer growth rates unless it achieves the same penetration rate in Colombia and Mexico. That said, the company hasn’t shown that it’s able to achieve that yet since it only has 700 thousand customers in Colombia after 3 years of operating in that market while boasting just more than 4 million customers in Mexico after 4 years there. For these reasons, I’m reiterating my sell rating on Nu with a price target of $3.58.

Q3 Forecast

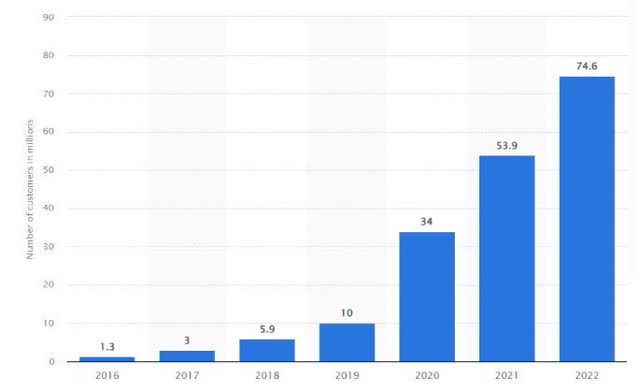

One of Nu’s attraction points is how it keeps growing its customers at a rapid pace. This allowed the neo-bank to reach 85 million customers last July according to its Q2 earnings presentation, making it the fourth-largest financial institution in Brazil. Given that the bank’s customers increased from 83.7 million in June, a 1.3 million increase, we can assume that Nu’s customers will grow by around 4 million in Q3 if its customers continued growing at the same pace in August and September. This means that its projected customer count is 87.7 million which is in line with the fintech’s recent announcement of reaching 90 million customers in late October – 85 million of which are Brazilian customers.

Although reaching such a milestone is a testament to the success of Nu in the Brazilian market, it shows how close the neo-bank’s customer growth is to stagnating. In fact, Nu’s double-digit YoY customer growth could come to an end by next year as its Brazilian operations are approaching maturity. With 85 million Brazilian customers, Nu is on track to end the year with nearly 87.1 million customers. This would represent a 16.73% YoY increase from 74.6 million at the end of 2022.

Statista

Therefore, for the company to maintain its rapid customer growth rate, it has to achieve similar penetration in both Mexico and Colombia, which it appears to be far from achieving. Nu launched its services in Mexico in 2019 and in 2020 in Colombia. However, its penetration rate is a measly 4.8% and 1.83% of the adult population in both markets, respectively. While Nu had somewhat similar rates in its early years in the Brazilian market, Mexican banks have taken note of its success and are reacting faster than Brazilian banks.

For example, the second largest bank in Mexico in terms of assets – Banorte – has a strategy for digital banking through its own mobile app, an independent digital bank, and a JV with e-commerce startup – Rappi. Another example is credit card startup – Stori – which reached 2 million customers earlier this year. This shows that Nu faces much tougher competition in its secondary markets which could see the digital bank’s customer acquisition costs increase in the coming quarters in order to attract more customers in Mexico and Colombia.

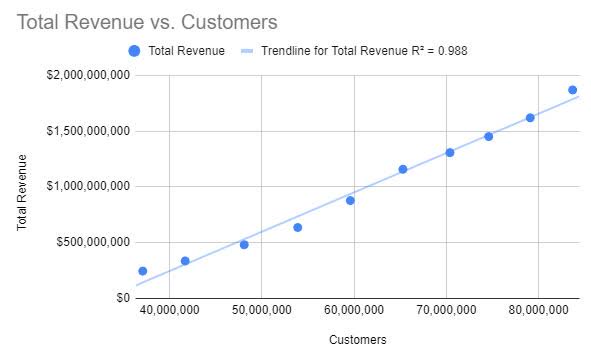

Taking the projected Q3 customers figure into account, we can easily forecast Nu’s Q3 revenues as there is a strong linear correlation between the number of its customers and revenue represented by an R² of 0.988. In simple terms, this R² value represents a strong relationship as the lowest possible value of R² is 0 and the highest possible value is 1. As such, linear regression is a suitable method to forecast Nu’s Q3 revenues.

That said, results may vary from the regression line since the economic situation has been improving in Brazil in the past months as interest rates dropped from 13.75% in July to 12.75% in September. Another factor that could lead results to vary from the regression line is that Nu has been growing its average revenue per active customer (ARPAC) over the past quarters and reached more than $9 in Q2 for the first time in the company’s history.

Having said that, it should be noted that Nu is mainly focused on attracting customers with limited access to the banking sector who usually belong to low income cohorts. The fintech does so by attaching much lower fees to its products than those seen at traditional banks in Brazil. However, that might change due to the macro environment in Latin America – namely Brazil and Mexico – where Nu mainly operates.

While both economies have been outperforming expectations throughout this year, BMI Research expects an economic slowdown in Mexico in 2024 due to political uncertainty ahead of the presidential election and an anticipated slowdown in the US. The same research also expects a slowdown in Brazil in the second half of the year and 2024 as its economic growth in the first half of 2023 was mainly driven by a more successful than expected harvest. In addition, since interest rates are high in Brazil despite the recent cuts, they are expected to have a lagging effect on the economy. As such, consumer demand could be weak in both countries which would impact Nu’s ARPAC growth in the process.

Information from Company Filings

According to the model, I’m estimating Nu’s revenues to be around $1.92 billion, less than analysts’ estimate of $2.03 billion by 5%.

Through the revenue projection, we can estimate Nu’s cost of revenue to be around $1.13 billion since the digital bank had an average gross margin of 41.03% in the first half of the year, which is in line with management’s target of improving gross margins from last year. As a result of these estimates, I’m projecting the company’s gross profit to be $790.4 million in Q3.

|

Revenue |

$1,926,475,506 |

|

CoR |

$1,136,055,168 |

|

Gross Profit |

$790,420,338 |

In terms of its operating costs, Nu has been reducing its costs as a percentage of revenue in an impressive manner over the past year. First, customer and support operations costs have averaged 6.78% of revenue since Q1 2022. As such, I’m using this percentage to estimate the Q3 customer and support operations costs to be around $130.5 million.

|

Quarter |

Customer & Support Operations |

% of Revenue |

|

Q1 22 |

$61,571,000 |

7.02% |

|

Q2 22 |

$77,703,000 |

6.71% |

|

Q3 22 |

$90,249,000 |

6.91% |

|

Q4 22 |

$105,840,000 |

7.30% |

|

Q1 23 |

$107,815,000 |

6.66% |

|

Q2 23 |

$113,309,000 |

6.06% |

|

Q3 23 |

$130,544,268 |

6.78% |

The next expense is G&A, which has averaged around 14.18% of revenues in the first half of the year. This is down from 22.5% in 2022 as a result of Nu’s efforts to operate more efficiently. As the company’s measures have shown their impact in Q1 and Q2, I’m using the average percentage of revenue to estimate Q3’s G&A cost, which would amount to $273.1 million.

|

Quarter |

G&A |

% of Revenue |

|

Q1 22 |

$245,108,000 |

27.94% |

|

Q2 22 |

$229,505,000 |

19.83% |

|

Q3 22 |

$261,778,000 |

20.03% |

|

*Q4 22 |

$241,303,000 |

16.64% |

|

Q1 23 |

$236,881,000 |

14.63% |

|

Q2 23 |

$256,408,000 |

13.72% |

|

Q3 23 |

$273,135,339 |

14.18% |

*Q4 22 G&A cost excludes a one-time $355.5 million contingent share award termination charge.

The same also applies to marketing expenses as they represented 1.5% of revenue in the first half of the year on average. I’m using the average of those 2 quarters only since the 2022 marketing expenses were inflated by the investments the neo-bank made during the World Cup, which management doesn’t expect to see this year. As such, we can project Nu’s marketing expenses in Q3 to be $28.9 million, representing a QoQ decline from $33.9 million. This is in line with management’s expectations in the Q2 earnings call of marketing expenses dropping due to lower customer acquisition costs in Mexico due to the launch of new products.

|

Quarter |

Marketing Expenses |

% of Revenue |

|

Q1 22 |

$27,608,000 |

3.15% |

|

Q2 22 |

$36,208,000 |

3.13% |

|

Q3 22 |

$38,103,000 |

2.92% |

|

Q4 22 |

$51,078,000 |

3.52% |

|

Q1 23 |

$19,272,000 |

1.19% |

|

Q2 23 |

$33,923,000 |

1.82% |

|

Q3 23 |

$28,954,867 |

1.50% |

We can also use the same method to forecast Nu’s other expenses as they averaged 3.03% of revenue over the past 6 quarters. In this way, the forecasted other expenses would be $58.4 million. This means that the estimated total operating costs is $491 million which leads to a projected operating income of $299.3 million.

|

Quarter |

Other Income/Expenses |

% of Revenue |

|

Q1 22 |

$27,458,000 |

3.13% |

|

Q2 22 |

$44,729,000 |

3.86% |

|

Q3 22 |

$31,792,000 |

2.43% |

|

Q4 22 |

$46,285,000 |

3.19% |

|

Q1 23 |

$43,285,000 |

2.67% |

|

Q2 23 |

$54,366,000 |

2.91% |

|

Q3 23 |

$58,439,959 |

3.03% |

|

Revenue |

$1,926,475,506 |

|

CoR |

$1,136,055,168 |

|

Gross Profit |

$790,420,338 |

|

Customer & Support Operations |

$130,544,268 |

|

G&A |

$273,135,339 |

|

Marketing Expenses |

$28,954,867 |

|

Other Income |

$58,439,959 |

|

Total Operating Costs |

$491,074,432 |

|

Operating Income |

$299,345,906 |

This leaves income tax to forecast before reaching an estimated EPS. Considering that income taxes averaged 36.2% of total revenue in Q1 and Q2, we can use this figure to project Q3’s income tax to around $108.3 million. By adding all the projections, we can project Nu’s Q3 net income to around $190.9 million or an EPS of $.04 at the last reported outstanding share count of 4.7 billion. This would be less than analysts’ EPS estimate of $0.062 by 35.5%.

|

Revenue |

$1,926,475,506 |

|

CoR |

$1,136,055,168 |

|

Gross Profit |

$790,420,338 |

|

Customer & Support Operations |

$130,544,268 |

|

G&A |

$273,135,339 |

|

Marketing Expenses |

$28,954,867 |

|

Other Income |

$58,439,959 |

|

Total Operating Costs |

$491,074,432 |

|

Operating Income |

$299,345,906 |

|

Income Tax |

$108,376,460 |

|

Net Profit |

$190,969,446 |

|

OS |

4,730,272,000 |

|

EPS |

$0.04 |

Rising Delinquencies Could be a Sign of Trouble

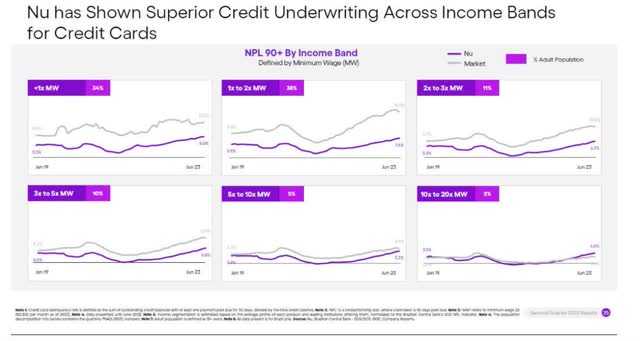

Despite Nu’s 15-90 non-performing loans (NPL) declining QoQ from 4.4% to 4.3%, 90+ NPL increased sequentially from 5.5% to 5.9%, a trend that started in Q4 2021 where 90+ NPL increased from 3.1% to the current 5.9%.

NU Holdings Earnings Presentation

Moreover, the percentage of Nu’s 90+ NPLs among those with an income of 10-20x minimum wage is at 4.6% which is higher than the market average of 3.5%. At the same time, 90+ NPL among those with an income 5-10x minimum wage is approaching the market average at 5.2% vs 5.9%. While this increase in 90+ NPLs is in line with management’s expectation, it could be a sign that NPLs among lower-income cohorts could increase in the coming quarters due to the economic situation in Brazil.

NU Holdings Q2 Earnings Presentation

With that in mind, the percentage of people with debts overdue and those saying they won’t be able to pay off their debts is increasing in Brazil, according to a survey by the National Confederation of Trade in Goods, Services, and Tourism. As is, the percentage of defaulters increased to 30% in August, equaling the result of December 2022. Moreover, 12.7% say they won’t be able to pay their overdue bills which is the highest level since January 2010. Given that this situation mainly impacts those with incomes of up to 3x minimum wage, Nu’s days of outperforming the market in terms of loans may be coming to an end.

Valuation

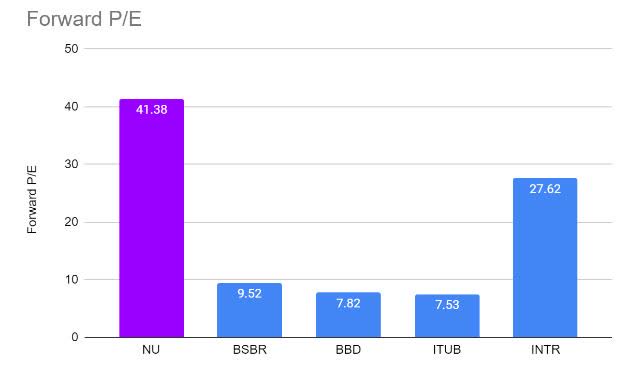

When it comes to valuation, I still believe Nu is substantially overvalued at current levels. At its current valuation, the neo-bank is trading at 41.38 forward P/E which is an extremely high valuation. Compared to other Brazilian banks, Nu has the highest P/E ratio as shown in the graph below.

Companies’ Share Prices

While some may argue that Nu deserves to be trading at such a premium due to its growth prospects, it is facing a serious risk of customer growth stagnating in the coming quarters. This is mainly due to almost half of Brazil’s adult population already being Nu customers which means that its addressable population is declining. In order to combat that, Nu has to show that it can penetrate the Mexican and Colombian markets at the same penetration rate as the Brazilian market or it might be risking stagnating or decelerating customer growth.

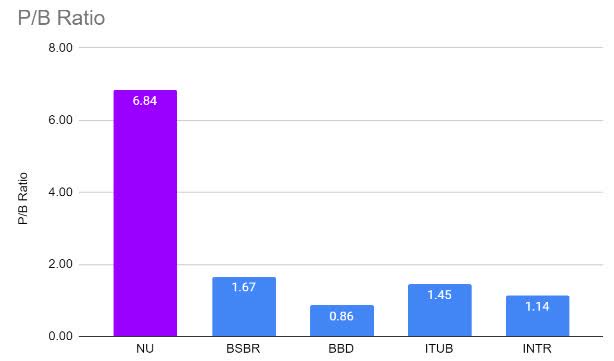

Meanwhile, Nu also appears to be overvalued when looking at its P/B ratio. The reason I’m using this ratio is that it’s suitable for banks as it paints a picture of a bank’s financial strength and the quality of its assets.

That said, Nu’s book value is $5.6 billion which amounts to a P/B ratio of 6.84. This is extremely high, in my opinion, as banks usually have a P/B ratio of less than 1 given the credit risks they face. While most of the other Brazilian banks I’m using to compare Nu with have a ratio of above 1, the company is still trading at much higher valuations than its competitors.

Analyst’s Calculations

Companies’ Filings

Given that the average P/B ratio of Brazilian banks is 1.28, Nu should be trading at $1.53 based on its book value per share of $1.19. However, I believe it should be trading near a 3 P/B ratio in order not to discount its growth potential, which is why I have a price target of $3.58 on Nu.

Upside Risks

The main risk to my thesis is the economic situation in Brazil. While delinquency rates are increasing, the Brazilian Central Bank has cut interest rates aggressively from 13.75% last July to 12.75% in September to stimulate consumer spending. As such, demand for Nu’s products may increase which would have a positive impact on its customer growth and revenues in turn given the correlation between them.

Another risk to my thesis is if Nu is able to acquire customers at a faster pace in Mexico and Colombia since they should be a key driver for customer growth as the company is nearing maturity in the Brazilian market. This could be achieved soon as the neo-bank has applied for a banking license in Mexico to provide its customers with a wider range of products including investments, payroll portability, and higher deposit limits. All of these features could have a positive impact on its customer growth in Mexico if it’s able to differentiate itself from the heated competition in the Mexican fintech space.

Conclusion

While Nu has been delivering impressive growth in several key metrics, it is trading at a huge premium while facing the risk of its customer growth stagnating or decelerating in the coming quarters. Furthermore, the digital bank’s 90+ NPL has been constantly rising over the past 7 quarters and I expect this trend to continue in Q3 given that the percentage of defaulters in Brazil increased to 30% in August.

From a fundamental standpoint, Nu is trading at a substantially high premium based on its P/E ratio and P/B ratio which are more than other Brazilian banks. That said, I believe the current share price is a good level to start a short position in the stock as the reason it is trading at such a high premium is investors’ enthusiasm about its upcoming Q3 earnings which I expect it to miss analysts’ revenue and EPS estimates. As is, I have a price target of $3.58 on Nu which would be a fair valuation for the digital bank since it takes its growth potential into account in my opinion.

Read the full article here