I typically completely avoid the antibiotics subsector in biopharma as it, in general, is a black hole for investment monies. However, Acurx (NASDAQ:ACXP) is one antibiotic company that, in my opinion, breaks the mold and will likely succeed greatly in the antibiotics space where most others have failed. Furthermore, I believe ACXP shares are undervalued and the company could soon be acquired in the near future. In this article, I’ll explain why. But first, one must understand why the antibiotics space has been a poor space for investment in recent history.

Antibiotic Development is a Biotech Wasteland

There are inherent risks in biotech investing. A decade’s worth and often hundreds of millions of dollars in R&D, along with binary risks of failed clinical trials or regulatory approval. Above and beyond the perils of investing in drugs or therapies, antibiotic companies, fortunate enough to receive FDA approval for their new antibiotics, struggle to commercialize their therapies. It’s not that these therapies aren’t valuable. They save lives. But in many cases, hospitals and prescribers will use new antibiotics, those not subject to antibiotic resistance, as a last resort (or at least sparingly), all in an effort to reduce the use of these new antibiotics to slow and prevent the uprising of strains resistant to the new antibiotics. To add insult to injury these antibiotics are usually only used for two weeks, and there are reimbursement issues:

Government reimbursement programs and private insurers reimburse hospitals for antibiotics as a bundle rather than separately. The less a hospital pays for the components of the bundle, the more likely it is to cover its costs or be profitable.

The result of this is that there is a wasteland of commercial state antibiotic companies that have failed to return capital to investors, including several bankruptcies and a few acquisitions at depressed prices. Companies with rosy projections that failed to commercialize successfully include Aradigm, Achaogen (which was Gates-backed, but still filed for bankruptcy), Melinta Therapeutics (and Cempra which it merged with, filed for bankruptcy), Tetraphase which was acquired for less than $50 million upfront and for less than their total BARDA contract value of $67 million. Paratek is one notable standout which was generating over $100m in revenues by the time it was acquired. The deal included CVRs and was therefore worth up to $462 million, but when looking at the long-term stock chart, virtually no long-term holders could have made a return.

These are just a few examples of how unsuccessful antibiotics have been in the past decade. However, these stories come after a big antibiotic buyout when Merck (MRK) acquired Cubist Pharmaceuticals for $8.4 billion ($9.5 billion including their debt), though Cubist’s antibiotic, Zerbaxa, has been a disappointment commercially as it only offers modest efficacy improvements over levofloxacin, and it lost patent protection in court for Cubicin, which was generating $700 million in 9-month sales at the time. So in the antibiotics financial world, there used to be bigger numbers.

These difficulties in the antibiotics space are much less likely to affect Acurx.

Acurx Overview

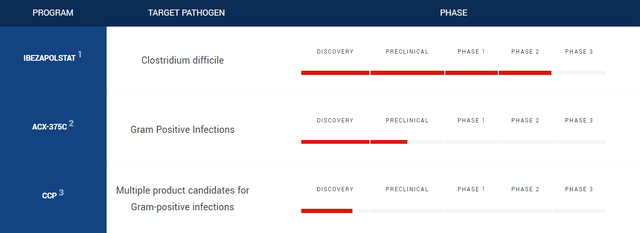

Acurx, which IPOed in mid-2021, started the development of its lead antibiotic, ibezapolstat, in 2018 when the company took control of the drug from retired professors from the University of Massachusetts, who continued to help work on the drug. The academics moved the asset forward through drug discovery to preclinical, with the help of NIH grants, and as Big Pharma wanted phase 2 data before dropping significant cash on the assets, CEO David Luci and his colleagues were brought into the picture with Acurx. The company is testing ibezapolstat in a phase 2 trial for C. difficile infection. Since then, they’ve spawned a second antibiotic candidate for MRSA infections. We won’t dive into that in this article.

Acurx Pipeline (Acurx Website)

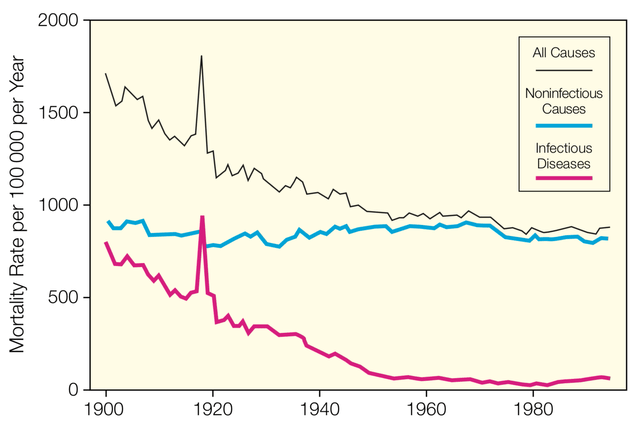

The company is developing what could be the first new class of antibiotics developed in decades. Antibiotics are to thank for the rapid decrease in mortality rate per person-year over the past century, but now most of us take them for granted.

Antibiotics History and Overview

Drop in Mortality Rate over Decades Attributable to Antibiotics (Roots of Progress)

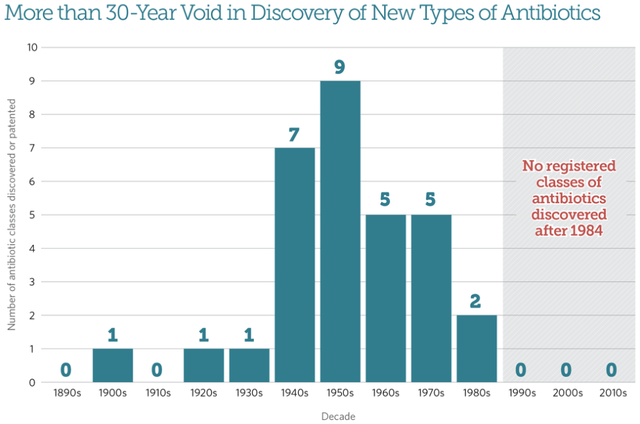

The mid-20th century marked the golden age of antibiotic development. Many of these new antibiotic compounds were isolated or derived from actinomycetes (bacteria found in soil). Since then this source has largely been exhausted, and sources for deriving antibiotics have become more difficult to find. This is especially true for Gram-negative bacteria, which have a membrane that is harder to penetrate as well as efflux pumps, which limits targeting by antibiotics and makes development more difficult. Since the 1980s, progress in antibiotic research has slowed.

Void in Antibiotics Discovery (Pew Charitable Trusts)

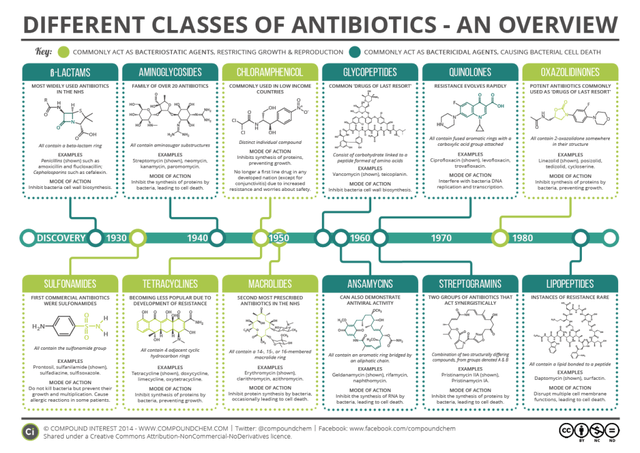

With a unique mechanism of action and chemical structure, Acurx’s lead antibacterial drug candidate, ibezapolstat (a Gram-positive selective-spectrum polymerase IIIC inhibitor, a DNA synthesis inhibitor active in low G+C Gram+ cells), has the potential to be one of the first new classes of antibiotic approved in decades. Although one could consider bedaquiline (a diarylquinoline approved in 2012 for multi-drug resistant tuberculosis) a new class, it isn’t as exciting as there are safety concerns and a very limited market opportunity. Antibiotics can be categorized by biological target or chemical structure. Targets include cell wall synthesis inhibitors, protein synthesis inhibitors, DNA/RNA synthesis inhibitors, membrane integrity disruptors, and metabolic pathway inhibitors. The structural classes are shown in the graphic below.

Classes of Antibiotics (Compound Chem)

Antibiotic Novelty

The issue with a lack of new antibiotics classes since the 1980s is that bacterial resistance to one antibiotic often leads to resistance to multiple antibiotics within the same class, since these antibiotics have similar chemical structures within each class. Because of this, a new class of antibiotics (new target, new structure) that has the potential to be much more useful in the clinic is what is needed:

That lack of innovation in the antibiotic pipeline is highlighted in another report released last week by the Boston Consulting Group (BCG), in partnership with the Wellcome Trust, the World Economic Forum, and the Novo Nordisk Foundation. The report argues that while many of the new antibiotics approved in recent years have proved useful, their mechanisms of action and chemical scaffolds aren’t all that different from previously approved antibiotics. What’s needed is more truly novel drug candidates.

Acurx’s ibezapolstat stands out from many antibiotics in development and those that are recently approved as a truly novel antibiotic.

Ibezapolstat Geared for Success: Clinical Efficacy

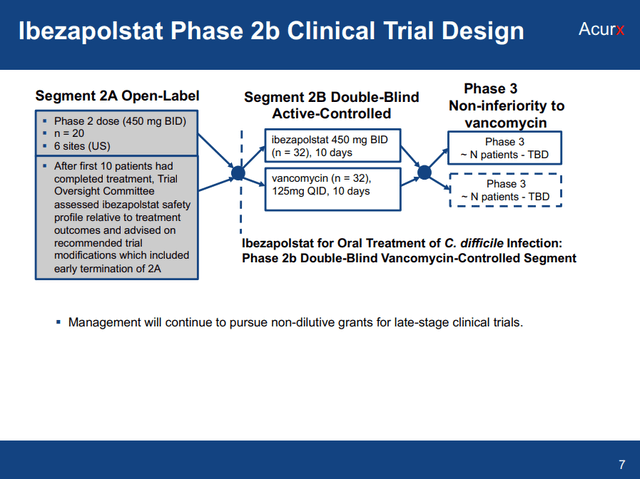

Along with being a very novel compound, there are a few other reasons why ibezapolstat is set to be a success and not necessarily just another “me too” antibiotic failure. Those reasons lie in the details of the clinical data generated to date. In Azurx’s phase 2 trial, patients with mild to moderate CDI were treated with orally administered 450mg ibezapolstat for 10 days BID.

All (10/10) patients met the primary and secondary efficacy endpoints of initial and sustained cure, with eradication of C. difficile occurring in 3 days. There were no SAEs, though nuanced comparisons of nausea, headache, or vomiting rates can’t accurately be compared against vancomycin or other regimens since the sample size was small and no adverse effects stood out. Ibezapolstat was found to not trigger sporulation or toxin release, which helps explain the good safety profile.

These good results are somewhat expected. Invitro potency vs C. difficile suggests clinical exposure to the drug in the intestine was found to be 100x the concentration required to kill in vitro (>100-fold concentration above MIC50 in patient stool samples). Lastly, rather than having deleterious effects on the gut microbiome (like vancomycin, fidaxomicin), ibezapolstat restored the gut microbiome.

Ibezapolstat Phase 2b Clinical Trial Design (Acurx World Antimicrobial Resistance Congress Presentation 9.7.23)

Ibezapolstat Geared for Success: Effect on the Gut Microbiome

The second reason ibezapolstat is set to be a success is that it is very selective. Unlike vancomycin which is a broad-spectrum antibiotic that wrecks the gut microbiome, leaving patients susceptible to reinfection, ibezapolstat is a selective-spectrum antibiotic that basically only targets “bad” bacteria. In studies designed to assess microbial activity against various gut microbes, ibezapolstat was found to only target firmicutes, and in that category, only some of those firmicutes, including strong activity against C. diff. The compound was found to be ineffective against Lachnospiraceae and Lactobacillaceae, which are considered beneficial bacterial populations for the gut.

In addition, stool samples from Acurx’s phase 1 ibezapolstat study showed that in healthy subjects, Gammaproteobacteria increased with vancomycin ( associated with NAFLD and endogenous alcohol production), while most other taxa decreased. Ibezapolstat, on the other hand, increased Actinobacteria even in healthy subjects, including certain species of Bifidobacteriaceae, which is a well-known class of healthy gut bacteria that produces B vitamins, healthy fatty acids, and digest fiber. Lastly, observed favorable effects on bile acids are an additional indication of a restored, healthy gut microbiome.

Comparison to Existing First-Line Therapies and Market Opportunity

Anyone who knows a friend or family member who has dealt with C. diff knows how big of a deal a powerful and well-tolerated, selective antibiotic could be for C. diff infection. However, does this mean the drug can be commercially viable? Ibezapolstat compares to existing first-line therapies well.

Part of the reason other antibiotics fail commercially is that they don’t offer a perceived quality of life improvement over other antibiotics. Take Paratek’s omadacycline as an example, which generated about $140 million in 2022 sales, was FDA approved in 2018, and which is used to treat community-acquired bacterial pneumonia (CABP) and acute skin and skin structure infections (ABSSSI). Omadacycline only beat linezolid in ABSSSI (acute bacterial skin and skin structure infections) treatment by 5% (88% vs 83%) for early response and by 3% (84% vs 81%) investigator-assessed clinical response at post-treatment evaluation, while exhibiting substantially higher rates of adverse effects (vomiting). While the drug was approved for oral-only dosing and designed to avoid understood mechanisms of tetracycline resistance, much higher side effect rates reduce the quality of life aspect of this drug.

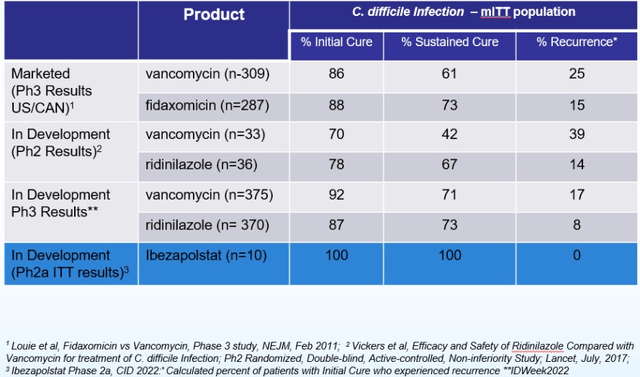

The C. diff landscape is different with vancomycin leaving about 25% of patients coming in for recurrent infection, and recurrent infections having a high likelihood of further recurrences. This is expensive to the healthcare system and devastating to the patient. Ibezapolstat appears to usher change to the treatment management landscape as it’s a novel chemical structure and class and it is likely to prevent recurrences, as well as increase the cure rate more substantially than any differences observed between fidaxomycin vs vancomycin, even though these two exhibit relatively high initial cure rates.

Ibezapolstat vs. C. Diff Antibiotics Competition (Acurx FY2022 10-K)

In Ibezapolstat’s recent Phase 2b readout, the drug cured all but one patient with C. diff, and pooling the results together gave a cure rate of 96%. Acurx’s stock reacted poorly (-30%) but this is likely due to the vancomycin cure rate in the phase 2b being 100% (14/14), which is inconsistent with published literature. The only concern would be that the trial enrolled patients that would be easy to cure and therefore vancomycin and ibezapolstat efficacies are actually similar, and the high cure rates observed were a function of only enrolling patients with mild infection. The company will be following up with sustained and extended clinical cure rates, which may show more of a difference between ibezapolstat and vancomycin.

Ibezapolstat use may also be buoyed by becoming a standard for first-line therapy, for its safety and efficacy already explained, but also because Acurx’s scientific advisory board (SAB) includes three writers of IDSA treatment guidelines, who previously knocked metronidazole off the guidelines a few years ago. Ibezapolstat could soon supplant vancomycin in C. diff treatment as these three are clearly familiar with the new compound.

As for the market opportunity, I tend to agree with Acurx’s assessment which is nicely outlined in their most recent 10-K.

Recent estimates suggest C. difficile approaches 500,000 infections annually in the U.S. and is associated with approximately 20,000 deaths. (Guh, 2020, New England Journal of Medicine). Based on internal estimates including a recurrence rate of between 20% and 40% among approximately 150,000 patients treated, we believe that the annual incidence in the U.S. approaches 600,000 infections and a mortality rate of approximately 9.3%. […] We estimate that, if approved with clinical data consistent with current data generated to date, ibezapolstat could capture over 40% of the CDI market in peak year sales based on the incidence rates noted above. At a preliminary price estimate of $3,000 to $3,500 per full course of treatment, this projects out to estimated peak year sales of over $1 billion per year in the U.S. alone. The peak market penetration of 40% assumes that there will be at least two treatment options available to treat CDI in addition to ibezapolstat even though only two antibiotics are currently recommended for the treatment of CDI and oral vancomycin has vulnerabilities with its 20%-40% reinfection rate and poor impact on patients’ microbiome. The selling price estimate of $3,000 to $3,500 is considered by management to be conservative as it is well below the price point of fidaxomicin, the most- recent approval in treating CDI which we believe is between $4,500 and $5,000 for a full course of treatment.

Ibezapolstat is QIDP designated and a new chemical entity (NCE) so the company will have 10 years of exclusivity minimum after FDA approval with Fast Track. CDI reinfection is estimated to cost billions of dollars in the U.S. alone so these management forecasts appear reasonable. I would only recommend caution with these estimates simply due to the commercial disappointments of the last few FDA-approved antibiotics.

Management

CEO David Luci comes from a corporate law background. He began his career with Ernst & Whinney LLP (now E&Y) as a CPA working in the Healthcare Practice Group. He later practiced corporate law at Paul Hastings LLP, focusing on healthcare M&A, private equity, etc. In 2002 he worked directly for his first biotech company when his law firm was sold. This company was sold to Genzyme (SNY) for $345 million. Every company he has worked for has been sold, regardless of whether the science worked out or not. Given his track record of leadership and experience in fairly large M&A transactions, there is a good chance Acurx will follow suit.

Total inside ownership is over 4 million shares or 35% per the latest proxy filing. With heavy insider ownership mainly from the CEO and Chairman, management is aligned with shareholders’ interests.

Competition

There isn’t really much competition in the C. difficile arena. Summit Therapeutics (SMMT) failed with ridinilazole in a phase 3 test for superiority, where they found the compound to perform roughly equal to vancomycin while roughly halving the recurrence rate. Pfizer (PFE) failed to prevent C. diff infection with their phase 3 vaccine candidate but did reduce infection severity. Crestone Pharma has a novel target, narrow spectrum antibiotic for C. diff in phase 2 trials but is apparently having difficulties with dosing. The competitive landscape looks fairly good for Acurx.

Financials

The company has a $7.2 million TTM cash from operations. A few million in stock-based compensation and changes in accounts payable distinguish this operational cash number from TTM net income of $13.2 million. The company currently has cash of $9.1 million on the books (end of June 2023) and estimates that that number is not enough to meet its operating requirements for the next 12 months (since the 10-Q statement). So the company might need extra money if it isn’t sold or if it doesn’t out-license any of its compounds for some upfront cash. One additional source of income (which could be occurring right now) is the exercise of Armistice Capital’s 2.67 million warrants which have an exercise price of $3.26. Armistice owns shares too so it is possible they sold a bunch of shares at a higher price already given there was a lot of volume the past two weeks. The proceeds from the sale could finance a buyback of their position through warrant conversion. I don’t know if this is occurring but if it doesn’t, Acurx will need an additional source of capital. If the company doesn’t deliver on the business development/M&A side, its cash burn will likely increase with the commencement of a phase 3 trial C. diff ibezapolstat trial.

Valuation

There aren’t really any great recent comps for valuation. While one can do a standard 10-year discounted cash flow model for an antibiotic, I’ll simply use a risk-adjusted multiples approach and be relatively conservative. Using peak sales of $600 million (conservative, instead of $1 billion) in 2035 (approval estimated in 2026), a 2x peak sales multiple (lower than other biotech multiples of perhaps 4-5x due to the antibiotics market), and a fairly normal clinical stage discount rate of 15% adjusted to the present, we arrive at a valuation of $224 million.

As of August 11, 2023, there were about 13 million shares outstanding with 6.9 million outstanding warrants at a $3.28 exercise price which are mainly from Armistice, and 3.0 million outstanding options at a $5.64 exercise price primarily from share-based compensation. Using this fully diluted share count of 22.9 million shares, we arrive at a share price of $9.81/share. Maxim and HC Wainwright have price targets of $10 and $13 which were reiterated early this November, so this is reasonable.

ACXP Stock Technicals (StockCharts.com)

I’m no charting expert but the recent pullback from ~$8.50 with the shares coming down to the lower Bollinger band and support around the 200 and 50 DMAs, where a potential golden cross (50 DMA surpassing 200 DMA) looks likely to occur appears bullish to me in the short term. Perhaps a reader can chime in and offer their opinion.

Risks

The antibiotics market is a risky area of the already risky biotech sector. Microcap companies that are not turning profits and therefore require money to make progress are particularly risky in this difficult market environment and particularly poor market for biotechnology companies. Companies can go bankrupt or investors can be severely diluted during further fundraising rounds, particularly if done at poor valuations which further amplifies the ballooning of outstanding and fully diluted share counts.

Acurx’s phase 2 trial had an odd readout with vancomycin having unprecedented success in curing C. diff. While this is likely a fluke, it could potentially have something to do with enrollment criteria. Chances are good that ibezapolstat does indeed work much better than vancomycin due to other measured effects like sustained clinical response and changes to the gut microbiome. However, it will require a phase 3 to unequivocally prove this and this very slight doubt will remain until put to rest.

Conclusion

Acurx has generated very good data in C. difficile treatment using a novelly mechanistic antibiotic in a new chemical class that can help patients restore their gut health in addition to curing infection. The management has significant experience with positive track records in dealmaking and M&A. The world needs new antibiotics if we are not to fall susceptible to bacterial infections as a leading source of mortality and morbidity. Furthermore, C. diff is not as competitive of a field as CABP or ABSSSI in my opinion, and it is a significant market opportunity of likely over $1 billion per annum where Merck’s fidaxomicin is going to go off-patent soon (2027). Perhaps they will be interested in an antibiotic that appears to be significantly better and they can continue to corner the C. diff market and sustain their sales force in this area. The shares appear undervalued based on my back-of-the-napkin math and analyst price targets. Besides the risks of the current market and difficulty raising money as well as the oddities in Acurx’s recent data with vancomycin performing better than ever before, all I can say is that after reviewing Acurx’s data and watching a very healthy family member struggle (for about two years!) to fully recover from C. diff after being prescribed gut-destroying broad-spectrum antibiotics, it think there is high value for the patient in ibezapolstat and will likely be buying ACXP shares in the next few days after watching where the shares settle. ACXP shares appear undervalued though there are some distinct risks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here