What do gold and Bitcoin have in common?

The market theme is starting to switch from relentlessly hawkish central banks combating inflation to pricing in a growing level of disenchantment in central bank policies and fiat currencies.

There are two big tells that lead me to my conclusion.

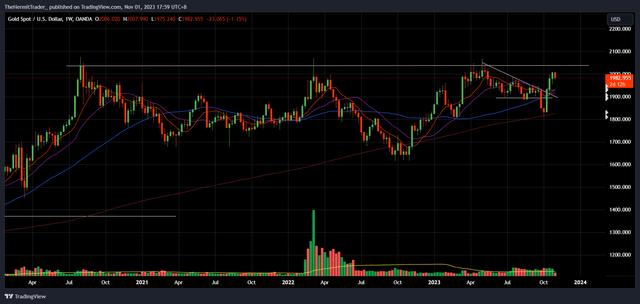

First, the price action in precious metals. Gold (GLD) should theoretically have been battered under the barrage of spiking bond yields and a strong USD.

Instead, we may observe that gold is building out a massive multi-month base spanning three years. Looking at recent momentum, I believe it is very probable that gold finally breaks the $2,050 resistance in the coming weeks. If so, this will likely pave the way for a fresh, strong uptrend.

Weekly Chart: Gold

TradingView

Gold has already achieved new highs against a host of major currencies, and I think it will eventually succeed in doing so against the USD.

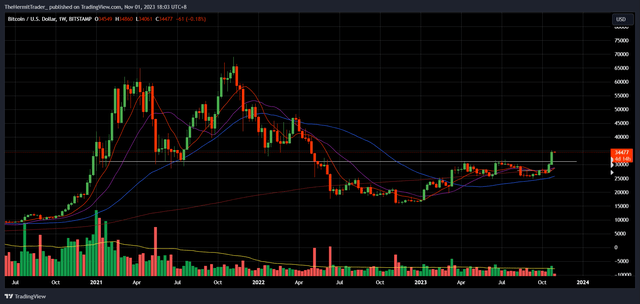

Second, Bitcoin (BTC-USD) had a very strong October, breaking out of a 1 year base. This strength is not confined to Bitcoin; altcoins such as Solana are also seeing strong rallies of late.

Weekly Chart: Bitcoin

TradingView

Why these two pieces of market price action are key to my thesis is because gold and Bitcoin should theoretically be battered by rising bond yields and a strong USD.

For more context, risk sentiment generally has been poor, as seen from the equity markets (SPY) (QQQ). Yet, high-beta cryptocurrencies have managed to buck this trend.

The commonality between gold and Bitcoin is their status as a hedge against misguided central banks and fiat currency weakness.

Bank of Japan example this week

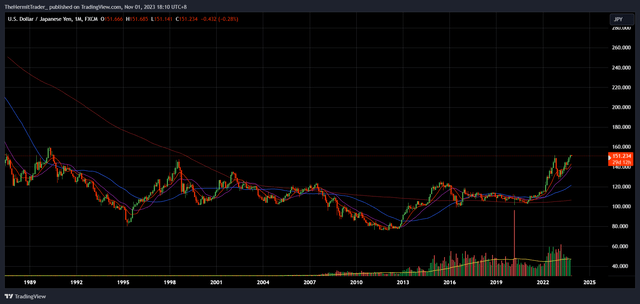

We already saw that this at the end of October when the Japanese Yen sold off aggressively and Japan bond yields spiked after yet another dovish Bank of Japan meeting.

The Bank of Japan has been too printer-friendly in the past, and has been experimenting with quantitative easing since 1991. Even during today’s backdrop of rising inflation, the central bank has only been willing to allow the 10 year yield to rise to 1%.

This is far behind the curve, compared to 4.5% on the US 10 year yield for example. The widening interest rate differential between Japan and other developed countries have led to sharp depreciation in the Yen over the years, eroding the purchasing power of Japanese civilians.

From the monthly chart of USD/JPY below, we can see that the USD has appreciated twice in value against the JPY since 2011. In other words, the Yen has halved in value against the USD in the last decade.

Monthly Chart: USD/JPY

TradingView

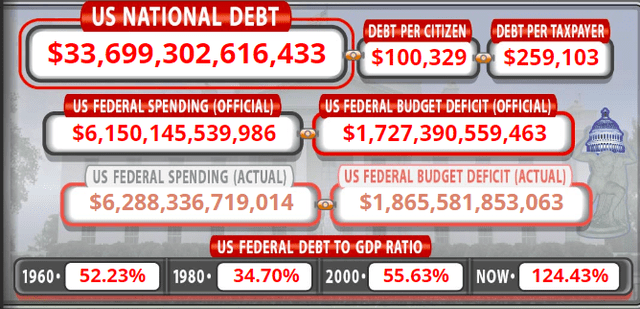

Even in the US, the years of QE by the Federal Reserve has culminated in a whopping USD 33 trillion national debt. The US federal debt to GDP ratio has climbed from 52% in 1960 to 124% now.

National Debt Clock

Without real assets like gold or silver backing the currencies of countries which are heavily indebted, the value of the currencies and government bonds should theoretically erode.

Bond yields may be spiking not only because of central bank rate hikes…

Throw in spiking bond yields into the picture and things become clearer. The market might be shunning government bonds for asset hedges like gold and cryptocurrencies.

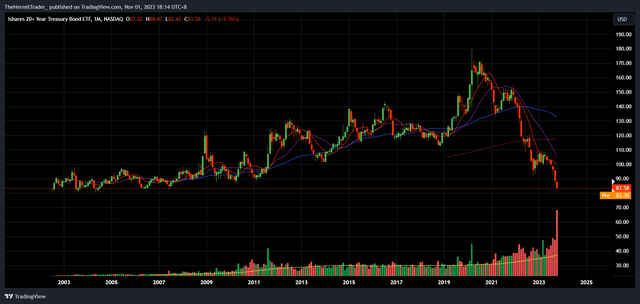

I wrote in late September to avoid buying Treasury bonds (TLT) as this is a dangerous falling knife. That remains the case with TLT plummeting close to new lows.

Monthly Chart: TLT

TradingView

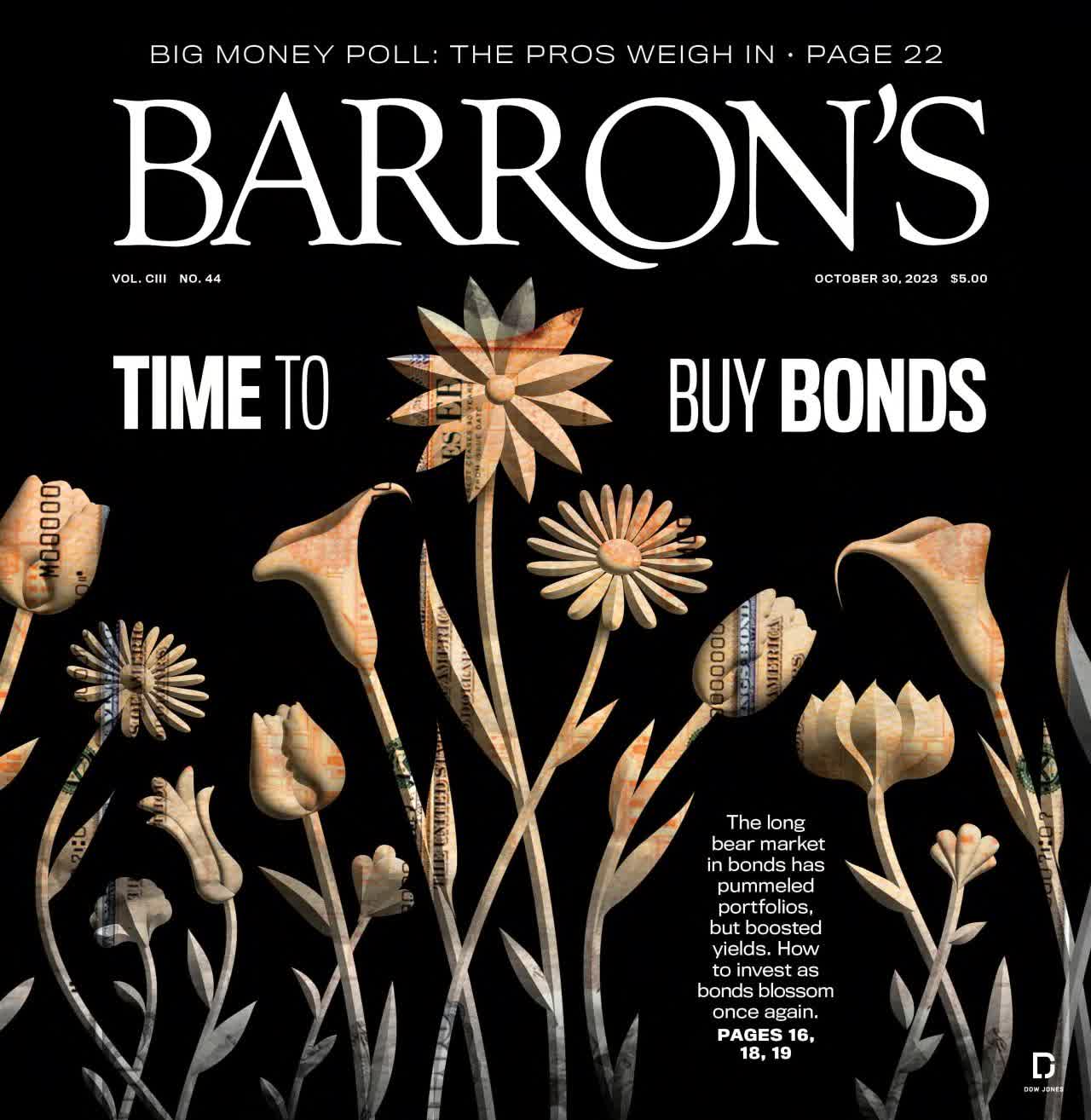

Barron’s released a cover on 30 October 2023 that it was “time to buy bonds”. Mass financial media are typically poor in catching the tops and bottoms. Avoid buying bonds – I do not believe this sell-off is over.

Barron’s

This is because there is a larger issue being fleshed out.

Previously, the markets believed that bonds were selling off due to central banks raising rates.

Now, looking at the price action in gold and Bitcoin, I believe even if we have seen the peak in the rate hike cycle, government bonds might continue to sell off because the market is genuinely losing confidence in fiat currencies and central banks.

Overall, I am of the belief that years of misguided central bank printing is culminating in a loss of confidence in fiat currencies and government bonds, which is playing out in front of us.

Two sectors are showing amazing relative strength in the face of rising yields – precious metals and cryptocurrencies. These two should theoretically be pummeled by high yields, but their resilience is a tell that the market may be looking at another budding narrative.

If my thesis proves to be correct, then we should see bond yields continue to climb even after central banks of developed countries have turned dovish. The Fed signaled a potential end to the hiking cycle in November, leading to a dip in bond yields. However, if bond yields continue to climb in spite of this “Fed pivot”, then that would add further confirmation to my thesis.

Be aware of the high risk involved in trading cryptocurrencies

Investing or trading cryptocurrencies contain far higher risk than precious metals like gold, which need to be highlighted. While the SEC is likely to approve the spot Bitcoin ETF this year, the launch of the ETF is likely to only take place in 2024.

In the absence of this, there are not many liquid vehicles to get exposure to cryptocurrencies in the stock market, other than names like Coinbase (COIN). Investors buying cryptocurrencies on such crypto platforms should be cognisant of the platform-related risks (as seen in the FTX saga), as well as the volatile nature of cryptocurrencies.

The SPDR Gold Trust (GLD) could be a more liquid instrument to play on this budding narrative.

Read the full article here