Investing in emerging markets was always sold as a way of potentially generating high returns, but the reality of the story has been disappointing. Broad emerging market funds have gone nowhere for over a decade, and because many have a substantial allocation to China, averages have languished under failed momentum and an unpredictable economic environment there. That’s why the iShares MSCI Emerging Markets ex China ETF (NASDAQ:EMXC) is an interesting fund. This exchange-traded fund, or ETF, offers exposure to a broad range of emerging markets, excluding China, providing an alternative investment strategy for those seeking international diversification.

A Deep Dive into EMXC

EMXC, managed by BlackRock Fund Advisors, seeks to track the investment results of the MSCI Emerging Markets ex China Index. This index is composed of large and mid-capitalization equities from emerging markets, excluding China. EMXC offers long-term growth potential and allows investors to maintain flexibility for a tailored approach to investing in China.

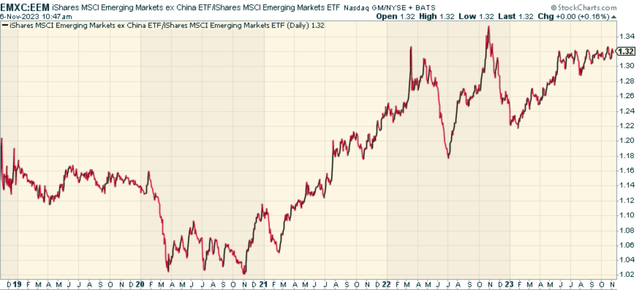

It’s certainly outperformed one of the larger behemoths in the space, iShares MSCI Emerging Markets ETF (EEM), over the last 5 years as the price ratio shows.

stockcharts.com

EMXC’s Portfolio Composition

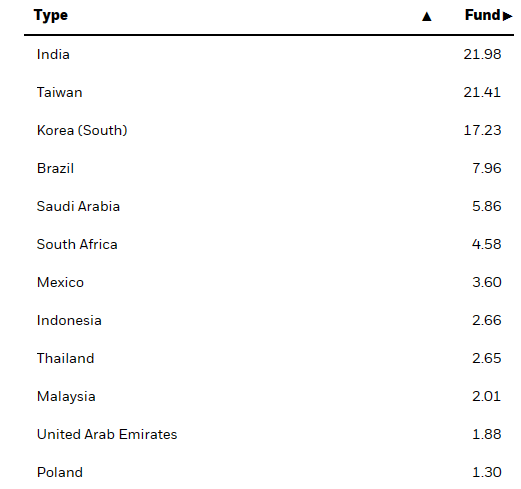

The EMXC portfolio primarily concentrates on the equity markets of Taiwan, India, and South Korea. The technology, industrial, and financial sectors in these three nations have displayed substantial expansion, featuring an impressive array of large-cap stocks. With these nations enjoying stable geopolitical conditions and strong trade and political alliances globally, they present relatively secure investment avenues.

ishares.com

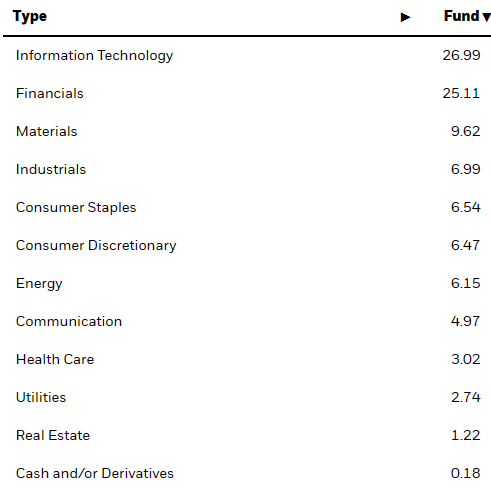

The fund’s diversification across various sectors and countries helps mitigate risks associated with investing in a single country or sector. The primary sectors that EMXC invests in include Information Technology, Financials, and Materials.

ishares.com

EMXC has a competitive expense ratio of 0.25 percent and a low turnover ratio. The fund’s net assets stand at approximately $7 billion, highlighting its strong presence in the market. EMXC’s beta against the S&P 500 (SP500) over three years is 0.88, suggesting a lower volatility compared to U.S. markets.

Navigating Emerging Market Investments

Investing in emerging markets requires careful consideration of various factors, including the economic, geopolitical, and fiscal conditions of the target markets. Despite the high growth potential, emerging markets can pose significant challenges due to their inherent volatility and susceptibility to global economic trends.

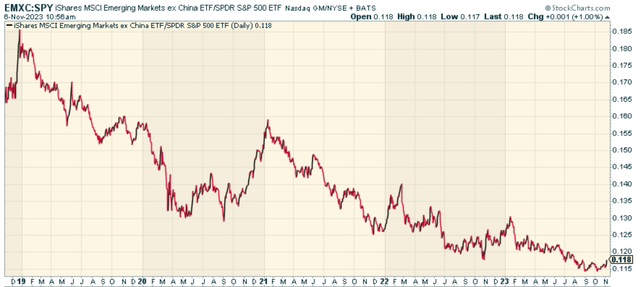

EMXC offers a strategic approach to investing in emerging markets by excluding China, a country often associated with higher volatility and risk. This strategy has yielded positive relative results for EMXC, making it an attractive investment option for those seeking exposure to emerging markets. Having said that, the U.S. still dominated in terms of overall global momentum. So while EMXC has done better than emerging market proxies which own China, it hasn’t done better than the U.S. That’s not a bad thing, just be aware of that when determining momentum potential.

stockcharts.com

Looking Ahead

The iShares MSCI Emerging Markets ex China ETF represents a compelling investment opportunity for those who wish to access the growth potential of emerging markets while maintaining a tailored approach to China. By investing in EMXC, you can potentially enhance your portfolio’s performance and achieve your investment objectives. I like this fund, but it would be nice to see finally a secular rotation of the US into emerging markets to really get this fund moving.

Read the full article here