Surge Energy Inc. (TSX:SGY:CA) (OTCPK:ZPTAF) is long overdue to give their loyal shareholders a bigger slice of the pie. The company has come under fire in previous years for making poor acquisitions and managing debt poorly. The company is about to have Net Debt/EBITDA under 1x for the first time in over 10 years. This should in turn lead to Surge Energy rewarding its shareholders as the company looks to enter Phase 2 of its “Return of Capital Framework”. This alone finally makes Surge Energy attractive to me as a buy. The company reported Q3 results late last week and the company performed as well as was expected. I think investors should be paying really close attention over the next 6 months as the company will become more attractive as they approach $250 million in Net Debt.

**Numbers mentioned are all in $CAD and charts are SGY:CA given the greater volume on the Canadian side**

How was Q3?

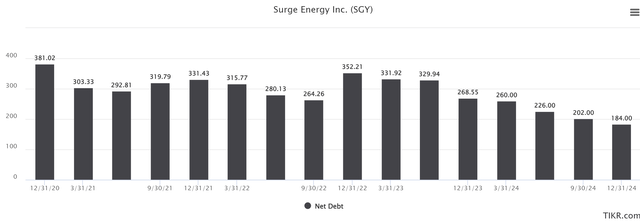

Surge reported earnings after the close on November 2nd. We saw the price of oil trade slightly higher in the quarter year over year ($82/barrel vs $74/barrel in 2022). The company saw a year-over-year increase of 18% in free cash flow from operating activities ($71.3 million) in the quarter as well. Daily average production increased 13% year over year, and net debt decreased by $25.5 million in the last quarter. This brings net debt down to $286 million.

All in all, pretty decent results. But the stock found itself down 3.5% on the following day. Now, the oil & gas market was down as is, but I might have expected some buying in the general weakness given the results. Although they were in line with what was expected. Maybe we should just be happy they didn’t disappoint? Maybe shareholders were hoping for a little bigger slice of the pie?

As for potential risks, the biggest risk is the commodity itself. At the end of the day, Surge and all other oil & gas companies seem to move with the price of oil. Given the geopolitical climate, I do think oil prices will continue to be a tailwind. We have seen short interest in oil fall off recently. Net positioning has jumped to the highest level since mid-2022. Oil is also one way to hedge against higher inflation. All of these lead to the price of oil going up which leads to greater cash flows for companies like Surge.

How’s That Dividend Coming?

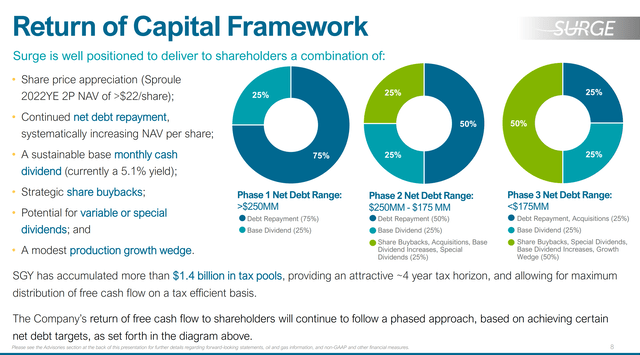

Well, they did announce an increase earlier this year. I would be shocked if they didn’t increase the dividend once again in 2024. Looking below, we can see the “Return of Capital Framework” that has been public for a while now, but we should enter Phase 2 in mid-2024 based on current estimates. My fear, and only fear is that Surge uses this extra money to continue to acquire companies instead of rewarding shareholders. While making acquisitions can reward shareholders in the long run, there have been a lot of patient people who I would imagine would prefer to see that reward come in the form of a deposit in their bank account. The stock is currently yielding at 5.1% which is just above the industry average of 4.9%.

Surge Energy

Looking below, we can see what analysts are expecting concerning net debt over the next few quarters. As mentioned earlier, Surge ended Q3 at $286 million. That number is missing from the below chart. If Surge follows expectations, we should see Phase 2 come to life in the Q2 announcement. This would mean we would see 50% of free cash flow coming back to shareholders one way or another.

TIKR.com

What can shareholders expect to see with respect to dollars and cents? Well, Free Cash Flow in 2024 is expected to be around $140 million. With the current dividend being responsible for roughly $48 million (0.48 annually per share and 100.31 million shares outstanding), that would leave $22 million to return to shareholders in various ways. I would expect the company to begin with a buyback plan. I hope they offer a special dividend or a slight increase to shareholders beforehand though.

What Does The Price Say?

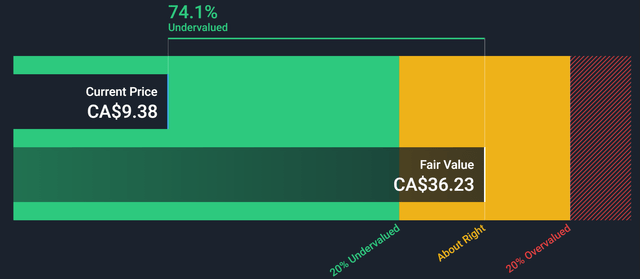

Let’s strictly talk about the current price for a share of Surge. On the TSX, it is trading at $9.39 per share. This seems attractive, being cheap exposure to the Oil & Gas sector. The company hasn’t paid out any special dividends yet while others have been. As I discussed, this is due to previous poor debt management but it seems the company is looking towards a time in the near future where they are paying out special dividends and buying back shares. But let’s dive into what one could expect concerning capital gains.

Simplywall.st

Looking above, we can see we really didn’t gain much ground all year. The stock has been essentially flat. Will we ever see the stock reach “fair value”? No. I don’t think so. The evaluation above is based on future cash flow. For the most part, Oil & Gas stocks are all well under their “fair value”. Not many are 75% undervalued though. The large reason for this is because free cash flows in the oil & gas industry are at all-time highs. Companies are raking in the dough, and not increasing CapEx. In my most recent article on Surge (back in January), the share price was higher, and the fair value was higher. So what’s changed? Essentially nothing. Oil prices have moved slightly, and the company continues to increase cash flow and reduce debt. Is there price opportunity here? I think there could be if management sticks to what they say they will be doing with respect to paying down debt.

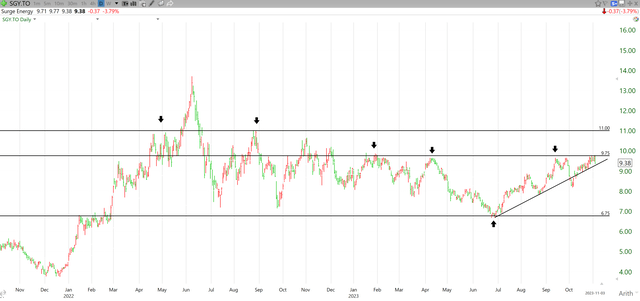

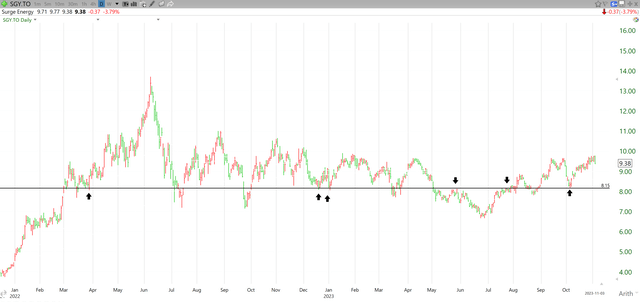

Looking below, we can see that the stock has had a bit of a yo-yo year. The stock bottomed out in June at around $6.75. Since then, it has risen back to current levels, but not without a big test of resistance at $9.75. Not once, but twice. The second rejection sent the stock back below the current short-term trend line in early October.

TC2000.com

Since we have once again tested the waters around $9.75. So much so that the current trend line and the resistance have reached a corner. Which way will we go? Your guess is as good as mine. In the technical community, this pattern is referred to as an ascending triangle. I would strongly advise waiting for the stock to break out before buying in. This means for the stock to break through that $9.75 and hold it. If we do break above $9.75, the stock could look to challenge $11.00 which would be nice to see.

In volatile stocks such as Surge, it is important to have a stop in place to help protect capital. If it breaks out, I would be placing a stop at $8.15. Looking below you can see this is a point of price support. You might be quick to point out that $7.20 is a spot where you’re less likely to get stopped out. While you would be correct, the goal here isn’t to pick a bottom. It’s to find a point of support within risk tolerance. We would need a breakout to buy in, meaning the stop of $8.15 has roughly 17% downside exposure. $7.20 would have 27% downside exposure. If I get stopped out at $8.15 and it’s too quick, and it bounces at $7.20. I can then buy back in and set a tight stop at $7.20 and miss out on the ride from $8.15 to $7.20.

TC2000.com

I would much rather allow a heavier position with a tighter stop in the hopes the trade works out than take a smaller position with a wider stop. I have no issue admitting I’m wrong. My job is to protect capital. So for now, I am on the sidelines, but this is on my daily watchlist as I wait to see which way the stock will break.

Back in January, I offered up a $14.00 price target. That target remains in place today. This is a technical target as it is the next multi-year point of resistance the stock has to overcome. As mentioned, we need to see the stock jump up over $11.00 before our eyes can move towards $14.00, but I do think if the oil market trends the way I believe it will, and Surge does its part to return value to shareholders that there could be some strong momentum in the stock pushing it to test the $14.00 resistance in late 2024.

Wrap-Up

As you can see, there is a lot of potential here. Surge Energy is entering a very crucial next 6-12 months as the company is set to enter Phase 2 of their “Return of Capital Framework” plan, which essentially doubles the amount of cash flow going back to the shareholder in one way or another. While Surge is lagging some of its peers, it’s better to be late to the game than to never get there. I think how management decides to award this extra 25% of free cash flow will dictate where this stock goes. I’m optimistic they will keep the money in-house and directly reward shareholders through dividends and buybacks. As I mentioned, I am not holding this stock currently as I am watching for a breakout on the technical side. I do think the stock has positive fundamental catalysts with respect to the debt being paid down, and the oil & gas market outperforming over the next year. Should we get the technical breakout, I would be buying the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here