Humility is nothing but truth, and pride is nothing but lying.”― Golden Flower

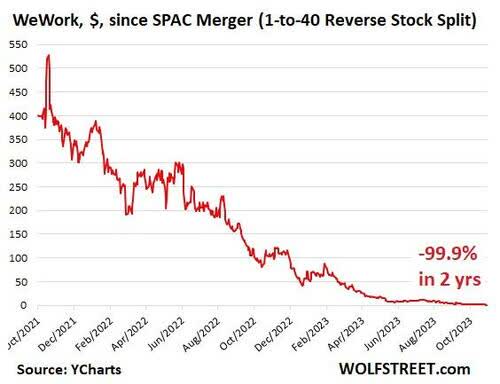

WeWork, Inc. (WE) officially filed for Chapter 11 bankruptcy this week and now has become in some financial circles and Twitter feeds officially known as WeBroke. And thus ends the spectacular rise and fall of a company that was once valued at $47 billion in 2019 despite consistently bleeding cash throughout its existence.

YCharts, WolfStreet.com

All in all, the company raised nearly $14 billion via just over 20 funding rounds, a good portion of this from Softbank, which continued to pour good money after bad. Softbank also owned just over 70% of the company’s equity as the time of its bankruptcy. After a few false starts, WeWork was finally able to come public in the first quarter of 2021 at a valuation of $9 billion. This was thanks to the SPAC/IPO craze of 2020/2021, which was chiefly powered by easy money from the Federal Reserve.

Most of the companies brought public during this period now sell for fractions on the dollar to where they debuted. Outside of the Internet Boom and Bust, it is hard to remember a time when so much shareholder value was destroyed in such a relatively short amount of time.

Shareholders will be wiped out by bankruptcy, while debt holders will receive equity. It is hard to see much if any value ever to be recovered even for the previous debt holders. The company’s business model of signing long-term leases and subletting the space on a shorter-term basis, once called ‘visionary‘, has turned out to be deeply flawed.

Still WeWork avoiding Chapter 7 liquidation did prevent property owners from having to mark their leases to the company down to zero, at least for the time being. That does not mean property owners will be unaffected as WeWork will be looking to terminate scores of large leases through the bankruptcy process.

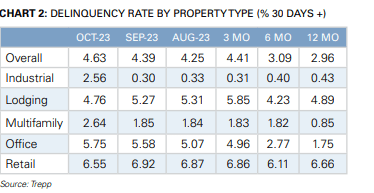

Trepp

This is another nail in the coffin of the commercial real estate or CRE sector, which was already facing extreme challenges on many fronts, which I most recently articulated in an article entitled 2007 Deja Vu. Delinquency rates for office and other CRE categories have been rising sharply here in 2023. WeWork is the largest commercial lease holder in the nation with some 20 million square feet under lease through June.

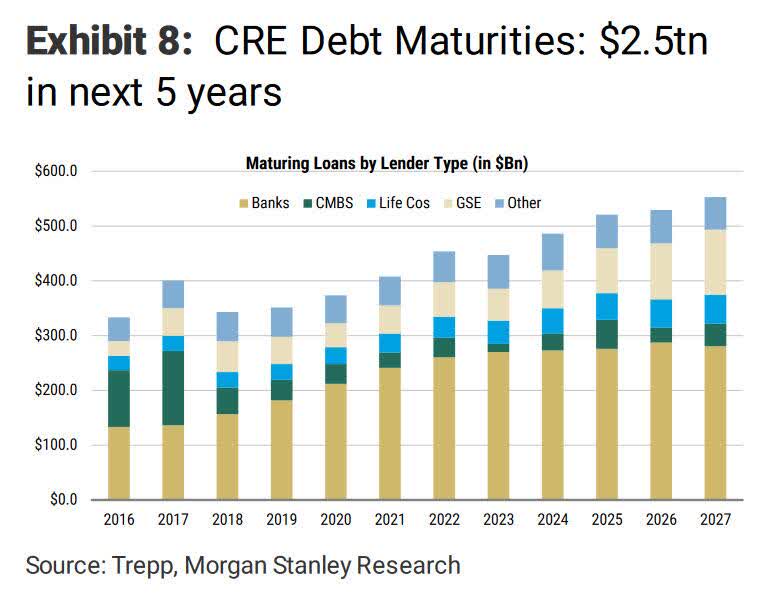

With office vacancy rates at historic highs in major cities like Chicago, Los Angeles, Baltimore and Los Angeles, this is the last thing the commercial real estate market needed right now given how much CRE debt needs to be refinanced at much higher rates in the coming years.

Trepp, Morgan Stanley Research

This will particularly impact the New York City CRE market. WeWork has some 70 leases in the city and Bloomberg is reporting the company will immediately move to terminate 40 of these. As it is, the office vacancy rate in the city is already at historic levels of just over 19%. As of the first quarter of 2023, WeWork leased nearly 7 million square feet of office space in Gotham.

This is potentially a huge new headwind for large Big Apple CRE landlords like Vornado Realty Trust (VNO) and SL Green Realty Corp (SLG) as this space is likely to be dumped on the market at below market rates. Higher vacancy rates will hardly help foot traffic in the city which is a down a third from pre-pandemic levels in some areas like Mid-Town and the Financial District according to a recent study out of the University of Toronto. This continues to be a major headwind for retailers and restaurants as well as for the property owners of those spaces.

In conclusion, not only did the mismanagement of WeWork cost its shareholders and debt holders dearly, but the company’s bankruptcy is likely to be a significant thorn in the side of an already struggling commercial real estate market, especially so in New York City.

Pride should never stand in the way of facing the truth.”― Charles F Glassman

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here