The Company

Xylem (NYSE:XYL) is a $23.3-billion market cap global water technology company focused on addressing significant water-related challenges worldwide. They provide products and services that enhance water utilization, management, conservation, and reuse, ultimately contributing to more resilient communities. Their clientele includes public utilities, commercial, agricultural, industrial, and residential customers. Following the acquisition of Evoqua Water Technologies in 2023, Xylem now has ~22,000 employees and is a part of the S&P 500 (SP500).

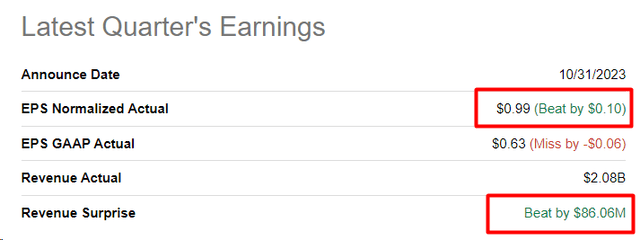

In Q3 2023, Xylem Inc. reported strong financial results that exceeded analyst expectations both in terms of adjusted EPS and sales figures:

Seeking Alpha, XYL’s Earnings Summary, author’s notes

XYL’s EPS increased to $0.99, up from $0.87 in the same period the previous year, surpassing the consensus estimate of $0.89. Net sales saw a remarkable 50% rise to $2.1 billion, exceeding the expected $2.0 billion, with organic revenue growing by 10%.

The company’s organic revenue increased in all business segments, driven by price increases, productivity savings, and backlog execution. Orders were up 43%, and the backlog grew 5% organically to $5.2 billion. Revenue in the U.S. rose by double digits while emerging market revenue declined due to weakness in China.

In May 2023, Xylem acquired Evoqua Water Technologies Corp. for $7.5 billion in an all-stock deal. This acquisition positioned Xylem as the world’s largest pure-play water technology company, providing new growth opportunities and cost synergies. Xylem shareholders now own ~75% of the combined company, with Evoqua shareholders owning the remaining 25%.

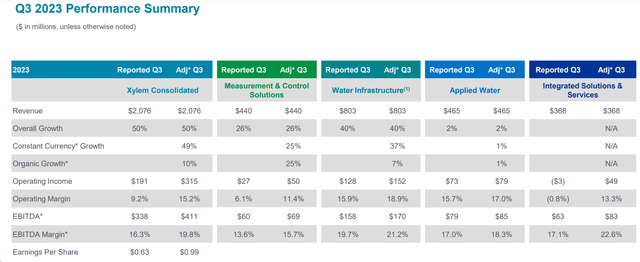

Xylem now reports results for 4 segments: Water Infrastructure, Applied Water, Measurement & Control Solutions, and Integrated Solutions and Services (IS&S).

Water Infrastructure and M&CS showed strong revenue growth, while Applied Water remained stable. The new IS&S segment experienced a 10% increase in revenue on a pro forma basis.

Xylem’s IR materials

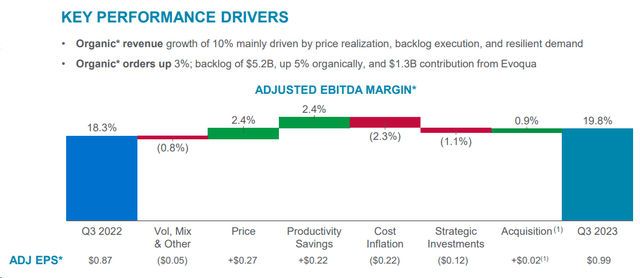

Consolidated expenses saw notable changes, with SG&A expenses increasing due to the Evoqua acquisition and R&D expenses decreasing slightly. The adjusted EBITDA margin improved by 150 basis points to 19.8%, with gains attributed to the Evoqua acquisition, price increases, higher volume, and productivity improvements. Excluding Evoqua, adjusted EBITDA increased by 60 basis points. In my opinion, these are pretty strong results, even if you take the adjustments into account:

Xylem’s IR materials

Management announced on the earnings call that the current COO, Matthew Pine, will succeed Patrick Decker as CEO on January 1. In October 2023, Bill Grogan took over as SVP and CFO, succeeding Sandra Rowland. Both Decker and Rowland will continue as advisors to Xylem until March 2024.

In January 2023, Xylem made a minority investment in Idrica, a leader in data management and analytics, to create an integrated software and analytics platform for water and wastewater utilities. This platform is already in use by >300 customers, the management noted.

Xylem’s focus remains on addressing global water challenges, with a commitment to a multi-year trajectory of organic growth, sustainable margin expansion, and strong free cash flow conversion. The integration of Evoqua positions the company to offer comprehensive water treatment solutions and expand its reach globally, creating value for customers and communities worldwide.

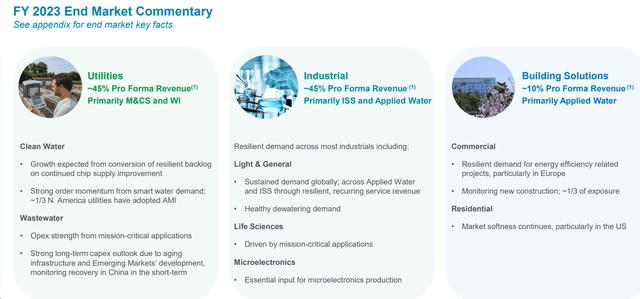

From what we hear on the call, the end markets are showing resilience, with utilities demonstrating robust demand and growth in clean water and wastewater solutions. The industrial segment is expected to provide steady growth, primarily in developed markets, with some moderation in emerging markets. Building solutions are anticipated to see mid-single-digit growth, driven by replacement business in commercial applications.

Xylem’s IR materials

Being quite optimistic about the end markets’ demand drivers, the executive team raised the firm’s full-year guidance along with the 3Q FY23 results, now projecting organic revenue of $7.3 billion, an adjusted EBITDA margin of 19%, and adjusted EPS in the range of $3.71-3.73, reflecting strong business momentum and the impact of the Evoqua acquisition.

Xylem’s IR materials, author’s notes

XYL seems to benefit from trends in water conservation and drinking water sanitation, as well as from the Inflation Reduction Act. The recent acquisition of Evoqua should help the firm accelerate growth by providing complementary services and solutions for Xylem customers. Thanks to new growth opportunities and the synergy effect, I’d expect to see a margin expansion.

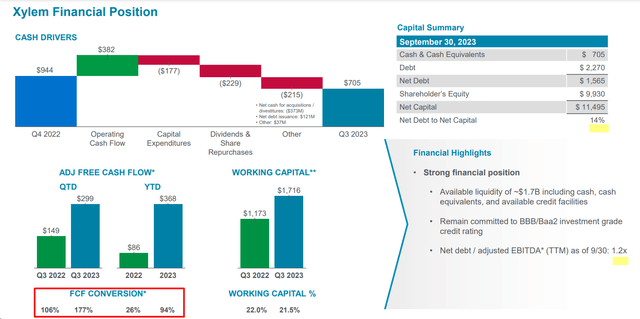

At the same time, despite the new purchase, I don’t see any bright red flags regarding XYL’s financial position. As of the end of Q3 FY2023, the company held $0.7 billion in cash and cash equivalents, with available liquidity amounting to $1.7 billion. Cash flow from operating activities in 2023 was $0.4 billion, showing an improvement from the previous year. Xylem’s free cash flow conversion rate hit 94% YTD, on track to meet the management’s target of 100% by year-end.

Total debt reached $2.3 billion at the end of the quarter, a 37% increase from the prior year, primarily due to the acquisition of Evoqua. The debt-to-capitalization ratio decreased to 19% from 35% at the end of Q4 FY2022, reflecting higher shareholders’ equity resulting from the Evoqua purchase. The trailing net debt/adjusted EBITDA ratio improved to 1.2 from 1.3 compared to a year earlier.

Xylem’s IR materials, author’s notes

But what about the stock’s valuation?

The Valuation

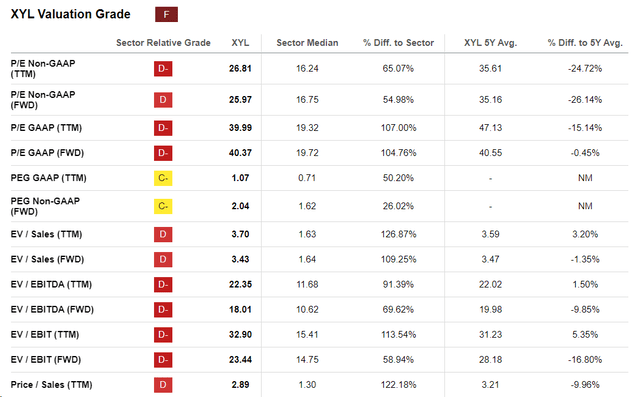

Xylem’s valuation ratios appear expensive with an “F” Valuation grade based on Seeking Alpha’s Quant System.

Seeking Alpha’s Quant System, XYL

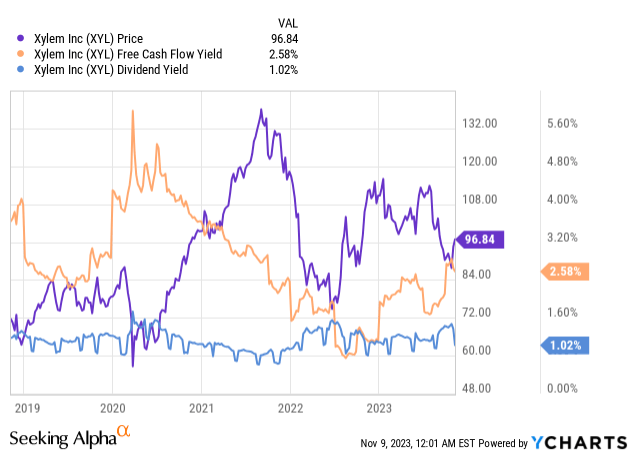

Against the backdrop of its historical valuation, XYL does not appear expensive: the stock is more fairly valued, trades at around the average level of its FCF yield, and pays the same dividend yield as before.

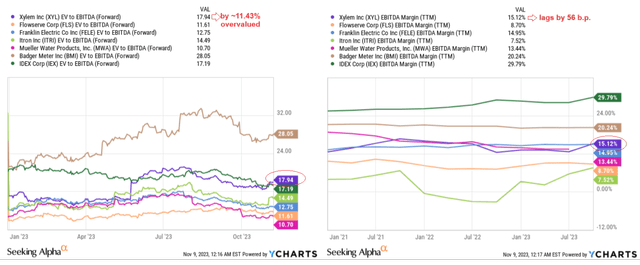

If we compare XYL’s EV/EBITDA ratio for next year of ~18x with other companies in the industry, we see that XYL trades at a slight premium of around 10-15%. However, the EBITDA margin lags slightly behind the peer group, making it difficult to explain the existing premium:

YCharts, author’s notes

However, other analysts disagree with me. Kristina Ruggeri from Argus Research [proprietary source] recently updated coverage of XYL, stating that the stock is trading at a discount to its peers (the analyst’s peer group is different from the one I used – hence the difference):

On a fundamental basis, the shares are trading at 26-times our 2023 estimate, below the midpoint of their historical range of 20-45 but above the average of 22 for a group of peers that includes IDEX Corporation (IEX), Graco (GGG), and Dover Corp. (DOV). Compared to the peer group, the shares are trading at a discount on price/sales. Given the company’s strong balance sheet, recent acquisitions, and growth outlook, we are maintaining our BUY rating with a target price of $125.

Source: Argus Research

The Bottom Line

I definitely like the way the company is growing and developing and the opportunities it has through the recent acquisition. Long term, XYL looks like a sustainable utility company. What I’m missing is dividend yield, buybacks, and a more reasonable valuation. Yes, management raised the payout last quarter, and the potential synergy cost savings should boost margins to justify the existing valuation premium. But for now, this outlook alone is not enough. I would like to see XYL down 15-20% before considering a buy. That’s why I’m rating the stock a “Hold” this time.

Thanks for reading!

Read the full article here