Investment Thesis

Duolingo, Inc. (NASDAQ:DUOL) delivered a strong set of Q3 results. It’s difficult to single out the best elements, but perhaps, the most noteworthy aspect is the consistent and significant increase in paid subscribers.

This increase in paid subscribers has translated into a notable increase in free cash flows year-over-year. I now believe this stock is priced at about 38x forward free cash flow.

There’s a lot to be compelled towards this stock, so let’s get to it!

Quick Recap,

As we headed into the earnings call I said:

Duolingo is delivering very strong growth. And yet, frankly speaking, this investment thesis isn’t blemish-free. The big question that looms large is this, does Duolingo have a moat? And even as I shed light on this question, I argue that I believe there’s a lot to be excited about here.

Although, realistically, the stock is far from cheap at approximately 70x forward free cash flow. Nonetheless, I find myself bullish on Duolingo’s prospects.

I then went on to say,

However, convincing users to pay for premium content, especially in regions where there is a reluctance to do so, presents a challenge. In some countries, there are often cultural (and of course economic) factors that make users less likely to subscribe, even if the price is adjusted for local GDP per capita.

Essentially, with the benefit of hindsight, in those few lines, I encapsulate the whole investment thesis. Both the positive and negative attributes.

Duolingo’s Near-Term Prospects

Duolingo’s near-term prospects appear promising as the company maintains its strong focus on language education while gradually expanding into additional subjects such as math and music.

With a robust global user base and broad-based growth, the company aims to leverage its existing platform to maximize the potential of these new offerings. Their efforts to optimize free-to-pay conversion rates and improve revenue per subscriber indicate a commitment to enhancing the user experience and driving sustainable monetization.

Moreover, there’s the strategic rollout of Duolingo Max. Duolingo Max is a higher-tier subscription service introduced by the company. It incorporates key features, including generative AI technology. For instance, one feature is the role play, and the other is ”explain my answer.” The service was announced earlier and has been gradually rolled out with a focus on enhancing user experience.

If you follow my work, you’ll have seen me declare on numerous occasions that you should be aware of a company’s user adoption rate. This quarter saw paid subscribers increase by 60% year-over-year, a figure that is both impressive and yet, consistent with the prior two quarters, demonstrating that paying users are truly resonating with the app.

Furthermore, looking back to the prior Q3 period, it also saw paying subscribers increasing by 68% year-over-year, which reinforces that there’s nothing abnormal about this user growth in the current quarters and indicates that users are truly more than willing to pay for this app and are likely to continue doing so going forward.

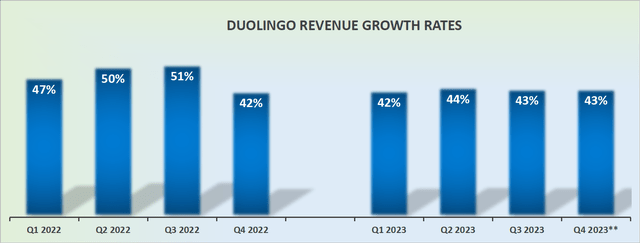

Revenue Growth Rates Continue to Sizzle

DUOL revenue growth rates

Looking ahead, Duolingo will need to balance its core language learning focus with the introduction of new subjects such as math and music. This is not simply about charging more for content, it’s a whole different user demographic as there’s no guarantee that someone who wants to learn Chinese or Spanish will eventually want to learn music too.

That being said, Duolingo is growing extremely rapidly even in the current macro environment where countless companies are reporting lackluster results.

DUOL Stock Valuation — 38x Forward Free Cash Flow

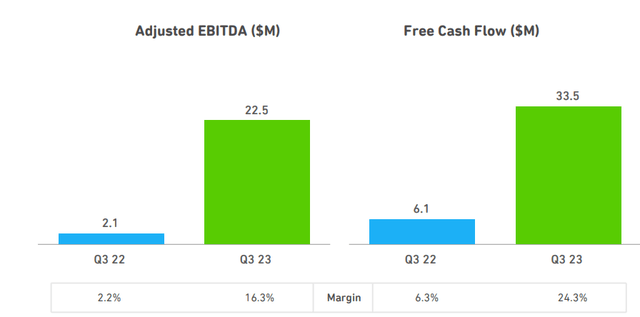

Right now, Duolingo is on a run-rate of approximately $120 million.

DUOL Q3 2023

As you can see from this graphic, unlike many companies that capitalize their expenses, this business not only delivers very strong free cash flows, but its free cash flows are, in fact, running ahead of its EBITDA.

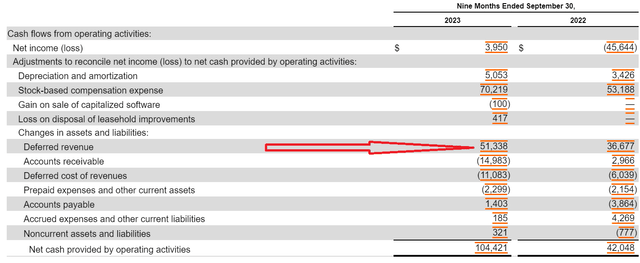

The reason for this is that Duolingo collects cash upfront for services to be recognized over time. I know this sounds complicated, but I’ll explain this as plainly as I can.

DUOL Q3 2023

Basically, you pay to use the app for some time. That cash enters Duolingo’s business, but you then use the app for some time, and that use is recognized as profit over time. As you know, it’s a highly effective business model, charging upfront for future use.

If we were to presume that Duolingo’s free cash flow could grow by 30% in 2024, a feasible achievement considering its momentum and operating leverage, this should see Duolingo delivering about $200 million of free cash flow.

This leaves this stock priced at about 38 times forward free cash flow, a figure that I believe is entirely justified given its very strong growth rates.

Risk Factors to Note

The online language learning sector is intensely competitive, with a constant influx of new products and numerous free alternatives.

Duolingo’s challenge lies in persuading users to choose its premium services over these free options.

Additionally, the company faces uncertainties about user retention and the eventual lifespan of users, after all, if you already learned the language, do you really want to keep paying for further access?

The Bottom Line

Considering Duolingo, Inc.’s robust revenue growth, consistent increase in paid subscribers, and the strategic rollout of Duolingo Max, the company appears poised for continued success in the near future. With a valuation of 38 times forward free cash flow, which seems well-justified given its strong growth trajectory, Duolingo’s stock holds promise for investors seeking exposure to the rapidly expanding online language learning sector. Despite the challenges it faces in user retention and competition from free alternatives, Duolingo, Inc.’s innovative offerings and commitment to enhancing the user experience position it favorably for sustained growth and potential long-term value creation.

Read the full article here