It isn’t quite Teddy Roosevelt’s “speak softly and carry a big stick,” but

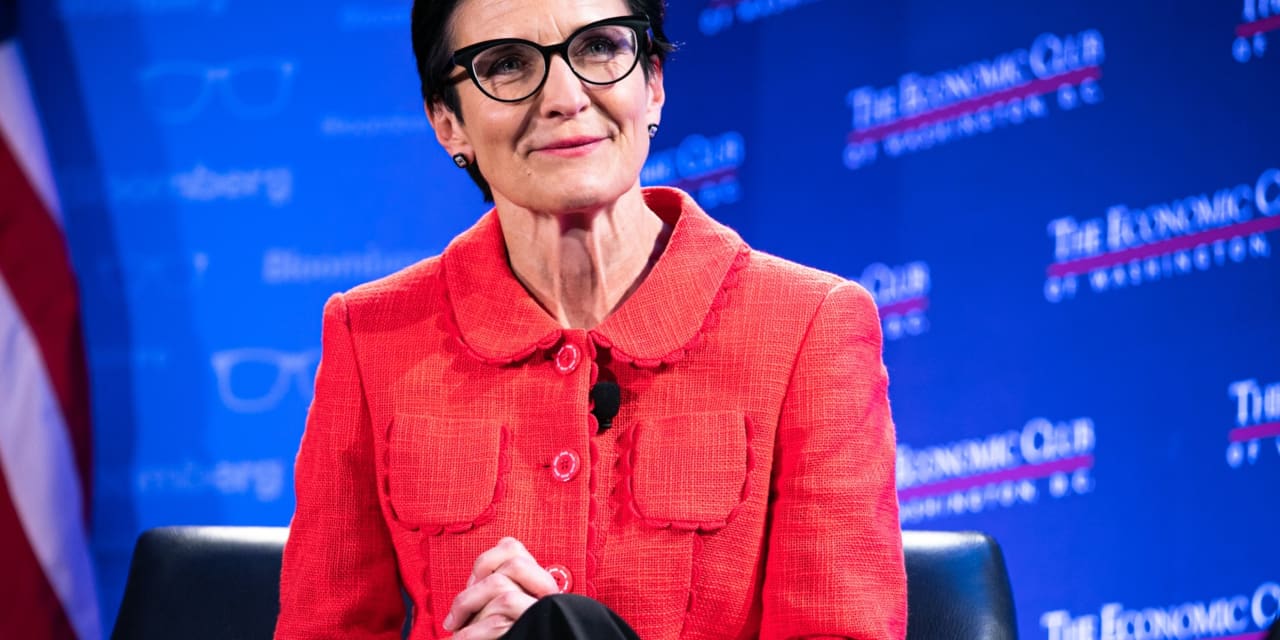

Citigroup

CEO Jane Fraser has her own aphorism: “Have big ears and thick skin.” And just as T.R.’s credo made sense for his world, Fraser’s seems apt for hers. Still relatively new on the job and with literally millions of constituents, she has done much listening, and faced slings, arrows, and brickbats since the day she became head of the giant, underperforming bank.

When we checked in on Citigroup last month, we noted that 1) hope springs eternal for a turnaround (the bank has been a laggard since the 2008-09 financial crisis), but that 2) Fraser might just be able to right the ship. That, and the stock was unduly depressed and perhaps ripe for a rebound. It is way early days, but since early November, shares have handily outperformed the market and the

KBW Nasdaq Bank index.

Perhaps, investors are beginning to buy into Fraser’s reorganization narrative and/or respond to other factors, which Fraser spoke to in a recent interview as part of our At Barron’s series.

For all of the missteps that Citigroup has made, the big bank now actually has a few things working in its favor. Citigroup shares tumbled during the banking sector upheaval in March, but the drop was nowhere near as severe as the plunge by some of its peers. Some of that relative outperformance is due to the stickier nature of Citigroup’s deposit base. The bank’s treasury and trade-solutions group has nearly 20,000 customers, including more than 90% of Fortune 500 companies, transacting across 95 countries—a client base dependent on Citigroup’s expertise in cross-border transactions that’s unlikely to flee.

Then there’s what Fraser—who was born in Scotland, raised there and in Australia, and joined Citigroup from McKinsey in 2004—calls “appropriately prudent.” When deposit levels were high and loan demand was low across banking during the pandemic, banks had little choice but to stash that deposit largess into Treasuries. Normally, that’s a safe bet, but when interest rates rose rapidly, the value of those bonds plummeted, which means U.S. banks now collectively have some $558 billion in unrealized losses on their balance sheets. Banks probably won’t have to realize those losses, but they are a thorn in the industry’s side.

The good news for Fraser is that Citigroup’s unrealized losses currently amount to $33.8 billion, roughly a quarter of

Bank of America’s

, which total $131.6 billion. How come? “We make sure that we hedge our deposits with short-term securities that in a rising-rate environment are floating. That’s why you’ve seen us with prudent and appropriate asset liability management,” Fraser says. “We also don’t have a lot of risk on the balance sheet.”

Citigroup also has never been a big player in commercial real estate, fortuitous with office vacancy rates in San Francisco at 34% and in the high teens in New York City. The bank’s exposure to commercial real estate was $66 billion at the close of the third quarter, less than 10% of the bank’s total credit exposure of $703 billion.

Largely avoiding these pitfalls allows Citigroup to focus on its turnaround, which includes reorganizing the bank into five business lines and eliminating layers of management. Shareholders are hoping that’s the ticket, with Citigroup’s stock down 31% since Fraser became CEO on March 1, 2021. To be sure, the seeds of Citigroup’s troubles, which include decades of ill-fitting acquisitions and a lack of investment in technology, predate Fraser, giving her a grace period. Wall Street has a mantra of its own, however: “Tick, tick, tick…”

The Street would like to see Citigroup’s annual costs fall below $50 billion, which would give the bank an efficiency ratio near its peers. But reorgs actually can cost money. Layoffs come with severance expenses, and Citigroup needs to modernize and consolidate its technology platforms. Plus, it has been investing in its treasury and trade-solutions group—“the jewel in the crown,” Fraser calls it—which has often delivered double-digit year-over-year revenue gains.

“All of the investments we’re making will either drive our revenues or they will be driving the efficiency of the bank, and our shareholders will benefit when we begin to bend the expense curve next year,” Fraser says. Investors will start glimpsing some of those changes in January, when the bank reports fourth-quarter results under its new structure and gives a forecast for 2024.

A turnaround isn’t the only possible tailwind. Fraser frequently notes that ESG—a style of investing focused on environmental, social, and corporate governance factors—needs a second “S,” for security, which pertains to anything from supply-chain issues to cybersecurity to financial security. With its global footprint, Citigroup is well positioned to fund these efforts by its multinational clients. “Because we operate all around the world, we can help [clients] with the volatility they might be seeing, or particular risks in an individual geography, because we’ve been in so many of them for a century,” Fraser says.

And while higher rates have chilled investment-banking activity, Fraser notes that Citi’s services businesses have performed “particularly strongly” as multinationals pay more attention to cash management and other liquidity needs. Accordingly, third-quarter profit in the bank’s institutional services group grew 12% year over year.

Speaking of the bank’s customers—how are they feeling right now? Better, it seems.

“Corporates were thinking they would sit on the sidelines and wait for rates to come down,” Fraser says. “Now that [interest rates are] higher for longer, we’re seeing them bite the bullet in debt markets. It has been just over seven quarters since we saw changes in rates. History would suggest that at about the seven-, eight-quarter mark, you start seeing more signs of life, as the bid/ask spread starts narrowing pretty rapidly. People adjust their expectations to the new price. So, we are seeing some signs of much more demand and activity. And that’s encouraging.”

As for the Federal Reserve taming inflation, Fraser is of the mind that we are over the hump. “Chairman [Jerome] Powell is going to be resolute in making sure that inflation doesn’t spike up,” she says. “Because there’s quite a lagging effect to some of the measures that have taken place, he’ll look at [the data] carefully. He will make sure that he gets down to the 2% inflation target. We’re more than halfway there. Sometimes, the second half can be a bit harder than the first half. But I think in this instance, we’re starting to see the economy doing some of the work now for him, in terms of slowing down the demand drivers.”

Does this mean she sees a soft landing?

“History suggests a soft landing is going to be hard to achieve. [But] I always say never underestimate the power of the U.S. entrepreneur and the U.S. economy. It has proved far more resilient than any of us thought.” If we have a recession, “it’s going to be pretty manageable,” she says. “The labor market and corporate balance sheets are in good shape.”

Recession or no, Fraser will have to navigate whatever comes her way, and then figure out how finally to get Citigroup back to the head of the pack. At which point, the CEO may need a new adage.

Write to Carleton English at [email protected] and Andy Serwer at [email protected]

Read the full article here