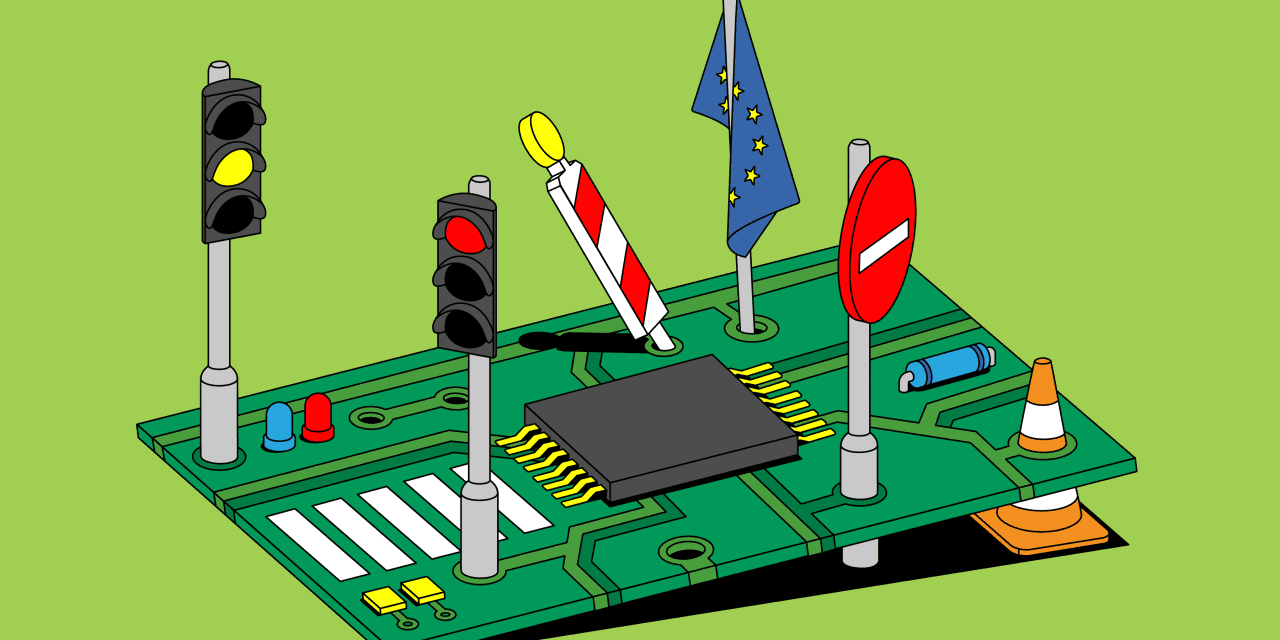

The European Union is seeking a consensus on regulating artificial intelligence, and for once it might be good news for big U.S. technology companies.

A draft of the EU’s proposed AI Act has been making the rounds since 2021. After much back and forth, the EU’s representatives face a key Dec. 6 deadline to reach an agreement. If the act remains in its current state, tech investors should be encouraged, with

Microsoft,

Alphabet

‘s Google, and

Amazon.com

set to be the big winners. The legislation won’t halt AI development, but it imposes a regulatory burden that could ultimately cement their dominance.

Why Is the EU AI Act Important?

The EU AI Act is set to be the world’s first comprehensive legal framework for the sector. While the U.S. government has imposed an executive order on AI, it’s unclear how that would be enforced. In contrast, the EU Act specifies potential fines based on global revenue.

Considering the difficulties of controlling access to AI models, Microsoft, Google, and Amazon will probably have to shape their approach in line with the EU’s requirements. The so-called Brussels Effect often causes the EU’s rules to become the effective international standard. U.S. tech companies, for instance, have spent several years figuring out how to adapt to the EU’s strict privacy law known as General Data Protection Regulation, or GDPR.

The EU has tended to be an antagonist to the U.S. technology giants. In recent years, It has levied billions in fines on them while passing sweeping legislation on digital markets.

What It Means for U.S. Big Tech

Instead of heeding calls from certain scientists and AI doomsayers to pause AI development, the current EU Act proposes to regulate it by implementing a sliding scale of requirements. That gives current AI leaders the ability to continue their innovation but is likely to add additional costs that could be harder for start-ups to handle.

The draft AI Act as supported by the European Parliament is set to assign a higher burden of regulation on the next generation of foundation models, the most powerful AI systems that can be adapted to different tasks.

That would probably include future versions of Microsoft-backed OpenAI’s GPT, as well as models from Google and

Meta Platforms,

and U.S. start-up Anthropic, which is backed by Google and Amazon.

The AI Act would ask whether these models present systemic risks. The ones that do would be subject to enhanced oversight, transparency, and documentation requirements.

The Sticking Point

France, Germany, and Italy have objected to the proposed targeting of regulation at foundation models, the powerful AI systems that can be adapted to different tasks, according to European Parliament member Axel Voss. Instead, they are arguing for regulation to apply to specific AI use cases such as a chatbot or image generator, while foundation models would be self regulated via codes of conduct.

How that negotiation resolves itself should become apparent over the next week or so.

France is home to Mistral AI, an AI start-up that has raised $113 million, according to PitchBook. Germany has Aleph Alpha, which has raised $654 million. Both firms are building AI models similar to the ones from OpenAI.

European venture-capital investors are worried that AI regulation targeting foundation models could put these companies at a disadvantage to their larger U.S.-based rivals.

“Applying risk-based regulation to foundation models, rather than at the application layer [typically apps like ChatGPT], misses the point. All algorithms can be misused by malicious actors—it’s how models are applied that brings risk,” Ekaterina Almasque, general partner at European venture-capital firm OpenOcean, told Barron’s.

Voss, who supports the current proposal put forth by the European Parliament, told Barron’s that Parliament members are sticking to their position that foundation models should be regulated.

The EU parties will come together next on Dec. 6 to try to hash out a compromise. While there’s no hard deadline, failure to agree would make it difficult for the legislation to pass before the coming European Parliament elections in June 2024.

The Beneficiaries

Big Tech companies would be able to use their deep pockets to meet the requirements of the draft act, which could involve paying to license copyrighted data as well as employing staff to test the systems and monitor compliance.

That gives them an advantage over challengers who already face the heavy cost of training next-generation AI models, even before complying with any new regulation. OpenAI’s GPT-4 cost more than $100 million to train, according to company co-founder Sam Altman—that is likely to be prohibitive for many. Microsoft has invested $13 billion in OpenAI. The firm is planning an employee share sale at a valuation of $80 to $90 billion, according to The Wall Street Journal.

Given their head start, vast resources, and ownership of the three largest public clouds, Amazon, Microsoft, and Alphabet are effectively now the AI incumbents. That status could be preserved by new regulation.

Microsoft declined to comment on the EU draft. Google, OpenAI, and Anthropic didn’t respond to requests for comment. A spokesperson for Amazon told Barron’s that it supported the EU’s regulation, but it was important that it didn’t limit low-risk uses of AI.

Interestingly, Meta Platforms has diverged from its Big Tech rivals when it comes to AI. The social-media pioneer doesn’t have its own cloud and has provided its own AI model on an open-source basis.

In June, Meta Platforms’ chief AI scientist Yann LeCun signed an open letter arguing that the EU’s current approach to AI regulation would create disproportionate costs for would-be competitors. LeCun has repeatedly warned that the future of AI risks being dominated by a few powerful companies.

Meta declined to comment on the EU legislation.

Until now, the AI race has largely been determined by talent and infrastructure, which has given Microsoft, Google, and Amazon a formidable advantage. Regulation could reinforce their lead. The dilemma for the EU—and all AI regulators—is balancing risk and competition. That battle is probably just getting started.

Write to Adam Clark at [email protected]

Read the full article here