Icahn Enterprises LP said Friday it’s planning to offer additional 9.75% senior six-year bonds in a private placement after closing an offering of $500 million earlier this week.

Proceeds will be used together with cash on hand to redeem the existing 4.75% senior unsecured notes issued by Carl Icahn’s investing arm

IEP,

that mature in 2024 in full.

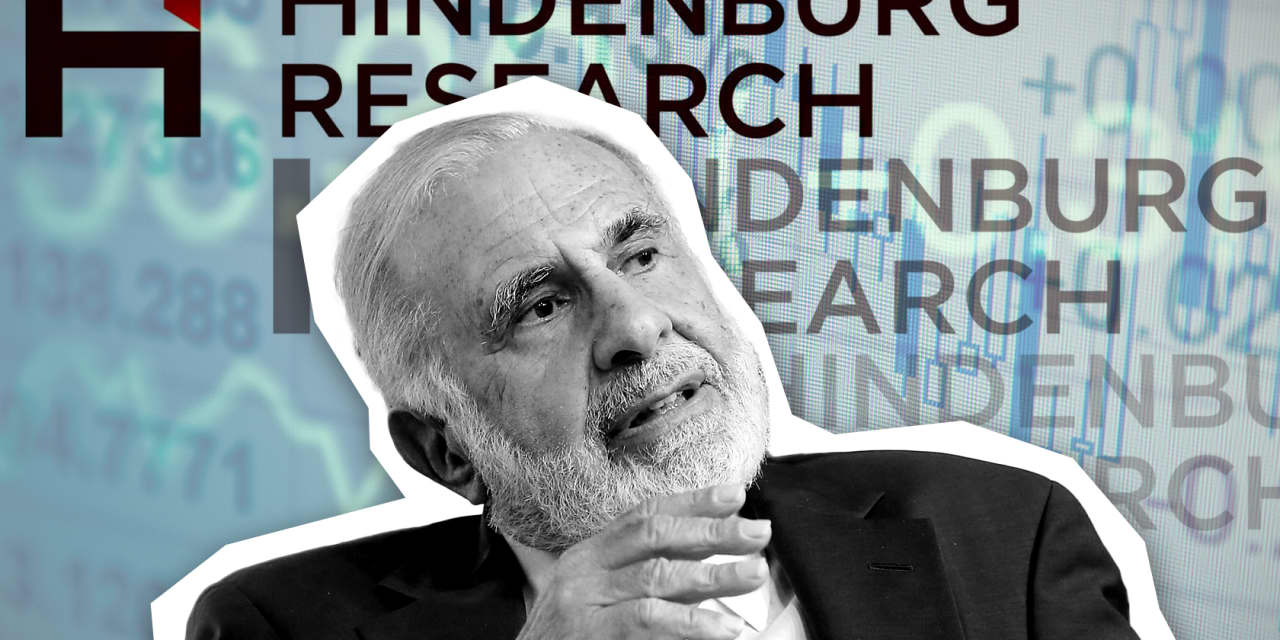

The stock was down 1% on Friday at $15.54, after earlier falling to a low of $15.01, its lowest level since November 2003. The stock has tumbled 69% in the year to date. Short seller Hindenburg Research published a scathing article about the company on May 2, accusing it of overstating values and paying a dividend it could not afford, among other things.

Icahn Enterprises, which is 84% owned by billionaire Carl Icahn and his son, Brett, offers exposure to Icahn’s personal portfolio of public and private companies, including petroleum refineries, car-parts makers, food-packaging companies and real estate. Its unit holders are mostly retail investors.

In August, the company halved its dividend to $1.

Icahn has rebutted the allegations and accused Hindenburg founder and CEO Nate Anderson of writing a misleading and self-serving report.

For more on Nate Anderson: The MarketWatch 50

Hindenburg also revealed that Icahn had borrowed money from his own company, a development that was disclosed in a footnote to financials and that Wall Street had overlooked. He has since repaid the loan.

From the archives (May 2023): What we know about Carl Icahn’s margin loan

See also: Carl Icahn rebuts short seller Hindenburg Research’s report. It’s already cost his company $6 billion in market cap.

The U.S. Attorney’s Office for the Southern District of New York contacted Icahn Enterprises shortly after the Hindenburg report was published, seeking information about the value of the company’s assets, corporate governance, dividends and other topics.

The S&P 500

SPX

has gained 23% in the year to date.

Read the full article here