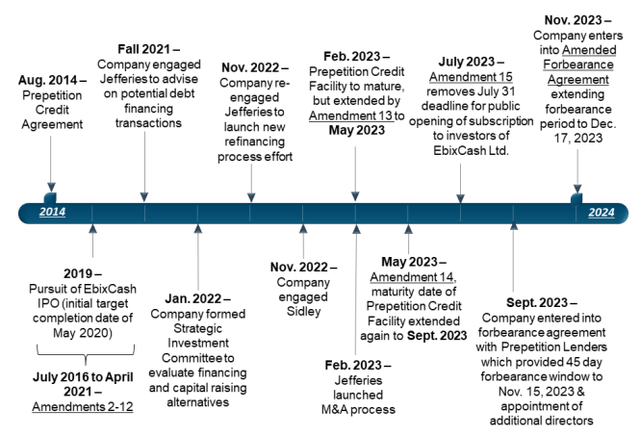

Following a number of unsuccessful debt refinancing and asset divestment efforts as well as a stalled attempt to launch an initial public offering for its Indian EbixCash payment solutions subsidiary in recent quarters, beleaguered insurance exchanges provider Ebix, Inc. or “Ebix” (NASDAQ:EBIX) ultimately filed for chapter 11 bankruptcy protection on Sunday to facilitate the sale of its North American Life and Annuity assets in a court-supervised auction pursuant to section 363 of the U.S. Bankruptcy Code.

Court Docket

The company has reached a $400 million “stalking horse” agreement with Zinnia, a leading life insurance and annuity technology and service company (emphasis added by author):

Zinnia’s proposal acts as a baseline for competitive bids for the acquisition of our North American Life and Annuity assets to a prospective strategic software company, who can seamlessly handle our NA L&A customer base.

During the Chapter 11 process, operations worldwide will continue in the ordinary course while we complete the marketing and sale process to address the maturity of the Company’s credit facility,” said Robin Raina, President and CEO of Ebix.

“With less than 15% of our worldwide revenues coming from the NA L&A assets being sold to address the credit, and the rest of the businesses of the Company continuing to exhibit strong fundamentals, we believe that the Company’s future is bright – with strong operating fundamentals, a robust business model, world-class products, and a continued ability to generate healthy operating cash flows across the world.”

Please note that the company’s international operations, including EbixCash, are not part of the bankruptcy filing.

The company has reached an agreement with existing lenders to provide an aggregate of $105 million in debtor-in-possession (DIP-) financing.

However, Ebix will only receive up to $35 million in fresh funds, with the remainder of the facility simply moving $70 million in pre-petition debt to the top of the capital structure (“roll-up”).

Perhaps most importantly, equity holders are not expected to be wiped out according to the terms of the restructuring support agreement (emphasis added by author):

5.03 Existing Equity Interests. On the Plan Effective Date, provided that all DIP Claims and Prepetition Secured Claims have been paid in full in cash, and except for dilution by any stock that may be issued as part of the Restructuring Transactions, the existing common Interests of Ebix will be reinstated and will not otherwise be affected by the Restructuring Transactions, to the extent permitted by Law.

That said, the $400 million stalking horse bid by Zinnia won’t be sufficient to cover the company’s $650+ million in secured debt obligations (assuming full utilization of the new DIP facility).

In this case, the restructuring support agreement requires the sale of additional assets:

(…) to the extent the proceeds of the sale of the NA L&A Assets are not sufficient to pay the Prepetition Lenders in full, the sale of such of the Debtors’ other assets as is necessary to fund the Restructuring Transactions contemplated herein and to pay all Prepetition Secured Claims in full (the “Sale Transaction(s)”) pursuant to a sale process or processes to be approved in the Chapter 11 Cases to be filed by the Debtors as described herein.

In addition, the company has deferred $7.5 million in payments to certain vendors and service providers in recent months and still owes approximately $7 million to travel services provider Amadeus (OTCPK:AMADF, OTCPK:AMADY) following an unfavorable court judgment earlier this year.

For my part, I do not expect the court-supervised auction to result in a higher bid, as the company has been marketing these assets to prospective buyers for several quarters already.

As a result, the company might be required to sell additional assets, with the Indian EbixCash operations perhaps being the most valuable part of the remaining business, at least when judging by the company’s proposed $700+ million IPO in India. If the IPO were successful, EbixCash’s valuation could have been in the range of $3.0 billion to $3.5 billion, according to fellow contributor Mikro Investments.

However, the fallout from a damning report by short-seller outfit Hindenburg Research last year and disciplinary action taken against the company’s auditor, K G Somani & Co LLP, has so far precluded Ebix from securing required regulatory approvals in order for the IPO to proceed.

In addition, EbixCash has recently been ordered by a Singapore arbitration tribunal to acquire the remaining 20% in ItzCash, the core of the company’s payment solutions business from the original seller Vyoman Tradelink Ltd. at an estimated valuation of up to $25 million.

That said, with the holding company now having filed for bankruptcy protection, I would not expect the IPO to proceed anytime soon, and a fire sale might very well result in EbixCash changing hands at a tiny fraction of its targeted IPO valuation.

Should Ebix fail to generate sufficient cash proceeds from asset sales, secured creditors are likely to demand a large stake in the company’s remaining operations, thus resulting in substantial dilution or even a wipe-out for existing equity holders.

Given the huge uncertainties regarding the company’s ability to repay secured creditors from asset sales proceeds, Monday’s ~70% selloff in the shares can hardly be considered a surprise.

However, should the company manage to emerge from bankruptcy with its remaining asset base including EbixCash largely intact, the beaten-down stock might represent a real bargain at current levels.

According to the terms of the restructuring support agreement, the restructured company should emerge from bankruptcy by mid-June at the latest point.

With the company being current in its regulatory filings and the restructuring support agreement not calling for a wipe-out of common equity holders, the stock might remain listed on the Nasdaq stock exchange throughout bankruptcy proceedings.

Bottom Line

After several unsuccessful efforts to address more than $600 million in overdue credit facilities out of court, Ebix, Inc. has filed for bankruptcy to facilitate the sale of its North American Life and Annuity assets in a court-supervised auction pursuant to section 363 of the U.S. Bankruptcy Code.

For my part, I remain skeptical of the company’s ability to raise sufficient proceeds from the auction alone and, as a result, would expect additional asset sales or substantial dilution being required to satisfy secured creditors.

However, should the company manage to emerge from bankruptcy with its remaining asset base including EbixCash largely intact, the beaten-down stock might represent a real bargain at current levels.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here