Lockheed Martin Corporation (NYSE:LMT) is a leading defense contractor for the US Department of Defense or DoD. It generated more than 70% of its revenue from the US DoD in 2022, as the company benefited from the DoD’s massive military budget, with a 2024 budget request of $842B, up from 2023’s $816B. However, it also represents a significant slowdown from 2022’s $742B, suggesting we could have passed the peak growth rates in the DoD’s spending.

In a recent December note, Goldman Sachs (GS) highlighted that US defense spending is “at an all-time high after a decade of substantial growth.” The investment bank added that the current cycle is likely at a peak, suggesting “a decline in the defense budget is more likely than continued growth at the recent pace.”

Despite that, Lockheed Martin remains well-placed to generate stable and robust free cash flow profitability in the medium term, sustaining buying confidence. As a result, I believe it should help mitigate the potential normalization in its topline growth rates as the company focuses on “generating free cash flow and returning value to shareholders.”

Furthermore, the company posted a significant $156B backlog in Q3, “underlining strong order intake both domestically and internationally.” Lockheed Martin’s successful F-35 program has also benefited its recent growth phase. Accordingly, the company remains ready to meet its annualized production run rate of 156 aircraft annually. In addition, LMT is “working to finalize TR3 software development testing,” as the F-35 program is expected to continue to benefit from domestic and possibly more robust international growth dynamics moving ahead.

Lockheed Martin could see some near-term margin variability on its Missiles and Fire Control or MFC segment due to the “timing of impacts” on its classified programs. Despite that, the company is confident in its “strong backlog,” banking on the underlying demand from global allied nations to “improve security posture in a complex threat environment.”

As a result, I believe Lockheed Martin is well-positioned to achieve its target FCF outlook of at least $6B in the medium term as the company looks to return value to shareholders through buybacks and dividends. However, investors should expect a reduced cadence in share repurchases moving ahead, as its current cadence is “returning more than 100% of its free cash flow to shareholders.”

Accordingly, LMT highlighted that it expects to lower its share repurchase projections to $4B in 2024 before a normalized cadence of $3B for 2025-26. As a result, it represents a significant reduction from 2023’s $6B repurchase authorization.

While some investors could be disappointed with the normalization of the company’s capital allocation framework in share buybacks, I believe it’s justified. With LMT still expected to generate substantial free cash flow in the medium term, it should keep investors onside, even as its topline growth could slow. In addition, with LMT’s valuation much less attractive than my previous update in late 2021, a more aggressive repurchase cadence isn’t constructive for long-term shareholder value accretion.

LMT last traded at a forward EBITDA multiple of 12.8x, well above the 10x multiple in late 2021, reflecting significant pessimism then. As a result, I’m not surprised that LMT has significantly outperformed the S&P 500 (SPX) (SPY) over the same period, notching a total return of more than 40% in just over two years. As a result, it’s much higher than the SPX’s 2.6% uptick.

While I assessed that the long-term uptrend bias on LMT remains intact, the near- to medium-term potential upside seems less attractive with the normalization in its valuation. In addition, its 5Y average performance has also reverted above its 10Y average. Accordingly, LMT posted a 5Y total return CAGR of 15.4%, above its 10Y average of 14.8%.

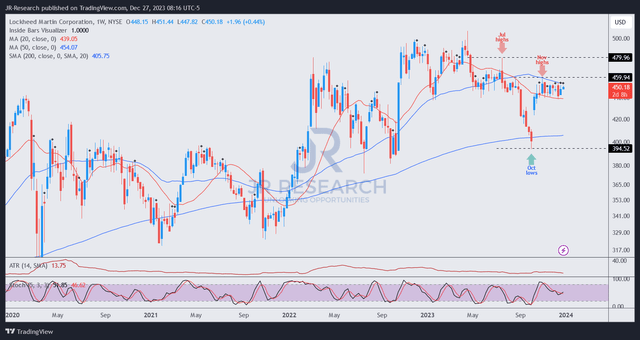

LMT price chart (weekly) (TradingView)

I also gleaned that the capitulation seen in LMT’s collapse toward its October 2023 lows has normalized. As a result, it is expected to face stiff selling resistance at the $460 and $480 levels. Without a decisive breakthrough of these levels, LMT’s potential upside looks well-balanced and is not likely to be significant.

With a less attractive valuation, growth normalization in the next few years, and a potential decline in the overall defense budget as the cycle peaks, LMT’s most attractive risk/reward upside has likely been reflected.

Hence, I’m ready to move to the sidelines as we await a more appealing opportunity to return.

Rating: Downgraded to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis. Have we spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here