Thesis

Earlier in October, I covered Oracle Corporation (NYSE:ORCL), where I analyzed the company’s Q1 results and the pickup in the company’s cloud infrastructure. I will be going over the company’s Q2 results and the near-term outlook for ORCL. Oracle is well-positioned to benefit from a resilient and consistently recurring revenue stream. I expect ORCL to continue to benefit from a favorable shift in its business mix, with Cloud Applications, Oracle Cloud Infrastructure (OCI), and strategic hardware continuing to grow at a fast rate. Although the stock is up 27% YTD, it is currently trading at 19x forward PE, which I consider attractive given the company’s growth prospects.

Q2 Review and Outlook

Oracle’s Q2 results were negatively impacted by supply constraints. The cloud revenue fell short of expectations by approximately $50 million after adjusting for currency fluctuations. This was mainly due to deliberate decisions made in capacity planning to accommodate large-scale OCI customers, even if it meant sacrificing short-term revenue.

In terms of recurring revenue, the application ecosystem grew by 9% in constant currency, while the infrastructure ecosystem grew by 12% in constant currency (compared to 14% in Q1 and 9% in Q2 of the previous year).

The management provided guidance for the third quarter, with revenue expected to grow by 6% to 8% YoY in constant currency. The total cloud revenue is anticipated to grow by 26% to 28% year-over-year, excluding Cerner, which is an acceleration from the 25% growth seen in the second quarter. Furthermore, the earnings per share guidance falls in the range of $1.35 to $1.39, with foreign exchange rates expected to have a neutral effect on EPS.

The second quarter results for Oracle were not really a catalyst for a positive upside for the stock. The muted results were somewhat anticipated due to the unfavorable conditions and challenges from Cerner. However, there were some unexpected developments that I would like to keep a close look on going forward, particularly the Cloud segment growth. Oracle’s slower-than-expected growth to supply chain issues while asserting that demand remains strong. I still maintain confidence in Oracle, especially with the prospect of more significant capex investments in the second half of the year, indicating robust demand and potential revenue growth ahead.

Oracle Can Benefit From AI

Oracle’s future growth in the cloud computing industry is its role within the emerging artificial intelligence ecosystem. AI’s success hinges on having the right chipset technology and significant computing capacity. Currently, there is a shortage of computing capacity for AI, partly due to chip shortages, which presents a short-term advantage for Oracle. However, there is also a sustainable long-term argument extends beyond this immediate advantage and is more sustainable. Oracle Cloud Infrastructure is well-equipped to handle AI workloads effectively. During the development of OCI’s second generation, Oracle placed significant emphasis on optimizing the networking layer. This optimization was specifically designed to facilitate rapid and efficient scalability, a crucial aspect for AI workloads.

Autonomous Database Can Pick Up

The success of Oracle Cloud Infrastructure has the potential to boost the sales of Oracle’s latest database offering. While the autonomous database was introduced several years ago, its adoption has been slow, possibly due to customer hesitation in adopting Oracle’s underlying cloud infrastructure. However, recent success, such as securing customers like Uber who are migrating non-legacy workloads to OCI, lend credibility to the platform. This could encourage more companies to consider the next iteration of the database. Moreover, the company’s recent partnership with Microsoft, which gives customers direct access to Oracle database services running on OCI and deployed in Microsoft Azure datacenters, will drive OCI adoption.

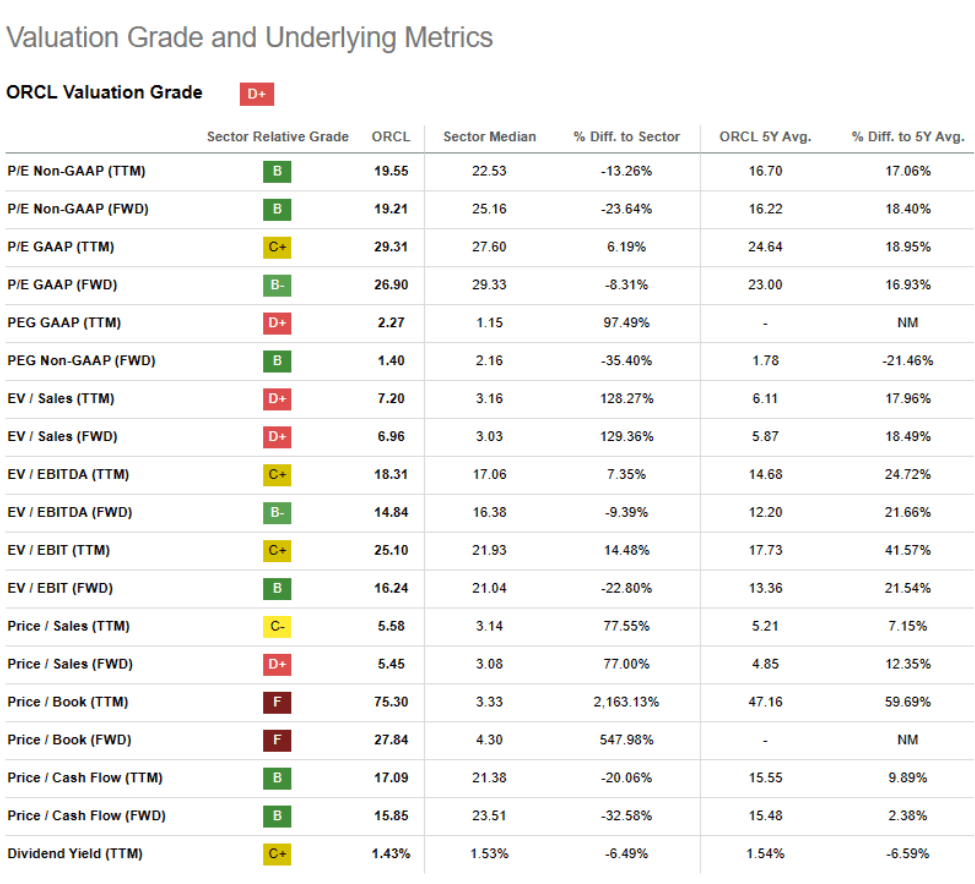

Valuation

Oracle has performed well in FY 2023, as reflected by the company’s stock price, which is up 27% YTD. However, I still believe that the stock still has significant upside as the current multiple is not too demanding, with the stock trading at 19x forward PE. The company’s SaaS and OCI segment still constitute a small portion of the company’s overall revenues, leaving significant room for growth. Moreover, Oracle’s new partnership with Microsoft to bring its database services into Microsoft Azure remains an emerging catalyst that could accelerate the adoption of OCI by making it more accessible to a broader audience. Hence, I remain optimistic on the long-term prospects and re-iterate my buy rating on the stock.

Seeking Alpha

Risks

The rise of Generative AI and AI technology is becoming a long-term trend that has the potential to boost IT spending and drive growth in the software industry. While there is a general expectation of increased spending on AI, if there is a slowdown in spending, it would impact ORCL’s stock price. Moreover, worsening macroeconomic factors can further dampen the already uncertain outlook for enterprise IT spending, that can challenge the growth outlook for Oracle. Recent from companies like Accenture, Tata Consultancy, and Infosys have fallen short of expectations, and the outlook for the next 12 months is not very encouraging.

Conclusion

Oracle stands to benefit from the growing artificial intelligence ecosystem within the cloud computing industry. I believe the shortage of computing capacity for AI due to chip shortages provides a short-term advantage for Oracle, but its long-term sustainable advantage lies in its well-equipped Oracle Cloud Infrastructure, optimized for efficient scalability, crucial for AI workloads. Furthermore, Oracle’s success in OCI could boost the adoption of its autonomous database offering, with recent collaborations and partnerships, such as with Microsoft, making it more accessible and appealing to a broader range of customers, especially those interested in AI-driven solutions. I maintain my positive outlook on the company and maintain my buy rating for the stock.

Read the full article here