Note:

I have covered Nordic American Tankers Limited (NYSE:NAT) previously, so investors should view this as an update to my earlier articles on the company.

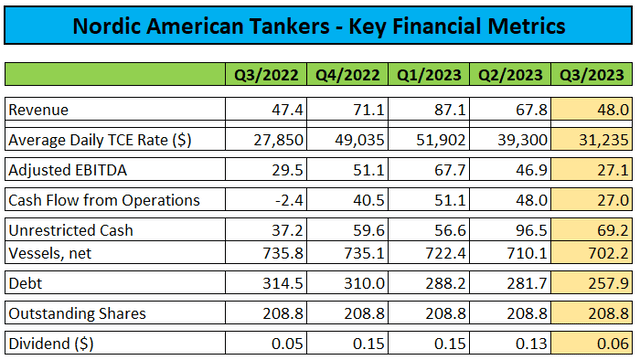

Four weeks ago, Suezmax pure play Nordic American Tankers or “NAT” reported seasonally weaker but still solidly profitable third quarter results:

Company Press Releases

With cash flow from operating activities down by almost 45% quarter-over-quarter, NAT reduced its variable quarterly cash dividend to $0.06 per share. The dividend is payable on January 17, 2024, to shareholders of record as of December 20, 2023.

The company’s average spot daily time charter equivalent (“TCE”) rate came in at $32,832. Including vessels on long-term charters, the company’s average daily TCE rate was calculated to $31,235.

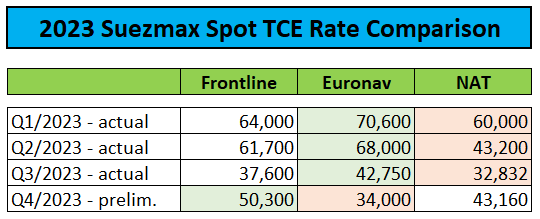

At the time of the earnings report, approximately 73% of available spot days for Q4 had been fixed at an average TCE rate of $43,160:

Company Press Releases

Please note that Frontline plc’s (FRO) spot fleet is of much lower average age and mostly scrubber-fitted while Euronav NV (EURN) provided its Q4 outlook four weeks ahead of peers.

Accordingly, the company’s preliminary TCE rate did not include meaningful benefits from the improved market environment experienced over the past two months. However, Euronav’s final numbers should be significantly higher.

As rates have increased further since the company’s third quarter report, analysts are projecting revenues to jump by almost 50% sequentially. Consequently, I would expect the quarterly cash dividend to more than double to an estimated $0.14 per common share.

With the Suezmax tanker market benefiting from a combination of seasonal strength and ongoing Red Sea disruptions, Q1 might be even stronger.

In addition, first quarter results should benefit from the initial contribution of the recently acquired Suezmax tanker Nordic Hawk and the expiration of two low-margin time charter contracts for the Nordic Cygnus and Nordic Vega. However, the charterer of the Nordic Cygnus has the option to extend the time charter by twelve months which is basically a given in the current rate environment.

Should the current charter rate environment take hold, Q1 revenues could approach $100 million thus resulting in an estimated quarterly cash dividend of $0.20 per common share.

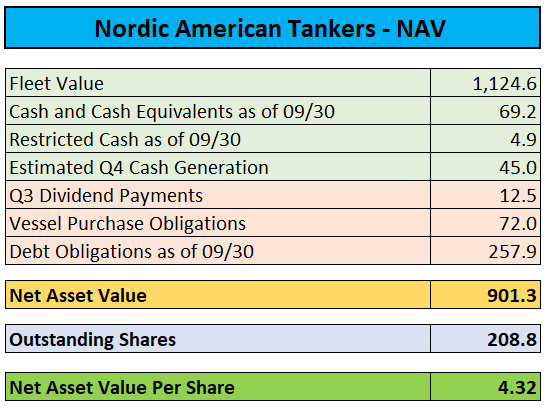

Valuation-wise, NAT is trading very close to net asset value (“NAV”), even after including an assumed $45 million in Q4 cash generation:

MarineTraffic.com / Regulatory Filings / Author’s Estimates

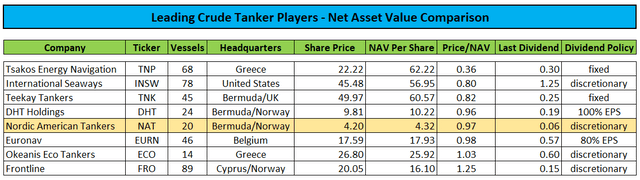

While the company is certainly not a bargain at prevailing share prices, the market is assigning even higher valuations to a number of peers:

Value Investors Edge

With most tanker players distributing a material part of their cash flow to common shareholders, valuations are heavily impacted by anticipated dividend yields.

As the Houthi attacks on vessels in the Red Sea are unlikely to stop anytime soon, Suezmax tankers appear to be a prime beneficiary.

Consequently, I would expect a strong year for Nordic American Tankers with the potential for substantial dividend increases.

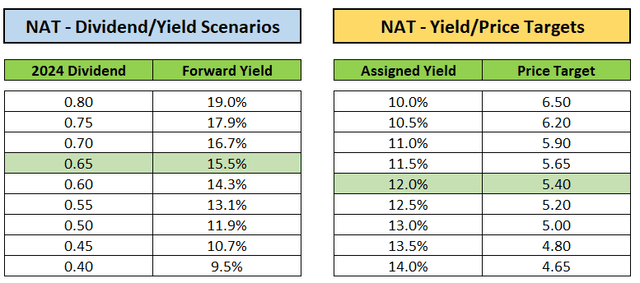

Assuming an aggregate of $0.65 in cash distributions for 2024, the company’s forward dividend yield would calculate to 15.5%.

Assigning a 12% forward dividend yield would result in a $5.40 price target or more than 20% upside from current levels.

Author’s Calculations

With already strong Suezmax tanker market fundamentals bolstered by tailwinds from recent geopolitical events, I am upgrading the company’s shares from “Hold” to “Buy“.

Bottom Line

While Nordic American Tankers reported seasonally weaker Q3 results, seasonal strength in combination with the situation in the Red Sea will benefit the company’s near-term results.

Should the current market conditions persist, the company’s cash generation would increase very meaningfully which in turn should result in substantially higher distributions.

With the Houthi attacks on vessels in the Red Sea unlikely to stop anytime soon, current tailwinds might continue into the seasonally weaker second and third quarters.

Consequently, I am upgrading Nordic American Tankers to “Buy” with a price target of $5.40 based on anticipated higher cash generation and payouts in 2024.

Risks

Should OPEC commit to further, material output cuts, demand for crude tankers would decrease.

In addition, should the U.S. and its allies succeed in their efforts to end the Houthi attacks on merchant vessels in the Red Sea, charter rates are likely to give back some of their recent gains.

Read the full article here