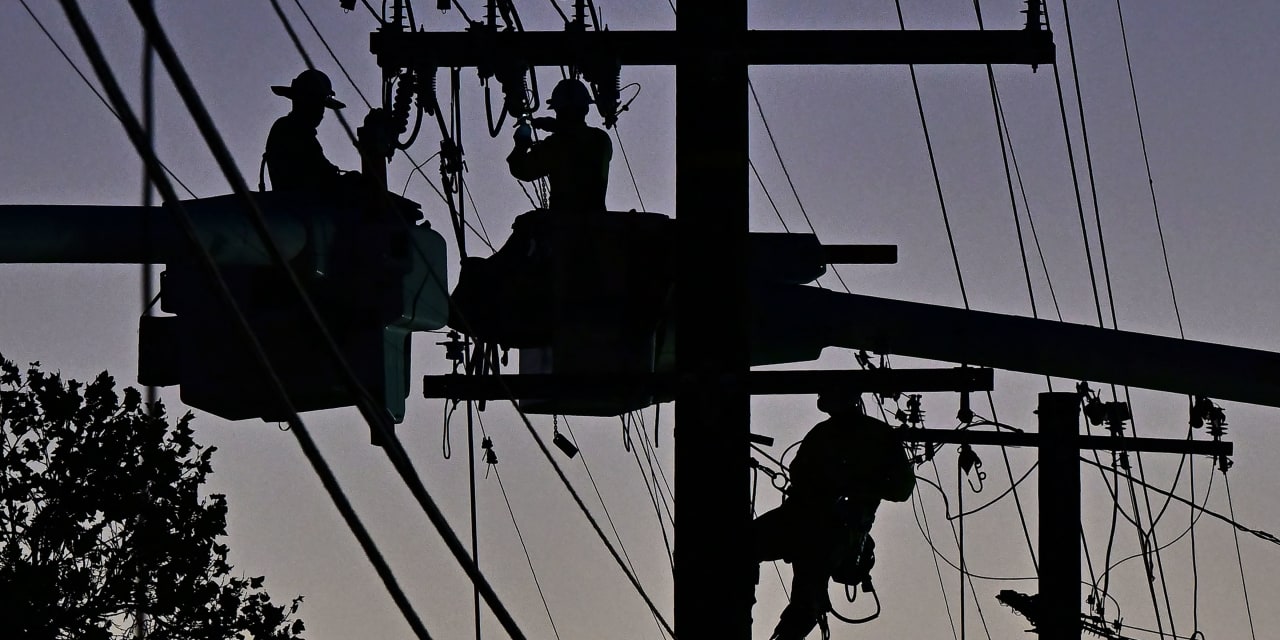

Data centers, electric vehicles, and heat pumps are all creating more demand for electricity. The result is that the utility industry is having trouble getting the gear it needs to pump out the power.

Builders are running into shortages of transformers—those buzzing boxes at the top of power poles—and transmission wires.

“We’re…seeing extended lead times for transformers,” said David Schulz, CFO at electrical distributor

Wesco,

at a conference in September. CEO John Engel said on the company’s third-quarter earnings conference call in November that the wait to get transformers was still longer than normal.

On Friday, the National Association of Home Builders announced plans to seek $1.2 billion in government funding to boost U.S. transformer production.

It isn’t just transformers that are needed. Power lines are hard to source, too. “

Prysmian

[lead time] is about 50 weeks plus,” said Jason Huang, CEO at TS Conductor. TS is a start-up making higher-tech transmission wires designed to carry more juice.

Prysmian is one of the dominant producers of cables globally. Its backlog of orders sits at about $11 billion, up from about $2.3 billion at the end of 2019.

Those data points are three canaries in the coal mine—so to speak—signaling that the U.S. isn’t quite ready to expand its electricity grid.

“You already have a tight supply situation,” added Huang, in an industry he said is poised to double its capital spending. The industry is “not even seeing that increase in your capex spending yet,” he said “This is just today’s environment.”

Overall, electricity demand growth is projected to accelerate, thanks to EVs and everything else that is going electric. The Energy Department sees electricity generation capacity expanding at a rate of about 2.6% a year over the coming 20 years, about double the rate since 1990.

Electric utilities in the U.S. have spent roughly $135 billion a year on average for the past few years to maintain and increase their capacity. That number should be near $170 billion in a couple of years, according to the Edison Electric Institute.

Growth is something the industry has to gear up for. Transformers are manufactured by the likes of

Eaton

and

Hubbell,

but most of the business is repair and replacement of existing infrastructure, explained RBC analyst Deane Dray. There hasn’t been a lot of investment for growth.

The good news is that will change. Companies such as Eaton and Prysmian can make good money as the grid grows.

Their numbers have already started to improve. Prysmian earnings have risen at about 57% a year for the past three years—between 2020 to 2023, including fourth-quarter estimates. Eaton has grown earnings at about 29% a year on average for that period.

For Prysmian, Wall Street expects earnings to rise at about 5% a year for the coming three years, according to FactSet. Analysts project 9% average annual earnings growth at Eaton over that time.

Wall Street sees earnings growth decelerating at both, but that doesn’t mean the peak is in. Analysts are loath to assume that good times will last forever, so they tend to forecast what they see as normal results.

Both stocks are popular on the Street. For Eaton, 64% of analysts covering the stock rate shares at Buy, while 71% of analysts covering Prysmian shares rate them Buy. The average Buy-rating ratio for stocks in the

S&P 500

is about 55%.

One reason analysts like both stocks is that supplying parts to the electrical grid is becoming a growth business again.

Write to Al Root at [email protected]

Read the full article here