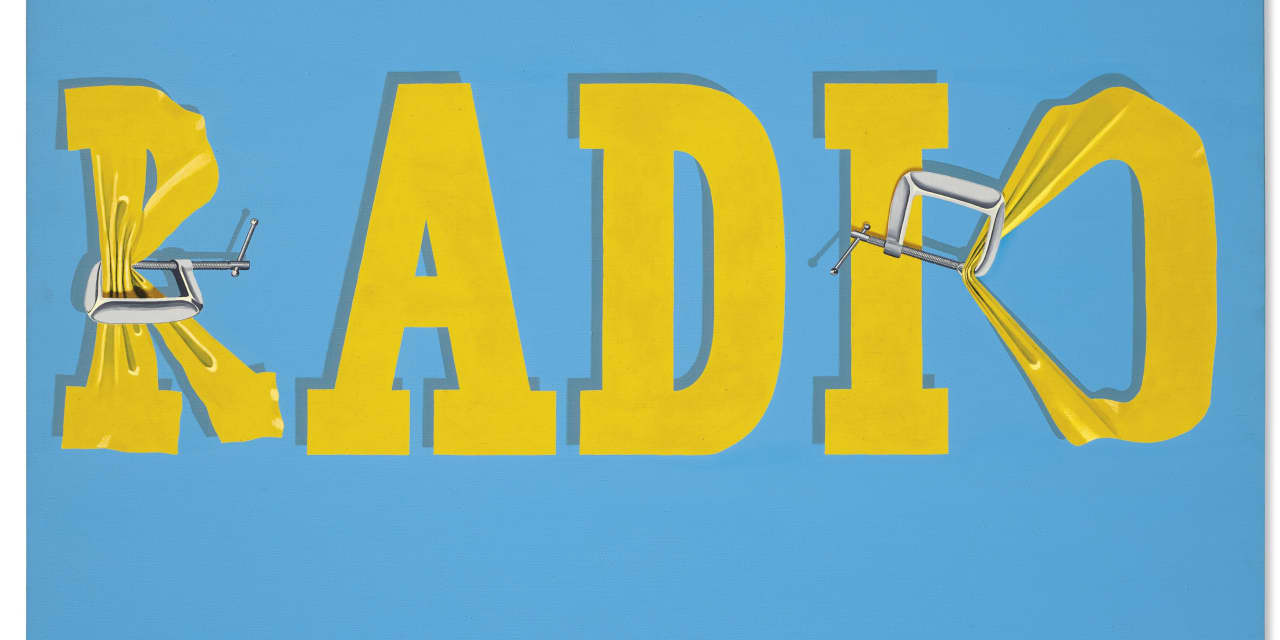

Philadelphia-based broadcaster Audacy has sought bankruptcy protection amid a sharp drop in radio advertising spending.

The company, which has radio and podcast operations, said it has filed a chapter 11 petition in the U.S. Bankruptcy Court for the Southern District of Texas after reaching an agreement with a majority of its creditors.

Audacy

plans to cut its $1.9 billion debt by roughly $1.6 billion, leaving $350 million of debt outstanding following the reorganization, subject to court approval.

A group of lenders will provide roughly $57 million in debtor-in-possession financing for the proceedings. Subject to court approval, Audacy expects the DIP financing and its cash from operations and available reserves to enable it to fulfill its commitments to employees, advertisers, partners, and vendors.

The company has been remaking itself in the past few years into a multiplatform audio content and information company, including its acquisition of CBS Radio in 2017. But its revenue has declined and its net losses have widened.

While its transformation has enhanced its competitive position in news and sports radio, “the perfect storm of sustained macroeconomic challenges over the past four years facing the traditional advertising market has led to a sharp reduction of several billion dollars in cumulative radio ad spending,” CEO David J. Field said in a statement. “These market factors have severely impacted our financial condition and necessitated our balance sheet restructuring.”

He expects Audacy to “emerge well positioned to continue its innovation and growth in the dynamic audio business.”

Audacy said it expects the court to hold a hearing in February to consider the plan, and that it expects to emerge from bankruptcy once it obtains approval from the Federal Communications Commission.

The Wall Street Journal last week reported that Audacy was preparing for such a move after it missed interest payments on its senior loans in October. It raised doubt last year over its ability to continue as a going concern. The company obtained consent from its lenders for a grace period to restructure its debt.

Write to Janet H. Cho at [email protected]

Read the full article here