Freeport-McMoRan Inc. (NYSE:FCX) investors have experienced debilitating pessimism to surging optimism within three months as the leading Copper miner prepares for its fourth-quarter or FQ4 earnings release on January 24.

I updated FCX holders in an October update, urging investors to capitalize on the then-freefalling shares, even as FCX fell toward its May 2023 low at the $33 level. That thesis has played out, as FCX has significantly outperformed the S&P 500 (SPX) (SPY) since then. That period coincided with a mini-tender offer by TRC Capital in early November to purchase “up to 3M shares of FCX’s common stock” at $32.2 per share. Freeport-McMoRan’s call to shareholders to reject the offer was apt, construing it as an opportunity by TRC Capital to “capitalize on uninformed or quick-to-sell shareholders.” Therefore, investors who sold their shares to TRC Capital at the lows have been given an invaluable lesson to assess investor psychology before pulling the buy/sell trigger and not falling prey to the market.

With FCX re-testing its early August 2023 levels, I assessed it’s apt for me to determine if I should still maintain my Buy rating or move to the sidelines, awaiting a more constructive opportunity.

It’s essential to consider the dilemma in our assessment of the Chinese economy. Notwithstanding the government’s efforts to support its domestic economy, weak consumption amid a property market malaise has dominated weak investor sentiments over the past year. Copper imports to China have also “decreased as China’s smelting expansion led to higher domestic processing of ore.” In addition, China’s leading automakers have mostly failed to meet their 2023 projections, given the increasingly competitive dynamics. In addition, these challenges have also hampered the development of China’s renewable power infrastructure, “hampered by grid constraints and slowing sales, impacting copper demand.”

However, copper demand/supply dynamics have also shifted to a tighter underlying supply, as noted by a “decrease in available global copper ore supplies.” Furthermore, I also enunciated in my previous update that Freeport-McMoRan management stressed that copper prices must rise above $4 to be commercially viable to “leverage its reserve portfolio.” The company has also projected higher underlying copper prices, suggesting it remains optimistic about its long-term outlook.

Despite that, copper futures (HG1:COM) have failed to regain the $4 level after briefly flirting just below that level in late December 2023. Consequently, selling pressure has re-emerged, with HG1 falling toward its late November 2023 levels over the past three weeks. Despite that, copper futures have already bottomed out in late October, in line with the bottom I anticipated for FCX. Hence, the selling intensity shouldn’t be unexpected, as profit-taking has likely occurred as the market reassesses the mixed signals from China.

FCX’s valuation remains priced at a premium against its peers. It last traded at a forward EBITDA multiple of 7.9x, well above its metals and mining peers’ median of 6x (based on S&P Cap IQ data). Seeking Alpha Quant’s “D-” valuation grade lends credence to my observation.

Freeport-McMoRan remains well-poised to benefit from the long-term opportunities in renewable energy transition and EV market share gains. However, it’s still important to pay attention to the market action to assess the most attractive risk/reward entry levels and potentially outperform the market.

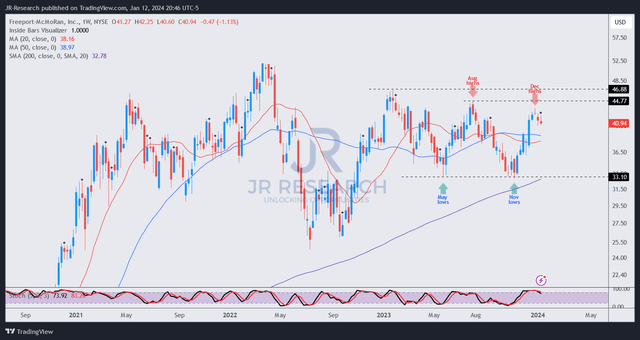

FCX price chart (weekly) (TradingView)

FCX formed an astute bear trap (false downside breakdown) in late October, taking out its May lows before validating its bullish reversal. The accumulation signal lasted four weeks through November at the $33 level, allowing pessimistic holders to unload their shares to astute dip buyers (such as TRC Capital) who understood the opportunity.

With the rapid surge in FCX over the past three months, the buying momentum has failed below a critical resistance level (August high: $45 level). It also coincides with the marked weakness in underlying copper futures, although it has not impacted the selling intensity in FCX yet. However, I assessed that FCX seems to be in a distribution zone, which could increase selling intensity when the sellers gain momentum.

Fundamentally, China’s mixed signals might not be constructive for investors in the near term. Technically, FCX’s price action suggests a steeper selloff is due, helping to improve the risk/reward profile for investors who missed buying its late 2023 lows.

Rating: Downgraded to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here