I urged investors in leading net-lease REIT W. P. Carey Inc. (WPC) to capitalize on its valuation dislocation in early November 2023. Back then, WPC sold off due to the implied uncertainties of its Net Lease Office Properties (NLOP) spin-off. As a result, WPC revisited the $50 level (last re-tested in May 2020), likely stunning weak holders into expecting that the worst could still be over the horizon.

However, by the time I provided my update, astute price action investors would have realized that WPC had been consolidating constructively at that level for over four to five weeks. In other words, I assessed dip buyers helped WPC form a base before staging a surging run from its early November lows, as weak holders offloaded their shares at the worst possible time.

With WPC recovering more than 35% (adjusted for dividends) from its early October 2023 low through last week’s high, it’s timely for us to reassess whether investors should consider allowing the recent optimism to cool off first. Consider that WPC is still down more than 12% over the past year on a total return basis. Taking a 5Y and 10Y view, WPC posted a total return CAGR of 5.4% and 7%, respectively. In other words, you could have outperformed substantially over its long-term averages by taking advantage of its peak pessimism opportunity laid out on a platter three months ago. After such a remarkable recovery, let us revisit what has changed since early November that has bolstered such a massive revaluation in WPC.

Recall that the Fed highlighted three potential rate cuts in 2024. However, if you waited for the Fed’s signal (in mid-December) to do so before picking up the pieces in WPC’s battering, you would have missed out on the meat of the recent move. Therefore, while Fed Chair Jerome Powell and his FOMC colleagues likely played a part, investors who correctly anticipated the move benefited more significantly.

For REIT investors, I believe it’s clear why the Fed’s move matters. Yes, they have not cut yet, but the market isn’t going to wait till it cuts before moving to re-rating WPC. Consider WPC’s valuation priced in such steep pessimism in October 2023 that its AFFO per share multiple fell to 10.1x, well below its 10Y average of 13.9x. Therefore, these dip-buyers capitalized on a highly attractive valuation, anticipating a more dovish Fed (moving ahead) as they moved to add exposure. That should be how WPC investors consider its bullish thesis, as it’s a fundamentally strong and well-diversified REIT.

As it curtailed its office exposure to 16% of its annualized base rent or ABR, it’s expected to bolster W. P. Carey’s valuation tailwinds as it looks to reinvest. In addition, the company provided a recent investment update, highlighting a full-year investment volume of $1.3B. It includes a cadence of $320M in the fourth quarter, indicating the REIT’s ability to capitalize on attractive cap rates (weighted average: 7.7%) to boost its portfolio. W. P. Carey also projects $180M in closures in January 2024, suggesting that the investment momentum is expected to carry on.

I believe WPC investors are familiar with the high-quality characteristics brought by the REIT. It’s rated BBB+ (stable) by S&P, focusing on single tenants and providing “stable and predictable cash flows.” Given its recent office portfolio spinoff, it has also allowed W. P. Carey to improve its debt profile, helping to maintain an adjusted EBITDA leverage ratio in the mid-to-high 5 levels. With the Fed’s rate cuts potentially actualizing this year, the market has likely re-priced its cost of capital, bolstering its ability to sustain its improved AFFO payout ratio. While I still see the potential for a lowered growth profile in its same-store NOI as inflation rates peaked, it was likely priced in when WPC hit peak pessimism in October.

With WPC’s AFFO per share multiple crossing above the 14.2x level recently, it has also fully normalized against its 10Y average. In other words, I assessed that investors who missed buying three months ago should consider waiting for another more attractive dip-buying opportunity.

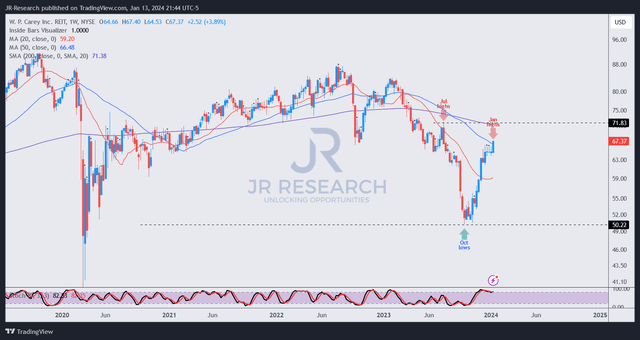

WPC price chart (weekly) (TradingView)

I gleaned that WPC’s resurgence could still have more upside potential, reaching the $72 zone before consolidating. However, the risk/reward profile is much less attractive than the one I assessed in early November. Furthermore, such sharp momentum spikes could be more prone to intense profit-taking as dip buyers reallocate their exposure to protect sharp gains.

Consequently, it could also spur higher potential downside volatility, presenting more attractive opportunities for investors looking to add more exposure. As a result, I encourage investors not to chase the recent surge if they have not added. Instead, they can consider assessing potential consolidation zones within the $56 to $59 level to add more exposure, partaking in the medium-term recovery in WPC.

Rating: Downgraded to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here