It’s been about four months since I wrote my dour article about Value Line Inc. (NASDAQ:VALU), and in that time the shares have returned negative 11% against a gain of about 5.6% for the S&P 500. A stock trading at $44.20 is more compelling than one that’s trading at $50, though, so I thought I’d review the name again. I’ll determine whether or not it makes sense to buy by looking at the most recent financial results from the firm and by looking at the valuation. When I judge the valuation, I’m going to do so against the stock’s own history, and against alternatives available to investors today, namely the 10-Year Treasury Note.

I know that my writing can be a bit “extra” as some of the young people apparently say. Some people are driven away by the tiresome jokes, some don’t like the fact that I’m writing bad things about their preferred investments, and some people are turned off by all of the proper spelling. Whatever the reason, my stuff can be “a bit much.” For that reason, I write a “thesis statement” paragraph at the beginning of each of my articles. This allows the investor to get in, get the gist of my thinking, and then get out again before my writing induces vertigo or nausea. You’re welcome.

I think Value Line is the canonical “cash cow.” The business doesn’t grow very much, and over 60% of net income is spun out in the form of a dividend. Given that, I think we should judge it as a cash cow business. When we compare it to the 10-Year Treasury Note, things don’t look great. The dividend would need to grow at a CAGR of greater than 10% to simply earn the (much less risky) cash flows earned by the Treasury Note holder. So, people who buy this stock are taking on more risk, and getting a lower return than a Treasury Note holder. That makes very little sense to me. Investing is a relativistic game, where we’re always hunting for the best risk adjusted returns. The stock offers lower returns, and higher risk in my view, and for that reason I see no point in owning the stock.

Financial Snapshot

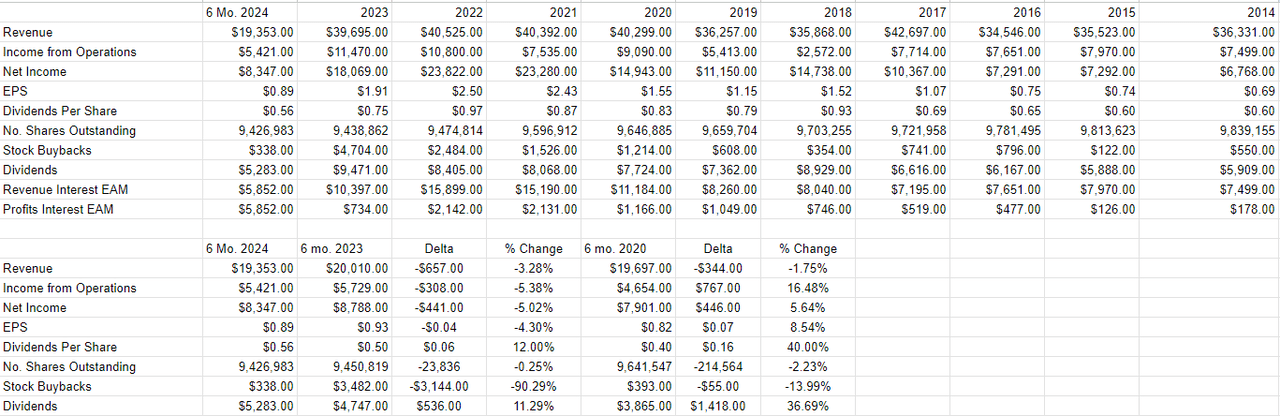

I’d say that relative to the same period a year ago, the most recent financial results could be described as “lackluster.” Specifically, revenue, income from operations, and net income are down by 3.3%, 5.4%, and 5% respectively. Additionally, the trend here is not great in my view, given that revenue for the latest six months is actually lower (by 1.75%) relative to the same period in 2019. This is one of those companies that seems to be generating less sales now than they did prior to the pandemic. Given that the company pays out about 63.3% of its net income in the form of dividends, I think we should consider this to be the proverbial “cash cow”, and I think we should value the shares accordingly.

While I don’t think there’s anything particularly wrong with the business, I don’t think it’s worth much of a premium, and so I’d only be willing to buy it if the shares were reasonably priced.

Value Line Financials (Value Line investor relations)

The Stock

Those who have some familiarity with my stuff know that I judge the business and the stock that supposedly represents the business as two distinct “things.” This is because the stock is often a poor proxy for what’s going on at the business, or what will eventually happen to the business. Acknowledging the disconnect between the two is the reason that a site like this one exists, for instance, so I feel like I’m on pretty solid intellectual footing here.

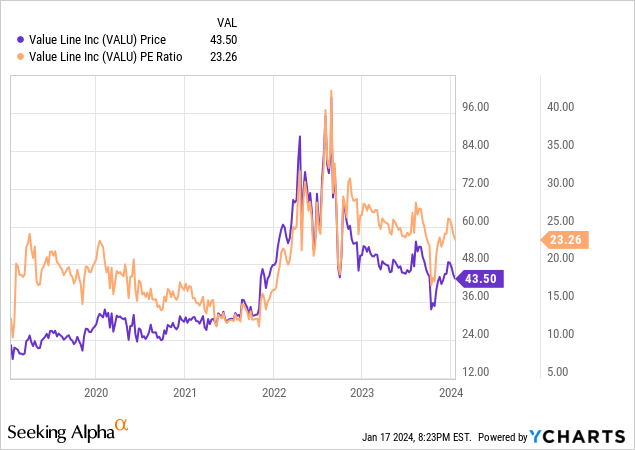

Anyway, I think the stock of even the most sclerotic business such as this can be a great investment if you get it at the right price. In this context, “right price” means “sufficient discount relative to the overall market and the stock’s own history.” We see from the chart below that the stock is actually trading at a fairly hefty premium relative to what it had when revenue was actually higher than today.

In addition to looking at simple ratios, I want to compare the attractiveness of the stock to the risk free investments that an investor might buy. So, I also consider the stock relative to a 10-Year Treasury Note. After all, if an investor can receive the same, or greater, cash flows from a Treasury Note than from a stock, why buy the more risky stock? This gets to the idea that we need a risk premium when we buy stocks, and absent a reasonable risk premium, it makes little sense to buy.

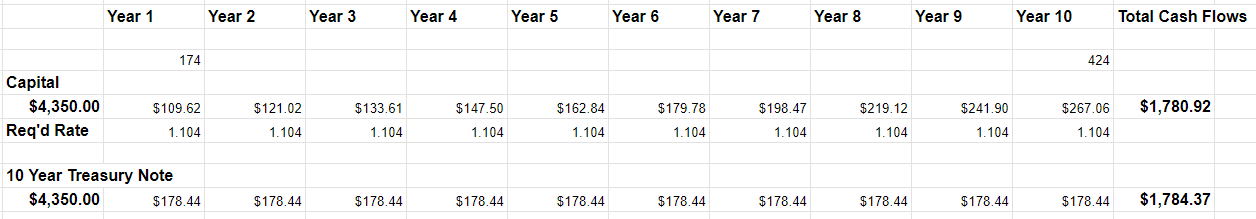

Given that the yield on the 10-Year Treasury Note is currently about 4.1%, and given that Value Line’s dividend yield is only about 2.5%, the dividend would need to grow from current levels to match the level of income earned by the holder of the Treasury Note. You may be wondering “at what rate would the Value Line dividend need to grow to match the cash flows earned by the owner of the Treasury Note?” I’m glad you asked me that my rhetorically convenient friend. I’m glad you asked because answering the question will give me the opportunity to show off one of my favourite investment tools: the “everything relative to Treasury Notes” table.

We see from that table, reprinted here for your enjoyment and edification, that the dividend would need to grow at a CAGR of about 10.4% over the next decade to match the cash flows from the Treasury Note.

Value Line v. Treasury Note (Author calculations)

It’s at this point that I feel compelled to remind all of you that revenue is lower today than it was in 2019. I also feel compelled to remind you that the payout ratio for this stock is sitting around 63%. These two facts suggest that the holder of this stock over the next decade may not earn the same level of cash as the Treasury Note holder. This prompts the question: why would you buy the relatively more risky stock to earn less money than you would on the relatively less risky Treasury Note? At some point predictability becomes an attractive quality, and at some point we need to consider the relative merits of investment A to investment B. On these merits, Value Line is simply less compelling an investment than the Treasury Note in my view. For that reason, I would recommend eschewing this stock until some combination of lower yield on the Treasury Note, or higher dividend yield on the stock move in favour of the equity.

Read the full article here