We’re in a golden age of medical discovery. Consider just a handful of new treatments approved in 2023: Perhaps the most revolutionary is a therapy for sickle-cell disease, an inherited blood disorder that causes extreme pain. The treatment is the first approved medicine based on CRISPR gene-editing technology.

Other breakthroughs continue to proliferate at a record pace. In fact, 2023 saw more novel therapeutics approved than almost any other year in the 21st century.

These advances include the first-ever cellular therapy to treat Type 1 diabetes. It introduces donor pancreatic cells into a patient’s bloodstream, where they create insulin and help regulate blood-glucose levels. This liberates patients from frequent injections.

Last summer, the U.S. Food and Drug Administration granted full approval for a new Alzheimer’s drug for the first time in more than 20 years. The breakthrough therapy slowed disease progression by 27% in clinical trials. FDA approvals are also expected for new drugs to treat cancer and inflammatory conditions, among other ailments.

Unfortunately, this run of success may not last. Short-sighted U.S. government policy threatens to dismantle the incentives for future medical discovery.

Consider the Inflation Reduction Act (IRA), enacted in 2022. It grants the U.S. Department of Health and Human Services the power to “negotiate” drug prices under Medicare, though “negotiate” is a misnomer. If companies don’t accept the government-set price for a particular medicine, they face an escalating tax penalty of up to 19 times the price of that drug.

These price controls could force many companies, particularly smaller companies, to shutter research on important new medicines. This would have an outsize impact on innovation, since around 64% of novel-drug approvals originate at small companies.

Studies from the University of Chicago, the University of Southern California and elsewhere have all found that IRA price caps will reduce the number of new medicines that come to market. A new study by health-data company Vital Transformation reports that these caps could prevent as many as 139 new drugs from coming to market over the next decade.

Common-sense solutions

A number of smaller common-sense reforms now being considered would mitigate the worst effects of the IRA.

The ORPHAN Cures Act, for instance, is a bipartisan bill introduced by Reps. John Joyce, a Pennsylvania Republican, and Wiley Nickel, a North Carolina Democrat, in the House, as well as Sens. John Barrasso, a Wyoming Republican, and Tom Carper, a Delaware Democrat, in the Senate.

The legislation would address a provision in the IRA that could lead to fewer new rare-disease therapies. As currently written, the IRA exempts so-called orphan drugs, which are those that treat rare diseases, from price controls — but only as long as the drug in question only treats a single rare disease and no more.

This restriction discourages drugmakers from further testing to discover additional applications. The ORPHAN Cures Act would change the current incentive structure to encourage, rather than discourage, finding additional uses for orphan drugs.

Recent survey data demonstrates Americans’ strong support for the ORPHAN Cures Act. For example, a Morning Consult poll taken last November found that almost 70% of voters want their representatives in Washington to support the bill, while close to 80% said they don’t want the government to discourage scientists from researching treatments that could treat more than one rare disease.

But revising the IRA mustn’t stop with the ORPHAN Cures Act. Lawmakers should also fix the IRA’s “small-molecule penalty.” Existing law creates an arbitrary distinction between large-molecule or “biologic” drugs, which are typically administered as injections or infusions, and small-molecule drugs, which are more common and usually taken orally.

The IRA grants biologics 13 years of exemption from price-cap eligibility, while small-molecule drugs have nine years — a short window in which to break even on a drug that may have cost billions of dollars to develop.

Having different timelines for small-molecule and biologic drugs makes little sense, given that we need both types of medicines. Discouraging small-molecule development could be more costly for both the U.S. health system and individual patients.

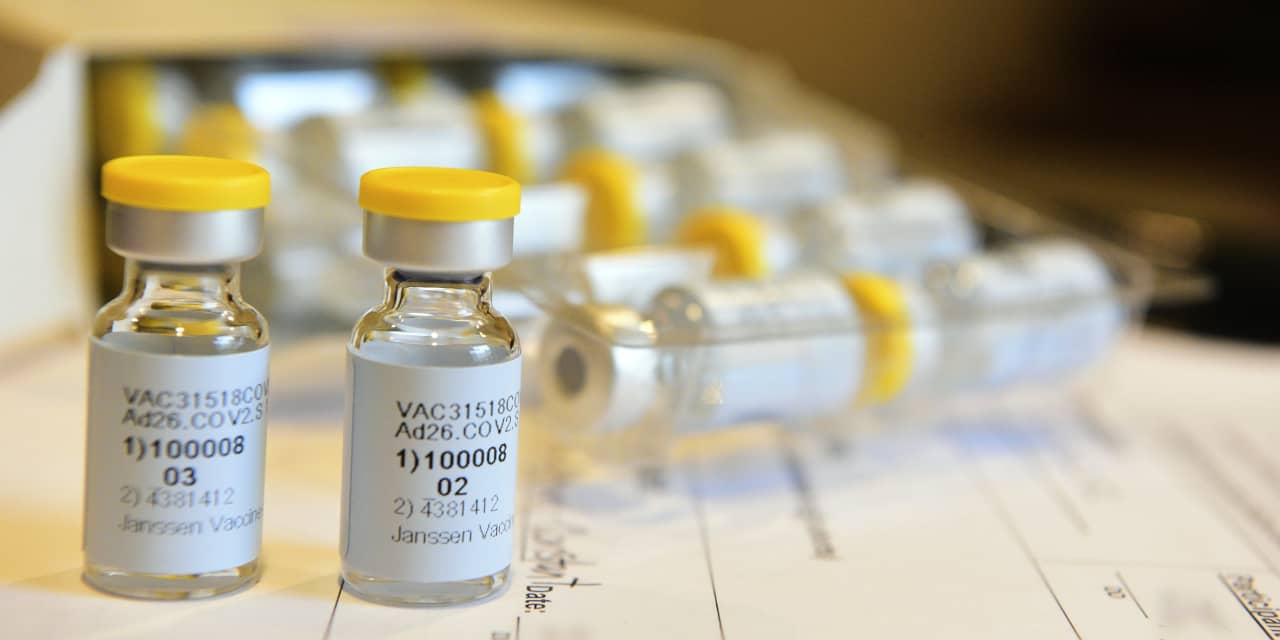

U.S. political leaders and policymakers love to celebrate American innovation, and rightly so. From CRISPR to the mRNA advances that enabled scientists to develop Covid-19 vaccines in less than a year, it’s been an extraordinary decade of progress.

But if leaders are serious about helping patients, policymakers on both sides of the aisle should work together to offset the most harmful parts of the IRA. Passing the ORPHAN Cures Act and addressing the IRA’s small-molecule penalty would go a long way toward protecting patient health and access. We’re at a moment of great medical progress. But we also need wise policy to ensure that it bears fruit.

Rachel King is CEO of the Biotechnology Innovation Organization, an industry trade group. She is co-founder and former CEO of GlycoMimetics and serves on the board of Novavax.

More: Biden administration’s antitrust victories are much-needed wins for consumers

Plus: Sharing COVID therapy secrets is a Trojan horse that would gut U.S. biotech

Read the full article here