In a few thousand words, you’ll arrive at the conclusion of our account of the 2024 Barron’s Roundtable, as interesting a gathering of market mavens and stockpickers as any we can recall in recent years. For a group that largely considered the 2024 outlook for equities “meh” when the Roundtable met on Jan. 8, our panelists managed to recommend a total of 56 stocks—and a handful of bond funds, too—in a daylong discussion.

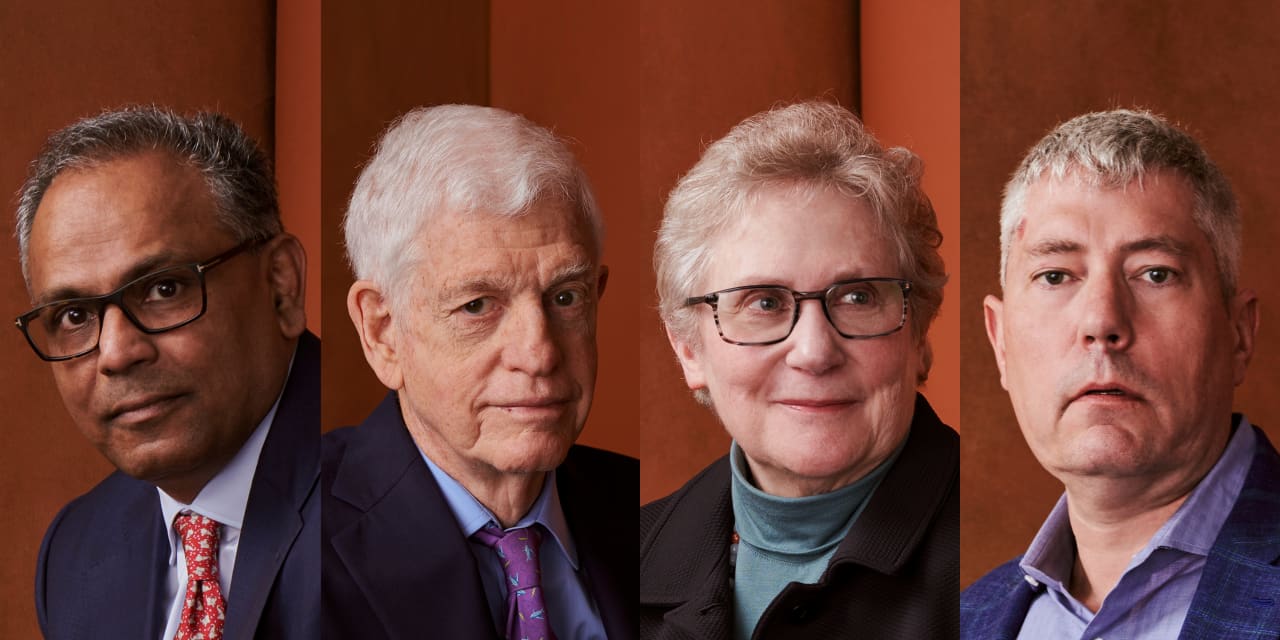

This week’s third and final report on the proceedings includes the investment recommendations of Henry Ellenbogen, Rajiv Jain, Abby Joseph Cohen, and Mario Gabelli—a foursome whose stocks and stock-picking styles vary greatly, despite a shared penchant for seeking value.

Henry, chief investment officer and managing partner of Durable Capital Partners, likes private markets, platform companies, and franchises whose value compounds over time—and his Birkenstocks.

Rajiv, chairman and CIO of

GQG Partners,

hopscotches from Abu Dhabi to Rio de Janeiro to Jakarta to Santa Clara to place big bets on fast-growing businesses benefiting from a changing world.

Abby, a professor of business at Columbia Business School, schooled us in the potential revival of beaten-up U.S. blue chips and the attractions of Japanese REITs.

And who knows more about “corporate lovemaking,” and the companies likely to prosper from mergers, spinoffs, and other transactions, than Mario Gabelli, chairman and chief executive officer of Gabelli Funds?

Whether or not you agree with their picks and prognostications, all four are worth a listen. Lend them an ear via the edited commentary below.

Henry, what looks promising to you this year?

Henry Ellenbogen:

Chemed

is a holding company with two durable franchises, one in healthcare services and one in home services, led by a proven CEO. From 2001 to 2019, the stock compounded at 20% a year, while the

S&P 500

compounded at 7%. The company gets little attention on Wall Street, in part because of its complexity. The Covid pandemic created headwinds for Chemed, but they are now behind us. Normalized growth is returning, defined as midteens growth in adjusted earnings per share.

Tell us about the businesses.

Ellenbogen: Vitas Healthcare provides hospice care, and is 92% funded by Medicare. The business is driven by aging demographics and increased acceptance. There are four market-share leaders in the U.S., and many smaller, private companies. Vitas is the largest hospice provider in Florida, a particularly attractive market that accounts for 50% to 60% of revenue.

Covid materially disrupted the business, and Ebitda [earnings before interest, taxes, depreciation, and amortization] fell 10% from 2019 to 2022. After several years of operational improvements, Vitas has begun to add capacity, and the business has inflected positively. We expect that revenue grew 10% in 2023, and that the growth rate will be sustained in the next few years.

The other business, Roto-Rooter, is the largest emergency plumbing service in the U.S. It is also a franchiser, with high returns on invested capital. Plumbing is a relatively acyclical business, but with people working at home during the pandemic, demand increased and revenue grew by 18% in 2021. Then, as people returned to the office, demand weakened and the company faced tougher comparable-period sales. Roto-Rooter historically has emerged from downturns stronger because it has used soft periods to effectively acquire more plumbers. Annual revenue growth could return to 5%-6%.

How did a hospice provider and a plumbing service wind up under one corporate roof?

Ellenbogen: Chemed was a classic conglomerate. The CEO, Kevin McNamara, shrunk it down to the two best businesses. The company has used its significant free cash flow to shrink the share base, as well. We expect earnings to accelerate in coming years. The company could earn close to $28 a share in 2025, and has zero debt. It deserves to trade between 22 and 28 times earnings.

David Giroux: It is already trading at 25 times earnings.

Ellenbogen: We expect Chemed to beat earnings estimates.

My next pick was also hurt by Covid, and growth is accelerating as we move beyond the pandemic.

Bright Horizons Family Solutions

stock returned 30% a year, on average, from its 2013 initial public offering until the start of the pandemic, while the S&P 500 returned 12%. A lot of that growth was [price/earnings] multiple expansion, but a healthy amount was actual earnings growth.

Bright Horizons has two leading franchises, both built off the simple idea that employers want to maximize the productivity and retention of their most important assets, their employees. One business offers structured childcare as an employee benefit, and the other offers backup care. Employers fund all or part of the childcare business, which allows the company to pay preschool teachers well. Bright Horizons boasts a more than 95% client-retention rate. It is five times bigger than any other player in the employer-sponsored childcare market.

The company operates more than 1,000 premium childcare centers, 850 of which were forced to close during Covid. The majority of front-line staff was furloughed. The center business delivered $166 million of profits in 2019, and would barely have broken even during the pandemic without government support. As Covid eased, the business had a tough time ramping up again, given high inflation. But now it is past the peak pain point, and wage pressures have normalized. Occupancy is 75% of pre-Covid levels, but demand for childcare is high, and enrollment is growing by 12% year over year.

What is the outlook for the backup-care business?

Ellenbogen: That business provides care when an employee’s childcare arrangement falls through. Generally, an employer will subsidize 20 days a year of childcare, either at a center or through a home healthcare worker. Bright Horizons has no competition in this segment. It created the benefit, and has 1,100-plus backup-care clients. This business had $80 million of Ebitda in 2019, and revenue could double from 2019 levels by 2024. This is a higher-margin business, and should grow faster than the structured childcare business.

Sonal Desai: Are these businesses offered only for preschool?

Ellenbogen: The childcare centers are for preschoolers. The backup-care business also engages with slightly older children because it has added services like virtual tutoring and summer camps.

We expect Bright Horizons to earn about $4.50 a share in 2025. Our estimate is materially above Wall Street’s. Beyond then, earnings could grow at a midteens rate. The company has a money-losing business in the United Kingdom that accounts for about 16% of revenue. It might take strategic action on that, which would be additive to earnings, but that isn’t in our estimates. In 2019, Bright Horizons traded for 30 times earnings. We expect it to trade at a multiple in the mid-20s from here.

I recommended

J.B. Hunt Transport Services

in the past. The best time to buy a growth cyclical is near the bottom of a cycle. Freight has been weak since the fourth quarter of 2022. At some point, it will improve and investors will want to own companies that have done two things: proved their resilience through the cycle, and maintained or improved the quality of their business. J.B. Hunt has done both. The company has significantly improved its growth profile in recent years.

Intermodal transport [shipping freight by two or more transportation modes] represents 55% of total operating income. Intermodal is 20% to 30% less expensive than moving freight long-distance by truck only. J.B. Hunt basically pioneered this industry in the 1980s, although prior to last year it hadn’t gained share in intermodal since the 2010s, due to tensions with its primary partner, BNSF Railway. Now the tensions have been resolved, and J.B. Hunt increased market share last year by five percentage points.

The company’s intermodal business should be able to grow at two times GDP [gross domestic product]. Also, as service improves, the company should be able to get better pricing. As volume comes back, segment margins could rise to 10% to 12%.

What else does J.B. Hunt do?

Ellenbogen: Its Dedicated Contract Services segment is the largest provider of outsourced fleet management for small and midsize companies with about 20 to 200 trucks. DCS has grown through the cycle and now contributes 40% of operating income, versus 28% in 2018. It is a one-of-a-kind business that is significantly undervalued. The business operates with three- to five-year contracts with inflation escalators. It has 98% customer retention, and generates 10%-20% cost savings for customers. It is the closest thing I have seen to a subscription business in transportation. DCS’ operating income rose about 15% in 2023, and will continue to compound at 10% to 15% in the next few years. [The company reported 2023 earnings on Jan. 18. DCS operating income rose 12%.]

Timing the freight cycle is tough, but we expect J.B. Hunt to earn close to $10 a share in 2025 and trade at a price/earnings multiple of 23 to 25.

Todd Ahlsten: How would you compare J.B. Hunt with

Old Dominion Freight Line

?

Ellenbogen: Both are excellent companies. Old Dominion is a pure play on LTL [less-than-truckload transport]. It is a high-service provider with the best terminal network, and earns higher returns on capital because of it. It is in the B2B [business-to-business] segment.

Tesla

is a large customer. J.B. Hunt’s DCS segment is a lower return-on-investment business, but a higher top-line grower than ODFL. It is going to double in the next five years, but is still only 40% of the business. Old Dominion should trade at a higher P/E multiple.

One good thing about an economic downturn, especially for young companies, is that you get to see how their business models and management teams handle stress. As we have left the free-money era, we have learned a lot about younger companies. My next recommendation,

HubSpot,

is emerging as the leading provider of customer-relationship-management, or CRM, software for small and midsize businesses globally. It serves B2B companies with 25 to 2,000 employees. It was built organically on a single [computer] code base, meaning its software is easier to use and lower-cost to operate than competitive offerings. Companies need to standardize their code base to get ready for artificial intelligence. HubSpot is already there.

HubSpot came public in 2014. The company has built a complete front-office suite of software products for marketing, CRM, and customer service. In the past two years, HubSpot has won market share across the globe. Last year, in the face of macro headwinds that affected small and midsize businesses, it grew revenue 25%, on top of 39% growth in 2022, off a $2 billion base.

There are two debates about HubSpot. How big can the company get, and what will long-term margins look like? HubSpot’s market penetration is in the early stages. The company established its product set only in 2020. The global market is large, and HubSpot can grow for many years before it competes with

Salesforce.

We believe HubSpot can achieve an operating-margin profile of 30%-plus, versus the current 15%. CEO Yamini Rangan is focused on balancing growth and profitability as the cost of capital has risen. Also, as HubSpot moves upmarket, it is selling more to larger customers, which leads to an improvement in unit economics. Generative AI’s initial use cases partly involve content creation, customer service, and summarizing information—all core functions of HubSpot. The company has weaved AI into its products already, even if customers don’t realize it.

We don’t model any benefits from AI on price or volume, although you will see them relatively soon. We expect the company to generate about $1 billion of Ebitda in 2026, and trade for 25 to 30 times enterprise value to Ebitda.

Giroux: In 2021, stock-based compensation was elevated at a lot of software companies. Is it coming down?

Ellenbogen: HubSpot’s stock-based comp is high, but management is focused on bringing it down.

It wasn’t easy to go public in 2023 because investors demanded not just growth but also financial performance. But often the best companies go public in tough markets, and

Birkenstock Holding,

the German footwear company, was one. We expect it to prove a durable global franchise.

Birkenstock was founded in 1774, long before

Hermès

in the 1800s or Chanel in the early 1900s, or almost any luxury brand relevant today. Brand awareness in the U.S. is 68%, even though the company spends only 2% of revenue on advertising [ex-keyword costs], while most footwear companies spend 10%. What also struck us in our due diligence was a lack of discounting. Birkenstock took a page from the best European luxury brands by constraining supply growth relative to demand. There is also a relative lack of fashion risk, as 75% of the business comes from five perennial silhouettes. All but one have been in the market for over 40 years. By the way, I have a pair. They’re incredibly comfortable.

Glad to hear that.

Ellenbogen: Oliver Reichert became CEO in 2013. He’s the first CEO outside the family. Since his arrival, revenue has grown by 20% a year. He has kept manufacturing in Germany, embellished the core silhouettes, limited distribution, and optimized the sales channel mix. As a result, we anticipate unit growth of 8% to 10%, and average price growth of 10%. Revenue could compound by 20% for several more years. Birkenstock has industry-leading Ebitda margins of 30%, and we look for earnings of 2.50 euros [$2.73] in the fiscal year ending in September 2026. The stock could trade for 20 to 25 times earnings as people understand that it is more of a perennial than a fashion item. It is selling for $45.70, or just about its IPO price of $46.

I discussed

Toast

in the midyear Roundtable. We first invested in 2020, when the company was private. The story is simple. Restaurants want to standardize their software. There is a lot of staff turnover, and they want to hire people who know how to use the technology. Also, no restaurant has a $2 million IT [information technology] department. Toast has become the industry standard for point of sale, human resources, and CRM. It spends 10 times more on research and development than other industry players. Restaurants love it.

The stock didn’t do much last year.

Ellenbogen: Toast missed guidance on average software revenue per user in the back half of 2023. This is an important metric because there are only so many restaurants to sell to. Investors think the company will tap out market penetration relatively soon. We don’t see that, and expect revenue to continue growing by 25% for the next several years. Margins could climb to 20% from break-even this year. Toast could earn 75 cents to $1 a share by 2027. We see the stock trading up to $30 from $17.

Thanks, Henry. Rajiv, are you ready to roll?

Rajiv Jain: While we are bottom-up investors, we pay attention to the macro backdrop. Rising inflation and interest rates have certain implications for high-multiple stocks. Government policies can matter. You can see this, for example, in the power issues developing in emerging markets. Lack of bank financing is leading to little thermal capacity addition, and hence no real alternative for base load. Consequently, there is an increasing risk of power shortages in most countries. LNG [liquefied natural gas] at $13 isn’t an affordable option for most, while renewables aren’t dependable for base load.

We are bullish on the semiconductor space. We entered 2022 with only a 5% weighting in tech stocks. Partially because of rising inflation, we thought high-multiple stocks would get nailed. That hurt our performance last year, but in the second half of 2023, we found semiconductor stocks attractive for several reasons.

One, WFE [wafer-fabrication equipment] is running at $85 billion, but could easily normalize to $110 billion to $115 billion over the next three years. It should grow at a high-single digit rate over the longer run. We feel the industry is underearning based on longer-term demand trends, which is the opposite of 2021, when, because of Covid stimulus, it was overearning. Demand for chips is on the rise, as we all know.

PC sales are running around 240 million to 245 million units, whereas five years ago they were running around 280 million units. Smartphone sales peaked six or seven years ago, but have a life span of only seven or eight years, so a replacement cycle is coming. AI is also a driver for both. There are a couple of names to focus on.

Such as?

Jain:

Nvidia

is by far our largest position. The P/E multiple has come down, and the stock is back to selling for 23-24 times 2025 earnings. Earnings estimates have gone up dramatically. Nvidia is increasing prices, which isn’t common in semiconductors. You’re looking at 100% price increases for various chips, so gross margins are expanding along with revenue growth. The company has a $1.5 trillion market cap, but could easily continue growing at a 20% compound annual rate. It still has only a 15% market share in servers. The biggest issue could be capacity constraints at

Taiwan Semiconductor Manufacturing,

an Nvidia supplier.

You could view

Arm Holdings

in the same context. It came public in September and is trading for 50 times earnings. The company dominates the market for mobile chip architecture and is gaining share in central processing units. ARM used to earn a 1.7% royalty on the use of its processor designs, but that could easily rise to high-single or low-double digits. Arm could grow by 20%-plus a year for a long time. Ninety percent of the stock is still owned by SoftBank.

Nvidia and Arm are big, liquid stocks. We rarely invest below the top tenth percentile of market cap. We view

Synopsys

as a “cousin” of Arm. It is also a fantastic company.

Where are you investing outside of tech?

Jain:

Petrobras

[Petróleo Brasileiro] is a large position. We have owned it for more than two years. We are upbeat on energy markets. It became obvious in the past few years that there is massive underinvestment in the energy space. Capital spending has gone from $700 billion to $350 billion. Petrobras had a lot of issues 10 to 12 years ago. The company changed its governance standards and cut costs.

This is probably the cheapest large-cap stock in the world, trading at four times earnings. Since we bought it, we have gotten almost all of our capital back as dividends, and it still has a dividend yield of almost 20%. The company pays out 40% of its free cash flow as dividends, and pays special dividends. But it isn’t for the faint of heart: There is a lot of political noise in Brazil.

Petrobras has some of the best energy assets outside of the Middle East, and a lot of room to grow production. It has a low depletion rate. The company is as profitable as

Chevron,

and selling for a third of Chevron’s valuation. We see a bargain.

Banco BTG Pactual is another Brazilian company we like. There’s a joke that the initials stand for Better Than Goldman. The company is controlled by André Esteves, who sold it to

UBS

in 2006 and bought it back in 2009. BTG has a $30 billion market cap and has grown by 20%-plus a year over the past 10 years. Return on equity is 20%.

What lies ahead?

Jain: We are bullish on Brazil. Credit growth is running at almost a midteens rate, even as interest rates have risen from 4% to a peak of 13%. Rates are now around 11% and likely heading lower. Insiders own 70% of BTG. They can only sell the stock at book value, so there is an incentive to increase book. The stock trades at two times book value, and about 12 times earnings. It could compound annually in the high teens.

The Brazilian real has been one of the best-performing currencies in the past three years. Like the Mexican peso, it is up 15%. These countries have fewer worries than in the past about the impact of Federal Reserve policy, partially because of the reforms they have undertaken. Brazil has privatized some of its biggest companies, including

Eletrobras.

Moving east, we like

Banco Bilbao Vizcaya Argentaria,

or BBVA. It has a $58.2 billion market cap and trades for 6.5 times earnings. The dividend yield is almost 7%. BBVA receives almost 40% of the profits pool of the Mexican banking system. Mexico’s banking system is unique, in that it is extremely underpenetrated but highly consolidated. Three players control almost 80% of the system. Mexico accounts for 50% of BBVA’s profits, and Turkey, 15%. The bank’s return on equity is almost 20%, and it has been buying back shares.

Heading south, we are bullish on the Middle East. We have spent a lot of time working there, and countries are opening up. We own International Holding Company, IHC, a brokerage firm headquartered in the United Arab Emirates. The company has a $270 billion market cap. It is 75% owned by the royal family of the U.A.E. We believe the business can compound at double digits. The U.A.E. economy is growing by 5% or 6% a year. There is a lot of oil wealth, and per capita income is $90,000. Hedge funds are opening in Abu Dhabi, and it is hard to find commercial real estate.

What is the best way to buy IHC?

Jain: You can buy it on the Abu Dhabi stock exchange. Almost 60% of the earnings are annuity-like, and earnings could head much higher. The bulk of profits come from real estate, healthcare, and other services, mostly in the U.A.E. but also around the region. IHC gets a first peek of sorts at a lot of global venture-capital deals. It was one of the earliest investors in SpaceX. The parent injects assets from other companies into IHC, and injected almost $25 billion a few weeks ago. Needless to say, we like free asset injections, but the company also has organic growth from pretty sticky assets. The management is excellent and has shown a knack for savvy deals.

So, this is really a play on the royal family. Jain: And Abu Dhabi, and the U.A.E. It isn’t a big risk for three reasons. Core earnings should grow at a high-single digit to low-double digit rate. Asset injections have been significant over the past five years, and the company can buy back stock due to stable free-cash-flow generation. The U.A.E. is an extremely wealthy country. It controls almost 3% of global oil reserves. Most important, it’s also an extremely well-managed country.

Heading further east, India is in the midst of an infrastructure boom. It has an almost $4.5 trillion economy, twice the size of Australia and larger than the U.K. India has constructed almost 6,000 miles of roads a year for the past five years. Capital spending on railways has grown by nine times. The government has built 30 million lower-income homes over the past decade. It has also digitized many services, like tax collection, which has brought the informal economy into the formalized world.

From an infrastructure perspective, companies tied to the

Adani Group

are the best investment. It has a very dynamic and competent management team. The stocks fell last year after a short seller’s report. [The company denied the accusations, and India’s Supreme Court recently turned down requests for a special investigation.] Adani Enterprises, the company’s flagship, listed in 1994. Since then, it has compounded at 32% a year in dollar terms. It’s a must-own name in India. In the past 25 years, it has been a better investment than Nvidia and

Apple.

The company has a $45 billion market cap.

Adani Enterprises controls almost 25% of India’s air-passenger traffic. Airports are some of the best assets to own. Passenger traffic is growing at a midteens rate. The company controls about 30% of air cargo volume. India has built 70 new airports in the past six years and will privatize 70 others in the next five or six years. Adani also owns an eclectic group of assets including roads, the largest data centers in India, and mining services.

India’s government has changed a lot in the past three decades. Could an Indian election and political shift hurt the company?

Jain: That is the biggest short-term risk, but they have managed to operate through many changes. We also like

Adani Ports and Special Economic Zone.

Some 45% of India’s container shipments go through the company’s ports, and cargo volume is growing by 15%-plus a year. The company has a market cap of around $35 billion, and trades for 24 times earnings. As for validation, Adani Ports operates half of Israel’s port capacity, and the U.S. government recently invested in an Adani project in Asia. The Group’s execution skills are remarkable. Port capacity has grown at a midteens rate with 72% margins.

The family owns 65% of Ports, and you can tell they are good capital allocators because 90% of reserves are retained earnings. They haven’t raised much outside capital, which is unusual in capital-intensive businesses.

Bank Central Asia

is a $75 billion-market-cap bank in Indonesia. The bank was bought by a Chinese family just after the 2000-01 Asian financial crisis. It has a sterling reputation and one of the lowest deposits costs. The stock is selling for 20 times earnings. The bank has sold at a high valuation for the past 15 years for good reason: The family has shown the ability to withdraw from lending businesses that will slow down growth. It is growing at 15%-plus a year, with 20%-plus ROE. A lot of banks in emerging markets tend to be growth businesses rather than cyclical enterprises tied to the credit cycle.

Nothing in China?

Jain: China is tough. Our emerging markets fund is more heavily invested in the Middle East than China. The business risk in China is quite high currently, and government intervention has led to significant derating. You don’t want to argue with the Chinese Communist Party. That said, the state-owned enterprises are interesting, and we own some.

My last recommendation is

TotalEnergies,

the European energy company. The CEO, Patrick Pouyanné, is one of the best in the business. The company produces almost 2.8 million barrels of oil a day. He brought the break-even cost down from almost $100 a barrel to $30. Total has good assets not only in North Africa but also in West Africa. European oil companies haven’t done as well as U.S. names. The stock trades for about seven times earnings, and the company buys back 4% of the shares per annum. With oil at $75 or so, the free-cash-flow yield is 13% to 14%.

Energy should be a core part of any portfolio due to the underinvestment in the sector. Global demand continues to creep up. The ESG [environmental, social, and governance] bubble has popped in stock markets. Ground reality has begun to sink in.

Thank you, Rajiv. Abby, you’re up.

Abby Joseph Cohen: That was fascinating. To review my expectations, I don’t expect a recession in the U.S. Interest rates might decline, but probably not as much as the consensus expects, nor on the schedule the consensus expects. There is a good chance the dollar will continue to depreciate. Energy prices are likely to rise, in part due to concerns about the shipping lanes through the Red Sea.

I also want to make an obvious statement: The U.S. stock market’s performance has been truly exceptional for several years. U.S. large-caps have more than doubled since January 2019, the year before the pandemic. European stocks are up more than 50%. The MSCI China index was down 22% in 2022 and declined another 12% in 2023.

Taking a 10-year perspective, U.S. stocks have compounded at an annual growth rate of about 10%, and non-U. S. stocks, by 2% to 4%. The U.S. has had the best-performing market in five of the past six years, although gains have been highly concentrated among certain sectors, and even in certain stocks. I will talk about U.S. stocks that have underperformed, because that is where I see opportunities. While IT and communications stocks were up 56% and 54% last year, energy was down 5%. I’m going to recommend Chevron, despite Rajiv’s comment.

He didn’t say it was expensive, just less cheap than his pick.

Cohen: Chevron was down 14% in 2023. The company has a lot of capital that can be returned to investors. It yielded about 4% last year, and is expected to yield 4.2% in 2024. Based on consensus estimates, Chevron could earn about $14 a share this year. It was trading on Friday [Jan. 5] at $150.

Chevron is on track to incorporate its acquisition of Hess, which should be helpful. That deal and a major project in Kazakhstan were big investor concerns, and that project is also now on target. The alleviation of investors’ worries combined with an attractive valuation, the probability of returning more cash to shareholders, and a likely increase in oil prices, make Chevron attractive. Rising natural-gas prices are helpful to Chevron, as well.

Healthcare stocks were clobbered last year. My selection is

Pfizer,

one of the great heroes during the pandemic due to its development of the Covid vaccine and Paxlovid. But like some other companies in other industries, it lost its footing in the post-Covid environment. The stock was down almost 41% over the past year, and investors have lost confidence in the company. There have been concerns about Pfizer’s earnings estimates and vaccine uptake by the public, and there is a lot of unused Paxlovid at pharmacies and formularies, not only in the U.S. The stock currently yields 5.6%, reflecting investors’ concerns. It is trading for 13.3 times this year’s estimated earnings.

What could spark a turnaround?

Cohen: Pfizer has a history of successful acquisitions. One possible catalyst is the recent acquisition of Seagen, a significant oncology company. Pfizer has notable product lines in oncology, immunology, cardiology, and endocrinology. Some of its best-known drugs have lost their patent protection, but some remaining products look good. Everyone loves to hate Pfizer. Management has signaled that it intends to move forward with acquisitions.

Estée Lauder’s

stock is also depressed. The company sells cosmetics and skin-care products under many well-known brands. Demand was hurt by the pandemic. People wore masks or worked from home and decided they didn’t need makeup. More recently, there have been problems with Estée’s business in China, given the economic weakness there. Asia had been a significant growth driver for the company. A lot of products were sold in duty-free shops in airports, and sales suffered from the decline in travel.

Questions have been raised about leadership, as well. The company has been controlled by the Lauder family for three generations, and the board has a lot of family and friends. Could Estée Lauder become a candidate for a buyout by a private-equity firm? Likely not, given the family ownership, but there is a large amount of private equity and M&A capital looking for opportunities.

Management has already signaled improvements it’s targeting in 2024, including making sure that the e-commerce business is properly aligned. It is doing much better. The company will probably reduce discounts, as well. It has been focusing on some newer brands that appeal to younger people, and on skin-care products.

What has the stock done?

Cohen: It was down 47% in the past year, although it still has a high P/E based on earnings estimates for the fiscal year ending in June. The P/E multiple is around 32, based on fiscal 2025 estimates, but only 24 if you look to fiscal 2026. This seems to be a transition year for the company. It can’t blame all its problems on the pandemic or China. There is also obsolete inventory that needs to be cleaned out.

I have two other ideas beyond beaten-down U.S. stocks. As its name suggests,

Lynas Rare Earths,

based in Australia, is a miner and processor of rare-earth minerals. In many cases, they aren’t rare, just hard to process. Lynas specializes in two categories: specialty metals used in magnets that allow for miniaturization in electronics, and minerals used in glass production. Lynas mines in Western Australia, and operates the world’s largest rare-earths processing plant in Malaysia. It has a strategic agreement with the U.S. Department of Defense, which is fully funding the company’s U.S. refinery. These materials are essential to the security of our nation and allies.

The company has a market cap of about $4.2 billion. It trades for 13 to 14 times estimated earnings for the fiscal year ending in June 2025. The stock fell 16% in the past 12 months, due to concerns about whether an expansion of the Malaysia plant would occur on time. Things look OK now, and U.S. refining capacity will be coming onstream this year.

What is your other idea?

Cohen: If I were looking to invest in one other market outside the U.S., I would look to Japan. I said that last year, as well, when I recommended

Toyota Motor

and

Daikin Industries,

both of which still look interesting. Partly, this has to do with Japan’s final move toward reflation. The Japanese economy is doing somewhat better. Stocks are still attractive from a valuation perspective. I am proposing two Japanese REITs [real estate investment trusts].

A few years ago I recommended

Prologis,

a logistics REIT in the U.S.

Nippon Prologis REIT

is a related company, trading in Tokyo. It is expected to generate a total return of about 25% this year, although if Japanese interest rates rise too much, too fast, that would be a problem. The company has long-term contracts with its customers, which has served it well. If costs go up because of rising rates, it won’t have the flexibility to raise prices. But projected total returns range from 18%-28%, depending on the interest-rate scenario.

Is this pick more of a play on Japan, or specific trends within the Japanese market?

Cohen: Both. We are seeing inflows of foreign capital into Japan. Also, the Japanese economy favors logistics providers. And, this REIT’s returns, as well as those of my next stock, are higher than REITs elsewhere in the world.

The second company is

Japan Hotel REIT Investment.

It, too, is expected to have a total return in the high-20% range over the next 12 months. Last year, its price fell 11%. Japan Hotel will benefit from several things happening in Japan. Consumers are out spending money and traveling. Japanese hotels are doing better. Japan Hotel REIT is focused on individuals, families, and business travelers who can afford to spend. If the Japanese economy sours and people stop spending, that would be an issue. The REIT is expected to yield 5.7% in calendar 2024.

Thanks, Abby. Mario, you are last this year, but by no means least.

Mario Gabelli: We talked about the Magnificent Seven today. Well, I’m going to talk about the Unloved Eight. The market is OK. There are some geopolitical issues, and we have a presidential election in November that could create some interesting market dynamics. The part I’ll embellish is the notion of corporate lovemaking: We could see financial spinoffs, deals and more deals, and continuing regulatory pushback to mergers and acquisitions. Companies are getting used to the level of interest rates and regulatory hurdles, and sellers are adjusting the prices they seek to do a deal. Europe remains a problem. Also, we are expecting some notable initial public offerings this year. One that I’m looking forward to is Univision Holdings, which impacts

Grupo Televisa.

John [John W. Rogers Jr.] recommended

Sphere Entertainment

today [in the second Roundtable installment]. I’m going to do the same. Sphere has debt, including convertible debt it recently issued. But it also has assets: Madison Square Garden Networks, a part of Sphere, broadcasts New York Knicks and Rangers games. It has struck a deal with YES Network to create a streaming joint venture. Details aren’t available, but a joint venture or deal could help reduce debt at

Madison Square Garden Sports,

which owns the Knicks and Rangers.

Sphere has 34.7 million shares, and two share classes. Sphere has an opportunity to leverage its intellectual property by licensing additional Spheres around the world. None of that is priced into the stock today. The Dolan family controls the company through supervoting stock. Having launched the Sphere successfully, will [CEO] James Dolan then look to monetize a portion of the Knicks and Rangers?

What do you think?

Gabelli: Madison Square Garden Sports has 24 million shares outstanding, selling for $177 each. If you assume the Knicks are worth over $6 billion and the Rangers are worth over $2 billion, you’re getting the Rangers for free. Dolan’s success with Sphere could stimulate a deal. The company could sell limited partnership units. Would somebody else buy a piece of the teams? Right now, my clients are buying a piece. We’re getting the Knicks at a third of the price that Forbes thinks they’re worth.

Don’t your clients want to cash out at some point?

Gabelli: No. Why? How many basketball teams are going to be created?

Baseball was underappreciated several years ago. But the pitch clock [which shortens the time between pitches] has shortened the length of a game. Second, a significant number of Hispanic players are coming into the game. With the Hispanic population now about 19% of the U.S. population, attendance, and enthusiasm have been growing. And third, broadcasters’ contracts are up for renewal before expiration in 2028, and will be renewed at significantly higher rates.

On July 18,

Atlanta Braves Holdings

was spun out of

Liberty Media

as a publicly traded company. It had previously traded as a tracking stock. The nonvoting stock, ticker BATRK, is selling for $39 and the voting stock, BATRA, is selling for $42. The company has a market cap of about $2.4 billion. The Battery, which holds the company’s real estate assets, is worth more than $700 million. This could be a $50 stock based on other recent baseball team sales.

When, already?

Gabelli: Who cares? My taxable clients don’t want to pay taxes on any sale at the long-term capital-gains rate of 23.8%, or higher for those in California or New York.

Independent of this, Todd [Ahlsten] discussed

Deere

this morning [in the first Roundtable installment]. Todd, you were right: The American farmer is doing well. My pick is

CNH Industrial,

formerly Case New Holland. The stock is trading for $12, and there are 1.2 billion shares outstanding. The CEO, Scott Wine, is excellent. He is positioning the company to get a higher price/earnings multiple. CNH is investing significantly in precision agriculture.

There are concerns about the extended farm cycle. The Brazilian agricultural sector has been struggling, and sales of tractors 140 horsepower and lower have been weak. CNH has a marketing program to move the goods, which means it will take a hit on fourth-quarter earnings. We think the company earned $1.50 a share last year, and will earn $1.65 this year and $1.75-$1.80 in 2025.

Exor,

the Agnelli family’s holding company, owns 27%.

Next,

raise your hand if you’re giving money to your favorite candidate this year. There is going to be a tsunami of spending on political advertising in 2024. Linear television companies will get an enormous tailwind. Global advertising spending is also rising. Automotive advertising is stronger; it accounts for roughly 25% of local TV stations’ advertising revenue.

So let’s talk about

Tegna,

a broadcast and digital media company. The company’s TV stations reach 39% of all the U.S. television households. NBC stations are 43% of the business, and

CBS

stations, 29%. CBS will broadcast the Super Bowl this year, and NBC will broadcast the summer Olympics. Tegna received a buyout offer in 2022 for $24 a share. The Federal Communications Commission extended the terms of a revised deal and the buyer terminated, and the stock is now $15. There are around 180 million shares outstanding. Tegna will earn $3.50 a share this year. The company is buying back stock, and could attract another buyer. I expect the stock to rise 50% in 12 months.

Meryl Witmer: Does Tegna have a lot of debt?

Gabelli: It has about $2.8 billion of net debt.

Grupo Televisa’s stock fell from $15 to $3.10. The company has 560 million shares, and a market cap of $1.7 billion. Mexico is a beneficiary of nearshoring. Also, the peso is strong. Televisa owns a cable TV business, and a stake in DirecTV. It also owns 45% of Univision, a Spanish-language broadcaster that is expected to come public this fall. The stock, excluding Univision, is probably worth about $7 per Televisa share. You’re getting Univision for free.

Why did Televisa’s stock nosedive?

Gabelli: It fell because of concerns about the streaming business. Streaming companies are spending billions of dollars on content, which hurts earnings.

Now, let’s talk about teeth. With an aging population, the dental implant business is growing at an accelerating rate.

Henry Schein,

based in Melville, N.Y., distributes medical and dental equipment. The company was the victim of a cyberattack in the fall, and the stock dropped from about $75 to $62. Now it is back in the low-$70s. The company has said that the episode sharply crimped fourth-quarter revenue and earnings. I calculate that Schein earned $4.50 a share in 2023. This year, I estimate, it will earn $5.50. It has been good at making acquisitions. We expect Schein to trade up to $90 to $100 a share in 2025.

Witmer: Why would a cyberattack lead to such a big cost?

Gabelli: If you can’t get supplies to customers, they start ordering elsewhere. It created a $350 million air pocket in revenue.

On to

Paramount Global.

There are roughly 650 million shares, 41 million of which are voting stock. Of that, 31.5 million of the voting shares and 31.4 million of the nonvoting shares are held by National Amusements. Shari Redstone controls National Amusements and Paramount, which has struggled in part due to last year’s Hollywood strikes. She has hired an investment banker to try to help National Amusements.

Netflix

has an equity cap of $215 billion.

Disney’s

is $220 billion.

Comcast’s

is $175 billion. Paramount’s is $10 billion. This is a tiny morsel for another company.

Paramount is trading for $15 a share. It has around $12 billion of net debt pro forma, accounting for the sale of Simon & Schuster. The company cut its dividend from 96 cents a share to 20 cents. Convertible shares are subject to a mandatory exchange of 1.0013 shares of Class B stock in April, which means the company will save another $45-plus million in dividends. It will also recognize $700 million in gains on the sale of Simon & Schuster to

KKR

in the fourth quarter of 2023. John Malone [chairman of Liberty Media] sings the song that the media industry needs consolidation and scale. Does that mean David Zaslav [CEO of

Warner Bros. Discovery

] comes uptown to Broadway and West 45th Street [Paramount’s headquarters] to see these guys? Everyone is talking to Paramount. Apple could pay 2/10ths of an Apple share, and $11 billion for the debt, and buy a company with good content and high cash flow.

Our clients own 50% of the voting stock that trades publicly. I would like Paramount to leverage up its owned and operated TV stations, which generate $700 million to $800 million a year in free cash flow, and spin the business off to shareholders. Then, it could sell the rest of the company.

[Subsequent to the Roundtable, Skydance Media CEO David Ellison reportedly made an offer for National Amusements. Gabelli said in a follow-up to his Roundtable comments: “We are mindful of an attempt to buy National Amusement shares, subsequently merge Skydance into Paramount, and likely replace existing management. We continue to believe that Paramount and its existing content are attractive. We also continue to believe that no transaction could result in change of control without a spinoff of Paramount Global’s CBS owned and operated stations. We will aggressively pursue what is right for our clients and all shareholders.”]

Thanks, Mario, and everyone. Time for dinner!

Write to Lauren R. Rublin at [email protected]

Read the full article here