Maybe you thought the stock market had moved on from what could be called the Year of the Magnificent Seven in 2023, when that group of companies dominated the performance of the S&P 500. But the seven still have heavy weighting in the benchmark index. One way to cut this risk is to park money in an equal-weighted S&P 500 index fund, but it turns out that a different weighting approach has tended to outperform an equal-weighted index.

The Invesco S&P 500 Revenue ETF

RWL

tracks an index that weights the companies in the S&P 500

SPX

by the sum of their revenue over the previous four quarters. The index and the exchange-traded fund that tracks it are rebalanced every quarter. This ETF is rated five stars (the highest rating) within Morningstar’s Large Value fund category.

The S&P 500 is weighted by market capitalization. The Magnificent Seven companies — Microsoft Corp.

MSFT,

Apple Inc.

AAPL,

Nvidia Corp.

NVDA,

Amazon.com Inc.

AMZN,

Alphabet Inc.

GOOGL,

GOOG,

Meta Platforms Inc.

META,

and Tesla Inc.

TSLA,

— make up a combined 28.9% of the portfolio of the SPDR S&P 500 ETF Trust

SPY,

which is designed to track the performance of the index by holding all 500 stocks with the same market-cap weightings as the index.

During an interview with MarketWatch, Nick Kalivas, Invesco’s head of factor and core ETF strategy, said that with a revenue-weighted approach, the most rapidly growing large-cap companies typically have a lower weighting than they would in the cap-weighted index. He called revenue weighting “a way to access value and implement a value-oriented strategy without the risk of a pure deep-value strategy.”

Performance comparison

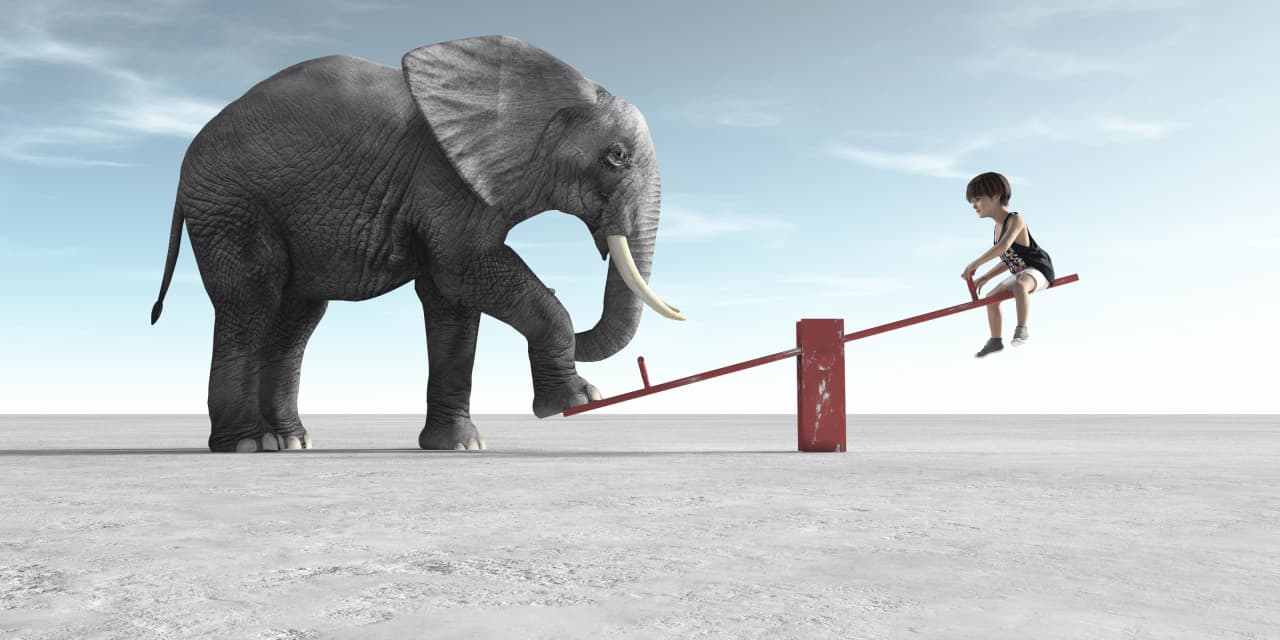

The seesaw pattern of performance for the S&P 500 during 2022 and 2023 illustrates how the revenue-weighted approach might have made it easier for investors to weather the volatility without succumbing to the temptation of selling their holdings and moving to the sidelines. This type of market timing can backfire, as an investor may remain on the sidelines long enough after a recovery begins to hurt their long-term performance.

Here’s a comparison of total returns for the Invesco S&P 500 Revenue ETF, the Invesco S&P 500 Equal Weight ETF

RSP

and the SPDR S&P 500 ETF Trust for various periods:

| ETF | 2024 return | Return since end of 2021 | 2023 return | 2022 return | 2021 return | 3 years | 5 years | 10 years | 15 years |

|

Invesco S&P 500 Revenue ETF RWL |

1% | 12% | 17% | -6% | 30% | 46% | 91% | 196% | 643% |

|

Invesco S&P 500 Equal Weight ETF RSP |

0% | 1% | 14% | -12% | 29% | 32% | 76% | 173% | 671% |

|

SPDR S&P 500 ETF Trust SPY |

3% | 7% | 26% | -18% | 29% | 39% | 103% | 232% | 674% |

| Source: FactSet | |||||||||

The total returns include reinvested dividends and are after expenses, which come to 0.39% of assets under management annually for RWL, 0.20% for RSP and 0.0945% for SPY.

RWL declined only 6% in 2022, when SPY fell 18% and the equal-weighted S&P 500 was down 12%. RWL was in the middle of the three for performance during the 2023 rally. So from the end of 2021 through Monday, the Invesco S&P 500 Revenue ETF was the best performer, by far.

Looking further back, the three ETFs all performed well during the strong market of 2021. RWL has been the best three-year performer and has also beaten the equal-weighted ETF for the five- and 10-year periods.

The cap-weighted SPY has been the overall winner for the 5, 10 and 15-year periods, during which the information technology sector, along with tech-oriented players in the communications services sector (which includes Alphabet and Meta) and in the consumer discretionary sector (with Amazon and Tesla) have had such a strong influence.

Top holdings

Take a look at the top 10 holdings of the Invesco S&P 500 Revenue ETF, which together make up 22.3% of the portfolio:

| Company | Ticker | % of the Invesco S&P 500 Revenue ETF | Sales – past four reported quarters ($mil) |

| Walmart Inc. |

WMT, |

4.0% | $638,785 |

| Amazon.com Inc. |

AMZN, |

3.4% | $554,028 |

| Berkshire Hathaway Inc. Class B |

BRK.B, |

2.5% | $349,271 |

| Apple Inc. |

AAPL, |

2.2% | $383,285 |

| Exxon Mobil Corp. |

XOM, |

2.1% | $344,999 |

| CVS Health Corp. |

CVS, |

1.9% | $348,191 |

| UnitedHealth Group Inc. |

UNH, |

1.9% | $371,622 |

| McKesson Corp. |

MCK, |

1.8% | $291,098 |

| Cencora Inc. |

COR, |

1.6% | $262,173 |

| Costco Wholesale Corp. |

COST, |

1.6% | $245,652 |

| Sources: Invesco, FactSet | |||

Walmart Inc.

WMT,

has the top ranking. The retailer has had the highest revenue for any U.S. company over the past four reported quarters by a wide margin. The portfolio’s weightings don’t match the relative revenue amounts perfectly, because of differing corporate fiscal calendars and financial reporting schedules and the rebalancing schedule of the underlying index. The rebalancing takes place after the close of business on the third Friday in March, June, September and December.

For comparison, here are the top 10 holdings (actually 11 stocks with two common-share classes for Alphabet) of SPY, which make up 33.1% of the portfolio:

| Company | Ticker | SPDR S&P 500 ETF Trust | Sales – past four reported quarters ($mil) |

| Microsoft Corp. |

MSFT, |

7.4% | $218,310 |

| Apple Inc. |

AAPL, |

6.8% | $383,285 |

| Nvidia Corp. |

NVDA, |

3.7% | $44,870 |

| Amazon.com Inc. |

AMZN, |

3.5% | $554,028 |

| Alphabet Inc. Class A |

GOOGL, |

2.2% | $296,376 |

| Meta Platforms Inc. Class A |

META, |

2.2% | $126,955 |

| Alphabet Inc. Class C |

GOOG, |

1.9% | $296,376 |

| Berkshire Hathaway Inc. Class B |

BRK.B, |

1.7% | $349,271 |

| Broadcom Inc. |

AVGO, |

1.3% | $35,819 |

| Tesla Inc. |

TSLA, |

1.3% | $96,773 |

| Eli Lilly and Co. |

LLY, |

1.2% | $32,073 |

| Sources: State Street, FactSet | |||

Only three companies make both lists: Amazon, Berkshire Hathaway Inc.

BRK.B,

and Apple.

Click on the tickers for more about each company, ETF or index.

Click here for Tomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page.

Applying revenue weighting to small-caps and midcaps

Kalivas said that applying the revenue-weighted approach led to consistent outperformance when compared with that of the cap-weighted indexes of smaller companies.

The S&P SmallCap 600 Index

SML

and the S&P MidCap 400 Index

MID

are also weighted by market capitalization, but the effect is less magnified than it is with large-caps, because of the size limits.

For these indexes, a revenue-weighted approach makes for more concentrated portfolios that have performed better than the cap-weighted indexes over long periods.

The SPDR Portfolio S&P 600 Small Cap ETF

SPSM

has a 5.7% weighting for its largest 10 holdings, while the Invesco S&P SmallCap 600 Revenue ETF

RWJ

is 16.3% concentrated in its top 10 holdings.

The SPDR Portfolio S&P 400 Mid Cap ETF

SPMD

has a 6.3% weighting for its 10 largest holdings, while the Invesco S&P MidCap 400 Revenue ETF

RWK

is 17.4% weighted to its top 10.

Here are performance comparisons for these four ETFs:

| ETF | 2024 return | Return since end of 2021 | 2023 return | 2022 return | 2021 return | 3 years | 5 years | 10 years | 15 years |

|

Invesco S&P SmallCap 600 Revenue ETF RWJ |

-1% | 2% | 16% | -11% | 53% | 24% | 101% | 165% | 799% |

|

SPDR Portfolio S&P 600 Small Cap ETF SPSM |

-1% | -4% | 16% | -16% | 27% | 15% | 56% | 123% | N/A |

|

Invesco S&P MidCap 400 Revenue ETF RWK |

0% | 13% | 24% | -8% | 34% | 50% | 95% | 173% | 696% |

|

SPDR Portfolio S&P 400 Mid Cap ETF SPMD |

0% | 2% | 16% | -13% | 25% | 25% | 65% | 135% | 592% |

| Source: FactSet | |||||||||

Again the returns are net of annual expenses, which are 0.39% of assets for RWJ and RWK, and 0.03% for SPSM and SPMD.

Despite the higher expenses, the Invesco funds’ revenue-weighted approaches have outperformed the cap-weighted approaches for small-caps and midcaps over long periods.

Don’t miss: This ETF outperforms by stressing corporate culture — but not ESG

Read the full article here