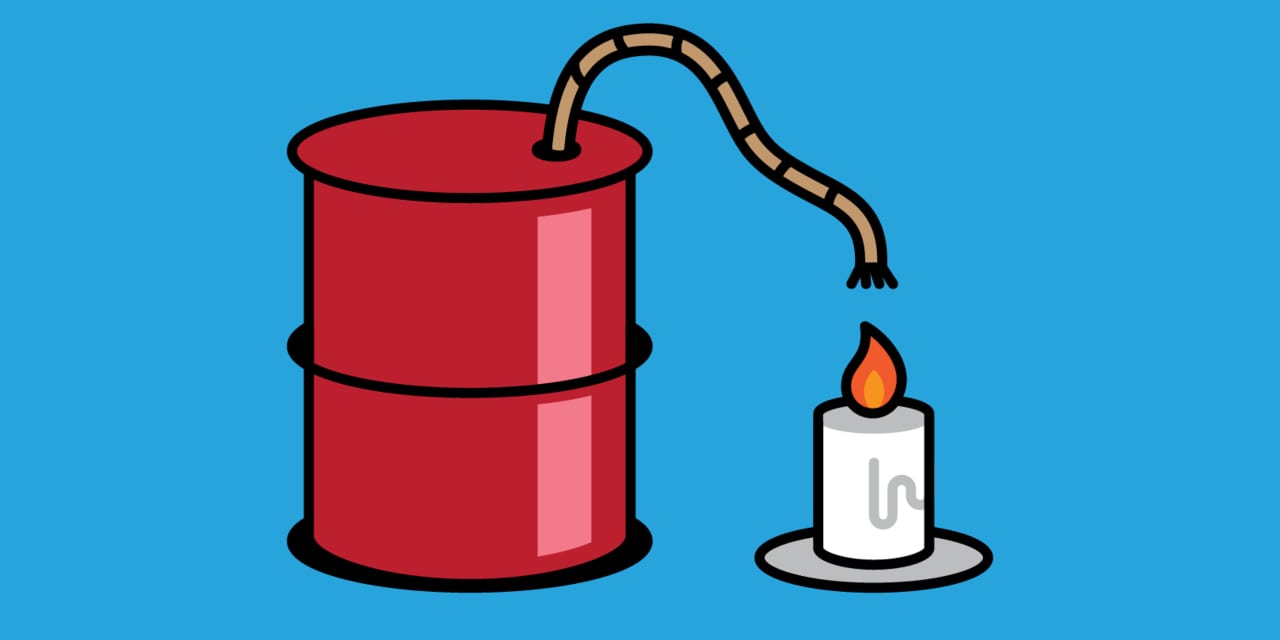

A drone attack by Iran-backed militants based in Syria and Iraq killed three U.S. troops in Jordan this past week, resulting in U.S. retaliatory strikes on Friday and fears of a tipping point in the Mideast conflict. It’s the kind of escalation that normally would cause oil prices to jump.

And yet crude has barely budged so far, and U.S. gasoline prices have actually fallen, since Hamas attacked Israel on Oct. 7.

For the week, traders remained in a wait-and-see mode and were still hesitant to attribute much of a risk premium to oil prices. Barrels of oil, not to say goods of all kind, are still making their way around the globe despite heated rhetoric, attacks, and blockades.

But investors don’t have to go far back in history to see how escalating violence involving Iran can affect oil prices. In 2019, Iranian-backed forces attacked assets in and around the Persian Gulf. At one point during the attacks, more than half of Saudi Arabia’s production was curtailed, causing oil prices to spike 10% in a day. RBC Capital Markets analyst Helima Croft wrote this past Sunday that she sees a “very real risk of a return to the 2019 playbook.”

“We think many market participants may have drawn the wrong conclusion from the 2019 experience,” she wrote. “They likely did not mark the height of Iran’s disruptive capabilities, but rather a preview of what could come.”

Write to Avi Salzman at [email protected]

Last Week

Markets

The Federal Reserve left rates unchanged, with Chairman Jerome Powell saying a March cut “isn’t the most likely case.” On Friday, January jobs came in hot, at 353,000. On the week, the

Dow

and the

S&P 500

both rose 1.4%—to new highs—and the

Nasdaq Composite

was up 1.1%.

Companies

Japan’s Aozora Bank and New York Community Bancorp staggered under bad commercial real estate loans. Ireland’s

Flutter Entertainment,

which owns FanDuel in the U.S., listed on the NYSE with plans to make it its primary exchange, a blow to London. It was tech earnings week:

Microsoft

and

Alphabet

both beat on earnings, but warned of the cost of AI capital investments.

Meta Platforms

announced a dividend,

Amazon.com

beat big, and

Apple

warned on China sales. A Delaware judge said that Elon Musk’s 2018

Tesla

pay package (potential payout: $55.8 billion) was improperly approved by the board. Musk then threatened a shareholder vote to incorporate in Texas.

Deals

A Hong Kong court gave up on restructuring talks and ordered the liquidation of China

Evergrande.

..Swiss-based

Holcim

agreed to spin off its U.S. construction-materials business, probably in a 2025 initial public offering…Amazon dropped its deal to acquire

iRobot

after hitting EU resistance…Bloomberg reported that media mogul Byron Allen offered $14.3 billion for voting shares of

Paramount Global,

a 50% premium. The plan: Sell the film studio and real estate,s and keep TV and streaming.

Write to Robert Teitelman at [email protected]

Next Week

Monday 2/5

After an earnings week dominated by megacap tech companies, large-cap healthcare and pharma companies get their turn on the stage.

Vertex Pharmaceuticals

releases results on Monday.

Amgen,

Eli Lilly,

and

Gilead Sciences

announce earnings on Tuesday.

CVS Health

and

McKesson

report on Wednesday.

AstraZeneca

rounds out the week on Thursday.

Several consumer-focused companies report results and give insights into the strength of U.S. shoppers.

Estée Lauder

and

McDonald’s

announce earnings on Monday.

Chipotle Mexican Grill

follows suit on Tuesday, with

Walt Disney

and

Yum! Brands

reporting on Wednesday. Two global consumer-staples giants close out the week, with

Unilever

releasing results on Thursday and

PepsiCo

on Friday.

Friday 2/9

The Bureau of Labor Statistics releases its annual revisions to the consumer price index. Recalculated seasonal adjustments affect data for the period of January 2019 through December 2023. Federal Reserve governor Christopher Waller recently highlighted the importance of the revisions in giving a fuller picture on the progress made so far in the fight against inflation. Last February, CPI readings for several months from late 2022 were revised higher.

Email: [email protected]

Read the full article here