Shares of

JetBlue

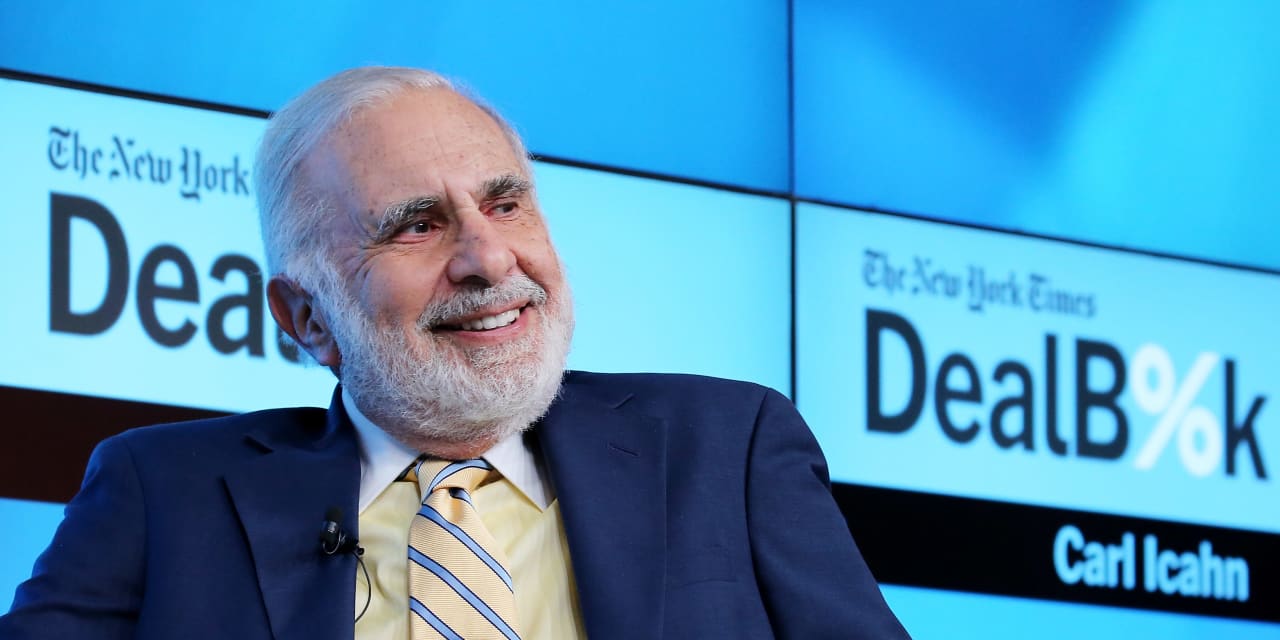

Airways were up more than 2% after-hours on Friday as investors reacted favorably to news that Carl

Icahn

had won two seats on its board, giving the activist more influence over the low-cost airline’s future.

Icahn disclosed a nearly 10% stake in

JetBlue

on Tuesday, sending its shares up more than 20%. The stock, which closed at $6.96 Friday, is ahead more than 25% this year on hopes that a combination of new management and activist pressure could fuel a turnaround for the airline, which may still be hoping to merge with rival

Spirit Airlines.

After the close of trading Friday, JetBlue Airways confirmed that Icahn had secured two board seats, which will be filled by Icahn Enterprises’ general counsel Jesse Lynn and portfolio manager Steven Miller.

“We are pleased to have reached this agreement with Icahn Enterprises,” Peter Boneparth, chair of the JetBlue board, said in a statement. “Our board and leadership team are focusing our full attention on taking aggressive action to return to profitability and strengthen JetBlue’s foundation for the future.”

Seaport Global analyst Daniel McKenzie—who has the only Buy rating on the stock among analysts tracked by FactSet—viewed Icahn’s equity stake as a vote of confidence. “The fact that an experienced activist investor with a solid record finds deep value in JetBlue doesn’t surprise us,” he wrote in a note on Wednesday.

But McKenzie, who raised his price target to $9, is bullish for fundamental reasons, seeing 2024 as “a transition year to a better 2025.” And he’s wary of Icahn’s role. ”Activist investments in airlines have a mixed history, ending in both failure and success,” he wrote.

United Airlines Holdings

was a success story, he said, as activists worked with management and labor, but an activist’s involvement in

American Airlines Group

wasn’t so successful as “pilots quickly threatened to essentially burn down the house if the activist interfered with jobs.”

Icahn has history with airlines—he took TWA private in 1988, saddling it with debt; the airline then filed for bankruptcy protection in 1992.

Icahn is getting involved in JetBlue at an inflection point for the carrier. JetBlue got a new chief executive officer just one day before Icahn’s position became public, when longtime company veteran Joanna Geraghty became the first woman to lead a major U.S. airline.

JetBlue also named a new chief operating officer and a new president in recent weeks; the former has already started on the job, while the later will begin next week.

Raymond James analyst Savanthi Syth noted investors shouldn’t expect a major shake-up given Geraghty’s long tenure at the firm: “We expect continuity under Ms. Geraghty who has been well-tested having managed the operation through the pandemic,” she wrote in a recent note.

Geraghty is taking over ahead of a potentially big merger fight. In January, the Department of Justice blocked the proposed $3.8 billion merger between JetBlue and Spirit, the sixth and seventh largest airlines by market share in the U.S.

Though news of the DOJ’s action sent Spirit shares into a nosedive, JetBlue stock rose with J.P. Morgan analyst Jamie Baker saying it had “dodged a bullet” given Spirit’s poor performance in recent quarters.

TD Cowen’s Helane Becker was also encouraged by the deal’s potential failure. “We believe this is a positive for JetBlue as business at Spirit turned negative between the time the merger was announced to now,” she wrote in a recent note.

An appeals date is set for June and JetBlue has said it would fight a negative ruling.

Other analysts question whether JetBlue really wants to go through with the merger. “How much JetBlue wants to continue to pursue Spirit given all their issues, remains to be seen,” notes Melius Research Conor Cunningham. “This is just not the airline JetBlue thought they were inheriting when they agreed to buy them.”

While the Spirit deal may not be dead, many industry watchers expect a standalone path forward for JetBlue. Geraghty was at the firm when the Spirit deal was announced, but she now has the ability to pursue a different path.

Icahn didn’t mention Spirit in his initial Securities and Exchange Commission filing earlier this week. Now that he has board seats, he’s almost certain to have a say in the company’s next moves.

Write to Teresa Rivas at [email protected]

Read the full article here