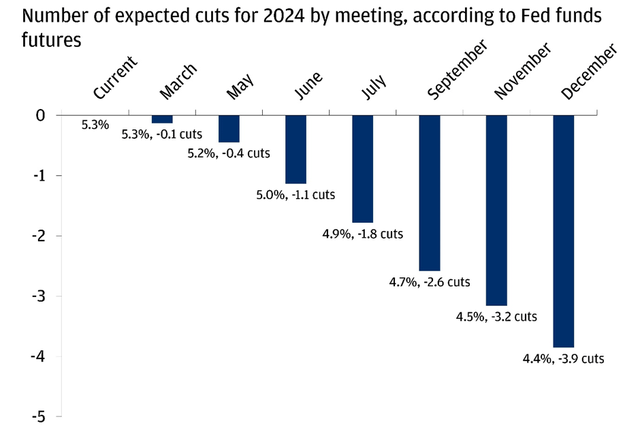

It’s been a topsy-turvy last few weeks for Treasury rates, and January’s stronger-than-expected inflation print only added to volatility across the curve. On a somewhat positive note, investors appear to be paring back expectations for an aggressive Fed easing cycle in reaction. As a result, current levels imply not only a delayed start but also a convergence with Fed guidance on the number of 25bps rate cuts for 2024 (down to about four cuts vs. a peak of six to seven cuts prior).

Chase

On balance, I’d agree with this more cautious view. Yes, there are valid concerns about stress in commercial real estate and banking (New York Community Bancorp’s troubles being a case in point), which call for easing. But the ‘higher for longer’ case seems stronger in light of a resilient economy and labor market backdrop, as well as the rather sticky core inflation trend. Recent Fedspeak (“I see no reason to move as quickly or cut as rapidly as in the past” – Fed Governor Waller) also lends support to a more gradual rather than aggressive pace of rate cuts.

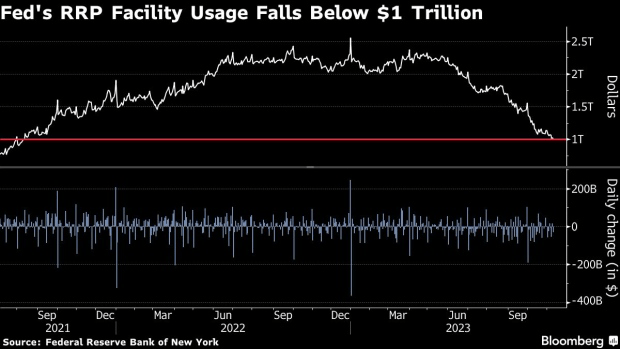

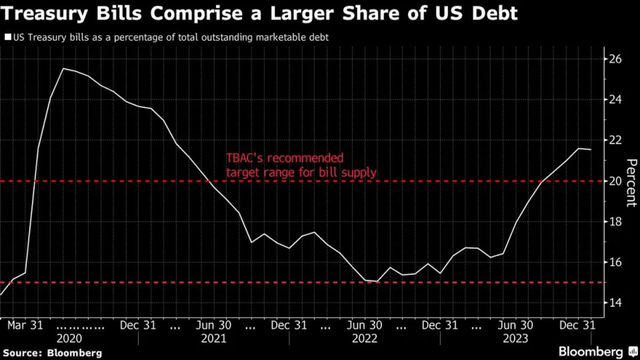

Leaving the Fed’s reaction function aside, supply/demand risks, the other key driver of Treasury yields, haven’t abated either, particularly at the longer end of the yield curve. Recall that most of last year’s incremental supply came in the form of Treasury bills (‘T-bills’), so much so that the Treasury is running its T-bill issuance mix well above its ‘recommended’ target. Expect a reversal this year now that reverse repo balances are close to being exhausted. In turn, a higher mix of longer-dated coupon issuances over bills means the latter has a much more favorable supply/demand outlook.

Bloomberg

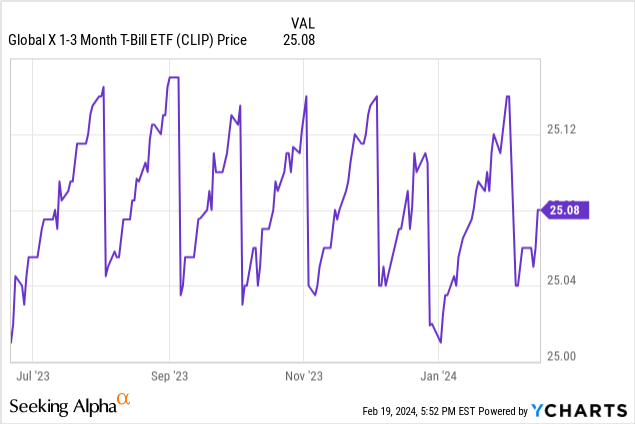

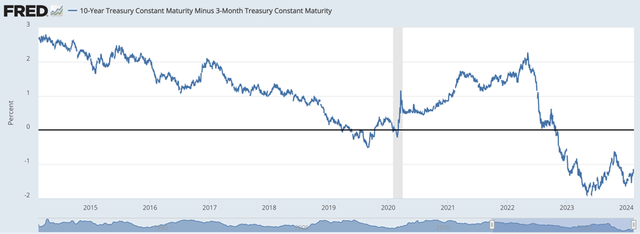

In any case, investors get compensated a lot more for taking on less duration risk (i.e., sensitivity to interest rate fluctuations) at the front end due to the currently inverted yield curve. The one to three month maturity targeted by the low-cost Global X 1-3 Month T-Bill ETF (NYSEARCA:CLIP), is particularly attractive given this is the highest-yielding segment of the curve. Thus, in line with my prior coverage of the fund, this remains as good a vehicle as any to park some excess cash.

CLIP Overview – The Lowest Risk/Highest Yield T-Bill Vehicle

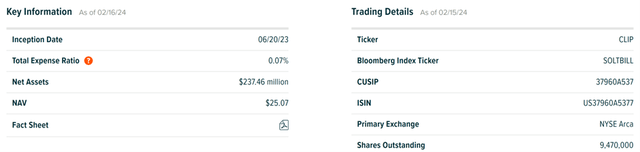

Global X’s 1-3 Month T-Bill ETF offers investors targeted exposure to US Treasury bills with one and three-month maturities by tracking (pre-expenses) the Solactive 1–3-month US T-Bill Index. While CLIP is less established than its closest comparable, the iShares 0-3 Month Treasury Bond ETF (SGOV), it is closing the gap, having seen strong growth in its asset base (up to ~$237m) and improved liquidity (4bps median bid/ask spread). After also accounting for its 7bps total expense ratio (vs. 13bps gross for SGOV), CLIP comes out ahead on cost, in my view.

Global X

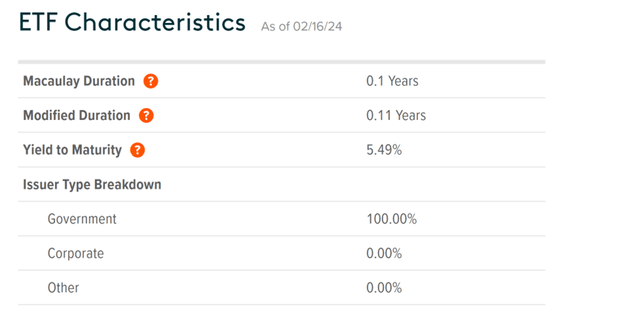

The portfolio is narrower than last quarter at 21 T-bill holdings, though its average yield to maturity remains broadly unchanged at 5.5%. CLIP’s current portfolio composition also further leans toward the one-month maturity than before, driving a lower modified duration of 0.11 years. In essence, CLIP now offers the same yield for even less interest rate risk, skewing the risk/reward very favorably, in my view. Even relative to SGOV, which offers a lower average yield to maturity of 5.4% for similar duration (0.11 years), CLIP’s portfolio comes out on top.

Global X

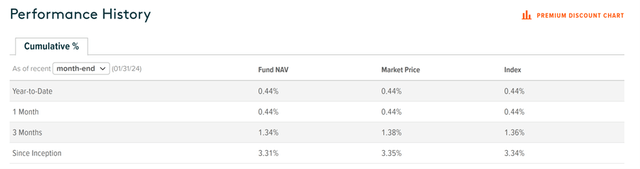

CLIP Performance – Returns Boosted by an Inverted Yield Curve

In the meantime, CLIP is slowly but surely building a very solid track record of performance. Since its June 2023 inception, the fund has appreciated by a cumulative +3.3% in NAV terms (+3.4% in market price terms), closely tracking its benchmark Solactive 1-3 month US T-Bill Index. Over the last one and three months, CLIP has also matched SGOV’s returns on an NAV basis, while in market price terms, the fund has slightly outperformed.

Going forward, expect more of the same, as CLIP’s shorter maturity profile also gives it a slight yield edge. And relative to more broad-based T-bill funds, its targeted exposure to the highest yielding 1-3-month segment of an inverted Treasury curve (note <3-month T-bills currently yield up to 5.4%) is a key advantage, allowing CLIP to offer higher income with no principal protection tradeoffs.

Global X

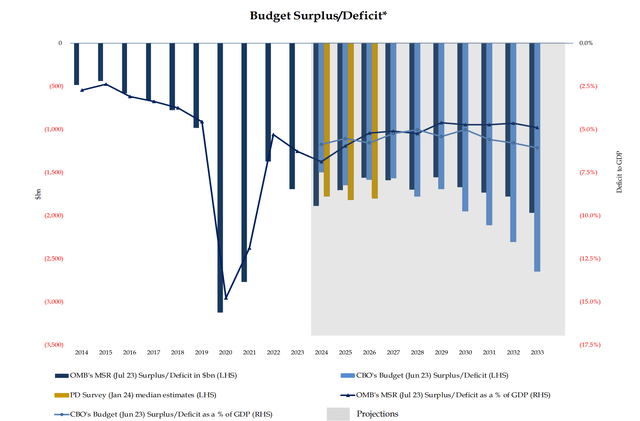

Post-Refunding Winds of Change Strongly in Favor of T-Bills

Fundamentally, my preference for Treasury bill funds over longer-dated coupons remains very much intact. For one, the long-term fiscal deficit outlook ultimately hasn’t changed – despite the Q1 Treasury refunding guide for a lower-than-expected Q1 borrowing outlook (albeit still historically high at $760bn in privately held marketable debt) and no meaningful QoQ increase in coupon issuances in Q2. Tellingly, the accompanying Q1 Treasury Borrowing Advisory Committee (TBAC) report also pushed back against sanguine market expectations on account of the larger deficit outlook.

US Treasury

Per TBAC, a change in the Treasury supply mix may finally be in the offing as well. Recall that throughout last year, outsized T-bill supply was largely supported by money market funds rotating out of the Fed’s reverse repo facility (i.e., where banks have parked their excess cash balances post-QE). This year, on the other hand, reverse repo balances are almost drained, and the lack of a key demand anchor should pave the way for a normalized supply mix in line with TBAC recommendations (i.e., less bills and more longer-maturity issuances).

Bloomberg

All else being equal, more supply at the longer end should normalize the yield curve via a higher term premium (vs the negative term premium currently per the St Louis Fed chart below); the logic being that investors demand higher yields to absorb additional coupon supply. T-bills, by contrast, shouldn’t suffer from anywhere near the supply pressure and, by extension, present a superior ‘safe-haven’ from a potentially volatile next few months. Also worth watching out for are details on the winding down of the Fed’s ‘quantitative tightening’ program, which could potentially add relief across the curve. Counterbalancing this is that 2024 is an election year, which usually comes with upside risks to the Treasury issuance schedule (i.e., upward pressure on yields).

Fed

Target the Highest-Yielding Section of the Treasury Curve

The combination of stronger-than-expected inflation and economic data has led to a pullback in rate cut expectations, but I think it’s probably too early to be taking on duration risk here. After all, the government remains on track to run extremely high deficits for the years to come, while supply/demand risks remain, albeit mainly at the longer end, as the Treasury terms out issuances this year. And in the increasingly likely scenario we continue to see ‘sticky’ core inflation and labor market tightness, the Fed could well push its rate cut plans further out into next year, pressuring yields higher. Given the still inverted Treasury yield curve, investors get paid more for less at the front end, particularly the one to three-month segment targeted by CLIP; thus, I see no good reason to rotate out of low-cost T-bill ETFs here.

Read the full article here