Stock in

Intuitive Machines

sharply dropped in after-hours trading Friday after the company’s Odyessus lunar lander tipped over when it landed on the moon’s surface. The extreme stock move shows just how hard it is to trade events that will move a small capitalization stock.

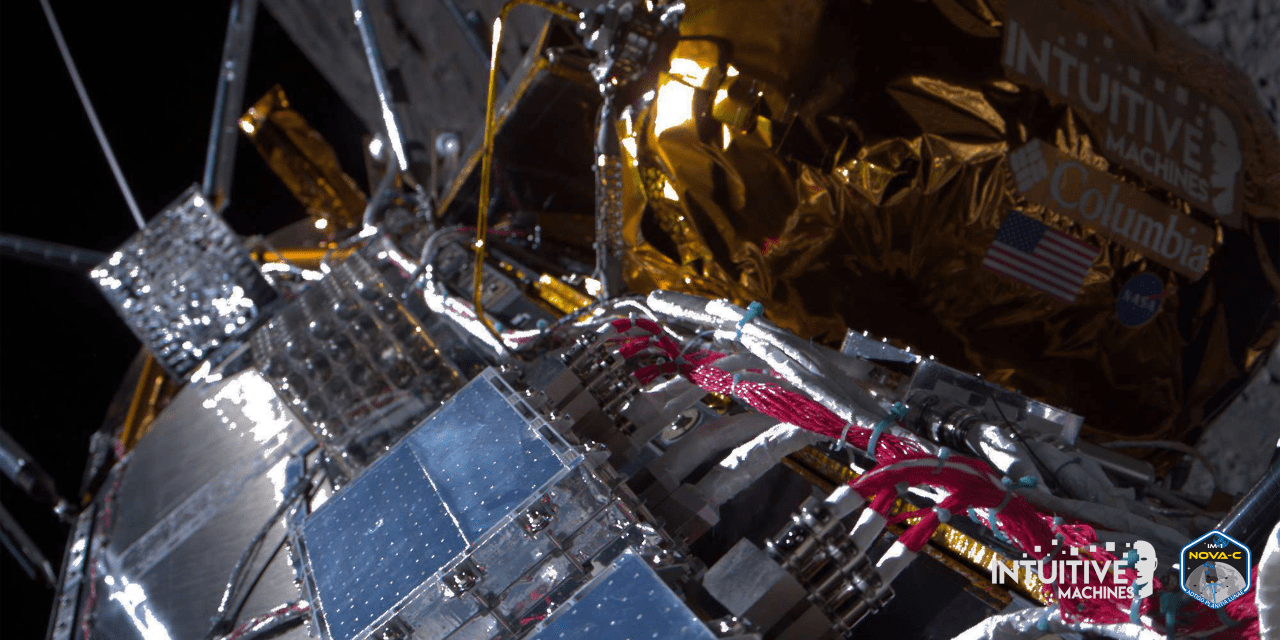

Intuitive and NASA held a news conference on Friday evening. The lander “is stable, near or at the intended landing site,” said Intuitive CEO Steve Altemus. One hiccup though—the lander is on its side.

Altemus said the craft was going 25,000 miles an hour in orbit and landed at about 6 miles an hour, with a horizontal speed of about 2 miles an hour—a comfortable walking pace. The company believes one of the lander’s feet caught on something on the way down, causing it to trip.

NASA’s associate administrator for space technology, Dr. Prasun Desai, still called the landing a success.“Congratulations to the Intuitive machines. An amazing successful landing,” he said.

Indeed, the spacecraft’s journey marked the first soft landing on the moon for a U.S. entity in some 50 years. What’s more, Odysseus landed on the moon autonomously—the first-ever such landing for an American company.

Data from the fuel tank is what led Intuitive’s team to conclude that the lander tipped. Odysseus is carrying 12 payloads that will gather data and conduct scientific experiments. The company told Barron’s that all of the science payloads are intact and operational.

Intuitive stock was down almost 32% in after-hours trading Friday at $6.55 a share. Yet through regular trading, shares were up more than 30% for the week and up more than 150% for the month. Intuitive stock also ended Friday on a high note, with a market cap of just under $1 billion.

Intuitive is still a young company—and Wall Street projects about $22 million in fourth-quarter sales, according to FactSet. Intuitive hasn’t scheduled the release of its fourth-quarter results yet. Sales in 2024 are expected to be about $300 million, up from about $72 million expected for all of 2023.

Four analysts cover Intuitive stock, all of whom rate shares Buy. The average analyst price target is $10.75 a share.

Write to Al Root at [email protected]

Read the full article here