The Biden administration’s game of deal or no deal with Corporate America is getting predictable.

The proposed merger between Kroger and Albertsons—two of the country’s biggest grocery companies—is the latest deal to be challenged.

The main issue is food prices. The Federal Trade Commission said the deal will lead to higher grocery prices for millions of Americans. The Biden administration isn’t going to let that slide—not given its track record, and certainly not in an election year.

The government’s antitrust lawyers are being kept busy.

Capital One’s

$35 billion tie-up with

Discover Financial,

combining two of the biggest credit-card companies, may well be the next target. Several Democrats urged U.S. regulators to block the deal in a letter Monday.

JetBlue’s

proposed merger with

Spirit Airlines

was blocked earlier this year as a federal judge sided with the Justice Department, which argued it would lead to higher airfares. Even companies that have completed mergers recently have been put through the wringer to get there—just ask Microsoft and Activision.

The White House’s antitrust crusade is causing problems for U.S. companies in their pursuit of growth.

It’s potentially damaging for market breadth, an issue that has been in focus in light of the so-called Magnificent 7’s meteoric rise over the past few years. For the other 493 names in the S&P 500, M&A is a key tool available to generate growth, but at the moment that well-trodden path is being blocked.

JetBlue wants to better compete with the four biggest U.S. airlines, Capital One hopes to challenge the dominance of

Mastercard

and

Visa,

while Kroger and Albertsons are trying to fend off competition from

Amazon

and Walmart.

But there’s a genuine likelihood that all three will end up being unsuccessful. Where do those companies go next?

As November edges closer, companies may even start to consider delaying potential deals pending the outcome of the election.

—Callum Keown

***

FTC Sues to Block Grocer Megamerger, Citing Consumer Harm

The Federal Trade Commission sued to block

Kroger’s

proposed $25 billion merger with rival

Albertsons,

saying the combination could raise prices for consumers and dent pay for workers. The companies’ plan to sell 413 stores in 17 states as part of the deal won’t solve the problem, the lawsuit said.

- Already, the attorneys general in Washington and Colorado have sued to stop the merger. Nine states including California joined the FTC’s case. Lawmakers including Sen. Elizabeth Warren and the United Food and Commercial Workers International Union, which represents workers, also oppose the merger.

- Kroger said blocking the merger would harm consumers, who would see higher prices and fewer grocery stores, and would strengthen nonunion grocers. Kroger said it has cut prices every year since 2003, investing $5 billion to lower prices, and reducing its gross margin 5%.

-

Big-box chains including

Walmart

and

Costco Wholesale

have been gaining market share in food retail as they leverage their size for cheaper prices. Online competitors such as

Amazon.com

have forced more traditional grocers to offer pickup and home delivery to compete. - A 2018 FTC paper examined how consumer prices changed following 14 supermarket mergers. It found price increases in highly concentrated markets but price decreases in less concentrated markets. The FTC has to figure out which markets are too concentrated and which mergers could lead to reduced competition.

What’s Next: The combined Kroger-Albertsons would operate 5,000 stores and have $228 billion in annual sales. Their combined market share of 15% to 20% would still be smaller than Walmart, which has more than 5,200 U.S. locations and makes more than a quarter of its sales in groceries.

—Janet H. Cho and Evie Liu

***

Bitcoin Briefly Tops $57,000, the Highest Level Since 2021

The price of Bitcoin briefly topped $57,000 early Tuesday, the highest level since 2021 driven by expectations for lower Federal Reserve interest rates, a coming technical change to how miners of the crypto are compensated, and the start of Bitcoin exchange-traded funds. Ether and other digital coins followed the largest cryptocurrency higher.

- MicroStrategy, a software company that buys crypto, added an additional $155 million of Bitcoin to its holdings this month.

- Shares of crypto companies were rising. MicroStrategy, Coinbase Global, and Marathon Digital Holdings surged in premarket trading Tuesday.

- Central banks recently have renewed their criticism of cryptocurrencies. The Atlanta Federal Reserve on Monday warned that crypto is risky. Officials at the European Central Bank last week wrote a blog post saying the existence of ETFs “doesn’t change the fact that Bitcoin is not suitable as a means of payment or as an investment,” and that “the fair value of Bitcoin is still zero.”

What’s Next: The question now is how long the rally can hold. The record price for Bitcoin is just above $65,000, which it hit in November 2021. The emergence of Bitcoin ETFs has opened up a wider pool of investor money, but it’s unclear how long the boost will last.

—Brian Swint

***

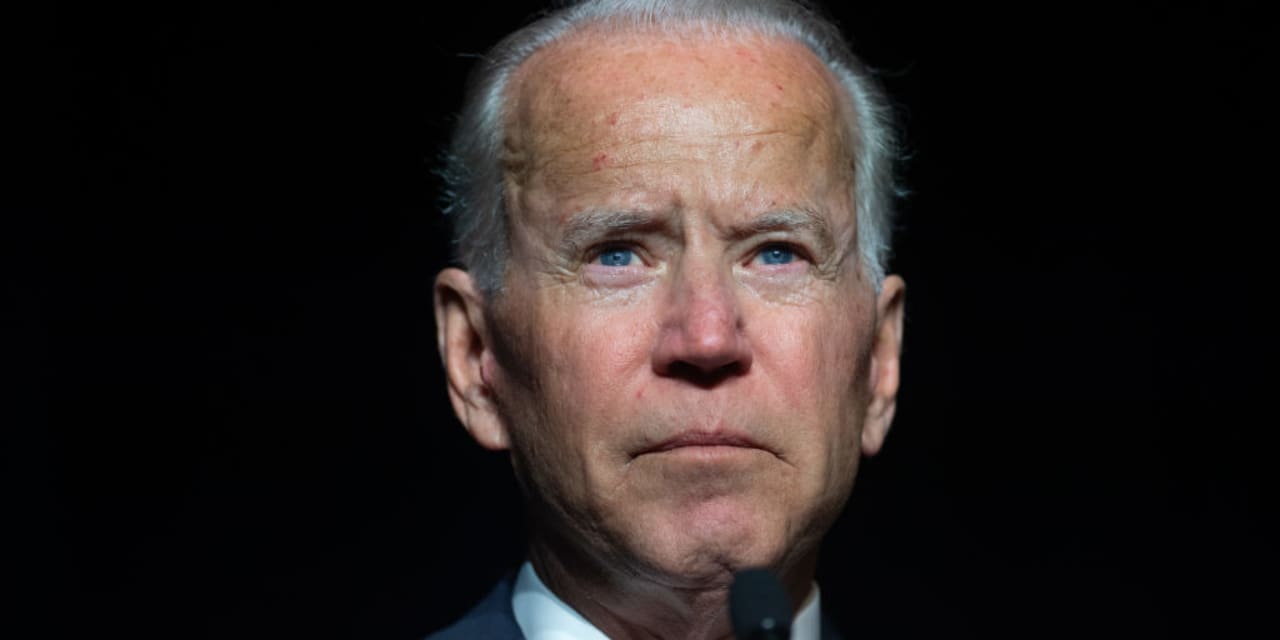

Biden, Lawmakers to Meet as Another Shutdown Deadline Looms

President Joe Biden has invited the top four congressional leaders to the White House today to nudge them forward on legislation needed to avoid a partial federal government shutdown starting this weekend. Lawmakers need to pass spending for some agencies by midnight Friday.

- Funding for the departments of Agriculture, Energy, Housing and Urban Development, Transportation, and Veterans Affairs expires on Friday. Other agencies run out of funding on March 8, as part of the stopgap funding extension House Speaker Mike Johnson (R., La.) pushed through in January.

- Biden also wants Congress to move forward on a $95 billion foreign aid package for Ukraine, Israel, Taiwan, and humanitarian aid that the Senate passed earlier this month. Although the bill has bipartisan support, Johnson hasn’t brought it to a floor vote.

- Senate Majority Leader Chuck Schumer (D., N.Y.) said even a partial shutdown would mean chaos. Sen. Minority Leader Mitch McConnell (R., Ken.) said they have the means and the time to avoid a shutdown but success depends on clean legislation, free of amendments that would make passage unlikely.

- Republicans’ narrow 219-212 House majority means Johnson will likely need Democratic votes to help pass the bills. That could endanger his standing with some House Freedom Caucus members who might try to oust him as speaker, like they did to former Speaker Kevin McCarthy.

What’s Next: Congress might have to pass another funding extension until lawmakers can reach an agreement that satisfies both sides. However, House Freedom Caucus Chairman Bob Good told Fox that a shutdown isn’t the worst thing and that Republicans shouldn’t hold hands with Democrats just to show they are governing.

—Janet H. Cho

***

Activist Investor Criticizes Disney’s AI Mediocrity

Activist investor Blackwells Capital criticized

Walt Disney’s

artificial intelligence and augmented reality mediocrity, saying the entertainment company lags behind other big companies.

Disney

needs to think like a technology company, the activist said, starting with a single chief technology officer overseeing all of its tech efforts.

-

Blackwells chief investment officer Jason Aintabi said its three nominees to Disney’s board can help improve the content, governance, and technology issues. He compared Disney with

Netflix,

Amazon, and

Apple,

which do have top tech chiefs. Disney didn’t respond to a Barron’s request for comment. - Blackwells said Disney’s shares have been underperforming but that they could jump up to 129% if the company boosted its use of AI and spatial computing, to offer experiences such as a Star Wars augmented-reality 3-D lightsaber fight with a Jedi on Tatooine or an African safari with Lion King characters.

- Disney’s board of directors separately sent shareholders a letter saying it is “laser-focused” on driving shareholder value, including restoring and boosting its cash dividend, buying back $3 billion in shares this year, and cutting costs by at least $7.5 billion by the end of fiscal 2024.

-

Disney said it is on track to deliver $8 billion in free cash flow and that its direct-to-consumer streaming businesses will reach profitability in the fourth quarter of fiscal 2024. Its sports streaming venture with

Fox

and

Warner Bros. Discovery

is also slated to go live in the fall.

What’s Next: Disney said David Greenbaum, former president of its Searchlight Pictures, would take a new role as president of Disney live action and 20th Century Studios. He succeeds Sean Bailey, who ran live action movies for Disney’s studio since 2010.

—Janet H. Cho

***

Zoom Video, Workday Beat Expectations and Talk Up AI Projects

Zoom Video Communications

topped expectations as revenue continued to climb. It talked about its digital AI assistant, which is aimed at improving productivity, as corporate customers continued to stick with the platform even amid teleconferencing competition from

Microsoft.

It also announced a $1.5 billion share buy back.

- Zoom, which exploded in popularity during the Covid-19 pandemic and then faced the threat of fading with return-to-office policies, said enterprise customers rose 3.5% from the prior year. About 3,810 of them contributed more than $100,000 of revenue in the past year, up 9.8% from earlier.

- Its Zoom AI Companion rolled out in fiscal year 2024, which ended in January. CEO Eric Yuan said the company is committed to “democratizing” AI accessibility regardless of a customer’s business size. It is also developing new features for its contact center business.

-

Separately,

Workday,

which also beat earnings expectations, announced an agreement to acquire HiredScore, a New York-based start-up that sells “AI-powered” talent software, for undisclosed terms. CFO Zane Rowe told Barron’s that it is still in the early days of making money on Workday’s AI investments. - For the April quarter, Workday sees 18% subscription growth, consistent with Wall Street estimates. The company noted that the three-month period will benefit from the inclusion of leap day—the extra day that comes with a leap year—adding about one percentage point of growth.

What’s Next: For its April quarter, Zoom projects revenue of $1.125 billion, just shy of expectations, though its profit outlook for $1.18 to $1.20 a share is above consensus. Zoom projected fiscal 2025 revenue of $4.6 billion, up 1.5% from fiscal 2024.

—Eric J. Savitz and Liz Moyer

***

Be sure to join this month’s Barron’s Daily virtual stock exchange challenge and show us your stuff.

Each month, we’ll start a new challenge and invite newsletter readers—you!—to build a portfolio using virtual money and compete against the Barron’s and MarketWatch community.

Everyone will start with the same amount and can trade as often or as little as they choose. We’ll track the leaders and at the end of the challenge the winner whose portfolio has the most value will be announced in The Barron’s Daily newsletter.

Are you ready to compete? Join the challenge and pick your stocks here.

***

—Newsletter edited by Liz Moyer, Patrick O’Donnell, Rupert Steiner

Read the full article here