Brief History Of Alpine To Present Day, Including Recent Bull Run On Kidney Disease Data

Alpine Immune Sciences, Inc. (NASDAQ:ALPN), headquartered in Seattle, joined the Nasdaq in June 2017, via a merger with failing Cystic Fibrosis drug developer Nivalis Therapeutics.

Backed by several biotech venture capital firms, including Frazier Healthcare Partners, Alpine BioVentures, and OrbiMed Advisors, the combined company began life with ~$90m cash, and a share price of ~$10. At that time, the company discussed its business as follows:

Alpine Immune Sciences, Inc. was founded in 2015 and is focused on developing novel protein-based immunotherapies using its proprietary variant immunoglobulin domain (vIgD™) platform technology.

The vIgD platform is designed to interact with multiple targets, including many present in the immune synapse. Alpine’s vIgDs are developed using a unique process known as directed evolution, which can produce proteins capable of either enhancing or diminishing an immune response and thereby may apply therapeutically to both oncology and inflammatory diseases.

Alpine has also developed its transmembrane immunomodulatory protein (TIP™) technology, based on the vIgD platform, to enhance engineered cellular therapies.

Alpine had established a worldwide research and development program with Kite Pharma – now part of Pharma giant Gilead Sciences, Inc. (GILD), potentially worth up to $535m in future milestone payments, plus royalties, however Kite walked away from the deal in 2019.

Meanwhile, Alpine had been developing its lead candidate, ALPN-101, a “dual Inducible T cell Costimulator (“ICOS”), and CD28 antagonist intended for the treatment of autoimmune and inflammatory diseases,” and in 2020, entered into a co-development partnership with the pharma giant AbbVie, which included a $60m upfront payment and the option for AbbVie to take over development and commercial activities for the drug, if approved, with >$800m of milestones potentially on the table for Alpine.

In the end, in December last year, with Alpine’s Phase 2 study of ALPN-101, now known as acazicolcept, overrunning, AbbVie gave Alpine the option to terminate the study early, in exchange for a significantly lower payout should AbbVie decide to take up its option, with total milestones falling to ~$150m maximum.

A second drug candidate developed by Alpine – davoceticept, or ALPN-2020, an investigational CD28 costimulator and dual checkpoint inhibitor, was shelved after two patient deaths occurred across two clinical studies, one evaluating the drug as a monotherapy, and a second alongside Merck’s mega-blockbuster checkpoint inhibitor keytruda, or pembrolizumab, in advanced malignancies.

In short, Alpine endured a tricky start to life as a public company, its stock plummeting to lows of <$4 in 2020, however, its saving grace has been a third asset, povetacicept, or ALPN-303.

In its Q3 2023 quarterly report / 10Q submission, Alpine calls povetacicept “a dual antagonist of the B cell activating factor (“BAFF”), and a proliferation-inducing ligand (“APRIL”), cytokines, which play key roles in the activation, development, and survival of B cells.”

The 10Q goes on to state that:

povetacicept has exhibited greater potency in preclinical studies versus wild-type TACI-based comparators, as well as other inhibitors of BAFF and/or APRIL alone.

We are evaluating povetacicept in our RUBY-3 and RUBY-4 studies.

RUBY-3 is a multiple ascending dose, multi-cohort, open-label, phase 1b/2a study of povetacicept in IgA nephropathy, lupus nephritis, and primary membranous nephropathy, where povetacicept is being administered subcutaneously once every four weeks for up to 48 weeks. Key endpoints include proteinuria, eGFR, renal response, and disease-related autoantibodies.

RUBY-4 is a multi-cohort, open-label phase 1b study of povetacicept in immune thrombocytopenia, autoimmune hemolytic anemia, and cold agglutinin disease, where povetacicept is being administered subcutaneously once every four weeks for up to 48 weeks. Key endpoints include respective blood cell counts, including durable responses, as well as disease-related autoantibodies.

Since 2021, povetacicept’s preclinical data has attracted the attention of Wall Street analysts, helping to keep its share price stable as the acazicolcept and davoceticept programs unravelled, and in November last year, the company was able to share positive clinical data that has triggered a six-month bull run on shares, which have risen in value by >215%, to trade at $39 at the time of writing, valuing the company at ~$2.53bn.

Povetacicept’s Data – A Shot At Best-in-Class Status In Multi-Billion Kidney Disease Market?

Alpine chose to share its data in a late-breaking Poster Session at the American Society of Nephrology Kidney Week 2023, on Nov. 2, 2023. The headline data below is copied from an Alpine press release:

- As of Oct. 25, 20 participants with IgA nephropathy (IgAN) have been enrolled, 12 at the 80 mg dose level, of whom five have UPCR data available at 24 weeks.

- In IgAN, treatment with low-dose povetacicept, 80 mg SC every four weeks was associated with clinically meaningful improvements in proteinuria, with a 53.5% reduction from baseline in urine protein to creatinine ratio (UPCR; n=5) at 24 weeks. In addition, at 24 weeks, 4/5 (80%) had achieved remission, as defined by UPCR < 0.5 g/g and ≥50% reduction in UPCR from baseline with stable renal function (≤ 25% reduction in eGFR from baseline).

- In IgAN, treatment with low-dose povetacicept also was associated with a >60% reduction in the key disease-related biomarker galactose-deficient IgA1 (Gd-IgA1), as well as stable renal function as assessed by estimated glomerular filtration rate (eGFR) (+7.1% from baseline at 24 weeks; n=5).

- The first participant with primary membranous nephropathy (pMN), also treated with povetacicept 80 mg SC every four weeks, achieved an immunological remission, defined as a reduction in the highly disease-relevant biomarker anti-PLA2R1 to an undetectable level, from a baseline of 209 to < 2 RU/mL by 22 weeks.

- Povetacicept has been well tolerated, with no reported administration-associated reactions, no instances of IgG < 3 g/L, and no severe infections.

- A higher dose of povetacicept, 240 mg SC every four weeks, continues to enroll, with initial data expected in 1H 2024.

IgAN is a disease characterized by hematuria (blood in urine), and proteinuria (high levels of protein in urine), which can lead to progressive renal (kidney) failure, and it affects ~150k patients in the US, and even greater numbers in Europe and Asia.

IgAN has traditionally been treated with renin-angiotensin-aldosterone system (RAAS) blockade with immunosuppression, but recently approved drugs in the indication include Calliditas Therapeutics AB (publ) (CALT) Tarpeyo, an oral, delayed-release formulation of the corticosteroid budesonide that received full approval in January this year, having received accelerated approval in 2021, and Travere Therapeutics, Inc. (TVTX) Filspari, a non-immunosuppressive drug, awarded accelerated approval in February 2023 (accelerated approval allows the drug to be sold commercially, although the drug developer must conduct further studies, which, if unsuccessful, could see the drug withdrawn from the market).

In 2023, Filspari earned $29.2m of revenues in its first year on the market, while Tarpeyo earned ~$105m in revenues. That may sound underwhelming, given Alpine’s $2.5bn market cap, however, although analysts have shared few thoughts on the peak revenue potential of povetacicept, Wall Street has speculated that Vera Therapeutics, Inc. (VERA) atacicept, which has a very similar mechanism of action to Alpine’s drug, being a self-administered fusion protein that blocks BAFF and APRIL, could achieve $1.25bn in peak sales in the IgAN indication alone, while Vera’s management believe the annual market opportunity for its drug is $6bn – $10bn.

I discussed Vera in a deep dive note posted to Seeking Alpha shortly after the company’s stock began rising on positive IgAN data for atacicept, in January this year. Shares traded at $25 at the time, and I gave the stock a “hold” recommendation, given that approval of the drug is dependent on the outcome of a separate Phase 3 study and maybe 2-3 years away, but shares have continued to rise, to >$45 at the time of writing, valuing Vera’s business at ~$2.5bn – the exact same value the market attaches to Alpine.

Vera’s data was from a Phase 2b study, at 72 weeks, and was summarized in a press release as follows:

Participants treated with atacicept for 72 weeks demonstrated a 62% reduction in Gd-IgA1, a reduction in the percentage of participants with hematuria to 19%, and a 48% reduction in UPCR in the per-protocol (“PP”) analysis.

Vera’s data seems to slightly lag Alpine’s in terms of UPCR – a 48% reduction at 72 weeks, vs. 54% in just 24 weeks – although it should be noted Alpine’s data is taken from just five patients, and that in other areas, such as estimated globular filtration rate (“EGFR”), atacicept may have a slight edge, although the reality is we may not know for sure until we have the full RUBY-3 data.

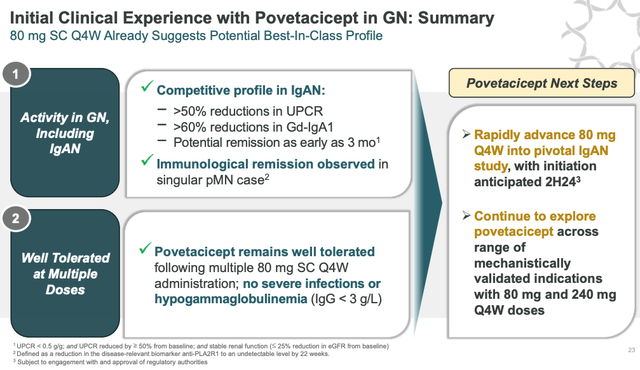

Povetacicept clinical experience to date (Alpine presentation)

As we can see above, a slide from a recent Alpine presentation suggests management is confident that, even at this early stage of development, povetacicept is exhibiting best-in-class potential, and management expects to move the drug into a pivotal study in IgAN in the second half of this year.

As such, it seems possible that povetacicept could still beat atacicept to market, if approved, of course, and if we consider that the list price of tarpeyo and filspari is ~$85k per annum, and multiply this by the addressable patient population of 150k people in the US alone, we reach a figure of nearly $13bn.

A 10% share of that market would be enough to make povetacicept a “blockbuster” (revenues of >$1bn per annum), and considering commercial stage pharmas generally trade at a price-to-sales ratio of 3-5x sales, it’s not hard to see why the share price of Alpine has been climbing.

If management can expand the label of povetacicept into other indications, it could have a multi-billion selling drug on its hands, meaning that investors buying today would have good reason to believe the share price and market cap valuation could double in the next 3-5 years, not to mention the prospect of the company becoming an attractive acquisition target – provided its drug works as well as management believes it will.

Risks To The Alpine Bull Thesis – Intense Competition, Poor Track Record, Finances

Before getting too carried away with the best-case scenario, however, it’s worth considering some drawbacks to the bull thesis.

Kidney disease is a difficult space for biotechs and drug developers characterized by high rates of failure, although recent approvals have arguably opened up the IgAN space somewhat, and both povetacicept and atacicept are achieving levels of UPCR reduction – >40% – that the FDA may deem approvable, with apparently solid safety profiles.

Nevertheless, there are other drug candidates in the race for approval in IgAN. As I wrote in my note on Vera:

For example, in November, Japanese Pharma Otsuka Holdings Co., Ltd. (OTCPK:OTSKF) reported that its IgAN candidate sibeprenlimab, after a 12-month Phase 2 study, has achieved:

geometric mean ratio reduction in 24-hour uPCR from baseline was 47.2%, 58.8%, 62.0%, and 20.0% with sibeprenlimab 2, 4, and 8 mg/kg, and placebo, respectively.

This appears to be as competitive, if not even more impressive than Alpine’s data taken from a very small number of patients. The Swiss Pharma giant Novartis AG (NVS) also poses a major challenge to Alpine’s ambitions. Its Phase 3 stage candidate atrasentan also has delivered some positive Phase 3 data, with the endpoint of reducing levels of proteinuria being met at 36 weeks, and the company planning to push for accelerated approval.

Novartis gained access to atrasentan via its $3.5bn buyout of Chinook Therapeutics in 2022, and the company has two further late-stage assets, in oral complement factor B inhibitor iptacopan, and subcutaneously administered anti-APRIL antibody zigakibart, which has a similar MoA to povetacicept and atacicept, and which Novartis believes it can bring to market by 2027. Approval for atrasentan and iptacopan could occur even sooner, and both have “blockbuster” revenue expectations.

Meanwhile, other companies developing therapies targeting IgAN include BioCryst Pharmaceuticals, Inc. (BCRX), Ionis Pharmaceuticals, Inc. (IONS), Omeros Corporation (OMER), Roche Holding AG (OTCQX:RHHBY), another Swiss Pharma giant, and the generics giants Takeda Pharmaceutical Company Limited (TAK) and Viatris Inc. (VTRS).

In short, alongside recently approved tarpeyo and filspari, povetacicept must do battle with two drugs with a very similar MoA, in atacicept and zigakibart, plus numerous other candidates that are apparently further down the line, development-wise. In that context, buying Alpine stock based on Phase 2 data from a handful of patients may not feel like a wise move.

In such a tight race for approval, companies will need to be able to call upon substantial cash reserves to fund pivotal studies, regulatory matters, R&D, and a potential commercial launch. As of Q3 2023, Alpine reported $197m of current assets and a year-to-date net loss of $38m. My guess is that the closer povetacicept gets to approval, the higher Alpine’s operational costs will climb, and at some stage the company will likely be forced to complete further dilutive fundraisings, negatively affecting its share price in the process.

Alpine continues to be led by Executive Chairman and CEO Mitchell Gold, formerly CEO of Dendreon Corporation, where he helped bring prostate cancer immunotherapy Provenge to market, although that drug never became the blockbuster asset the company believed it could be.

Considering that Alpine has had two clinical misses, with acazicolcept and davoceticept, it seems vital that management makes the most of its opportunity with povetacicept, however, battling the likes of Novartis, and entrenched incumbents such as Travere and Calliditas, will not be straightforward, and it may be worth asking the question if Alpina has the commercial nous required to succeed in such a crowded space, even if it were to develop the most effective therapy?

Concluding Thoughts – Is Alpine Immune a “Buy,” “Sell” or “Hold” after recent developments?

As mentioned above, after neither of its original candidates succeeded in the clinic, Alpine is now pretty much “all-in” on povetacicept.

Clearly, the market has seen something it likes in the early povetacicept data readouts, but equally, I find it difficult to find areas where the drug is a major improvement on existing standards of care, or in comparison to two other companies’ drugs with the same MoA, targeting the same disease indications.

As such, I find a market cap valuation of $2.5bn a little high for a company that has to date arguably encountered more failure than success, has limited financing, no prospect of near-term revenues, substantial single asset risk, and plenty of competition.

With that said, I clearly underestimated how much the market would appreciate data shared by Vera Therapeutics in January, although it should be noted that even after its recent rally, it’s now worth the same as Alpine, despite being further along development-wise.

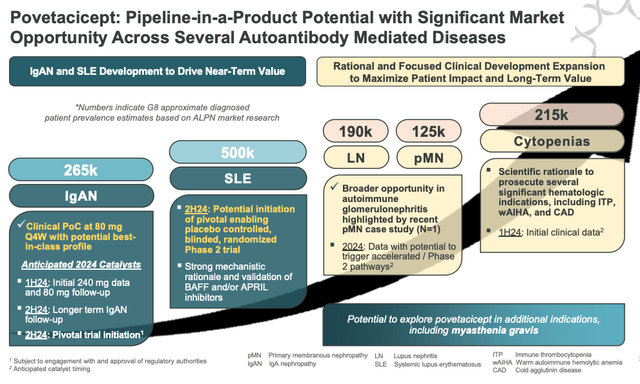

povetacicept pipeline in a product potential (presentation)

As we can see above, Alpine makes the “pipeline in a product” claim that is common to many biotechs developing a single drug as opposed to a diverse pipeline, and there are certainly reasons to believe that povetacicept could successfully win approvals in all the markets mentioned above – after all, there are at least three companies focused on developing drugs with the same MoA, so we should not underestimate the potential of Alpine’s drug.

With such a long development path still to follow before a commercial approval can be considered genuinely likely, however, and with no data set large enough to make a bona fide judgment on the quality of Alpine’s product relative to its competition – of which there is plenty – while I will steer clear of giving the company a “sell” recommendation, owing to the clear market opportunity in play, I’ll be staying on the sideline when it comes to buying Alpine stock.

This field of drug development, for my money, is a little too risky, and I cannot point to a clear advantage that Alpine enjoys over its competition, at least at this time.

Read the full article here