The DoubleLine Yield Opportunities Fund (NYSE:DLY) is a closed-end fund aka CEF that income-focused investors can employ in order to achieve their goals. DoubleLine has earned something of a reputation as a top-notch bond fund manager and, much as is the case with PIMCO funds, offerings from DoubleLine tend to have higher yields than can be obtained elsewhere in the market. The DoubleLine Yield Opportunities Fund is not an exception to this, as its 9.01% current yield is competitive with other bond funds, although it is not as high as a few other funds that invest across the debt spectrum. For example, the PIMCO Income Strategy Fund (PFL) is yielding 11.70% right now. Here are the yields of a few other bond funds that are classified as multi-sector taxable bond funds by Morningstar:

|

Fund Name |

Current Yield |

|

DoubleLine Yield Opportunities Fund |

9.01% |

|

PIMCO Income Strategy Fund |

11.70% |

|

BlackRock Multi-Sector Income Trust (BIT) |

9.52% |

|

Western Asset Diversified Income Fund (WDI) |

11.88% |

|

Virtus Global Multi-Sector Income Fund (VGI) |

12.83% |

As we can see, the DoubleLine Yield Opportunities Fund has a lower yield than many of its peers, although it is still far more attractive than what can be obtained in the equities space. However, this lower yield is at least partially caused by the fact that the DoubleLine Yield Opportunities Fund has lower leverage than many of the other funds on this list. That is something that will undoubtedly appeal to many investors, particularly those who are risk-averse. As many income-focused investors are retirees who are simply looking to earn the income that they need to support themselves without making huge gambles, the proposition that this fund offers could prove attractive.

As regular readers may remember, we previously discussed the DoubleLine Yield Opportunities Fund back in September of 2023. The bond market has been somewhat mixed since then, as bonds generally declined for a few weeks following the publishing of that article and then surged through the end of the year as the market became overly enthusiastic about the potential for interest rate cuts in 2024. Year-to-date, the bond market has been weaker as the market is gradually coming to realize that it is highly unlikely that the Federal Reserve will cut interest rates to anywhere near the degree that was expected at the start of this year.

While the stock market is still arguably pricing in a half-dozen or so interest rate cuts, the bond market is not. Readers of my other articles on the fixed-income markets will likely be unsurprised at this, as economic data never supported the prospect of multiple rate cuts in 2024 and I expected that the bond market would decline in earnest during the first few months of the year.

As such, we might expect the performance of the DoubleLine Yield Opportunities Fund to have been mixed since we last discussed it. This is not exactly correct though, as the shares of the fund are up 6.46% since that article was published. This is not a bad performance at all over a six-month period and it significantly beats the 2.86% gain of the Bloomberg U.S. Aggregate Bond Index:

Seeking Alpha

To put this in perspective, that share price gain works out to roughly 13% annualized, which is actually higher than the historical average return of common stocks. Bonds typically deliver lower returns than common stocks, so this is a rather impressive performance over the period.

However, the actual performance that investors in the fund realized is much better than this figure suggests. This is because the DoubleLine Yield Opportunities Fund is a closed-end fund and one of the defining characteristics of such funds is that they pay out most or all of their investment profits to the shareholders in the form of distributions. This is the reason why these funds tend to boast higher yields than most other things in the market. It also results in the fund’s shareholders doing much better than the share price performance alone would suggest.

As such, it is important to take the fund’s distributions into account during any analysis of its returns. When we do that, we see that investors in the DoubleLine Yield Opportunities Fund have gained 12.08% since our last discussion on the fund:

Seeking Alpha

Clearly, investors in this fund are doing much better than investors in the Bloomberg Aggregate Bond Index. That is not exactly surprising though, as closed-end bond funds have generally been better than the indices over most of the past decade. That is due to the very low yields of ordinary bonds, which these funds are able to improve upon through the use of leverage.

As six months have passed since our previous discussion on the DoubleLine Yield Opportunities Fund, a great many things have changed. Undoubtedly, the most important of these changes is the fact that the fund released its full-year annual report which will give us a much better understanding of how well the fund managed to cover its distributions throughout the rather volatile bond market that has persisted for quite a while. We will make sure to pay special attention to this report in this article.

About The Fund

According to the fund’s website, the DoubleLine Yield Opportunities Fund has the primary objective of providing its investors with a very high level of total return. As I have pointed out in numerous previous articles, including my previous one on this fund, a focus on total return does not make a lot of sense for a bond fund. As I explained previously:

As a rule, bonds provide all of their investment return in the form of direct payments to their investors. A bond investor purchases a newly issued bond at face value, collects a regular coupon payment from the issuer that corresponds to interest on the loan, and then receives the face value back when the bond matures. There are no net capital gains over the life of the bond because bonds have no inherent link to the growth and prosperity of the issuing company. Thus, the bond’s yield is the only source of net investment returns.

There will undoubtedly be some readers who point out that bond prices rise when interest rates decline, so it can be possible to obtain some investment return through that method. While that is true, there is also a limit to how far bond prices can rise because interest rates cannot really go negative. There were a few times over the past ten years or so that saw central banks experiment with negative interest rates, but they rarely went deeply negative, and even then, there could be some issues with getting anyone to purchase a bond with a negative yield-to-maturity. Few people would willingly purchase something that is guaranteed to lose money when better options are available. As such, there is a theoretical limit to how much bonds can deliver in capital gains. These are called fixed-income securities for a reason.

The DoubleLine Yield Opportunities Fund does not invest in only a single type of bond. From the website:

The Fund will seek to achieve its investment objective by investing in a portfolio of investments selected for its potential to provide a high level of total return, with an emphasis on current income. The Fund may invest in debt securities and other income-producing investments of issuers anywhere in the world, including in emerging markets, and may invest in investments of any credit quality.

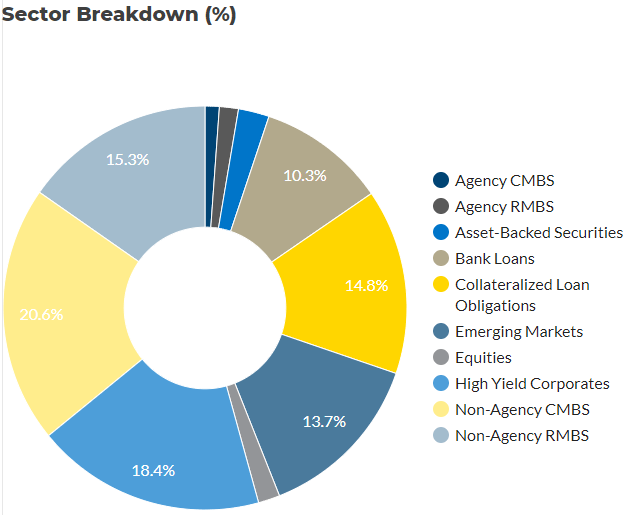

In theory, this actually states that the fund can invest in anything that it wants. A dividend-paying common stock could be considered an “income-producing investment,” after all. However, as is the case with most DoubleLine funds, this one pretty much just invests in debt securities. It does include both fixed-rate and floating-rate debt securities, but as of right now it is weighted towards fixed-rate debt:

DoubleLine

The only things on this chart that will usually be floating-rate debt are the collateralized loan obligations and the bank loans. That only accounts for 25.10% of the fund’s total assets, so we can see that the overwhelming majority of its money is invested in fixed-rate debt. Interestingly, the fund’s allocation to fixed-rate debt has been decreasing slowly over the past few months. The fund’s fact sheet, which is dated December 31, 2023, shows this sector breakdown:

Fund Fact Sheet

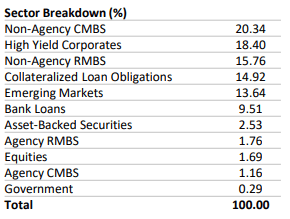

This shows a 24.43% allocation to collateralized loan obligations and bank loans as of that date. Thus, it appears that the fund’s allocation to these securities has increased slightly during the first two months of 2024 (the pie chart shown above is dated February 29, 2024). It is uncertain whether or not this increased weighting to floating-rate securities was an intentional decision on the part of the fund’s management or not, however. This chart shows the iShares Floating Rate Bond ETF (FLOT) against the Bloomberg U.S. Aggregate Bond Index over the first two months of 2024:

Barchart

Floating-rate bonds are represented by the black line and fixed-rate bonds are represented by the blue line. Thus, we can see that floating-rate securities generally outperformed fixed-rate bonds over the first two months of the year. That is not at all surprising as the bond market was projecting six interest rate cuts in 2024 back at the start of the year and it has since realized that scenario is highly unlikely to occur and has been repricing fixed-rate bonds lower in accordance with this realization. The price of floating-rate bonds tends to be less affected by interest rates due to the fact that these securities always deliver a yield that is competitive with the market rate. As such, floating-rate bonds will always outperform fixed-rate bonds during periods of rising interest rates.

In the case of the DoubleLine Yield Opportunities Fund, this means that if the fund made no changes to its portfolio during the first two months of the year, the representation of floating-rate securities would naturally increase relative to the fixed-rate portion of its portfolio. The DoubleLine Yield Opportunities Fund only showed a 14.00% annual turnover in its annual report so it seems likely that management is not actively making too many changes, and thus the rising allocation to floating-rate securities over the past two months is probably being driven by these securities simply outperforming their counterparts.

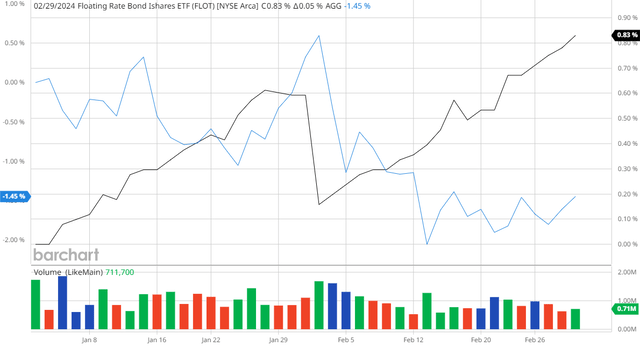

One thing that we frequently see with closed-end bond funds is that a large percentage of their assets are typically invested in speculative-grade securities (junk bonds). This makes a lot of sense, particularly over the past fifteen years. As we can see here, the yield of the U.S. Ten-Year Treasury Note has been under 3% for nearly all of the past ten years:

Trading Economics

Investment-grade bonds in general do not provide a substantial improvement over the United States 10-Year Bond Yield (US10Y). Here is the spread between Baa (the lowest-rated investment-grade bonds) and the ten-year Treasury over the same period:

Federal Reserve Bank of St. Louis

As we can see here, even the lowest-rated investment-grade bonds have rarely had a yield of more than 250 basis points over the ten-year U.S. Treasury. When we consider the low yield of government securities, this tells us that even the lowest-rated investment-grade bonds have typically traded with a yield under 4.50% over nearly all of the past decade. That is far too low to provide investors with an acceptable yield, especially when you consider both the limited potential for capital gains possessed by bonds and other debt securities as well as the expenses of an actively managed fund.

Thus, the only realistic option to provide an acceptable yield for most investors is to either run a portfolio holding a relatively high allocation to junk-rated debt or employ far more leverage than is prudent. Most funds have opted to put their money into junk-rated debt in order to provide a reasonably attractive yield for income-hungry investors.

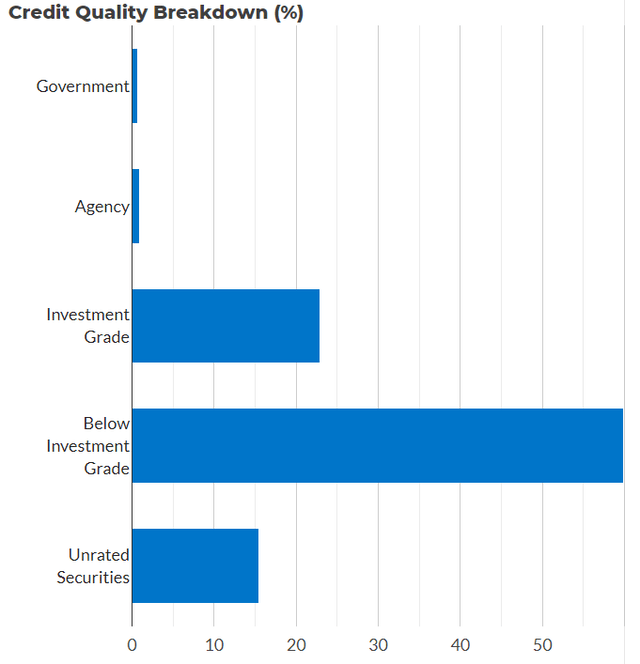

The DoubleLine Yield Opportunities Fund is no exception to this. According to the fund’s website, the fund currently has 59.92% of its assets invested in speculative-grade debt:

DoubleLine

The DoubleLine Yield Opportunities Fund is one of the only funds that does not explicitly break down its holdings by exact credit quality. All that we see here is that the majority of the fund’s holdings are in below-investment-grade securities. However, as I pointed out in a recent article, there is a very big difference in default risk between a BB-rated bond and a C-rated bond. It would be nice if the fund would break down its portfolio to this degree, as I am quite certain that most risk-averse investors would prefer not to be invested in anything rated CCC or below given how quickly the default rate increases once we get below that level. The fund’s annual report does not even include a breakdown by credit quality, so we cannot rely on that to obtain better information.

With that said most closed-end funds tend to have most of their junk debt allocations invested in BB and B-rated securities. We have seen this in other closed-end bond funds that I have discussed in this column. The same is probably true of the DoubleLine Yield Opportunities Fund and when combined with the fund’s 493 current holdings, this should protect us from having to take on too much default risk. However, there is no way to be certain about this conclusion at this time and it would be nice to have better information directly from the fund’s sponsor.

Leverage

As is the case with most closed-end funds, the DoubleLine Yield Opportunities Fund employs leverage as a method of boosting the effective yield that is earned by the assets in its portfolio. I explained how this works in my previous article on this fund:

In short, the fund borrows money and then uses that borrowed money to purchase bonds or other income-producing assets. As long as the purchased assets have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will usually be the case. However, it is important to note that leverage is much less effective at boosting the fund’s effective portfolio yield today with rates at 6% than it was three years ago when rates were at 0%.

Unfortunately, the use of debt in this fashion is a double-edged sword because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage since that would expose us to too much risk. I generally like a fund’s leverage to be less than a third as a percentage of its assets for this reason.

As of the time of writing, the DoubleLine Yield Opportunities Fund has leveraged assets comprising 19.39% of its portfolio. This is quite a bit less than most other bond funds possess, as noted in the introduction. For example, here is how this fund compares to its peers in this respect:

|

Fund |

Current Leverage |

|

DoubleLine Yield Opportunities Fund |

19.39% |

|

PIMCO Income Strategy Fund |

22.10% |

|

BlackRock Multi-Sector Income Trust |

34.10% |

|

Western Asset Diversified Income Fund |

31.26% |

|

Virtus Global Multi-Sector Income Fund |

30.77% |

As higher levels of leverage translate to higher levels of volatility, the fact that the DoubleLine Yield Opportunities Fund has lower levels of leverage than its peers should overall result in the fund showing greater stability over time, all else being equal. Unfortunately, this does not always show up in the share price performance of these funds due to the fact that net asset value and share price performance can differ during any given period. However, overall, this should mean that the DoubleLine Yield Opportunities Fund is a bit less risky than its peers and those investors who prioritize safety in their portfolio positions might appreciate this.

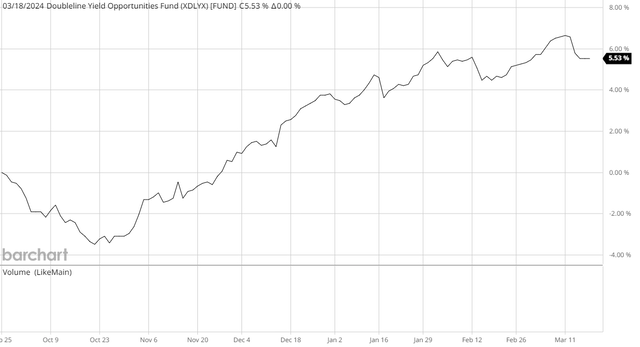

It is also worth noting that the DoubleLine Yield Opportunities Fund has seen its leverage decline since the last time that we discussed it. At the time that the previous article was published, the fund had a leverage ratio of 20.24%. The reason for this decline over the past six months is quite obviously that the fund’s net asset value increased. We can see that here:

Barchart

As we can quite clearly see, the fund’s net asset value increased by 5.53% over the period. Thus, assuming that the fund’s borrowings stayed at the same level, its leverage will now reflect a smaller percentage of a larger portfolio.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the DoubleLine Yield Opportunities Fund is to provide its investors with a very high level of total return. It does specifically state that it expects most of this return to come in the form of direct payments that it receives from the securities that it holds in its portfolio. In pursuance of this objective, the DoubleLine Yield Opportunities Fund purchases bonds, corporate loans, and other income-producing securities, which as the name implies are assets that provide income to their owners. The fund collects the payments that it receives from all of these securities and combines them with any profits that it manages to earn from selling bonds that have gone up in price (due to a decline in interest rates). This fund takes things a step further than that though, as it borrows money to purchase more securities than it otherwise could solely with its own equity capital. That effectively boosts the yield that the fund earns from its equity capital because it is able to keep the difference between the payments that it receives from the purchased securities and the interest payments that it has to make on the borrowed money.

The majority of this fund’s assets are invested in below-investment-grade securities, which tend to have high yields in most market environments. The fund’s basic business model is to pool together all of the money that it receives from all of these different sources and then pay it out to its investors, net of its expenses. We can probably assume that this model will allow the fund to boast a fairly high yield overall.

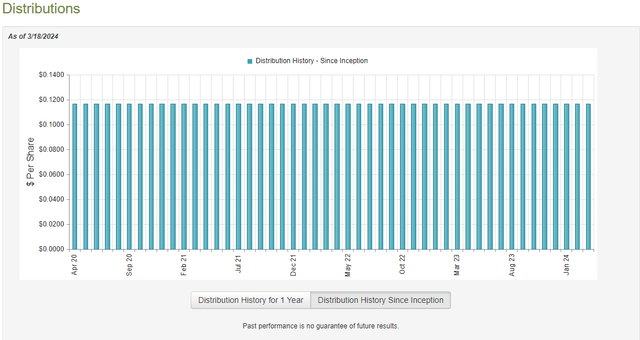

This is certainly the case, as the DoubleLine Yield Opportunities Fund pays a monthly distribution of $0.1167 per share ($1.4004 per share annually), which gives it a 9.01% yield at the current share price. As we have already seen, this yield compares pretty well with that of similar funds in today’s market environment. This fund has proven itself to be remarkably consistent with respect to its distribution over time, as we can clearly see here:

CEF Connect

As we can clearly see, the DoubleLine Yield Opportunities Fund has not changed its distribution since its 2020 inception. This is certainly the sort of track record that will undoubtedly appeal to any investor who is seeking to earn a safe and consistent level of income from the assets in their portfolios. However, it also begs the question of how this fund was able to sustain such a payout when many of its peers have changed their distributions over the same period. After all, interest rates increased substantially about halfway through the period shown above, and this resulted in many bond funds taking very high losses as the low-yielding bonds that were issued during the COVID-19 pandemic and the 2021 recovery are worth substantially less than face value in the market today. It is never a good idea for a fund to pay out more than it is actually earning from its investment portfolio since that will destroy its net asset value and ultimately hurt the sustainability of the fund. This is something that we should have a look at as part of our analysis of this fund.

Fortunately, we do have a relatively recent document that we can consult for the purposes of our analysis. As of the time of writing, the most recent financial report for the DoubleLine Yield Opportunities Fund corresponds to the full-year period that ended on September 30, 2023. While this document will not include any information about the fund’s performance over the past five or six months, it is still a much more recent document than the one that we had available to us the last time that we discussed this fund. That is a good thing to see overall, as this report should provide us with a great deal of insight into how well this fund performed during the very challenging market conditions that existed during the summer of 2023.

As many readers can likely recall, the Federal Reserve’s most recent rate hike came in July 2023 and over the course of a few months following that, the market was digesting the fact that interest rates would likely remain far higher than it previously expected for an extended period. This rate hike effectively ended the narrative that the federal funds rate would decline in 2023 and the market began selling off bonds and other interest rate-sensitive assets to bring prices in line with these new expectations. This could have caused the fund to take some losses, which will be reflected in this report.

For the full-year period that ended on September 30, 2023, the DoubleLine Yield Opportunities Fund received $85,190,320 in interest and $1,781,622 in dividends from the assets in its portfolio. This gives the fund a total investment income of $86,971,942 over the full-year period. It paid its expenses out of this amount, which left it with $62,044,771 available for shareholders.

This was, unfortunately, not enough to cover the $67,143,269 that the fund paid out in distributions over the period, but it did manage to get pretty close. However, this situation could still be concerning at first glance because the fund failed to cover its distributions with net investment income over the period. As I have pointed out in various past articles, we would generally prefer a fixed-income fund to have sufficient net investment income to cover its distributions in full.

With that said, there are other methods through which a fund can obtain the money that it requires to cover its distributions. For example, it might be able to exploit the bond price changes that accompany fluctuations in interest rates and realize some capital gains by selling bonds prior to maturity. Realized capital gains are not considered to be investment income for tax or accounting purposes but they clearly do result in money coming into the fund that can be paid out to the shareholders.

Unfortunately, the DoubleLine Yield Opportunities Fund did not have much success in earning money via these alternative sources over the course of the year. The fund reported net realized losses of $28,079,997 that were partially offset by $26,248,178 net unrealized gains. Overall, its net assets declined by $6,930,317 after accounting for all inflows and outflows during the period. This comes on the heels of a $239,560,596 decrease in net asset value during the prior full-year period.

Thus, the DoubleLine Yield Opportunities Fund has failed to fully cover its distribution for the past two years in a row. This is not something that we particularly would like to see, as it could suggest that the fund’s current distribution is unsustainable.

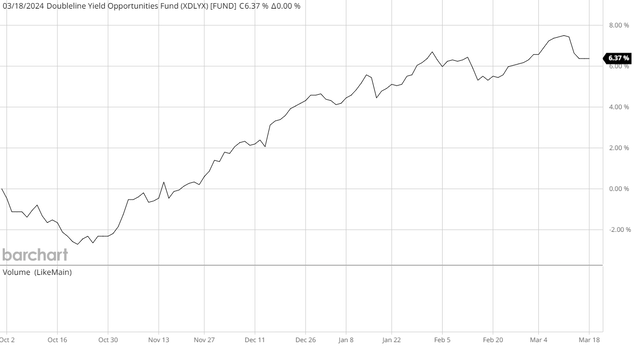

Fortunately, the fund does appear to be doing much better since the closing date of the most recent financial report. This chart shows the fund’s net asset value since September 29, 2023:

Barchart

As we can see, the fund’s net asset value is up 6.37% since the fund closed its books for the most recent fiscal year. This basically means that the fund has managed to cover all of the distributions that it has paid out since that date and then some as the fund’s portfolio has been growing despite the fact that it continues to pay out its distribution. Thus, the fund’s semi-annual report for the first six months of its 2024 fiscal year will likely look much better than the past few reports.

Overall, the fund is probably okay in terms of distribution sustainability, but we should still keep an eye on its net asset value. After all, there is still a chance that the Federal Reserve will not reduce rates at all in 2024 (we discussed this thesis in previous articles) and that could result in the bond market declining precipitously from today’s levels.

Valuation

As of March 18, 2024 (the most recent date for which data is currently available), the DoubleLine Yield Opportunities Fund has a net asset value of $16.04 per share but the shares only trade for $15.53 each. This gives the fund’s shares a 3.18% discount on net asset value at the current price. This is a much better price than the 1.25% discount that the fund’s shares have averaged over the past month and as such represents a relatively decent entry point.

Conclusion

In conclusion, the bond market has been selling off over much of the year so far to the point that bonds are now largely priced in line with the interest rate expectations of the Federal Open Market Committee. As such, today does look like a better time to buy a bond fund such as the DoubleLine Yield Opportunities Fund than at any time so far in 2024. However, there is still a chance that the Federal Reserve itself will have to step back from its current prediction of three interest rate cuts in 2024 at the meeting later this week. After all, inflation has been showing no signs of decreasing, and it would be foolish to cut interest rates at this point in time.

The DoubleLine Yield Opportunities Fund looks reasonably solid right now, although the fact that it has failed to cover its distributions for two years in a row is rather worrying. I would hold off on buying the fund until after the central bank meeting this week, however. At the same time, it probably does not make sense to sell it today.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here