Previous Thesis

I last covered Medical Properties Trust, Inc. (NYSE:MPW) back in November in an article titled: Don’t Get Cut Being Greedy When You Should Be Fearful. This was an obvious play on words referencing investors catching a falling knife in the form of MPW. For the record, I was once a shareholder in MPW, but sold out a while ago at a loss before they cut the dividend.

I discussed the dividend cut of nearly 50% to free up liquidity during the third quarter. And while this did free up capital giving the REIT a then 49% payout ratio, the company has continued to face issues I’ll discuss later in the article. Additionally, the share price has declined further from nearly $5 to $4.25, where it currently trades at the time of writing. In this article, I discuss why I wouldn’t touch this REIT with a 10-foot pole and why investors shouldn’t either.

Brief Overview

For those new to Medical Properties Trust, MPW is a REIT that invests primarily in healthcare facilities throughout the world. At the end of 2023, they had 439 properties in 9 different countries across 50 tenants. Some of their tenants include Steward, their largest company, followed by Circle Health. Of note, 40% of their properties are located outside of the United States, with most located in Germany & Switzerland.

Dividend Elimination?

I just want to say I don’t short stocks. As previously mentioned, I was a shareholder in Medical Properties Trust. Due to their consistent tenant issues, I decided to sell the stock at a loss and invest the capital elsewhere.

One thing I’ve learned is to not become emotionally attached to a stock. That’s probably the biggest lesson the stock market has taught me. As an investor heavily weighted in the REIT sector (XLRE), I have a few favorites that provide me with stable and reliable income. Those like Agree Realty Corporation (ADC), NNN REIT, Inc. (NNN) and VICI Properties Inc. (VICI). But I also invest in them because of their dividend safety.

Both ADC & VICI had payout ratios of around 75%, while NNN had a payout ratio of roughly 69%, very safe for REITs. But if their financials became suppressed for too long, no matter how much I liked them, I’d cut my losses if their fundamentals started to change. I’d also pay attention to how their CEO plans to correct their declining fundamentals.

During Q4 earnings back in February, MPW’s CEO addressed the dividend broadly:

The Board will meet later this quarter to discuss the dividend. The board’s policy on the dividend remains unchanged. As has always been the case, the Board will review all aspects of the company, including items such as FFO payout ratio, REIT requirements, and liquidity.

Now, some may say he didn’t say that the company was cutting the dividend. And while he didn’t, he didn’t sound too confident in paying a dividend for the upcoming quarter. This reminded me of Walgreens Boots Alliance, Inc. (WBA) when they broadly addressed the dividend during an earnings call.

When WBA’s management team failed to address specifically why they held the dividend and decided to forgo Dividend King status in the process, I realized the fundamentals might be changing and a dividend cut was likely to occur. A reader told me I was wrong and that they chose to not address this to give the new CEO flexibility. And while the cut was speculation on my part, we all know what happened.

And for good reason. Sometimes a dividend cut is needed. In this case, I wouldn’t be surprised if it was suspended or eliminated altogether. I don’t think it would be a bad move on the company’s part because of their liquidity issues. And I think it’s likely priced in already, so the share price won’t fall too far from here in my opinion.

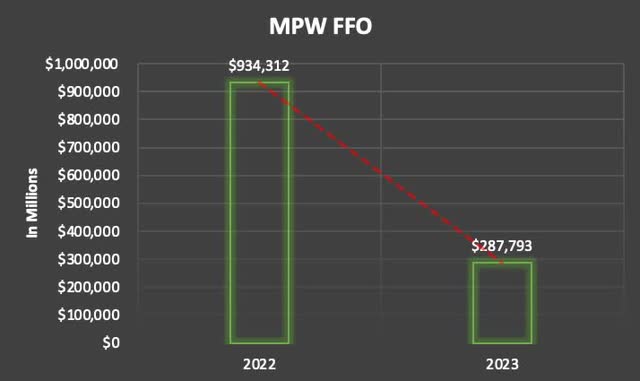

Using their CEO’s word and looking at their FFO payout ratio, you can see in the chart below that this declined significantly from 2022. According to their 10-K, FFO declined roughly 69% year-over-year, a huge drop. And the company paid out $615,390 in dividends for the full year. This gives them a payout ratio above 100% currently. And while some REITs do operate with elevated payout ratios, one has to wonder how long before the dividend is cut or eliminated? And what are they going to do to right the ship?

Author creation

MPW’s revenues also declined significantly year-over-year, dropping from roughly $1.5 billion to $871.8 million in 2023. In Q4 revenue of -$122 million was down from $306.6 million in Q3. I don’t know about you, but this doesn’t look like a company I want to invest my money in.

And despite the challenges over the last two years for REITs specifically because of higher interest rates, many have done well, even growing their financials over the same period. Case in point, VICI Properties and Agree Realty.

The good thing is FFO did come in above the guidance management set in Q3 of $1.56 – $1.58. FFO of $0.36 in the fourth quarter beat estimates by $0.07 but still fell from the prior quarter and Q4 ’22’s $0.43. Bringing the total to $1.59 for the full year. Year-over-year this fell nearly 13% from $1.82 in 2022.

Improving Liquidity

MPW has been trying to improve its liquidity, making efforts by selling off some of its assets. But again, who wants to invest in a company that has to sell off significant assets to improve liquidity? This tells me the company’s balance sheet is not in good shape, but it also puts the dividend at high risk of a cut if a company has to sell assets.

Management has expressed they want to use the liquidity to pay their off debt for years to come. But the question you have to ask yourself is, what will they do when that debt is paid? What assets will MPW have providing cash flow to sustain company growth and dividend payments in the future? What accretive acquisitions does management see themselves making to sustain their business? From their earnings call, it seems pretty vague to me.

The company’s largest and most troubled tenant, Steward recently agreed to sell its managed care business to behemoth UnitedHealth Group Incorporated (UNH) because of their financial issues. Furthermore, they closed on the sale of four of their Australian facilities for proceeds of $305 million and also sold five of their hospitals at a cap rate of 7.4%.

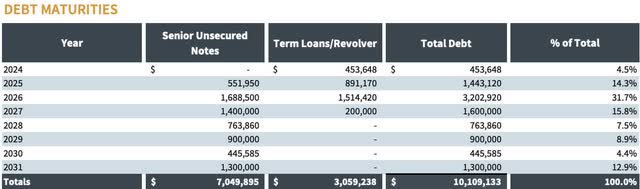

This is all towards their capital allocation plan to generate at least $2 billion this year. And some of this is expected to go toward the REIT’s upcoming debt. In May, MPW has $300 million maturing and an additional $130 million at the end of the year in December. Next year they have more than double that amount with $1.4 billion due. So, in the next two years, MPW has nearly 20% of its $10 billion in debt due.

MPW supplemental

Furthermore, the company’s leverage level continued to increase over the year, up from 6.4x in Q4 ’22 to 6.9x at the end of the fiscal year. For REITs, I like to see them operate in the 5x – 5.5x range. When they start getting closer to 6x and up, that’s when things can get tricky.

Additionally, this also speaks to the company’s management team. A healthy leverage level and well-laddered balance sheet give a company flexibility to not only make accretive acquisitions, but also free up capital to invest back into the business to grow organically. One of the best REITs with the best balance sheets right now is Agree Realty, who had a pro forma net debt-to EBITDA of just 4.3x.

For comparison purposes, CareTrust REIT, Inc.’s (CTRE) net debt-to EBITDA was just 1.4x at the end of their fiscal year. And I’ve covered this stock here on Seeking Alpha before. So, if you’re looking to invest into the medical REIT space, CTRE is the best option in my opinion. Comparing them to Sabra Health Care REIT, Inc. (SBRA) whose net debt-to-adjusted EBITDA was a healthy 5.74x at the end of their latest quarter.

Valuation & Risks

I get it. At the current price of a little over $4 a share, some investors may be saying how much can I lose? Most of their issues are already priced in and while I agree the stock won’t likely fall much farther, I don’t think it’ll see any significant upside anytime soon.

However, if you have a longgggg term outlook, then maybe, just maybe, MPW is a good stock to hold. At a price-to-book value of just 0.33x, your downside risk is likely limited. It does offer some upside to its high price target of $7 but the question is when will the stock reach that price? I don’t see it moving past $5 in the foreseeable future. MPW’s management team has a lot of work cut out for them and in my opinion, it will be a long time before investors see some upside.

Seeking Alpha

When it comes to risks, Medical Properties Trust has too many to name. Besides their largest and most troubled tenant, Steward, many may have forgotten about their tenant issues with Prospect Medical Holdings. The REIT entered into a recapitalization plan to defer rent payments until June.

While they were current on all rent and interest as of the fourth quarter, with interest rates likely remaining higher for longer, this may continue to put stress on Prospect, making it harder to remain current on rent payments. If so, this will certainly impact MPW’s financials in the coming quarters, and ultimately force them to cut or eliminate the dividend in the foreseeable future. This, along with their tenant troubles is something I will be keeping a close eye on going forward.

Bottom Line

MPW faced a lot of headwinds in 2023 with tenants Steward Health and Prospect Medical Holdings. Here we are in 2024 and these continue on. The REIT has been making a concerted effort to improve its liquidity to satisfy upcoming debt maturities and plans to reach $2 billion of allocated capital in 2024. One way to achieve this may be to make the decision to eliminate the dividend or cut again which I think is a high probability.

Additionally, their net debt-to-EBITDA has continued to climb year-over-year to 6.9x, and with rates likely to remain higher for longer, this will only continue to place more downward pressure on the company going forward. Due to their continued headwinds, vagueness from management on the company’s future going forward, and highly leveraged balance sheet, I continue to rate the REIT a strong sell and one investors should avoid.

Read the full article here