Note:

I have covered Perion Network Ltd. (NASDAQ:PERI) previously, so investors should view this as an update to my earlier articles on the company.

As some readers might remember, I have pounded the table for Israel-based provider of digital advertising solutions Perion Network or “Perion” several times in the past.

However, I downgraded the stock in early 2023 after learning about then-CEO Doron Gerstel’s intent to retire, as I considered him the mastermind behind Perion’s impressive turnaround in recent years.

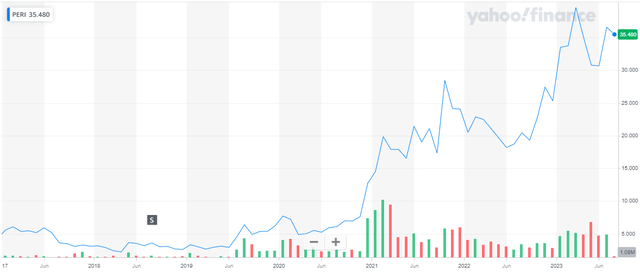

During his tenure, Perion’s share price soared by more than 500%:

Yahoo Finance

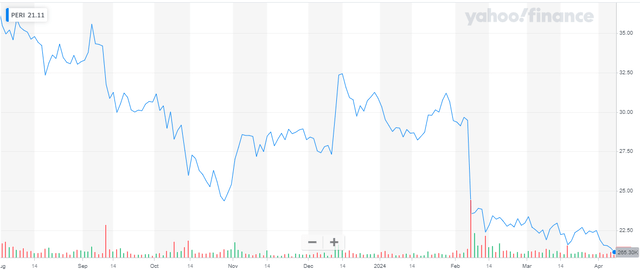

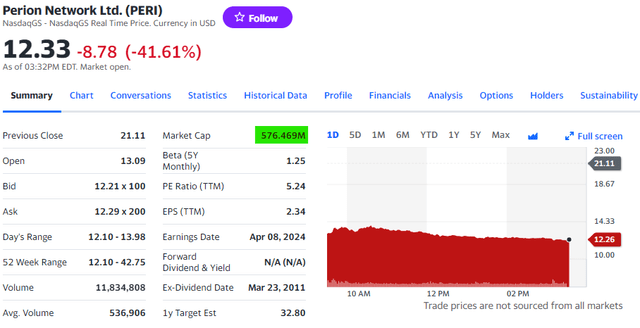

However, since he left in the company nine months ago, the multi-year streak of beat-and raise quarters has been broken, thus causing a severe drop in Perion’s stock price:

Yahoo Finance

As recent changes in the advertising marketplace have contributed to the decline, I wouldn’t blame the poor performance solely on new CEO Tal Jacobson, but in the end it is management’s job to stay ahead of potential negative developments, particularly with Mr. Jacobson having been the longstanding head of Perion’s search advertising business.

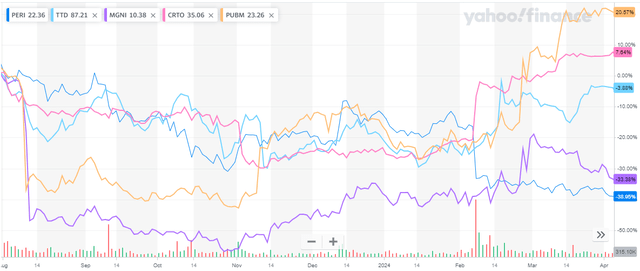

In addition, a number of competitors like PubMatic (PUBM), Criteo (CRTO) and The Trade Desk (TTD) have outperformed Perion quite handsomely in recent months:

Yahoo Finance

Two months ago, Perion’s stock took a 20% haircut after the company issued full-year guidance below consensus expectations for the first time in many years.

However, the February decline was dwarfed by Monday’s 40%+ selloff after Perion issued a truly massive earnings warning.

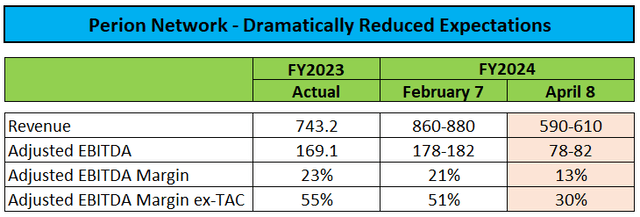

Company Press Release

In the press release, management attributed the vast majority of the disaster to the Search Advertising segment (emphasis added by author):

In the first quarter of 2024, Perion experienced a decline in Search Advertising activity, attributable to changes in advertising pricing and mechanisms implemented by Microsoft Bing in its Search Distribution marketplace.

These adjustments led to a reduction in Revenue Per Thousand Impressions (“RPM”) for both Perion and other Microsoft Bing distribution partners. These changes contributed to decreased search volume.

As a result of the Microsoft Bing modifications, Perion expects Q1 2024 revenue and adjusted EBITDA1 of $157 million and $20 million, respectively. For the full year 2024, the Company currently expects revenue and adjusted EBITDA1 of $590-$610 million and $78- $82 million, respectively. The decrease is mainly attributed to Search Advertising, and to a limited extent to the web video activity. The rest of the business indicators remain positive.

Please note that the Microsoft Bing partnership has contributed between 35% and 40% of Perion’s total revenues in recent years and based on the company’s revised guidance, it seems that revenues derived from Microsoft in 2024 are now projected to come in 90% lower than initial expectations which is a stunning development to say the very least.

Perhaps most disappointingly, management did not provide the slightest hint to these developments on the February 7 conference call despite having been already five weeks into Q1 at that time.

At that time, management even highlighted ongoing budget shifts to direct response marketing as a key driver of recent and anticipated future growth in search advertising revenue.

Given the anticipated, massive reduction in Microsoft Bing-related revenues this year, it is hard to imagine the longstanding search advertising partnership with Microsoft being extended beyond the end of this year.

While management still views the Microsoft relationship as “strong,” the press release already hints to the company’s focus now shifting to the Display Advertising segment which is expected to be bolstered by further acquisitions going forward (emphasis added by author):

Our relationship with Microsoft remains strong and both organizations continue to explore more opportunities to collaborate on a variety of digital advertising solutions,” commented Tal Jacobson, Perion’s CEO. “Our strategy was, and continues to be, grounded in a fundamental principle of making sure our solutions are diversified in terms of technologies, channels and partners, while focusing on the needs of our customers, brands and retailers across the digital advertising domain.

We continue to expand and strengthen our solutions and technologies by leveraging our cash flow generation and strong cash balance of almost half a billion USD to acquire companies that are complementary and additive to our growth.

A key driver of our long-term success is our focus on expanding our Display Advertising activity, whose growth drivers include AI-driven CTV, Retail Media and Digital out-of-home (DOOH). These growth drivers continued to deliver meaningful growth in the first quarter and are expected to increasingly contribute to our results in 2024.

From a valuation perspective, Monday’s selloff has resulted in Perion’s enterprise value being reduced to a measly $100 million as the company reported $474 million in cash, cash equivalents and marketable securities at the end of 2023. Perion continues to have no debt.

Yahoo Finance

However, with management’s likely looking to replace lost search advertising revenue with additional acquisitions, I would expect the majority of the company’s war chest being earmarked for future M&A activity, with only a small portion likely being utilized for buybacks under the company’s upsized $75 million share repurchase program.

Quite frankly, given the magnitude of the shortfall, I would have expected management to host a conference call on Monday and at least double or even triple the company’s share repurchase authorization.

Unfortunately, investors will have to wait another month for additional color on the search advertising disaster, as the company has scheduled its Q1 conference call for May 8, 2024.

Please note also that the company has yet to file its annual report on form 20-F, which was expected to be completed in March already. Without the report, Perion won’t be able to execute on its recently announced share repurchase program.

While an enterprise value of just above $100 million for a solidly profitable digital advertising business with over $300 million in annual revenues (net of traffic acquisition costs) is dirt cheap, I don’t see much sense in bottom fishing here as tremendous uncertainty regarding the company’s path forward is likely to result in ongoing selling pressure, particularly with management’s credibility having taken a major hit.

Without the company’s strong balance sheet, I would have likely assigned an outright “Sell” rating to the stock.

Bottom Line

Perion Network Ltd. perplexed market participants with a stunning FY2024 earnings warning as recent changes at Microsoft Bing are now expected to result in a dramatic reduction of search advertising revenues.

While the company’s valuation has reached bargain levels, material uncertainties in combination with management having provided plenty of cause for investor distrust is likely to keep the stock in the penalty box until investors get a better impression of Perion Network’s path forward.

For my part, I wouldn’t be surprised to see Perion’s board of directors making changes to senior management in the not-too-distant future.

Consequently, I am resuming coverage of Perion Network’s stock with a “Hold” rating.

Read the full article here