If you find yourself in a similar situation as I am, with over 30 years to go before retirement, prioritizing dividend compounders might prove to be a superior strategy, than chasing high-yield stocks.

The key criteria for my investing style is to benefit from both capital appreciation and dividends (reinvesting back in the portfolio) as this can yield substantially better results in the long-term, after all my goal is to beat the market.

Otherwise, I could just dollar-average the index and sleep well at night, but instead I am a born stock-picker, enjoying the thrill of beating the crowd.

Just consider that investing in a company with a starting dividend yield of only 2%, with a DGR of 12% annually over the course of 20 years will result in a yield-on-cost of 17.2%.

Conversely, a high-yield stock yielding 5% today with a DGR of 5% after 20 years would yield only 12.6% alongside significantly lower capital appreciation, given the business has very little cash left to reinvest and grow.

Naturally, expecting 12% DGR over the course of 20 years is optimistic, but let me show you two businesses today which are market leaders of superior quality, their shares have been under pressure approaching the “bargain territory”, and may prove to be compounders with double-digit DGR at least for the remainder of the decade.

UnitedHealth Group Incorporated (UNH)

UnitedHealth, with $371B in revenue as of 2023, is the largest healthcare company in the world, headquartered in Minnesota.

The business is well-diversified, operating through two main divisions.

UnitedHealthcare operates as a health insurance division, collecting premiums from companies and individuals in exchange for healthcare coverage. This division serves over 147 million people worldwide, and collecting premiums remains the largest revenue stream of UNH, contributing 77% to the overall revenue.

Optum is the second division, contributing around 21% to the total revenue, which focuses instead on:

- Providing pharmacy management services

- Sells data analytics and tech solutions to other healthcare providers

- Selling home care equipment and medical devices to treat chronic conditions

As one would expect with an insurance business, UNH is investing its cash reserves to earn additional yield on their money, which makes up less than 2% of the total revenue.

With UNH’s shares up 4.5x over the last 10 years, investors have been rewarded handsomely.

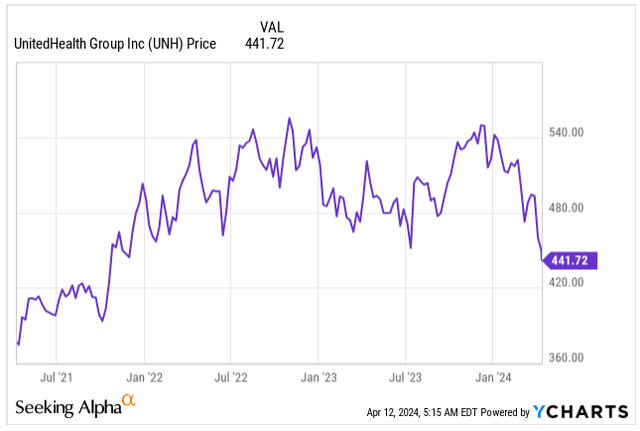

UNH is a great example of a quality business rarely being on sale, but recent challenges have pressured the stock, currently trading 20% below its ATH, giving long-term investors a good chance to accumulate the shares at a cheaper valuation.

UNH price (Seeking Alpha)

Increased medical care utilization and larger than expected medical benefits ratio in H2 2024 and 2025, are some of the cost pressures, which will be impacting the profitability of the business. Medicare Advantage payments are expected to rise by 3.7% in 2025, above the initial estimates, sending chills through the industry and impacting fellow Medicare and Medicaid providers, Humana (HUM) and CVS Health (CVS).

If one issue is not enough, UNH was hit with an antitrust investigation. Interviews were conducted with industry representatives by the U.S. Department of Justice to determine the possible impact on the sector following some of the acquisitions made by its health service arm, Optum. While no lawsuit has been filled yet, the major size of UNH’s business may be seen as a monopoly-like threat, which could spur further investigations into the company’s practices.

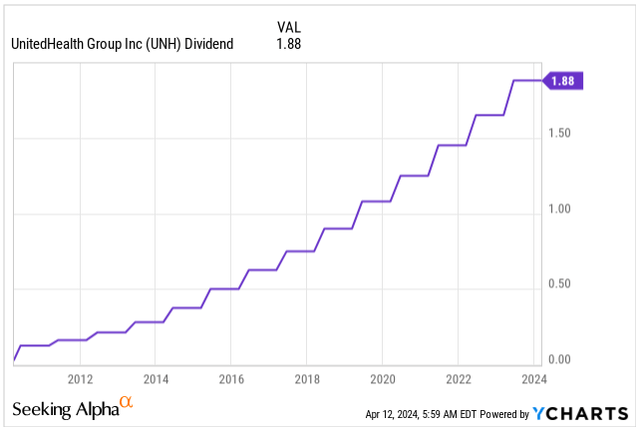

UNH remains one of the best dividend growth stocks money can buy today, increasing its dividend by 61x since 2010. The dividend currently stands at $1.88 per share or 1.7% dividend yield.

The dividend yield is low, but you should not be buying UNH for its immediate yield, instead you should buy it for its DGR which has not slowed down even in the last couple of years, with the last increase of 14% back in June 2023.

I am expecting the dividend growth will continue in the mid-teens for the remainder of the 2020s. If you bought the stock 10 years ago, today your yield-on-cost would be an attractive 9.92%.

UNH Dividend (Seeking Alpha)

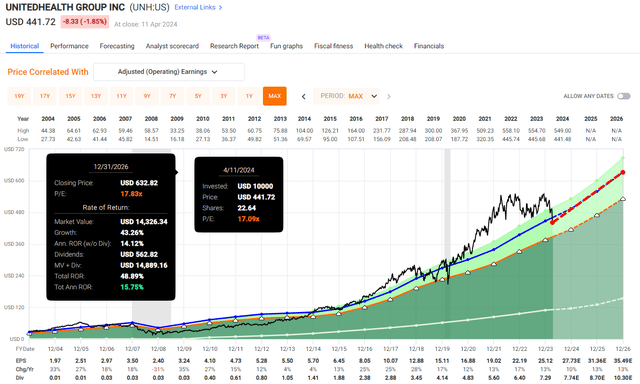

In the face of recent challenges, the stock has pulled back from a stretched valuation level of +20 P/E, that we have gotten accustomed to since 2020.

Today, the stock is trading at a blended P/E of “only” 17.09x, slightly below its 20-year average of 17.83x.

The historical EPS growth has averaged at 14.81% since 2003 and analysts polled by S&P Global are forecasting the growth to continue, albeit at a slightly slower pace:

- 2024: EPS of $27.73E, YoY growth 10%

- 2025: EPS of $31.36E, YoY growth 13%

- 2026: EPS of $35.49E, YoY growth 13%

Even though the valuation has a chance to contract further with the bad press taking its toll on the stock, buying the stock anywhere below $450 per share presents a good long-term opportunity.

I have already doubled-down on my existing position at around $445, and I am planning on doing the same if the stock drops below the $420 mark.

Keep in mind that UNH is a high-quality business benefiting from an aging population in the western-world which tends to use more healthcare services, creating natural demand for the company’s services and products.

In my view, the stock’s fair valuation is around 17x its earnings and with the forecasted EPS growth, I am looking for annual 15%+ total returns over the next three years.

UNH Valuation (Fast Graphs)

Prologis, Inc. (PLD)

Prologis operates as a global logistics behemoth and with the market cap of $113B it’s the largest REIT in the world, followed by American Tower (AMT).

Even though you might not be familiar with PLD being mostly a B2B-oriented company, there is a good chance the goods you bought from Amazon (AMZN) or Home Depot (HD) were handled in one of PLD’s warehouses as the company stores, fulfills consumers’ orders and manages returns for many of the world’s largest retailers.

Back in 2022, it was estimated that roughly 3% of the world’s $95 trillion GDP has been processed through PLD’s distribution centers, which are mostly found near major cities.

At the end of 2023, I made PLD one of my largest REIT holdings, during the time of peak pessimism driven by high interest rates in U.S. and Europe and called the company a “Top REIT pick for 2024”, given its strategic position benefiting from tailwinds of ever-increasing demand for e-commerce and cheap valuation in relation to its forward growth.

Now, as consumer prices rose 3.5% from a year ago in March, more than expected, the fears of delayed rate cuts were awoken again.

Expectations were for the Fed to start cutting rates in June, but now these expectations are being pushed back to Q3-Q4 2024, sparking fears that REITs will have to refinance their loans at higher rates, which could hurt their bottom line.

PLD Price (Seeking Alpha)

Higher refinancing costs are a real possibility for many REIT’s, including PLD, yet it’s times like these when investors have the ability to buy high quality companies at more reasonable valuations.

PLD, with a credit rating of “A” by S&P Global, has a less than 5% chance of going bankrupt in the next 30 years.

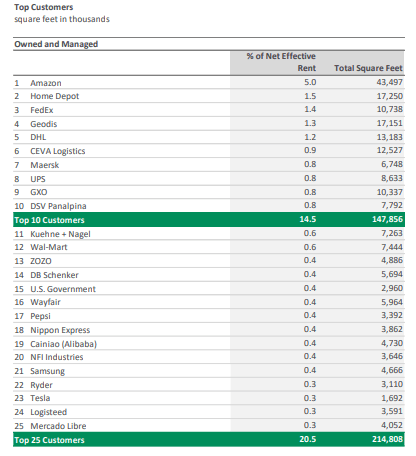

The company is well-diversified, with no single tenant exceeding 5% of its net effective rent and top 25 customers making up only 20.5% of the rent collected.

Even as some retail businesses in its portfolio are susceptible to cyclical weakness if the economy slows or enters a recession, the list is dominated by well-renowned businesses and long-term partners.

PLD Top Customers (PLD IR)

PLD’s current dividend of $0.96 or dividend yield of 3.2% is not the highest, especially compared to other quality REITs such as Realty Income (O) with a 5.9% yield or STAG Industrial (STAG) paying a 4% yield.

If the immediate yield is too low for your liking consider that PLD’s management is committed to rewarding shareholders with great DGR, increasing the dividend by 243% since 2010, with the last increase of 10% back in February 2024, despite the headwinds the industry is facing.

Keep in mind, during the Great Financial Crisis, PLD cut its dividend to retain cash and restructure the business. With the general consensus among investors being that companies cutting their dividends generally underperform the market, PLD has managed to outperform the S&P 500 (SP500) in total return by more than 120% since 2010, proving the naysayers wrong.

Going forward, I am expecting PLD to keep growing its dividend in the low double-digits, rewarding shareholders, as long as interest rates do not spike up even further.

In the face of these challenges, the valuation of PLD has taken a hit, but the company is not trading at a dirt cheap valuation, like some other REITs.

The REIT is currently priced at a blended P/FFO of 21.56x, slightly below its 15-year average of 22.69x, implying a small discount.

PLD has managed to grow its FFO by 11.63% annually since 2010 and while 2024 is expected to be a year of negative growth given the challenges, the FFO growth should resume in 2025 at a similar level as we were historically accustomed to:

- 2024: FFO of $5.49E, YoY growth -2%

- 2025: FFO of $6.22E, YoY growth 13%

- 2026: FFO of $6.88E, YoY growth 11%

I have doubled-down on the stock already back in October 2023, when the price dropped below $100 per share, however, today presents a good opportunity for long-term investors as well.

Of course, there is a risk the stock may pull back even further, especially if the next CPI report comes in above expectations, potentially prompting the Fed to maintain the elevated rates for longer, but any drop below $100 per share should be viewed as a great opportunity to accumulate even more shares in this dividend compounder.

In my view, it’s fair to expect the stock to be trading at around its historical valuation of 22.69x its earnings for the remainder of the decade as the business landscape improves, potentially delivering 12.8% total annual returns for investors buying the stock at today’s price of $120.

PLD Valuation (Seeking Alpha)

Takeaway

Identifying businesses which will compound wealth over a long period of time is no easy task.

One should focus on high quality market leaders, strong moat companies with little risk of their core revenue streams being disrupted by new technology or new entrants, and avoid overpaying for great businesses.

In today’s market, where valuations are stretched by conventional thinking, it’s difficult to be a bargain hunter.

Yet, I have found two businesses, UnitedHealth and Prologis, which came under pressure due to industry headwinds and market conditions, offering investors potentially attractive entry levels with dividend yields rather on the lower end, but strong DGR which can compound to high yield-on-cost over a long duration of time.

Read the full article here