Do you remember in Back To The Future when Marty’s dad got fired in 2015? It wasn’t by text or email. It was by fax! The movie got a lot right, like drones and video conferencing, but it missed the two most transformative developments of the next decade: cell phones and the internet. The problem with many predictions about technology is they don’t go far enough.

Some historically bad calls

1943: The President of IBM (IBM) predicts a worldwide need for maybe five computers.

1995: Newsweek publishes an op-ed from astronaut Clifford Stoll predicting that the internet will never replace the physical newspaper and seriously downplays the potential of eCommerce. Amazon (AMZN) reported $232 billion in revenue from online sales last year.

2007: former Microsoft CEO Steve Ballmer predicts that there is “no chance the iPhone is going to get any significant market share.” Apple (AAPL) boasts nearly 1.5 billion users and $386 billion in trailing twelve-month (TTM) sales.

2008: CTO of Oracle (ORCL) calls the cloud “complete gibberish.” Amazon and Microsoft (MSFT) reported $91 billion and $88 billion in sales for Amazon Web Services (AWS) and the Microsoft Intelligent Cloud during the last fiscal years. Oh, and Nvidia (NVDA) is worth over $2 trillion because of soaring data center sales.

What’s the point?

Everyone makes bad calls about the future, even the experts. Predicting the path of technology is tough, and many of us (me, too!) are resistant to new things that get overhyped.

The point is that there is a tendency to underestimate how much new technology will affect our daily lives. I remember when the internet came out. It was neat but of little practical use. Dial-up was incredibly slow and unstable, and once you got on, there wasn’t much to do.

But technology constantly tracks toward more convenient and efficient things, like eCommerce. It took a while, but it’s obvious in hindsight.

This is what I think about when folks downplay the potential of artificial intelligence (AI) in the business world and on our favorite stocks. There will be many failures and false starts along the way, but the technology is coming. The IMF predicts that 40% of global jobs will be altered. It will probably be many more in time.

Some stocks will enter bubble territory, failing miserably in the long run, while others will achieve massive success. I’m not putting all my eggs in one basket, and definitely not in every basket. But here are a few to consider and why.

Arm Holdings

Arm (ARM) Holdings is a chip company that doesn’t make chips. It designs what it calls “the architecture” for CPUs and GPUs that power smartphones, data centers, advanced driver assist tech, and many more. The company claims that 280 billion total units have been shipped and that 99% of global smartphones use its CPUs.

There are several reasons to like the company:

- Since it isn’t a manufacturer, it has a gross margin above 95% and a free cash flow margin near 30%.

- It has a strong balance sheet with $3.6 billion in current assets vs. $866 million in current liabilities.

- Its market share is increasing across many industries.

- The remaining performance obligation (RPO) increased 38% YOY last quarter to $2.4 billion.

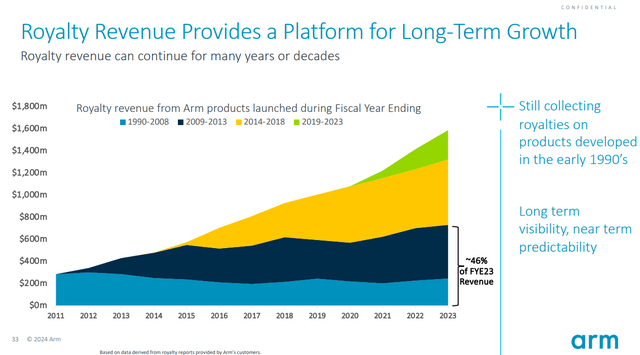

The best part of the business model is that royalty revenue stacks up as legacy products continue to be used while new products are introduced, as shown below.

Arm Holdings

Legacy revenue is a terrific thing. It is very profitable since the research and development was paid for years ago.

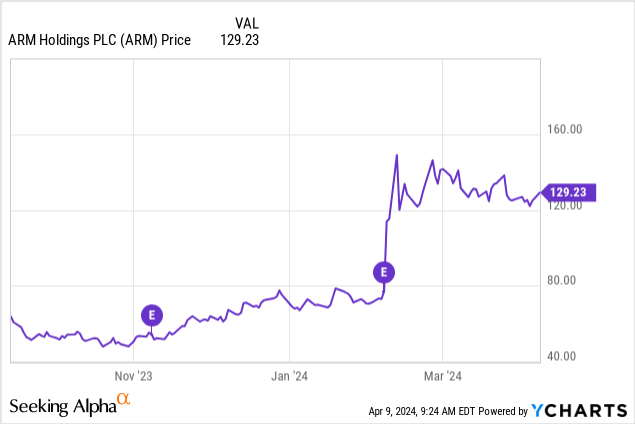

As shown below, Arm stock jumped after reported earnings last quarter, so it may be due for a short-term correction.

Keep this one on the watchlist and consider buying on dips.

UiPath

Robotic process automation (RPA) allows software to mimic people’s actions and automate tedious tasks. Think about a large company that needs workers to download documents, fill out forms, or input the info into its accounting system. Automating this process has massive implications for the company’s efficiency. This is why I own shares in RPA provider UiPath (PATH).

UiPath finished fiscal 2024 with $1.3 billion in sales and $1.5 billion in annual recurring revenue (ARR) (24% and 22% growth, respectively). The company’s balance sheet is excellent, with $1.9 billion in cash and investments and no long-term debt. It is increasing its presence with large customers and has a total customer base of over 10,800.

Guidance for fiscal 2025 is tepid at just 18% ARR growth, but this gives management the opportunity to beat and raise. It also means UiPath is reasonably valued at 9.5 times sales. Companies will be looking at how AI will make them more efficient and profitable, and this is a tremendous opportunity for UiPath to showcase its solutions.

Palantir

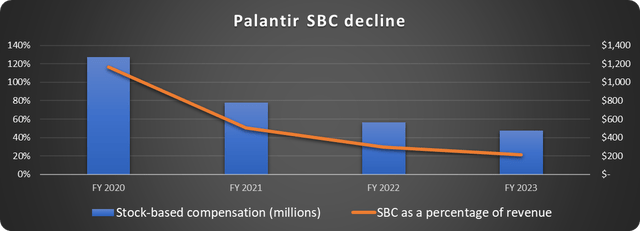

For years, the knock on Palantir (PLTR) was excessive stock-based compensation (SBC) and unprofitability, and deservedly so. However, the company just posted its fifth straight profitable quarter, and SBC is declining precipitously, as shown below.

Data source: Palantir. Chart by the author.

The company is entrenched in the defense industry, but the goldmine is the US commercial market. Competition is higher than ever, and many companies will look to Palantir to assist with data analytics and AI.

U.S. commercial sales increased 70% year over year in Q4 to $131 million, while total customers grew 35%. Palantir holds “boot camps” to introduce potential customers to its new AIP platform, which is terrific for sales. Watching a demo is one thing, but showing immediately how it can be applied directly to the customer’s business is much better.

Palantir’s rock-solid balance sheet reports $3.7 billion in cash and investments and no long-term debt. It’s no coincidence that Arm, UiPath, and Palantir are on firm financial footing and on this list.

Marvell Technology

The ultimate pick-and-shovels play on AI is investing in companies making the parts that move and store data. Marvell Technology (MRVL) fits this bill with its processors, controllers, switches, and other products for data centers, consumer electronics, automotive, and other industries. AI and custom compute are massive opportunities for Marvell to grow as enormous data centers are built.

Marvell’s revenue doubled from $2.9 billion to $5.9 billion in just two fiscal years before growth took a breather in fiscal 2024, with a 7% decline in sales to $5.5 billion. The company issued tepid guidance for Q1 fiscal 2025 based on lagging consumer, carrier, and networking demand but expects data center revenue to grow. With the economy stronger than many expected, Marvell has a great chance to beat guidance.

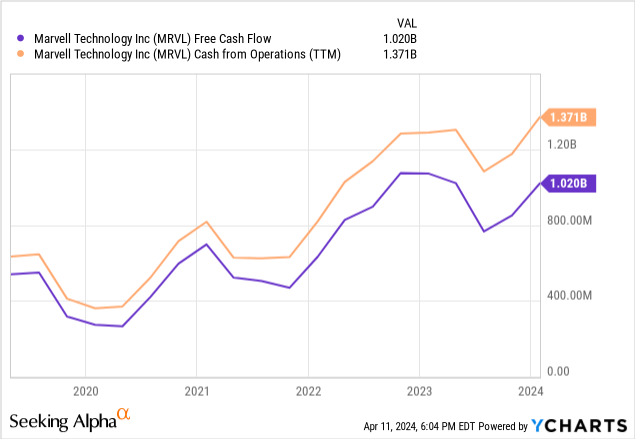

Marvell isn’t GAAP profitable yet, but much of its expenses are non-cash items like depreciation and amortization of intangible assets. Because of this, I focus on growth in free cash flow, which is on a steady uptrend, as depicted below.

Management has work to do to resume overall revenue growth, but the secular opportunity is large.

Is there an AI bubble?

As always, caution is warranted with speculative companies. Proper position sizing and diversification are important. Some stocks I won’t touch now due to their valuation, but others will be excellent long-term investments.

There was a bubble in July 1999, but the Nasdaq gained another 86% before peaking. So, assuming there is a bubble, the right question might be: what inning are we in?

Read the full article here